- SAP Community

- Products and Technology

- Human Capital Management

- HCM Blogs by SAP

- Country Compliance - Configure overrides for US WT...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Introduction

New York Notice of Pay Rate - WTPA form, unlike other country compliance forms, presents a unique challenge as it lacks standard or pre-defined mapping. To ensure smooth implementation, let's explore the essential setup steps required before utilising this form.

#Notice of Pay Rate https://dol.ny.gov/notice-pay-rate

Prerequisites

Before proceeding with the following steps, it's necessary to set up the global filter configuration override for assigning the form to new hires. Please refer to the steps outlined in the Global Filter Setup

Setting up override configuration for WTPA Form Fields

As previously mentioned, this form doesn't have a standard set of mappings and is not readily usable.

After defining the Global filter, the next step involves configuring overrides for specific fields within the form..

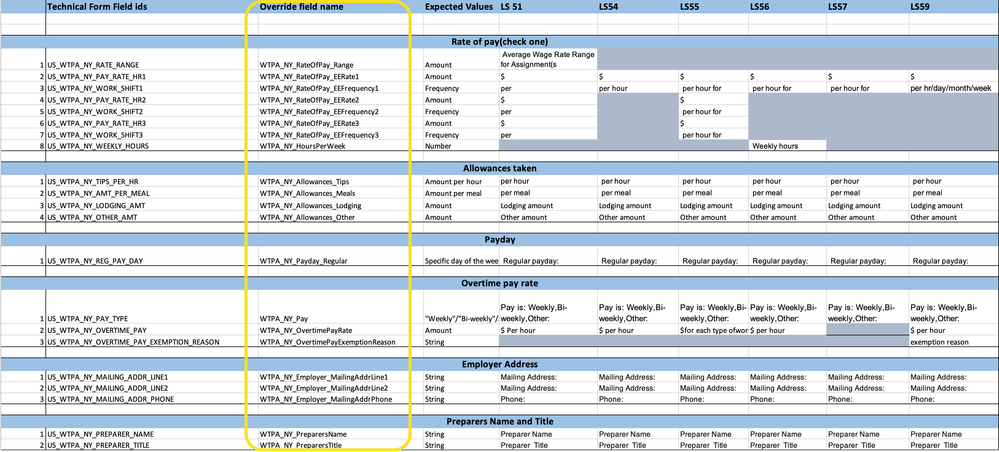

Overrides are required for the following fields. It's crucial to adhere strictly to the overriding field IDs highlighted in the excel snapshot below.

The above snapshot provides comprehensive customization expectations for each field across all supported WTPA forms. To enhance readability, the excel is divided into multiple sections corresponding to each form line item.

The excel provides detailed information on technical field IDs, Override Field names (for which Override definition should be derived), and the expected data type of the Overriding field.

Columns LS51, LS54, LS55, LS56, LS57, and LS59 represent the WTPA forms supported in the current release, with respective overriding fields applicable for corresponding forms. Greyed-out blocks indicate that the respective overriding field is not applicable for the form.

The Overriding Field Name serves as the key field for mapping the overridden data to the PDF form. It's imperative to strictly adhere to the case-sensitive ID text.

Generic steps apply to each overriding field

Step 1: Business Rule definition.

Applicable only when the value has to be derived or calculated based on certain rules.

Step 2: Identify a field from existing HRIS element, which holds expected respective Field value.

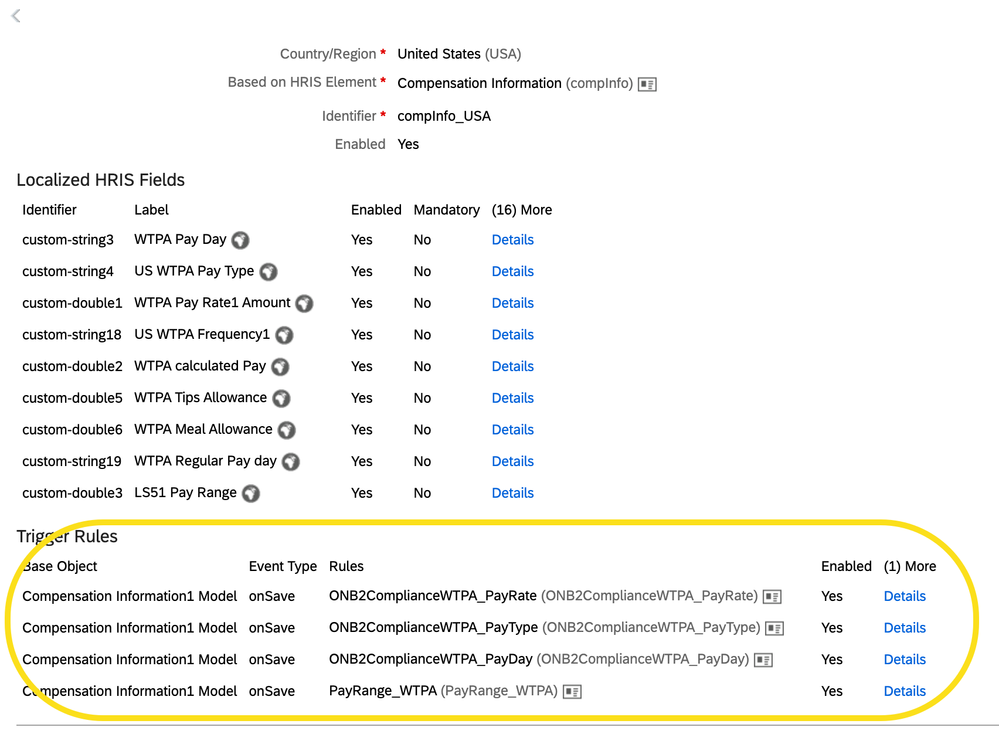

Navigate to “Manage Business Configuration” page, expand required entity and make sure the field is enabled and editable.

If Business Rule is defined for identified field, make sure it is added under respective HRIS element object in Business Configuration page.

Step 3: Provide view and edit permission

Navigate to "Manage Permission Roles" page and 'Edit' the right user role for admin user - who carries out NHDR step.

In Edit page, go to User Permissions -> Employee Central Effective Dated Entities, make sure at least View and Edit permissions are provided for field which is considered in step 1.

Step 4: Configure override path fieldOverrideMetadata definition

Refer section “Mapping New York Wage Theft Protection Act (WTPA) Forms" from Onboarding help portal (link) for details on field metadata override definition.

Step 5: Data Maintenance during New Hire Data Review (NHDR) step

Ensure that data is maintained or derived through a business rule for the field path defined in the overriding metadata.

Note: Screenshots for above steps can be referred in blog mentioned prerequisite section.

Now, let's examine some examples of configuring the overriding fields.

Section 1: Rate of Pay (Check One)

Field 1: "WTPA_NY_RateOfPay_Range"

Represents the "Average Wage Rate Range for Assignments." According to the Excel document provided, this field is applicable only for the LS51 form.

With Business Rule,

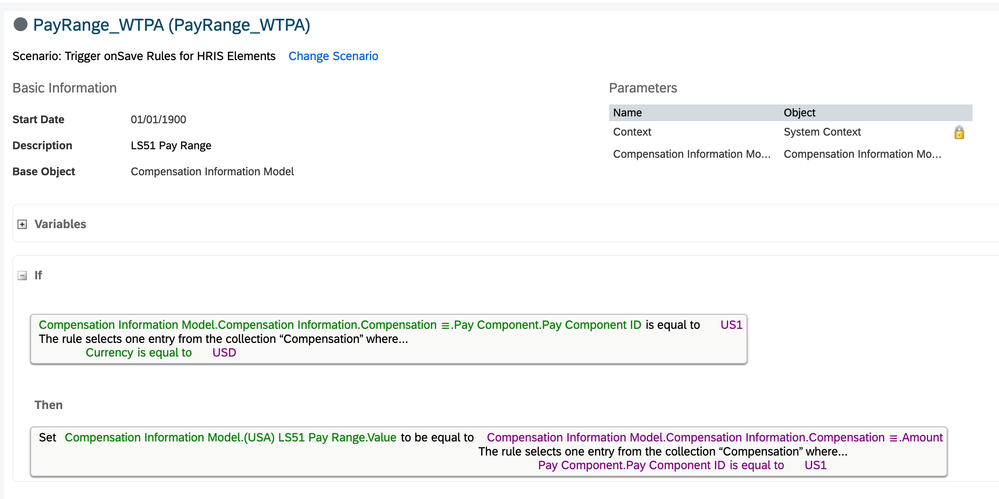

The sample business rule above serves as a simple illustration, processing data from the Compensation Information Model.

The amount corresponding to the Pay Component ID 'US1' with currency 'USD' is stored in the "LS51 Pay Range" field.

Then as in Step 4 (Generic Step), one has to maintain the override path,

| id | source | overrideFieldsMeta |

| compInfo.WTPA_NY_RateOfPay_Range | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customDouble3" } |

Without Business Rule:

If there is a direct field that contain the required value

For example, if the direct field is "benefitRate," then replace 'overrideFieldsMeta' with the following data:

{

"entity": "compInfo",

"entityPath": "compInfoNav",

"fieldPath": "",

"fieldType": "",

"field": "benefitsRate"

}

Then follow step 2 to step 5 explained in Generic steps section.

Field 2 and Field 3 : ‘WTPA_NY_RateOfPay_EERate1’ and ‘WTPA_NY_RateOfPay_EEFrequency1’.

According to attached excel both fields are applicable for all WTPA forms.

With Business Rule:

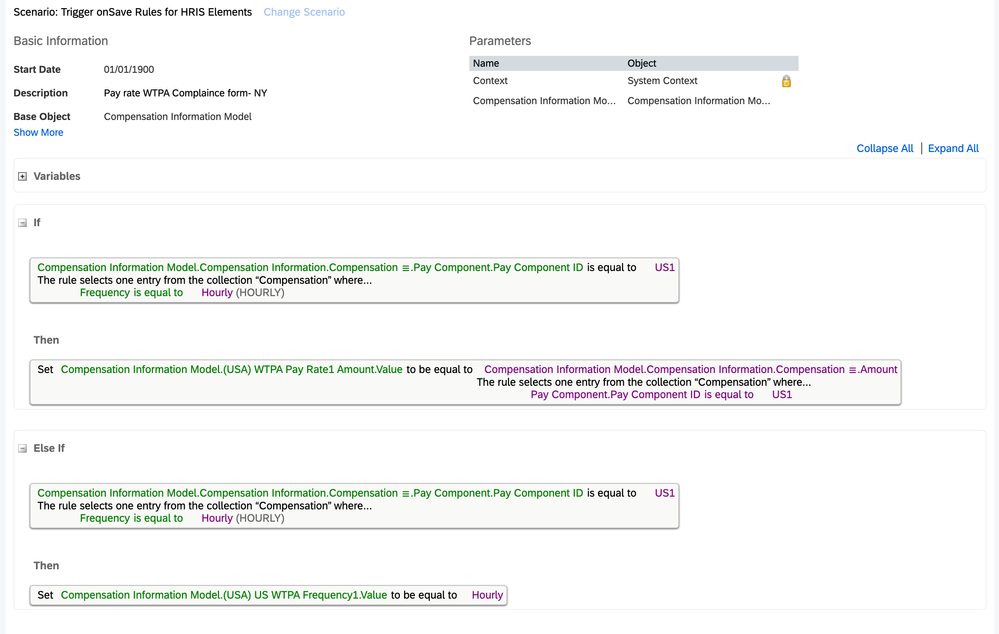

The described Business rule operates as follows: When the Pay Component ID is US1 and the frequency is Hourly, the corresponding Amount is saved in the "WTPA Pay Rate1 Amount" field, and the text 'Hourly' is assigned to the "WTPA Frequency1" field.

Override path :

| compInfo.WTPA_NY_RateOfPay_EERate1 | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customDouble1" } |

| compInfo.WTPA_NY_RateOfPay_EEFrequency1 | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customString18" } |

Follow Step 2 to Step 5 for respective fields.

Following a similar approach, overrides should be defined for the EERate2, EERate3, EEFrequency2, and EEFrequency3 fields.

Field 8 : ‘WTPA_NY_HoursPerWeek’ Weekly hours

This field is applicable only for LS56 Form.

One option is to define a Business rule to derive the standard weekly hours. Alternatively, it can be directly mapped to the 'Standard Weekly Hours' field from the Job Info entity, as shown below:

| compInfo.WTPA_NY_HoursPerWeek | Prepopulated Employee Central Fields Metadata | { "entity": "jobInfo", "entityPath": "jobInfoNav", "fieldPath": "", "fieldType": "", "field": "standardHours" } |

Section 2 : Allowances taken

All fields in this section are anticipated to be linked to the Amount field.

The Amount field can either be a standard field or a result of a Business rule.

Override definition based on direct field.

compInfo.WTPA_NY_Allowances_Tips | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customDouble5" } |

compInfo.WTPA_NY_Allowances_Meals | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customDouble6" } |

compInfo.WTPA_NY_Allowances_Lodging | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customDouble7" } |

compInfo.WTPA_NY_Allowances_Other | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customDouble8" } |

Section 3: Payday

Field WTPA_NY_Payday_Regular

Expected value is Specific day of the week/ month or Date.

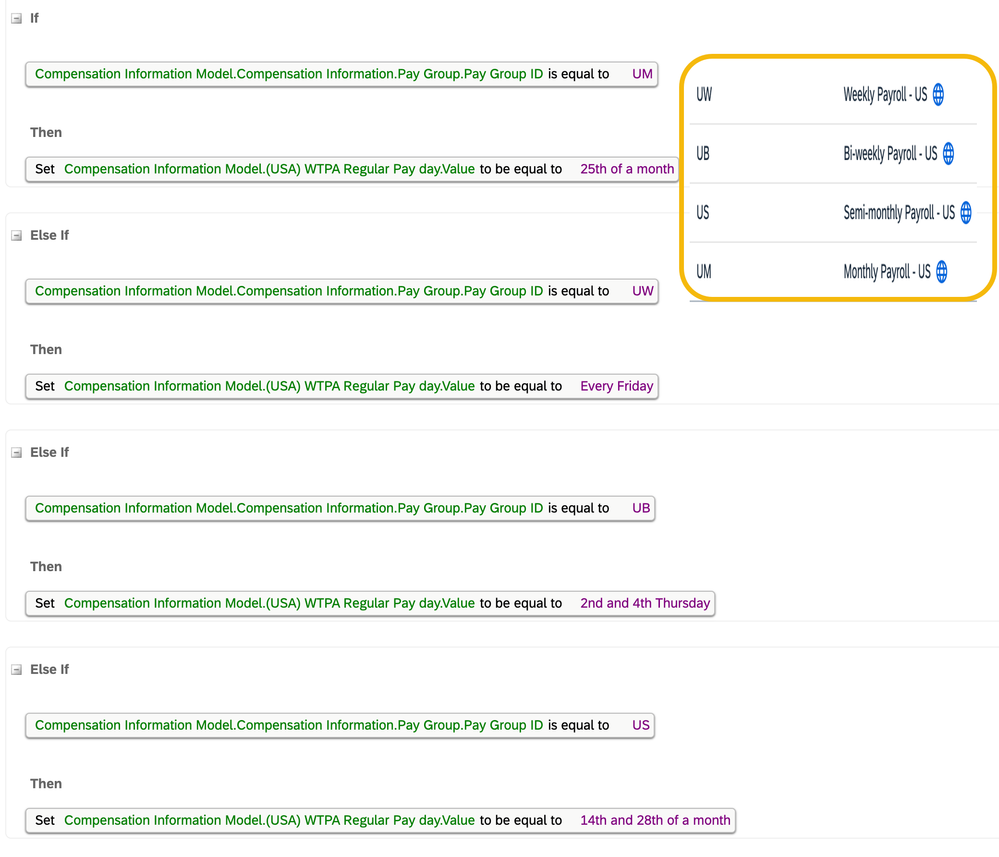

With Business Rule :

The described Business rule operates as follows:

If Pay Group Id – UM (Monthly Payroll), then WTPA Regular Pay day = 25th of a month

Else if Pay Group Id – UW (Weekly Payroll), then WTPA Regular Pay day = Friday

Else if Pay Group Id – UB (Bi-weekly Payroll), then WTPA Regular Pay day = 2nd and 4th Thursday

Else if Pay Group Id – US (Semi Monthly Payroll), then WTPA Regular Pay day = 14th and 28th of a month

Override path:

compInfo.WTPA_NY_Payday_Regular | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customString19" } |

The field path mentioned above can be substituted with any field, whether it's a direct field or a result of a Business rule.

Section 4: Overtime pay rate

Field 1: ‘WTPA_NY_Pay’

Represents field 'Pay is: Weekly, Bi-weekly, Other'. Accepts string values and applicable for all forms.

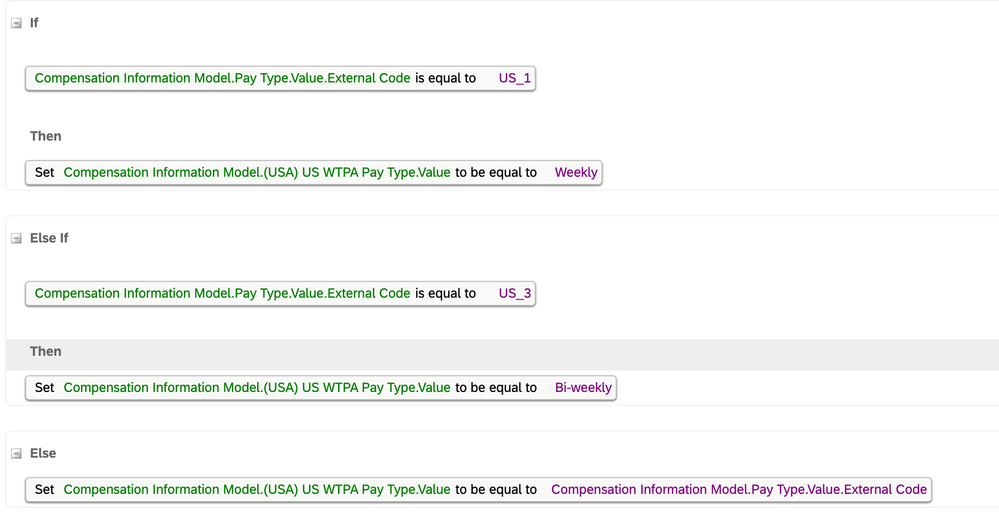

With Business rule:

The described Business rule operates as follows:

If Pay type = US_1, then ‘WTPA Pay Type’ = Weekly

Else if Pay type = US_3, then ‘WTPA Pay Type’ = Bi-weekly

Else ‘WTPA Pay Type’ = Pay type

compInfo.WTPA_NY_Pay | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customString4" } |

Field 2 & 3: ‘WTPA_NY_OvertimePayRate’ and ‘WTPA_NY_OvertimePayExemptionReason’

These fields represent the Overtime Amount and Overtime Exemption Reason, applicable across all forms.

Both of these fields can be derived through a Business rule or direct mapping.

Override path:

compInfo.WTPA_NY_OvertimePayRate | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customDouble2" } |

compInfo.WTPA_NY_OvertimePayExemptionReason | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customString9" } |

Section 5 & 6: Employer Address and Preparers Name and Title.

All fields in both sections accept String values and are applicable for all forms.

As usual, these fields can be mapped directly or derived through a Business rule.

Override path:

compInfo.WTPA_NY_Employer_MailingAddrLine1 | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customString13" } |

compInfo.WTPA_NY_Employer_MailingAddrLine2 | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customString14" } |

compInfo.WTPA_NY_Employer_MailingAddrPhone | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customString15" } |

compInfo.WTPA_NY_PreparersName | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customString16" } |

compInfo.WTPA_NY_PreparersTitle | Prepopulated Employee Central Fields Metadata | { "entity": "compInfo", "entityPath": "compInfoNav", "fieldPath": "", "fieldType": "", "field": "customString17" } |

Conclusion:

Completing the described configuration steps is crucial as they are one-time activity and mandatory for proper functionality.

Failure to configure any of the mentioned steps may lead to blank values in the generated PDF forms.

Once all the necessary configurations are completed, new hire will receive the notice in both English and their primary language, provided that the Labor Department offers a translation and it is included in the list of languages supported by SAP SuccessFactors.

- SAP Managed Tags:

- SAP SuccessFactors Onboarding

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

1H 2023 Product Release

3 -

2H 2023 Product Release

3 -

Business Trends

104 -

Business Trends

4 -

Cross-Products

13 -

Event Information

75 -

Event Information

9 -

Events

5 -

Expert Insights

26 -

Expert Insights

21 -

Feature Highlights

16 -

Hot Topics

20 -

Innovation Alert

8 -

Leadership Insights

4 -

Life at SAP

67 -

Life at SAP

1 -

Product Advisory

5 -

Product Updates

499 -

Product Updates

43 -

Release

6 -

Technology Updates

408 -

Technology Updates

12

- Global filter definition for Country Compliance WTPA forms in Human Capital Management Blogs by SAP

- Deep linking to SAP SuccessFactors Standard Portlets and Custom MDF portlets in Human Capital Management Blogs by Members

- Demystifying SAP SuccessFactors Suite Abbreviations and Terms for New Users in Human Capital Management Blogs by Members

- SAP SuccessFactors and Contingent Workers in Human Capital Management Blogs by Members

| User | Count |

|---|---|

| 8 | |

| 5 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |