- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- Workbook Calculation using an HR Expenses Budgetin...

Financial Management Blogs by SAP

Get financial management insights from blog posts by SAP experts. Find and share tips on how to increase efficiency, reduce risk, and optimize working capital.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

nathskie28

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

05-06-2022

7:15 AM

Hello there! last year, a series of blog posts were released by my colleague starting from the Workbook Calculation Adapter Overview down to the 5th example of the Workbook Calculation Adapter wherein it uses a locally saved Excel and is imported to be used for calculation. Now, I would like to share with you our experience with using an excel file for HR expense Calculation and make it a part of SAP Profitability and Performance Management calculation.

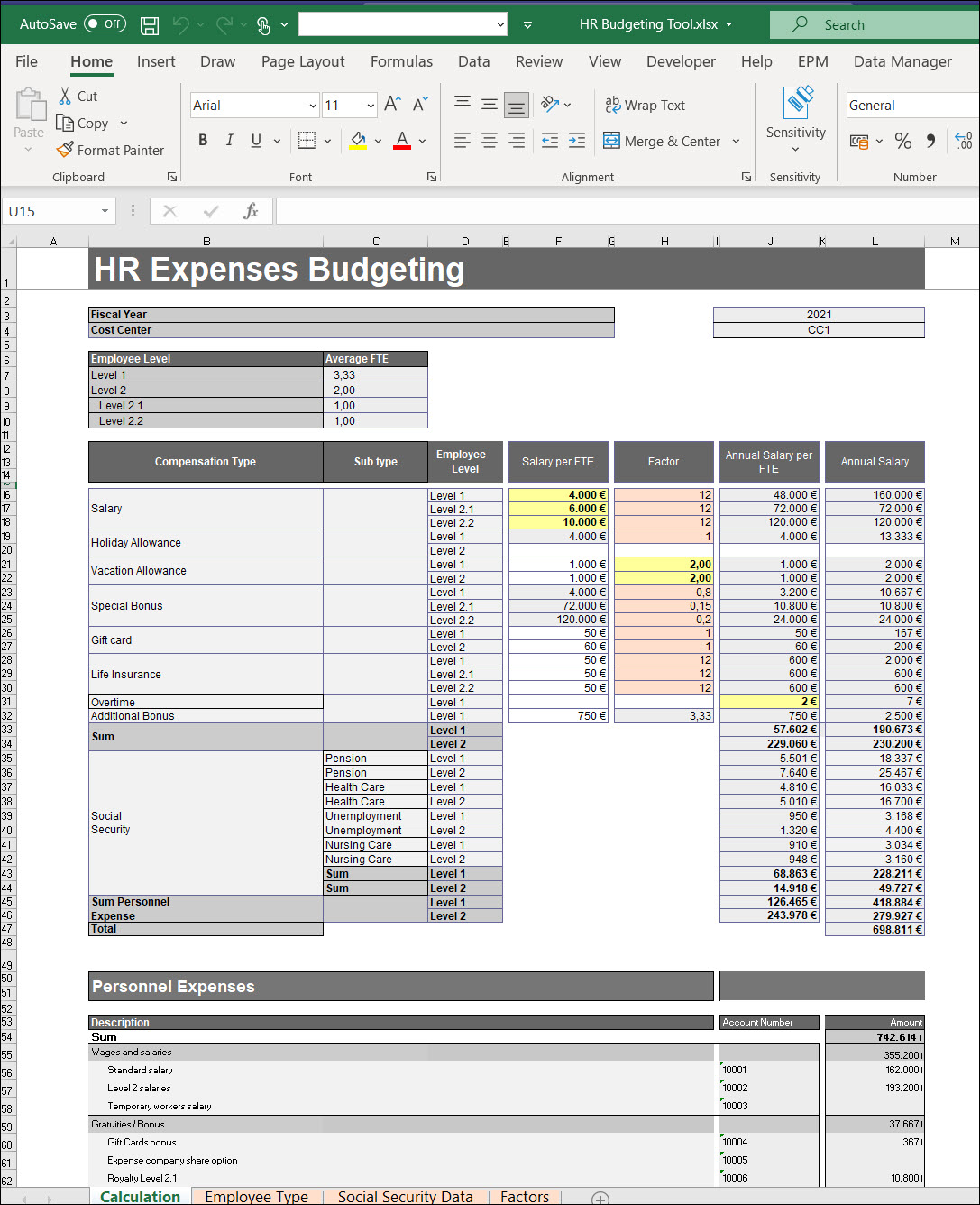

This HR Expenses Budgeting worksheet is basically an excel planning for HR-related expenses which is shown below.

The worksheet will consider different variables for calculation like compensation, Employee Type, factors, etc. that are also coming from a different tab, and once everything is calculated it is allocated to different accounts within a cost center. I will not drill down with how the calculation and formula work within the excel sheet but how we can use the HR Expense Budgeting data as an input to our workbook calculation adapter

Input (Model Table)

We will be having Salaries per cost center, which has the salary data for the fiscal year. It will serve as our input to the workbook calculation adapter.

Input Data

| Fiscal Year | Cost Center | Salary Level 1 | Salary Level 2.1 | Salary Level 2.2 | Vacation Level 1 | Vacation Level 2 | Overtime per FTE |

| 2021 | CC4 | 4000.00 | 8000.00 | 12000.00 | 4.00 | 4.00 | 4.00 |

| 2021 | CC3 | 3000.00 | 5000.00 | 7000.00 | 3.00 | 3.00 | 3.00 |

| 2021 | CC2 | 2000.00 | 4000.00 | 6000.00 | 2.00 | 2.00 | 2.00 |

| 2021 | CC1 | 1000.00 | 3000.00 | 5000.00 | 1.00 | 1.00 | 1.00 |

Configuring Workbook Calculation (Personnel Expenses Calculation)

The Signature.

The Cost Center was assigned in the Granularity section as it contains unique data records and the system considers all the data records for processing. Selection fields are also defined to ensure that the fields will also be included in the result table. And since we will be getting the values for Account and Allocation (amounts) we added them in the action fields so we could define the formula and it will be also included in the result.

| Signature | ||

| Granularity | Selection | Action |

| Cost Center | Cost Center | Account |

| Salary Level 1 | Amount | |

| Salary Level 2.1 | Currency | |

| Salary Level 2.2 | ||

| Vacation Level 1 | ||

| Vacation Level 2 | ||

| Overtime per FTE | ||

Configuring the Rules

Once you have connected the Input (Model Table) and defined the signature fields, the Input and Result tab will become available in the rules and will be containing the fields maintained in the Signature Section.

The input tab will not contain any data but can be used by adding dummy data to test the excel formula used in the result and is not considered in the calculation during system runtime.

Result Tab will basically layout/present the output that we wanted, and we use formulas by cross-referencing the value which will be captured in the Input tab. As our main goal is we use a workbook calculation adapter to get the Accounts and Allocation within the Cost Center

To calculate allocation per Account Number, we need to import the HR Expense Budgeting as it calculates the allocation based on the variable for salary, vacation, overtime, etc.

To Import, Follow the steps below to import an Excel or CSV file:

- On the expanded workbook calculation rules, choose the File button located at the upper left of the workbook.

- Select Import.

- Depending on the type of file to be imported, choose either Import Excel File or Import CSV File.

- Select Import Excel file.

5. Then select the HR Expenses Budgeting.

or you may read thru the Workbook Calculation (with Import) blog to know more.

After the import, the calculation rules will be filled with the data from the HR Expenses Budgeting shown below highlighted in orange boxes. The Input and Result tabs will still be intact.

The Workbook Calculation Adapter will read dynamically the values from our Input tab (coming from Input -Model Table) by using the formula “=Input!A2” in Cell I4 of the calculation tab to get the value of the cost center. Look at how we did it below at least for the Cost center.

We did the same thing for the Fiscal year, we used the formula “=Input!B2” in Cell I3 and for other variables that are highlighted in yellow which are Salary per FTE, Vacation factor, and Overtime.

As mentioned previously, In the result tab we can calculate the allocations (amount). By cross-referencing the value or reading dynamically in the HR Expenses Budgeting tabs we imported. We set the formula as shown below;

| COST_CENTER | FISCAL_YEAR | SALARY_LEVEL_1 | SALARY_LEVEL_2_1 | SALARY_LEVEL_2_2 | VACATION_LEVEL_1 | VACATION_LEVEL_2 | OVERTIME_PER_FTE | ACCOUNT | AMOUNT | CURRENCY |

| =Calculation!I$4 | =Calculation!I$3 | =Calculation!F$16 | =Calculation!F$17 | =Calculation!F$18 | =Calculation!H$21 | =Calculation!H$22 | =Calculation!H$31 | 10001 | =ROUND(SUMIF(Calculation!$J$56:$J$87,Result!I2,Calculation!$L$56:$L$87),0) | EUR |

The data is presented in the Result tab by itemizing the accounts per cost center and the allocation or amounts are calculated accordingly

Once all the configurations are done, we save, activate, and run the functions, the result would look like the sample below.

| Cost Center | Fiscal Year | Salary Level 1 | Salary Level 2.1 | Salary Level 2.2 | Vacation Level 1 | Vacation Level 2 | Overtime per FTE | Account | Amount | Currency |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10001 | 42000 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10002 | 97200 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10003 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10004 | 367 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10005 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10006 | 5400 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10007 | 12000 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10008 | 2500 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10009 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10010 | 3 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10011 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10012 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10013 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10014 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10015 | 2667 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10016 | 1000 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10017 | 1000 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10018 | 3333 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10019 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10020 | 62228 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10021 | 49727 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10022 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10023 | 0 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10024 | 30624 | EUR |

| CC1 | 2021 | 1000 | 3000 | 5000 | 1 | 1 | 1 | 10025 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10001 | 82000 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10002 | 121200 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10003 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10004 | 367 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10005 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10006 | 7200 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10007 | 14400 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10008 | 2500 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10009 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10010 | 7 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10011 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10012 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10013 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10014 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10015 | 5333 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10016 | 2000 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10017 | 2000 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10018 | 6667 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10019 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10020 | 118225 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10021 | 49727 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10022 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10023 | 0 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10024 | 35017 | EUR |

| CC2 | 2021 | 2000 | 4000 | 6000 | 2 | 2 | 2 | 10025 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10001 | 122000 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10002 | 145200 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10003 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10004 | 367 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10005 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10006 | 9000 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10007 | 16800 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10008 | 2500 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10009 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10010 | 10 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10011 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10012 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10013 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10014 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10015 | 8000 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10016 | 3000 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10017 | 3000 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10018 | 10000 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10019 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10020 | 174222 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10021 | 49727 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10022 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10023 | 0 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10024 | 39411 | EUR |

| CC3 | 2021 | 3000 | 5000 | 7000 | 3 | 3 | 3 | 10025 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10001 | 162000 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10002 | 241200 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10003 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10004 | 367 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10005 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10006 | 14400 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10007 | 28800 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10008 | 2500 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10009 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10010 | 13 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10011 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10012 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10013 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10014 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10015 | 10667 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10016 | 4000 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10017 | 4000 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10018 | 13333 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10019 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10020 | 230219 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10021 | 49727 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10022 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10023 | 0 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10024 | 43804 | EUR |

| CC4 | 2021 | 4000 | 8000 | 12000 | 4 | 4 | 4 | 10025 | 0 | EUR |

There you go! You can now use your existing excel based calculation tool as an input to workbook calculation by importing the locally saved excel file. You can also use the workbook calculation as an input to a Query function (Results Reporting) for reporting purposes.

If you enjoyed this blog share it with your friends and colleagues and leave a comment below. I’d like to know what you think!

- SAP Managed Tags:

- SAP Profitability and Performance Management

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Business Trends

145 -

Business Trends

15 -

Event Information

35 -

Event Information

9 -

Expert Insights

8 -

Expert Insights

29 -

Life at SAP

48 -

Product Updates

521 -

Product Updates

63 -

Technology Updates

196 -

Technology Updates

10

Related Content

- SAP Sustainability für Financial Services - Portfolio & Lösungen in Financial Management Blogs by SAP

- SAP Sustainability for Financial Services - Portfolio and Solutions in Financial Management Blogs by SAP

- Group Reporting Rule Based COI - TP calculation in Financial Management Q&A

- TRM Treasury: Movement interest expense (gross) with MZWST X "Calculate tax" to FI in Financial Management Q&A

- Calculating Forecast using sum of previous year actuals and input of current month forecast in Financial Management Q&A

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |