- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Mass upload of Taxes in SAP S/4HANA Cloud for Sale...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

03-23-2023

12:07 PM

Introduction

With SAP S/4HANA Cloud 2302 release we have a new Fiori app to mass upload Sales Taxes. With this app “Manage Tax Rates – Sales”, you can create tax rates in the form of condition records as the pricing master data in sales in mass. This Blog Post has been written to address common query of mass upload of taxes in Sales.

With this App following features are possible

- You can Search for existing condition records with filter criteria

- Create one or more condition records simultaneously. Mass functionality is possible. You can download the template and upload the conditions

- Determine the tax rate for a condition record

- Define pricing scales

- Copy selected condition records to new ones

- Edit and delete condition records

- Import condition records

- View import history

Process Flow

Let us see how the mass upload functionality works in SAP S/4HANA Cloud.

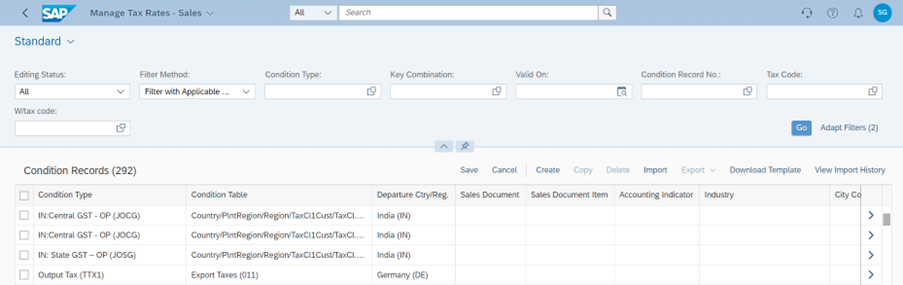

1. Open the app Manage Tax Rates – Sales

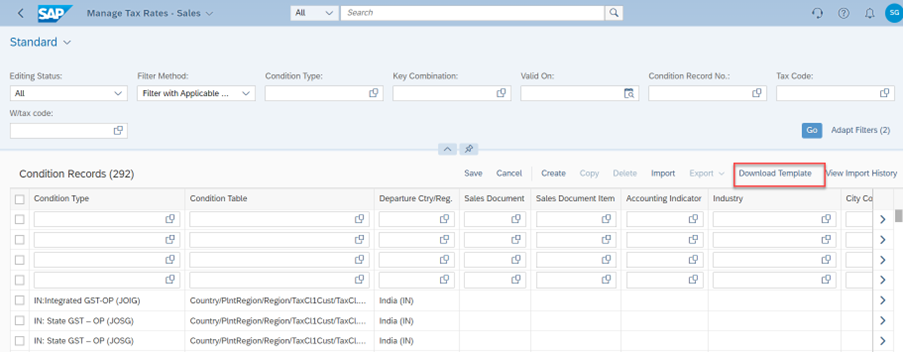

2. Download the template for Mass Upload

Fill the data as below. Below is a sample

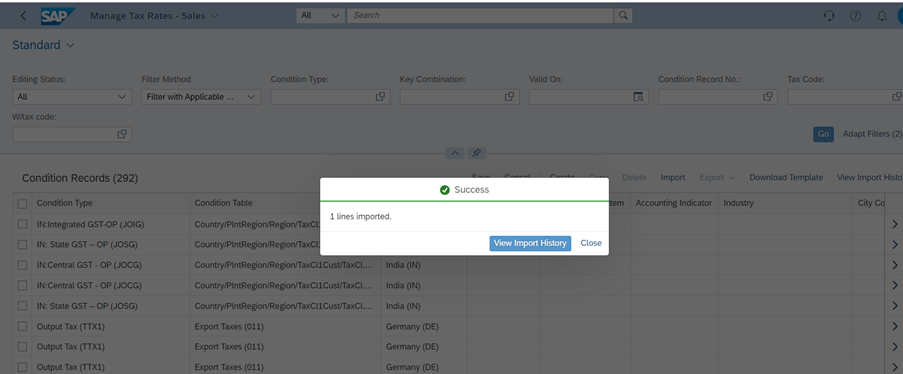

3. Import the Data

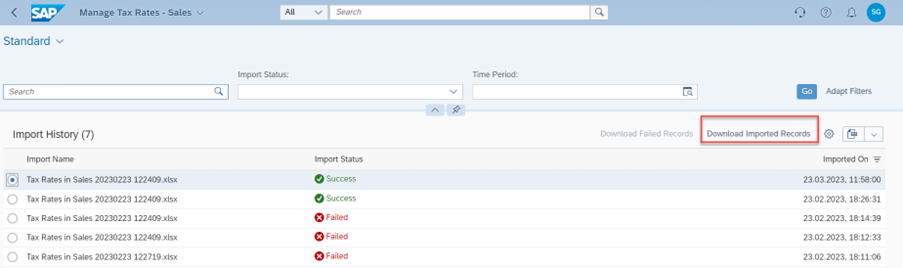

4. Once the file is imported, we can see the status

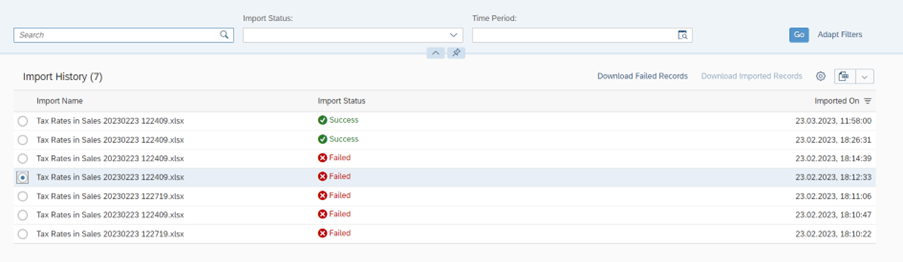

5. We can also download the failed and success file.

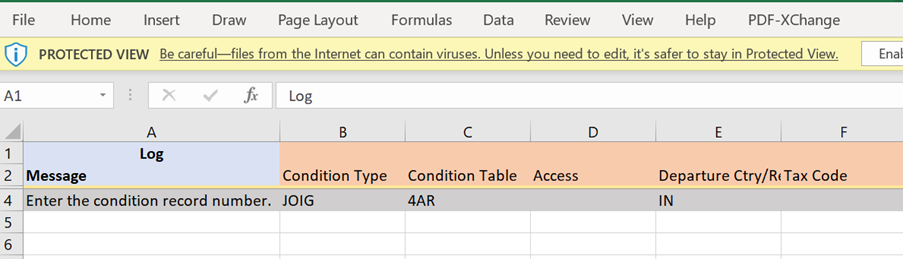

For failed error message can be seen as below

For Success we can see the condition record number created

6. The record can be validated

Conclusion

The Blog post should help your understand in detail how to upload sales taxes in mass using Manage Tax Rates – Sales

References

https://help.sap.com/docs/SAP_S4HANA_CLOUD/a376cd9ea00d476b96f18dea1247e6a5/6923c411b2b240fc9b6913b3...

- SAP Managed Tags:

- SAP S/4HANA Cloud for Sales,

- SAP S/4HANA Public Cloud

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

164 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

236 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Data Migration by creating copies. Best Approach? in Enterprise Resource Planning Q&A

- FAQ: S/4HANA Cloud, public edition - Sales in Enterprise Resource Planning Blogs by SAP

- SAP ERP Functionality for EDI Processing: UoMs Determination for Inbound Orders in Enterprise Resource Planning Blogs by Members

- Any alternative CDS View for "I_Trrmonitor" and "I_SlsPerformancePlanActualCube" ? in Enterprise Resource Planning Q&A

- Deep Dive into SAP Build Process Automation with SAP S/4HANA Cloud Public Edition - Retail in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 7 | |

| 5 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 |