- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Magnetic Media Compliance Reports: VAT Higher than...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

02-18-2022

2:54 PM

¿Quiere leer este post en español?

Hi everyone,

Keeping on with the series about the Report Formats you receive by default when you install the Magnetic Media Compliance Reports. In this blog post we will address the VAT higher than Cost Amount in 1001 Report Format. If you need more information on the 1001 Report Format, please click here to read our post about it.

If you have missed our previous posts regarding Magnetic Media Compliance Reports, you can find them here:

In this blog post we will go through these topics:

What is the VAT Higher than Cost Amount?

VAT Higher than Cost Amount refers to the posting of the gross expense to a single item, which results from the sum of the net expense and tax generated.

In Colombia, the VAT amount paid by companies on the purchase of goods and services is usually discountable, but in some cases, this does not apply, that is, it cannot be discounted in the VAT return. When this happens, the VAT amount paid must be carried over to the amount of the purchase made.

Example:

suppose the company bought a TV for $200.000 plus 5% VAT rate. If the company sells televisions, the $10.000 VAT rate goes to the discountable VAT account. But if the company does not sell televisions, and instead buys it to put it in the cafeteria, that VAT rate adds to the cost of the TV, so the fixed asset takes a total of $210.000.

In the first case, only $200,000 Colombian pesos would be taken into the inventory, as the rest is a tax that the company can deduct when filing the VAT return and from there that posts it to a separate account. The VAT generated on this case is reported in the 1005 Report Format. You can find more details here: Magnetic Media Compliance Reports: The 1005 and 1006 Report Formats.

In our example, the second case represents the VAT Higher than Cost Amount scenario, which is the main topic of this Blogpost.

You must evaluate your applicable business scenarios for VAT Higher than Cost Amount, according to regulations established in Colombia. To do this, we recommend that you look for the local consulting area of Colombia (partner or SAP Colombia) that specializes in Colombian tax regulations.

What is reported in 1001 Report Format?

According to the legal requirement established by DIAN (Dirección de Impuestos y Aduanas Nacionales), VAT Higher than Cost Amount is the only VAT scenario to be reported under this format.

In the 1001 Report Format, the expense and tax amounts must be correctly distributed and classified in the XML output file that you send to DIAN.

Thus, the net expense (base amount) is reported in the columns PAGO (Payments or credits in deductible accounts) or PNDED (Payments or credits in non-deductible accounts), and the VAT tax amount in the IDED (VAT higher than cost or deductible expense) or INDED (VAT higher than cost or non-deductible expense) columns, according to your setting for 1001 Report Format.

If you want to have more details about the information you report in the XML output file of 1001 Report Format, you can find them here: Magnetic Media Compliance Reports: The 1001 Report Format.

Tax Processing with Account Keys NAV and NVV

Before continuing, it is important to understand the VAT concepts and how it is handled in the system. Let’s have a look.

Account keys NAV and NVV configured with posting indicator '3' (Distribute to relevant expense/revenue items) are used to determine the VAT Higher than Cost Amount scenario.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in OBCN transaction, displaying the setting for account key NAV.

Account key NAV represents non-deductible and non-assignable input tax, that is:

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in OBCN transaction, displaying the setting for account key NVV.

Account key NVV represents the non-deductible and assignable input tax, that is:

No separate line item is created for the tax amount. The tax amount non-deductible is added to the G/L account line subject to tax. In case of several G/L account lines the tax amount is added to the particular positions proportionately.

Let's see examples of VAT tax codes using account keys NAV and NVV.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FTXP transaction, displaying the setting for a VAT tax code using account key NAV.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FTXP transaction, displaying the setting for a VAT tax code using account key NVV.

VAT Higher than Cost Amount in Financials (SAP FI)

In Financials, the gross expense and VAT taxes amount are posted at the same accounting document.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying a Vendor Invoice (KR).

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying the Tax Data generated in a Vendor Invoice (KR).

Taking this Vendor Invoice as an example, we have $82.044.531 as the net expense (base amount) and $3.281.784 as the tax amount, resulting in a total of $85.326.315. Thus, base and tax amounts must be reported to DIAN in 1001 Report Format.

VAT Higher than Cost Amount in Material Management (SAP MM)

Purchases Orders that have accrued expenses paid to third parties and taxes amounts must be reported to DIAN in the 1001 Report Format.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in ME23n transaction, displaying a Purchase Order document.

In Material Management, the gross expense is posted in the goods receipt document (MIGO) and VAT taxes amount in the invoice receipt document (MIRO).

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying a Goods Receipt document (MIGO).

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying an Invoice Receipt document (MIRO).

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying the Tax Data generated in an Invoice Receipt document (MIRO).

Taking this Purchase Order as an example, we have $33.461.300 as the net expense (base amount) and $1.673.065 as the tax amount, resulting in a total of $35.134.365. Thus, base and tax amounts must be reported to DIAN in 1001 Report Format.

How to configure the 1001 report format

Before you run the 1001 Report Format (CO_DIAN_1001), you need to configure data sources for the extraction: G/L accounts and VAT codes used in the VAT Higher than Cost Amount. Let's see what is needed.

Firstly, you must assign G/L accounts and their item types according to what is relevant to the 1001 report format, and you also inform their validity and classification.

Keep in mind that you must specify the G/L account that represents the expense in the transaction.

For example:

in the Materials Management scenario, the G/L account representing the expense in the transaction is only present in MIGO document, that is, the GR/IR clearing accounts found in the MIRO document should not be configured in 1001 Report Format as they will be derived technically from the expense G/L account found in the MIGO document.

As a rule, company codes must implement a detailed chart of accounts where each expense G/L account in the MIGO document is assigned to only one DIAN item type. This approach is necessary because DIAN requires companies to report each expense per DIAN item type, and Materials Management allows you to configure the same GR/IR clearing account for different types of expenses.

You can find more basic prerequisites in the SAP Note 3128041 - DRC - Magnetic Media: Basic Prerequisites for using SAP S/4HANA Magnetic Media compliance ....

To access the Maintain G/L Accounts customizing activity, go to:

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in SPRO transaction, with a highlight in the structure to draw attention to the Maintain G/L Accounts customizing activity.

In the Maintain G/L Accounts customizing activity, you find the following view:

For users who rely on a screen reader: The picture shows a screenshot of the Maintain G/L Accounts view in edition mode.

In more details, in this view you enter:

Continuing, you need to specify all the VAT identification codes and the key account codes in the Maintain VAT Codes customizing activity.

To access the Maintain VAT Codes customizing activity, go to:

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in SPRO transaction, with a highlight in the structure to draw attention to the Maintain VAT Codes customizing activity.

In the Maintain VAT Codes customizing activity, you find the following view:

For users who rely on a screen reader: The picture shows a screenshot of the Maintain VAT Codes view in edition mode.

In more details, in this view you enter:

Ready! After setting these configurations, the 1001 Report Format automatically extracts and organizes the relevant information in an XML output file that you can send to DIAN.

Find below the step-by-step execution of the 1001 Report Format:

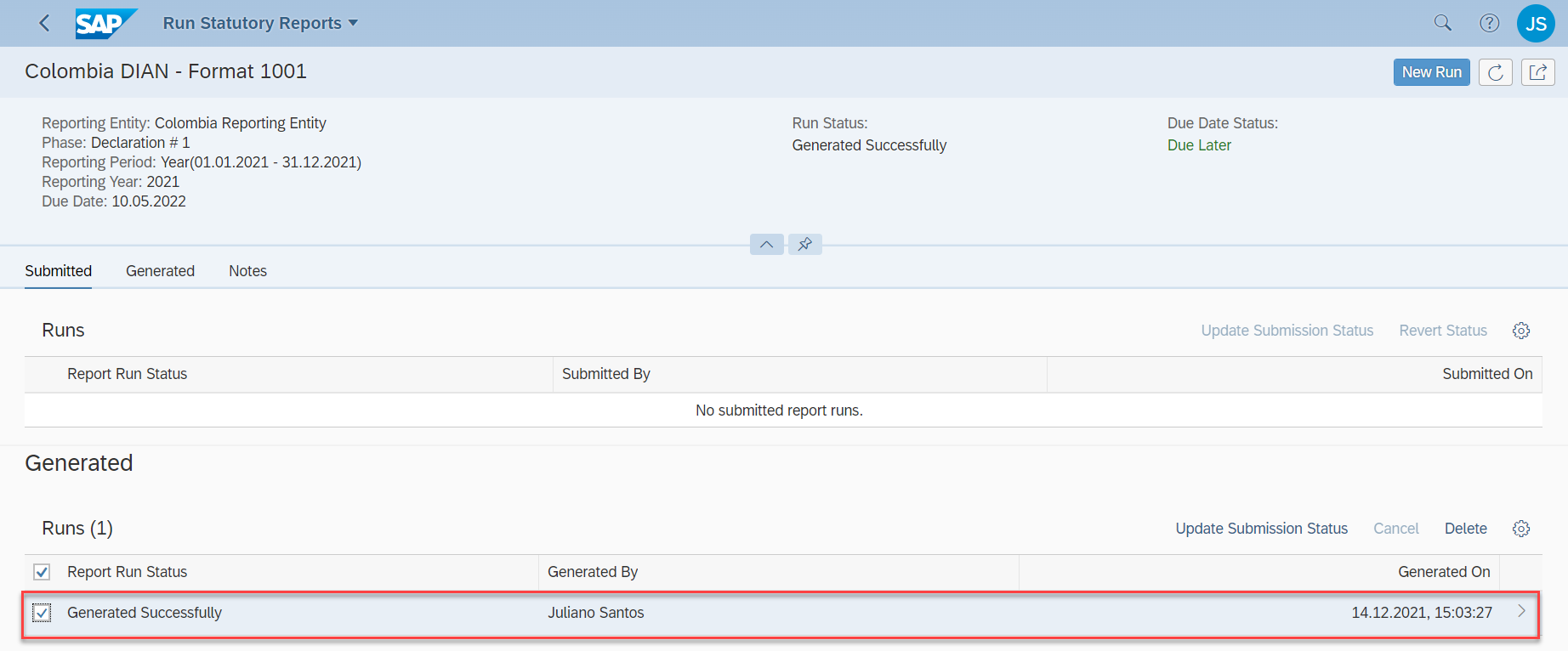

For users who rely on a screen reader: The pictures are screenshots of the step that is being described.

1 – In the SAP Fiori Launchpad, choose the Run Compliance Reports app.

2 – Filter for the CO_DIAN_1001 report format and choose the run you want to execute.

3 – Choose New Run.

4 – Enter the required parameters and choose Run.

5 – When your run is successfully generated, select it to see the details.

6 – Select the generated file and choose Download.

7 – Your XML output file is ready for you to send it to DIAN!

We hope this blog post is useful for you. Now you know the details of the 1001 Report Format and can stay compliant with the legal requirements of DIAN!

You find all the documentation for magnetic media compliance reports for Colombia in the SAP Help Portal, under help.sap.com/viewer/s4h_op_colombia.

If you have doubts about Magnetic Media in Colombia, you can also refer to SAP FAQ Note for Magnetic Media.

Are you missing any information about the magnetic media compliance reports? Let us know in the comments. Your doubt can be the subject of our next post.

And don’t forget to follow the Document and Reporting Compliance tag to stay tuned on news about Magnetic Media compliance reports for Colombia.

See you in the next post,

Ariel Dias

#SAPGoGlobal #SAPLocalization

Hi everyone,

Keeping on with the series about the Report Formats you receive by default when you install the Magnetic Media Compliance Reports. In this blog post we will address the VAT higher than Cost Amount in 1001 Report Format. If you need more information on the 1001 Report Format, please click here to read our post about it.

If you have missed our previous posts regarding Magnetic Media Compliance Reports, you can find them here:

- Magnetic Media Compliance Reports: City Codes in Master Data.

- Magnetic Media Compliance Reports: The 1003 Report Format.

- Magnetic Media Compliance Reports: The 1009 Report Format.

In this blog post we will go through these topics:

- What is the VAT Higher than Cost Amount?

- What is reported in 1001 Report Format?

- Tax Processing with Account Keys NAV and NVV.

- VAT Higher than Cost Amount in Financials (SAP FI).

- VAT Higher than Cost Amount in Material Management (SAP MM).

- How to configure the 1001 report format.

What is the VAT Higher than Cost Amount?

VAT Higher than Cost Amount refers to the posting of the gross expense to a single item, which results from the sum of the net expense and tax generated.

In Colombia, the VAT amount paid by companies on the purchase of goods and services is usually discountable, but in some cases, this does not apply, that is, it cannot be discounted in the VAT return. When this happens, the VAT amount paid must be carried over to the amount of the purchase made.

Example:

suppose the company bought a TV for $200.000 plus 5% VAT rate. If the company sells televisions, the $10.000 VAT rate goes to the discountable VAT account. But if the company does not sell televisions, and instead buys it to put it in the cafeteria, that VAT rate adds to the cost of the TV, so the fixed asset takes a total of $210.000.

In the first case, only $200,000 Colombian pesos would be taken into the inventory, as the rest is a tax that the company can deduct when filing the VAT return and from there that posts it to a separate account. The VAT generated on this case is reported in the 1005 Report Format. You can find more details here: Magnetic Media Compliance Reports: The 1005 and 1006 Report Formats.

In our example, the second case represents the VAT Higher than Cost Amount scenario, which is the main topic of this Blogpost.

You must evaluate your applicable business scenarios for VAT Higher than Cost Amount, according to regulations established in Colombia. To do this, we recommend that you look for the local consulting area of Colombia (partner or SAP Colombia) that specializes in Colombian tax regulations.

What is reported in 1001 Report Format?

According to the legal requirement established by DIAN (Dirección de Impuestos y Aduanas Nacionales), VAT Higher than Cost Amount is the only VAT scenario to be reported under this format.

In the 1001 Report Format, the expense and tax amounts must be correctly distributed and classified in the XML output file that you send to DIAN.

Thus, the net expense (base amount) is reported in the columns PAGO (Payments or credits in deductible accounts) or PNDED (Payments or credits in non-deductible accounts), and the VAT tax amount in the IDED (VAT higher than cost or deductible expense) or INDED (VAT higher than cost or non-deductible expense) columns, according to your setting for 1001 Report Format.

If you want to have more details about the information you report in the XML output file of 1001 Report Format, you can find them here: Magnetic Media Compliance Reports: The 1001 Report Format.

Tax Processing with Account Keys NAV and NVV

Before continuing, it is important to understand the VAT concepts and how it is handled in the system. Let’s have a look.

Account keys NAV and NVV configured with posting indicator '3' (Distribute to relevant expense/revenue items) are used to determine the VAT Higher than Cost Amount scenario.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in OBCN transaction, displaying the setting for account key NAV.

Account key NAV represents non-deductible and non-assignable input tax, that is:

- Non-deductible: A posting to a separate G/L account is created for the input tax amount.

- Non-assignable: A possible account assignment from the G/L account line is not transferred to the tax line.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in OBCN transaction, displaying the setting for account key NVV.

Account key NVV represents the non-deductible and assignable input tax, that is:

No separate line item is created for the tax amount. The tax amount non-deductible is added to the G/L account line subject to tax. In case of several G/L account lines the tax amount is added to the particular positions proportionately.

Let's see examples of VAT tax codes using account keys NAV and NVV.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FTXP transaction, displaying the setting for a VAT tax code using account key NAV.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FTXP transaction, displaying the setting for a VAT tax code using account key NVV.

VAT Higher than Cost Amount in Financials (SAP FI)

In Financials, the gross expense and VAT taxes amount are posted at the same accounting document.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying a Vendor Invoice (KR).

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying the Tax Data generated in a Vendor Invoice (KR).

Taking this Vendor Invoice as an example, we have $82.044.531 as the net expense (base amount) and $3.281.784 as the tax amount, resulting in a total of $85.326.315. Thus, base and tax amounts must be reported to DIAN in 1001 Report Format.

VAT Higher than Cost Amount in Material Management (SAP MM)

Purchases Orders that have accrued expenses paid to third parties and taxes amounts must be reported to DIAN in the 1001 Report Format.

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in ME23n transaction, displaying a Purchase Order document.

In Material Management, the gross expense is posted in the goods receipt document (MIGO) and VAT taxes amount in the invoice receipt document (MIRO).

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying a Goods Receipt document (MIGO).

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying an Invoice Receipt document (MIRO).

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in FB03 transaction, displaying the Tax Data generated in an Invoice Receipt document (MIRO).

Taking this Purchase Order as an example, we have $33.461.300 as the net expense (base amount) and $1.673.065 as the tax amount, resulting in a total of $35.134.365. Thus, base and tax amounts must be reported to DIAN in 1001 Report Format.

How to configure the 1001 report format

Before you run the 1001 Report Format (CO_DIAN_1001), you need to configure data sources for the extraction: G/L accounts and VAT codes used in the VAT Higher than Cost Amount. Let's see what is needed.

Firstly, you must assign G/L accounts and their item types according to what is relevant to the 1001 report format, and you also inform their validity and classification.

Keep in mind that you must specify the G/L account that represents the expense in the transaction.

For example:

in the Materials Management scenario, the G/L account representing the expense in the transaction is only present in MIGO document, that is, the GR/IR clearing accounts found in the MIRO document should not be configured in 1001 Report Format as they will be derived technically from the expense G/L account found in the MIGO document.

As a rule, company codes must implement a detailed chart of accounts where each expense G/L account in the MIGO document is assigned to only one DIAN item type. This approach is necessary because DIAN requires companies to report each expense per DIAN item type, and Materials Management allows you to configure the same GR/IR clearing account for different types of expenses.

You can find more basic prerequisites in the SAP Note 3128041 - DRC - Magnetic Media: Basic Prerequisites for using SAP S/4HANA Magnetic Media compliance ....

To access the Maintain G/L Accounts customizing activity, go to:

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in SPRO transaction, with a highlight in the structure to draw attention to the Maintain G/L Accounts customizing activity.

In the Maintain G/L Accounts customizing activity, you find the following view:

For users who rely on a screen reader: The picture shows a screenshot of the Maintain G/L Accounts view in edition mode.

In more details, in this view you enter:

- The interval of G/L accounts that are relevant for the 1001 report format.

- The item types for the G/L accounts you entered.

- The company code.

- The validity dates.

- The amount classification (PAGO for payments or credits in deductible accounts and PNDED for payments or credits in non-deductible accounts).

Continuing, you need to specify all the VAT identification codes and the key account codes in the Maintain VAT Codes customizing activity.

To access the Maintain VAT Codes customizing activity, go to:

For users who rely on a screen reader: The picture shows a screenshot of the SAP system in SPRO transaction, with a highlight in the structure to draw attention to the Maintain VAT Codes customizing activity.

In the Maintain VAT Codes customizing activity, you find the following view:

For users who rely on a screen reader: The picture shows a screenshot of the Maintain VAT Codes view in edition mode.

In more details, in this view you enter:

- VAT Codes that are relevant for the 1001 report format.

- The item types for the VAT Codes you entered. Make sure to use the same DIAN item type configured into the Maintain G/L Accounts customizing activity.

- Tax Procedure for the VAT Codes you entered.

- Account key for the VAT Codes you entered.

- The validity dates.

- The amount classification (IDED for VAT higher than cost or deductible expense and INDED for VAT higher than cost or non-deductible expense).

Ready! After setting these configurations, the 1001 Report Format automatically extracts and organizes the relevant information in an XML output file that you can send to DIAN.

Find below the step-by-step execution of the 1001 Report Format:

For users who rely on a screen reader: The pictures are screenshots of the step that is being described.

1 – In the SAP Fiori Launchpad, choose the Run Compliance Reports app.

2 – Filter for the CO_DIAN_1001 report format and choose the run you want to execute.

3 – Choose New Run.

4 – Enter the required parameters and choose Run.

5 – When your run is successfully generated, select it to see the details.

6 – Select the generated file and choose Download.

7 – Your XML output file is ready for you to send it to DIAN!

We hope this blog post is useful for you. Now you know the details of the 1001 Report Format and can stay compliant with the legal requirements of DIAN!

You find all the documentation for magnetic media compliance reports for Colombia in the SAP Help Portal, under help.sap.com/viewer/s4h_op_colombia.

If you have doubts about Magnetic Media in Colombia, you can also refer to SAP FAQ Note for Magnetic Media.

Are you missing any information about the magnetic media compliance reports? Let us know in the comments. Your doubt can be the subject of our next post.

And don’t forget to follow the Document and Reporting Compliance tag to stay tuned on news about Magnetic Media compliance reports for Colombia.

See you in the next post,

Ariel Dias

#SAPGoGlobal #SAPLocalization

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

27 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

26 -

Expert Insights

114 -

Expert Insights

170 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

242 -

Roadmap and Strategy

1 -

Technology Updates

1,501 -

Technology Updates

90

Related Content

- Need clarity on SAP Document and Reporting Compliance Malaysia Solution in Enterprise Resource Planning Q&A

- New Reporting Activities for Withholding Tax Declarations in SAP Document and Reporting Compliance in Enterprise Resource Planning Blogs by SAP

- What You Need to Know: Security and Compliance when Moving to a Cloud ERP Solution in Enterprise Resource Planning Blogs by SAP

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

- SAP Document and Reporting Compliance Brazil: Dashboard do Usage Analytics in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 22 | |

| 6 | |

| 6 | |

| 5 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |