- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- Magnetic Media Compliance Reports: The 1009 Report...

Technology Blogs by SAP

Learn how to extend and personalize SAP applications. Follow the SAP technology blog for insights into SAP BTP, ABAP, SAP Analytics Cloud, SAP HANA, and more.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-31-2020

8:23 PM

¿Quiere leer este post en español?

Finally, another post from our report format series! Today you’ll learn more about the 1009 report format for magnetic media reporting in Colombia.

As usual, if you have missed our previous posts, you can find them here:

How can you use the 1009 report format?

You use the 1009 report format to report your liability balance at the end of the fiscal period, which is generally December 31st.

Based on the G/L accounts that you configure in the Maintain G/L Accounts (FICODIANV_GLA) customizing activity, the 1009 report format extracts the following information for the output XML file that you send to DIAN:

Also, this report format can be integrated with payroll systems to report employee’s payroll data. For more information on how to integrate with payroll systems, see Integration with Payroll Systems.

According to resolution 000060 of 2017, the government of Colombia requires that the 1009 report format includes minimum amount calculation. This requirement goes live on 2019 for reporting the fiscal year of 2018 onwards.

The minimum amount calculation is a customizing setting that you use to configure your system to report values from open items according to a minimum amount that you specify. With this configuration, the system aggregates values in one single line of the XML output file according to threshold you have specified. That is, all amounts that are under this threshold are aggregated in this single line of the XML output file.

To set a minimum amount threshold for each report format, go to SAP Customizing Implementation Guide > Financial Accounting > General Ledger Accounting > Periodic Processing > Report > Statutory Reporting: Colombia > Magnetic Media (DIAN) > Define Minimum Amount for Report Formats (FICODIANV_MINAMT), and specify the report format, the minimum amount and the validity of this configuration.

To enable the minimum amount setting for the 1009 report format, make sure you have applied SAP Note 2594183 – Colombia Magnetic Media Compliance Reporting in SAP S/4 HANA OP1709 FPS1/FPS2 – 1....

Find below the information you report in the XML output file of the 1009 report format when you run this report in the Run Advanced Compliance Reports app:

The Item Type, Document Type, and Identification Number fields are composed of a unique key for the 1009 report format, and that this key is repeated for the registers of one sent XML file.

You can find more information about Magnetic Media report formats in DIAN portal: https://www.dian.gov.co.

Before you run the 1009 report format, you need to configure data sources for extraction. To do so, you have to assign G/L accounts and item types – together with their validity and classification – according to what is relevant to the 1009 report format.

Having said that, the first configuration setting you need to visit is the Maintain G/L Accounts customizing activity.

To access the Maintain G/L Accounts customizing activity, go to SAP Customizing Implementation Guide > Financial Accounting > General Ledger Accounting > Periodic Processing > Report > Statutory Reporting: Colombia > Magnetic Media (DIAN) > Configure Data Sources for Report Formats > Maintain G/L Accounts (FICODIANV_GLA).

In the Maintain G/L Accounts customizing activity, you find the following view:

In this view, enter:

After maintaining the relevant G/L accounts, you can set a threshold for the minimum amount.

Go to SAP Customizing Implementation Guide > Financial Accounting > General Ledger Accounting > Periodic Processing > Report > Statutory Reporting: Colombia > Magnetic Media (DIAN) > Define Minimum Amount for Report Formats (FICODIANV_MINAMT), and define a threshold for the minimum amount calculation.

Ready! After setting these configurations, the 1009 report format automatically extracts and organizes the relevant information in an XML output file that you can send to DIAN.

Find below the step by step execution of the 1009 report format:

We hope this blog post is useful for you. Now you know the details of the 1009 report format and can stay compliant with the legal requirements of DIAN!

If you have doubts about Magnetic Media reports, see our FAQ SAP Note.

Want to know more about the Magnetic Media reports in ACR? See Magnetic Media (https://help.sap.com/viewer/s4h_op_colombia) in the SAP Help Portal.

Are you missing any information about the Magnetic Media reports? Let us know in the comments below. Your doubt can be the subject of our next publication.

Until the next post,

Rosana

#SAPGoGlobal #SAPLocalization

This post was translated from English into Spanish using the SAP Translation Portal. Check it out!

Finally, another post from our report format series! Today you’ll learn more about the 1009 report format for magnetic media reporting in Colombia.

As usual, if you have missed our previous posts, you can find them here:

- Magnetic Media Compliance Reports: Address Determination for Minimum Amount Registers

Magnetic Media Compliance Reports: City Codes in Master Data

The 1009 Report Format

How can you use the 1009 report format?

You use the 1009 report format to report your liability balance at the end of the fiscal period, which is generally December 31st.

Based on the G/L accounts that you configure in the Maintain G/L Accounts (FICODIANV_GLA) customizing activity, the 1009 report format extracts the following information for the output XML file that you send to DIAN:

- Open items from creditors

- Open items from customers related to down payments

Also, this report format can be integrated with payroll systems to report employee’s payroll data. For more information on how to integrate with payroll systems, see Integration with Payroll Systems.

According to resolution 000060 of 2017, the government of Colombia requires that the 1009 report format includes minimum amount calculation. This requirement goes live on 2019 for reporting the fiscal year of 2018 onwards.

The minimum amount calculation is a customizing setting that you use to configure your system to report values from open items according to a minimum amount that you specify. With this configuration, the system aggregates values in one single line of the XML output file according to threshold you have specified. That is, all amounts that are under this threshold are aggregated in this single line of the XML output file.

To set a minimum amount threshold for each report format, go to SAP Customizing Implementation Guide > Financial Accounting > General Ledger Accounting > Periodic Processing > Report > Statutory Reporting: Colombia > Magnetic Media (DIAN) > Define Minimum Amount for Report Formats (FICODIANV_MINAMT), and specify the report format, the minimum amount and the validity of this configuration.

To enable the minimum amount setting for the 1009 report format, make sure you have applied SAP Note 2594183 – Colombia Magnetic Media Compliance Reporting in SAP S/4 HANA OP1709 FPS1/FPS2 – 1....

Find below the information you report in the XML output file of the 1009 report format when you run this report in the Run Advanced Compliance Reports app:

| Attribute | Title | Type | Length | Criteria |

| Cpt | Item type | Int | 4 | According to DIAN’s resolution. This data must be always reported. |

| Tdoc | Document type | Int | 2 | According to DIAN’s resolution. This data must be always reported. |

| Nid | Identification number | String | 20 | Fill this data without hyphens, periods, commas or blank spaces. This data must be always reported. |

| Dv | Verification digit | Int | 1 | Report this data for type 31 documents – Nit, if you have this data, report it. |

| Apl1 | Third-party first surname | String | 60 | This data is mandatory for natural persons. |

| Apl2 | Third-party second surname | String | 60 | This data is mandatory for natural persons if you have it. |

| Nom1 | Third-party first name | String | 60 | This data is mandatory for natural persons. |

| Nom2 | Third-party other names | String | 60 | This data is mandatory for natural persons if you have it. |

| Raz | Third-party social reason | String | 450 | This data is mandatory for legal persons. |

| Dir | Address | String | 200 | This data is mandatory if the residency country is Colombia. |

| Dpto | Department code | Int | 2 | DANE – numeric code, include zeros to the left hand-side. This data is mandatory if the residency country is Colombia. |

| Mun | Municipal code | Int | 3 | DANE – numeric code, include zeros to the left hand-side. This data is mandatory if the residency country is Colombia. |

| Pais | Residency or domiciliary country | Int | 4 | According to DIAN’s resolution. This data must be always reported. |

| Sal | Third-party’s payable balance on December 31th | Double | 20 | This data must be a positive and whole number. Do not include periods or commas. This data must be always reported. |

The Item Type, Document Type, and Identification Number fields are composed of a unique key for the 1009 report format, and that this key is repeated for the registers of one sent XML file.

You can find more information about Magnetic Media report formats in DIAN portal: https://www.dian.gov.co.

How to configure the 1009 report format

Before you run the 1009 report format, you need to configure data sources for extraction. To do so, you have to assign G/L accounts and item types – together with their validity and classification – according to what is relevant to the 1009 report format.

Having said that, the first configuration setting you need to visit is the Maintain G/L Accounts customizing activity.

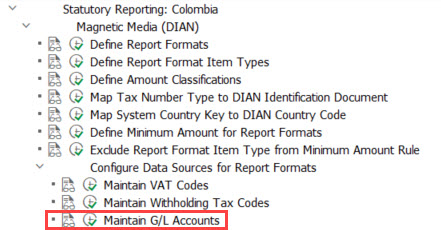

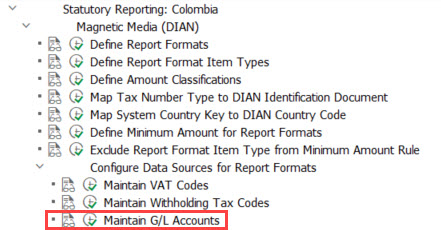

To access the Maintain G/L Accounts customizing activity, go to SAP Customizing Implementation Guide > Financial Accounting > General Ledger Accounting > Periodic Processing > Report > Statutory Reporting: Colombia > Magnetic Media (DIAN) > Configure Data Sources for Report Formats > Maintain G/L Accounts (FICODIANV_GLA).

For visually impaired readers: The picture shows a screenshot of the SAP system in SPRO transaction, with a highlight in the structure to draw attention to the Maintain G/L Accounts customizing activity.

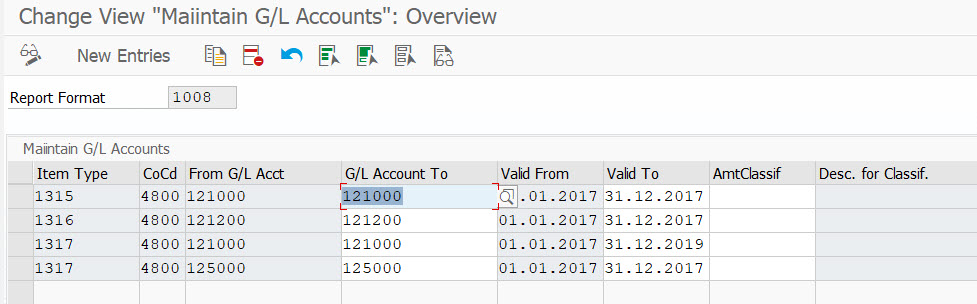

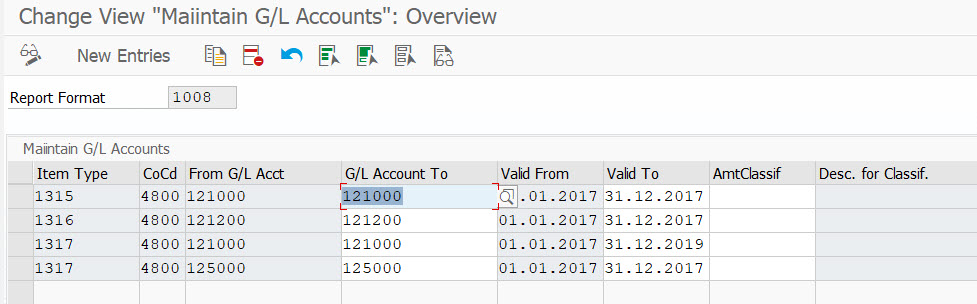

In the Maintain G/L Accounts customizing activity, you find the following view:

For visually impaired readers: The picture shows a screenshot of the Maintain G/L Accounts view in edition mode.

In this view, enter:

- Suppliers' reconciliation accounts

- Customer down payments accounts

- The item types for the G/L accounts you have entered

- The company code

- The validity dates

After maintaining the relevant G/L accounts, you can set a threshold for the minimum amount.

Go to SAP Customizing Implementation Guide > Financial Accounting > General Ledger Accounting > Periodic Processing > Report > Statutory Reporting: Colombia > Magnetic Media (DIAN) > Define Minimum Amount for Report Formats (FICODIANV_MINAMT), and define a threshold for the minimum amount calculation.

For visually impaired readers: The picture shows a screenshot of the SAP system in SPRO transaction, with a highlight in the structure to draw attention to the Define Minimum Amount for Report Formats customizing activity.

For visually impaired readers: The picture shows a screenshot of the Define Minimum Amount for Report Formats view in edition mode.

Ready! After setting these configurations, the 1009 report format automatically extracts and organizes the relevant information in an XML output file that you can send to DIAN.

Find below the step by step execution of the 1009 report format:

For visually impaired readers: The pictures are screenshots of the step that is being described.

1 – In the SAP Fiori Launchpad, choose the Run Compliance Reports app.

2 – Filter for the CO_DIAN_1009 report format and choose the run you want to execute.

3 – Choose New Run.

4 – Enter the required parameters and choose Run.

5 – When your run is successfully generated, select it to see the details.

6 – Select the generated file, and choose Download.

7 – Your XML output file is ready for you to send it to DIAN! ?

We hope this blog post is useful for you. Now you know the details of the 1009 report format and can stay compliant with the legal requirements of DIAN!

If you have doubts about Magnetic Media reports, see our FAQ SAP Note.

Want to know more about the Magnetic Media reports in ACR? See Magnetic Media (https://help.sap.com/viewer/s4h_op_colombia) in the SAP Help Portal.

Are you missing any information about the Magnetic Media reports? Let us know in the comments below. Your doubt can be the subject of our next publication.

Until the next post,

Rosana

#SAPGoGlobal #SAPLocalization

This post was translated from English into Spanish using the SAP Translation Portal. Check it out!

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,661 -

Business Trends

88 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

65 -

Expert

1 -

Expert Insights

178 -

Expert Insights

280 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

784 -

Life at SAP

11 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

330 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,886 -

Technology Updates

408 -

Workload Fluctuations

1

Related Content

- SAP Document and Reporting Compliance - 'Colombia' - Contingency Process in Technology Blogs by SAP

- What are the use cases of SAP Datasphere over SAP BW4/HANA in Technology Q&A

- Generate Custom Legal Certificates in SAP DRC in Technology Blogs by SAP

- Deliver Real-World Results with SAP Business AI: Q4 2023 & Q1 2024 Release Highlights in Technology Blogs by SAP

- What's New in the Newly Repackaged SAP Integration Suite, advanced event mesh in Technology Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 13 | |

| 10 | |

| 10 | |

| 9 | |

| 7 | |

| 6 | |

| 5 | |

| 5 | |

| 5 | |

| 4 |