- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Leading Ledger Selection for Parallel Accounting i...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-01-2023

5:03 AM

Introduction

A comprehensive guide to leading ledger selection in SAP S/4HANA Cloud, Public Edition system, accounting principles play a vital role in ensuring accurate financial reporting. This article aims to provide you with a clear understanding of how accounting principles are defined within the system, particularly when reporting in multiple accounting principles. We will focus on the crucial aspect of selecting the Leading Ledger and the Non-Leading Ledger, discussing the basis of decision-making.

Main section of this blog is “Leading Ledger Selection – Decision-Making”

Accounting Principle

Accounting principles are rules for legal accounting and financial statements and govern how companies record and report their financial data. Accounting standards are collections of accounting principles, for example, IFRS, HGB, US GAAP etc.

Ledger

A ledger that contains a full set of configuration settings and full posting information is called a standard ledger. Standard ledgers can be considered as synonymous for accounting principle.

- Leading Ledger

- Non-Leading Ledger

- Extension Ledger

Parallel Accounting

When your organization deals internationally, or it is a subsidiary of a corporate which is from some other country in such scenario you might need to produce your financials in more than one accounting principle. It is achieved through parallel accounting in SAP S/4HANA Cloud, Public Edition.

Parallel accounting in SAP S/4HANA Cloud supports you in fulfilling financial closing and management reporting requirements when you operate internationally. You need to close your books and do your reporting based on different accounting standards.

Available Ledger Combinations and Scenarios

The table below helps you to find out how many parallel ledgers your company needs, and which ledger combination is suitable. You can choose from the default ledger combinations and scenarios that are delivered by SAP and described here.

| Ledger Combinations According to Business Needs | ||

| Required Number of Ledgers | Required Ledger Combination | Supported Configuration Environment |

| Only one standard ledger that will cover your local accounting principle | Ledger 0L (leading ledger) | SAP Central Business Configuration and Manage Your Solution |

| Two parallel standard ledgers to fulfil the business need to use one local and one corporate accounting principle (IFRS) in parallel |

| SAP Central Business Configuration and Manage Your Solution |

| Two parallel standard ledgers to fulfil the business need to use one local and one corporate accounting principle (US-GAAP) in parallel |

| SAP Central Business Configuration and Manage Your Solution |

| Three parallel standard ledgers to fulfil the business need to use one local and two corporate accounting principles (for example, IFRS and US-GAAP) in parallel |

| SAP Central Business Configuration |

Based on the ledger combination that suits your business needs, select the relevant scenarios (scope items) during scoping:

| Scenarios | |||

| Ledger | Ledger Type | Accounting Principle (Default) | Scenario (Scope Item) |

| 0L | leading ledger | local accounting principle | J58 (contained in the standard scope and cannot be deactivated) |

| 2L | non-leading ledger | IFRS | 1GA |

| 3L | non-leading ledger | USGP | 2VA |

After considering the appropriate ledgers for your parallel accounting requirements in the implementation, the next step is to determine the leading ledger.

Leading Ledger Selection: Decision-Making

- SAP delivers the leading ledger as Ledger 0L with local accounting principle.

- SAP recommends using the leading ledger, such as IFRS or US GAAP, for your corporate/group ledger when you have a need for multiple accounting principles or parallel reporting.

- By default, SAP designates 0L (Local accounting principle) as the leading ledger. This may raise the question: if SAP recommends using the corporate ledger (IFRS or US GAAP) as the leading ledger if you need parallel reporting, why isn't the corporate ledger set as the default leading ledger? Let's explore this further.

- Local ledger and the leading ledger are mandatory in the S/4HANA Cloud system, the inclusion of non-leading ledger(s) is optional.

- In my personal view, SAP has made 0L (with the Local Accounting Principle) the default choice for the leading ledger selection, considering the frequency of implementations that only require a single ledger.

- In each company code, the leading ledger receives the same settings that apply to that company code: the currencies, the fiscal year variant, and the variant of the posting periods.

- The 0L ledger is mandatory for all company codes, necessitating the assignment of all company codes to the leading ledger.

- The document numbers assigned in leading ledger apply to all dependent ledgers.

- Only one common fiscal year variant is allowed in the leading ledger for all the company codes.

- It also means that the different fiscal year variant cannot be assigned to the leading ledger and company code combination. So, if you have multiple company codes and countries in your implementation and then if any of these company codes need a deviating/different fiscal year variant then you need to have corporate ledger (IFRS or USGAAP) as your leading ledger and assign your local accounting principle to non-leading ledger so that you can achieve different fiscal year variant for your company codes.

- Assigning alternative fiscal year variants is only possible for the non-leading, parallel ledger at the company code level.

- Assigning alternative fiscal year variants is limited to new company codes where no data has been posted yet.

- When making decisions about fiscal year variants, it is important to consider your future state. This includes potential future legal entities that may be added to the system, which could require a deviating fiscal year. In such scenarios, it is crucial to ensure that your system is capable of accommodating different fiscal year variants for the local accounting principle.

- You need to switch accounting principles to achieve corporate ledger as your leading ledger.

- To make the corporate ledger the leading ledger, a switch in accounting principles is required.

- Based on the standard settings and SAP documentation, we can infer that

- 0L Ledger = Local Accounting Principle (as per company codes)

- 2L Ledger = IFRS Accounting Principle

- 3L Ledger = US GAAP Accounting Principle

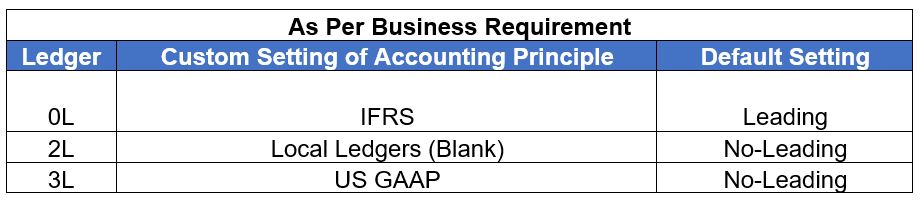

If we modify the default settings to the following:

- With the proposed modification, our system will be interpreted as

- 0L = IFRS Accounting Principle

- 2L = Local Accounting Principle (as per company codes)

- 3L = US GAAP Accounting Principle

Taking into account all the points mentioned above, it is essential to make an informed decision regarding the selection of the leading ledger. In many cases, the leading ledger can serve as the global ledger for all the entities, considering the reasons stated earlier.

Hint: If your company code requires a different fiscal year compared to the group accounting principle, you can achieve this by switching the Local ledger to a non-standard ledger (such as Ledger 0L) while maintaining the standard accounting principles (IFRS or USGAAP) for the group accounting principle. This allows you to maintain a deviating fiscal year variant for your company code in the local accounting principles.

Special Notes

- With additional ledger/ accounting principle you also get additional work as the several month-end activities are performed ledger-wise. Select additional ledger when you really need it.

- USAP and USGP both are US GAAP. USAP is for local accounting principle for US country and USGP is for internationally used accounting principle.

- When you change your leading ledger to corporate ledger. You also need to make changes in following functions

- Contract Accounting (FI-CA)

- Revenue Accounting (FI-RA)

- Group Reporting (FIN-CS)

- You cannot add ledgers after the initial scoping is finalized.

- You cannot remove activated ledgers at a later point in time.

Conclusion

Choosing the appropriate Leading Ledger is a critical decision in SAP S/4HANA Cloud, Public Edition when reporting in multiple accounting principles. This comprehensive guide has provided you with an in-depth understanding of accounting principles, parallel accounting, and the factors influencing Leading Ledger selection. By referring to the SAP Help Portal, you can make informed decisions and optimize your financial reporting processes, ensuring compliance and accuracy in your organization's accounting practices.

For precise guidance, please visit https://help.sap.com/docs/SAP_S4HANA_CLOUD

to ensure the correct selection of the Leading Ledger.

Disclaimer: This article is intended solely for educational purposes. When engaging in customer projects or working with SAP S/4HANA Cloud, Public Edition, it is essential to follow and seek guidance from the official SAP documentation available on https://help.sap.com/docs/ for S/4HANA Cloud, Public Edition.

----------------------------------END----------------------------------

Learn > Share > Grow

Embrace a culture of continuous learning and growth. Stay connected for additional insights and future blog posts to expand your knowledge.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

Ledger Combinations in SAP

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

S4HANACloud audit

1 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Assign Accounting Principles to Ledgers and Company Code: SAP Public Cloud in Enterprise Resource Planning Blogs by Members

- Recap of SAP S/4HANA 2023 Highlights Webinar: Finance in Enterprise Resource Planning Blogs by SAP

- Preparing for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

- Adjust settlement rule automatically created in IM for AuC in Enterprise Resource Planning Q&A

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 10 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |