- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- Post M&A considerations, including shared services...

Technology Blogs by SAP

Learn how to extend and personalize SAP applications. Follow the SAP technology blog for insights into SAP BTP, ABAP, SAP Analytics Cloud, SAP HANA, and more.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-04-2024

12:27 AM

Post M&A considerations, including shared services (Enterprise Business Services).

Carroll Oglesby III, Randy Garrison, Dmitry Melnik, SAP

This blog is based on SAP customers who underwent Mergers and Acquisitions or Divestitures (M&A/D). While we sanitized the names and used only public information, this material reflects actual post-merger integration (PMI) considerations, priorities, and PMI execution experiences of SAP customers. As such, this content will be helpful to any CIO team members facing similar challenges amidst business combinations. Moreover, to help you, our reader, we incorporate the first-hand perspective of an imaginary person, John, who serves as the Chief Information Officer of a company in the middle of an M&A deal. Think of this as Harvard Business Review type case.

Prologue

John put the phone down and sat back in his chair. The evening was settling in but John, the Chief Information Officer, felt like his day was only starting. The CEO on the phone a minute ago was very clear: since the Board had just approved the hotly debated M&A deal, in two days John must present to the Directors a detailed IT plan of the post-merger integration. His company was merging with a similar size competitor and the combined company was expected to compete fiercely in the rapidly changing fashion retail market. In his IT career, John had gone through a few M&A deals and understood the risks very well. The situation was further complicated by the fact that the combined company had to realize some $100m in synergies within the first year of operations. And the Board was looking for fast answers. Which PMI actions would be the most urgent? Most impactful? How would the architecture evolve? John had to address these and myriad other topics very fast.

Situation: M&A as a risky move

Much research has been done on the topic of M&A. Some numbers, though, tend to stand out amidst all the data and analyses: how quickly value can be destroyed in mergers and acquisitions. Some researchers found that while a typical “full control” premium paid by the acquiror can reach 30% of the acquired entity’s value, the returns to the buying shareholders are far from certain and exhibit an almost 60 percentage points range, from “negative thirties” to “positive thirties”. Examine the chart below: business combinations pose substantial risks in terms of the shareholder returns.

John typed his company’s stock ticker and stared at the screen. Yes, his company was paying an even higher full control premium, over 50% of the target’s recent stock price. So predictably, the market reacted negatively on the M&A news: John’s company lost 20% of its value in just one day. The stock performance chart (please see below) was quite telling…

[sanitized depiction of an actual situation]

What is the programmatic way to reduce the risks which are so well reflected in the market sentiment?

The experiences of our customers reveal three major milestones in the post-M&A, or PMI, effort:

While somewhat of an oversimplification, these milestones provide a solid framework for your PMI actions, from immediate to long-term.

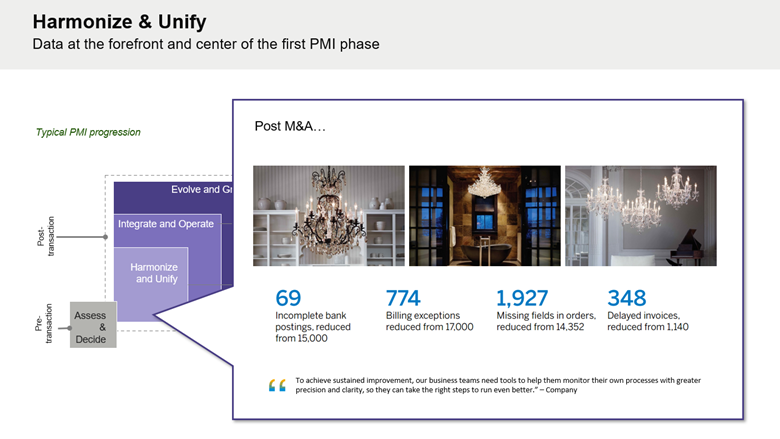

The Harmonize & Unify phase focuses on the data. How can the combined entity report its results to the shareholders? What nomenclature should it use going forward: SKU definitions, Business Partners, people (employees and contractors), operating units (business segments) vs. legal entities, and many other similar considerations form the basis of the data unification. This phase is usually urgent due to the reporting needs but also lays the foundation for the long-term growth.

The second phase, Integrate and Operate, focuses on synergies. For example, for a deal to be valuable to the shareholders, it needs to be accretive. Combined company net income expressed as net margin (Net Income / Revenue) must be higher than the net margin of the acquiring entity. Synergies are the costs which “sit in the middle” and should be taken out. Other types of synergies relate to revenue and include the ability to cross-sell and cultivate each company’s customers for a higher share of wallet. This is where the two short- and mid-term phases graduate into the thirds one, Evolve and Grow.

The chart below reflects this simple framework. On the right-hand side you can see the market shares of the key players in this market. We sanitized the names, but the numbers represent actual estimates by the Wall Street Journal; John’s company would become a larger player after this deal, capable to compete more successfully in the long run.

John re-examined the 3-phase PMI framework which had proven helpful in the past and contemplated the first few months post-closing of the deal. Yes, problems always pop up and multiply. He recalled the example of an acquisitive SAP customer in fashion and jewelry design where the business and IT colleagues had to solve various PMI issues.

Then another thought occurred to John as he started typing an email to his DBA team lead: reporting. Clearly, there will be no shortage of topics to address and problems to solve, but reporting would quickly become the highest priority to address with the CFO as well as colleagues from the acquired entity: the first quarterly report… John sighed and dialed the CFO. Night was young…

SAP customers utilize various means to report their combined operational and financial results. As integration deepens, the CFO and other executives get more details and insights. But here we emphasize the initial reporting needs and the process to build a solid long-term foundation. This brings up one of the options, SAP S/4HANA Group Reporting.

The below chart summarizes the workflow and distinguishes between fully automated and manual steps. On the left-hand side of the chart, you can see four different ways to bring in the data for group reporting, from completely manual data collection on the bottom to a fully automated and integrated approach on the top. Clearly, the actual world is more nuanced, but our takeaway is simple: the more integration effort channeled at the data unification upfront, the easier group reporting will become.

Combined company reporting is one of the many processes dependent on the unified and harmonized data. However, many other processes can be standardized across the two entities which after the deal operate as one. These processes often reside within the shared services or, as we call it nowadays, Enterprise Business Services (EBS).

Customers often prioritize the EBS standardization between two entities in the following way: start with the processes which are identical and do not touch the essence of the business, i.e., which are “undifferentiated” in the marketplace. For example, for John’s company invoices between the company and its 3PL (logistics) vendors are hidden from the end consumer, therefore we can call them “undifferentiated”. On the other hand, the product returns and exchanges constitute a major part of the consumer experience and therefore are “differentiated”, i.e., they separate the company from its competitors. Once you move the undifferentiated processes to the combined EBS, the next wave covers the processes which do differentiate the company and can be automated. For example, product delivery for online orders is one of those differentiated processes for John’s company. Finally, address the processes which can “make your smart people smarter”. These may include a wide range of processes in analytics, budgeting, even product GTM planning, and so on. And this is where you can extend the integration and automation from the headquarters (HQ) to the business unit (BU) level.

Chart below summarizes such prioritization and lists a few SAP customers who have achieved improvements in their respective process areas, from expense reports processing to direct customer service and product innovation. Please do follow the links and examine, for example, the case of the Huabao Group which utilizes SAP Intelligent Technologies to create consumer-specific custom-tailored fragrances.

John made a few notes to cover the EBS topics during his tomorrow’s team call to action. In his mind, the picture was emerging clearly: start with the data harmonization, proceed to the immediate and long-term reporting needs, extend the integration effort to other shared service (EBS) processes to help the combined company operate more efficiently. He smiled satisfactorily: this effort will also aide his team in pursuit of the synergies.

Complication: publicly announced synergies

Synergies, both on the revenue and the cost sides, are one of the reasons for business combinations. In the end, these synergies ensure the “2 + 2 = 5” value creation. However, the imperative to realize synergies quickly puts pressure on the PMI activities and can present a significant challenge to all Lines of Business (LOB), including IT. John’s company - while announcing the offer to buy shares of its former competitor and future business unit - stated that some $100 million of synergies will result from the combination in the first year. This expectation often goes under a magnifying glass of the shareholders and analysts so that the combined company ends up periodically reporting on the progress of such synergies.

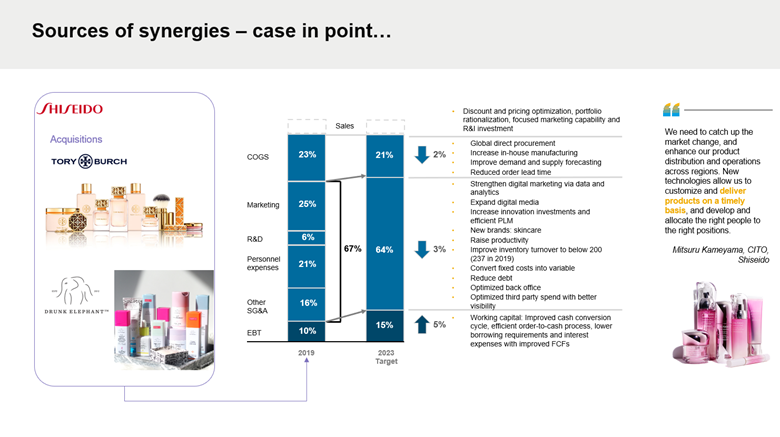

A business combination (M&A/D) provides an opportunity to reflect on the business evolution and reassess various improvement options. Here is one of the many examples and case in point.

John quickly made some calculations and paused, pondering each phrase of his report to the Board. Some de-duplication of systems and other items of the IT budget were clear, but they would not come even close to the required $100 million synergy target. John recalled the previous M&A/D and formulated his request to the Board: Directors’ guidance would be critical. He would ask the Board about the business direction before committing to a specific course of action in IT.

Consider a typical profit and loss statement (P&L) specific to this market (chart below). Start with the revenue on the left-hand side and move to the right. This is an actual SAP customer and the numbers come from their annual report. Costs of Sales, or COS, include direct procurement, inbound logistics, warehousing and other directly attributable costs. Will synergies come from here? Then organizational capabilities around centralized procurement and inbound logistics will most likely have to evolve, and this will present a specific set of IT implications. On the other hand, marketing and selling costs such as real estate (shops), sales commissions, distribution costs (outbound and last mile delivery) may provide another source of synergies; then the IT implications may be very different.

In both cases, customers often differentiate between process de-duplication and process evolution. The former is relatively straightforward, but its optimization impact is usually one-time. The latter requires more change management but may result in long-term (repeatable) efficiency gains.

We can summarize this based on the discussion we have had to this point:

But at any rate, business picture including the clear map of the synergies will drive the respective organizational capabilities development and, as a result, the underlying IT architecture. “Tell me what the business wants – we will formulate how to get there.”

Resolution

In the morning the sun looked warmer… John finished his coffee and pressed the send button. His tomorrow’s Board presentation was ready and just went on to the CFO and CEO for preview. Once he formulated the “must do” topics as well as “need your guidance” ones, the entire picture made sense, at least as the immediate action plan for the combined company’s IT function. Much work was ahead but the path was clear. Half a day after the M&A news and the CEO directive John was ready and eager to start his team meeting.

Let us recap the discussion so far.

Does this roadmap tell the full picture? Of course, not. This is merely a summary of key actions and focus areas during a typical PMI. Each company situation is unique and may differ based on the “pre” architecture, industry and market dynamics, urgency, constraints, and a multitude of other factors. In other words, your specific situation - and therefore roadmap - may differ. But we hope that this discussion may help you to frame your roadmap process based on the experiences of many SAP customers.

One question arises in relation to this picture: what lies ahead in the longer term? In other words, what is to the right of this graph? We cannot answer this question in simplistic terms: the further away we look into the future, the more the paths diverge. However, let us finish this discussion with one customer example. This organization went through a series of significant M&A/D transactions aimed both at creating more muscle and tuning it up (making it leaner, if you will). This is how they formulate their next horizon goals in terms of revenue and growth, direct-to-consumer business, Free Cash Flow and so on:

Epilogue

Party was in full swing. First anniversary as a combined company was indeed a great achievement. John glanced at his combined team and recalled the start of this merger. Much changed since then, and his team members – located across the globe and rooted in both companies – came a long way since a year ago when they barely knew and trusted each other. He smiled and raised a toast to all who turned a vision of the successful integration into reality.

Carroll Oglesby III, Randy Garrison, Dmitry Melnik, SAP

* * *

This blog is based on SAP customers who underwent Mergers and Acquisitions or Divestitures (M&A/D). While we sanitized the names and used only public information, this material reflects actual post-merger integration (PMI) considerations, priorities, and PMI execution experiences of SAP customers. As such, this content will be helpful to any CIO team members facing similar challenges amidst business combinations. Moreover, to help you, our reader, we incorporate the first-hand perspective of an imaginary person, John, who serves as the Chief Information Officer of a company in the middle of an M&A deal. Think of this as Harvard Business Review type case.

Prologue

John put the phone down and sat back in his chair. The evening was settling in but John, the Chief Information Officer, felt like his day was only starting. The CEO on the phone a minute ago was very clear: since the Board had just approved the hotly debated M&A deal, in two days John must present to the Directors a detailed IT plan of the post-merger integration. His company was merging with a similar size competitor and the combined company was expected to compete fiercely in the rapidly changing fashion retail market. In his IT career, John had gone through a few M&A deals and understood the risks very well. The situation was further complicated by the fact that the combined company had to realize some $100m in synergies within the first year of operations. And the Board was looking for fast answers. Which PMI actions would be the most urgent? Most impactful? How would the architecture evolve? John had to address these and myriad other topics very fast.

Situation: M&A as a risky move

Much research has been done on the topic of M&A. Some numbers, though, tend to stand out amidst all the data and analyses: how quickly value can be destroyed in mergers and acquisitions. Some researchers found that while a typical “full control” premium paid by the acquiror can reach 30% of the acquired entity’s value, the returns to the buying shareholders are far from certain and exhibit an almost 60 percentage points range, from “negative thirties” to “positive thirties”. Examine the chart below: business combinations pose substantial risks in terms of the shareholder returns.

John typed his company’s stock ticker and stared at the screen. Yes, his company was paying an even higher full control premium, over 50% of the target’s recent stock price. So predictably, the market reacted negatively on the M&A news: John’s company lost 20% of its value in just one day. The stock performance chart (please see below) was quite telling…

[sanitized depiction of an actual situation]

What is the programmatic way to reduce the risks which are so well reflected in the market sentiment?

The experiences of our customers reveal three major milestones in the post-M&A, or PMI, effort:

- Harmonize and Unify, -

- Integrate and Operate, –

- Evolve and Grow.

While somewhat of an oversimplification, these milestones provide a solid framework for your PMI actions, from immediate to long-term.

The Harmonize & Unify phase focuses on the data. How can the combined entity report its results to the shareholders? What nomenclature should it use going forward: SKU definitions, Business Partners, people (employees and contractors), operating units (business segments) vs. legal entities, and many other similar considerations form the basis of the data unification. This phase is usually urgent due to the reporting needs but also lays the foundation for the long-term growth.

The second phase, Integrate and Operate, focuses on synergies. For example, for a deal to be valuable to the shareholders, it needs to be accretive. Combined company net income expressed as net margin (Net Income / Revenue) must be higher than the net margin of the acquiring entity. Synergies are the costs which “sit in the middle” and should be taken out. Other types of synergies relate to revenue and include the ability to cross-sell and cultivate each company’s customers for a higher share of wallet. This is where the two short- and mid-term phases graduate into the thirds one, Evolve and Grow.

The chart below reflects this simple framework. On the right-hand side you can see the market shares of the key players in this market. We sanitized the names, but the numbers represent actual estimates by the Wall Street Journal; John’s company would become a larger player after this deal, capable to compete more successfully in the long run.

John re-examined the 3-phase PMI framework which had proven helpful in the past and contemplated the first few months post-closing of the deal. Yes, problems always pop up and multiply. He recalled the example of an acquisitive SAP customer in fashion and jewelry design where the business and IT colleagues had to solve various PMI issues.

Then another thought occurred to John as he started typing an email to his DBA team lead: reporting. Clearly, there will be no shortage of topics to address and problems to solve, but reporting would quickly become the highest priority to address with the CFO as well as colleagues from the acquired entity: the first quarterly report… John sighed and dialed the CFO. Night was young…

SAP customers utilize various means to report their combined operational and financial results. As integration deepens, the CFO and other executives get more details and insights. But here we emphasize the initial reporting needs and the process to build a solid long-term foundation. This brings up one of the options, SAP S/4HANA Group Reporting.

The below chart summarizes the workflow and distinguishes between fully automated and manual steps. On the left-hand side of the chart, you can see four different ways to bring in the data for group reporting, from completely manual data collection on the bottom to a fully automated and integrated approach on the top. Clearly, the actual world is more nuanced, but our takeaway is simple: the more integration effort channeled at the data unification upfront, the easier group reporting will become.

Combined company reporting is one of the many processes dependent on the unified and harmonized data. However, many other processes can be standardized across the two entities which after the deal operate as one. These processes often reside within the shared services or, as we call it nowadays, Enterprise Business Services (EBS).

Customers often prioritize the EBS standardization between two entities in the following way: start with the processes which are identical and do not touch the essence of the business, i.e., which are “undifferentiated” in the marketplace. For example, for John’s company invoices between the company and its 3PL (logistics) vendors are hidden from the end consumer, therefore we can call them “undifferentiated”. On the other hand, the product returns and exchanges constitute a major part of the consumer experience and therefore are “differentiated”, i.e., they separate the company from its competitors. Once you move the undifferentiated processes to the combined EBS, the next wave covers the processes which do differentiate the company and can be automated. For example, product delivery for online orders is one of those differentiated processes for John’s company. Finally, address the processes which can “make your smart people smarter”. These may include a wide range of processes in analytics, budgeting, even product GTM planning, and so on. And this is where you can extend the integration and automation from the headquarters (HQ) to the business unit (BU) level.

Chart below summarizes such prioritization and lists a few SAP customers who have achieved improvements in their respective process areas, from expense reports processing to direct customer service and product innovation. Please do follow the links and examine, for example, the case of the Huabao Group which utilizes SAP Intelligent Technologies to create consumer-specific custom-tailored fragrances.

John made a few notes to cover the EBS topics during his tomorrow’s team call to action. In his mind, the picture was emerging clearly: start with the data harmonization, proceed to the immediate and long-term reporting needs, extend the integration effort to other shared service (EBS) processes to help the combined company operate more efficiently. He smiled satisfactorily: this effort will also aide his team in pursuit of the synergies.

Complication: publicly announced synergies

Synergies, both on the revenue and the cost sides, are one of the reasons for business combinations. In the end, these synergies ensure the “2 + 2 = 5” value creation. However, the imperative to realize synergies quickly puts pressure on the PMI activities and can present a significant challenge to all Lines of Business (LOB), including IT. John’s company - while announcing the offer to buy shares of its former competitor and future business unit - stated that some $100 million of synergies will result from the combination in the first year. This expectation often goes under a magnifying glass of the shareholders and analysts so that the combined company ends up periodically reporting on the progress of such synergies.

A business combination (M&A/D) provides an opportunity to reflect on the business evolution and reassess various improvement options. Here is one of the many examples and case in point.

John quickly made some calculations and paused, pondering each phrase of his report to the Board. Some de-duplication of systems and other items of the IT budget were clear, but they would not come even close to the required $100 million synergy target. John recalled the previous M&A/D and formulated his request to the Board: Directors’ guidance would be critical. He would ask the Board about the business direction before committing to a specific course of action in IT.

Consider a typical profit and loss statement (P&L) specific to this market (chart below). Start with the revenue on the left-hand side and move to the right. This is an actual SAP customer and the numbers come from their annual report. Costs of Sales, or COS, include direct procurement, inbound logistics, warehousing and other directly attributable costs. Will synergies come from here? Then organizational capabilities around centralized procurement and inbound logistics will most likely have to evolve, and this will present a specific set of IT implications. On the other hand, marketing and selling costs such as real estate (shops), sales commissions, distribution costs (outbound and last mile delivery) may provide another source of synergies; then the IT implications may be very different.

In both cases, customers often differentiate between process de-duplication and process evolution. The former is relatively straightforward, but its optimization impact is usually one-time. The latter requires more change management but may result in long-term (repeatable) efficiency gains.

We can summarize this based on the discussion we have had to this point:

- Enterprise Business Services of the combined company will generally take care of the process de-duplication, especially for the processes which span across all business units (finance, logistics, procurement, etc.) Of course, processes “below”, i.e., specific to each BU, need to be addressed carefully, one by one.

- In parallel, various Intelligent Technologies can evolve the combined company processes, in some cases creating completely new processes and abilities which did not exist before.

But at any rate, business picture including the clear map of the synergies will drive the respective organizational capabilities development and, as a result, the underlying IT architecture. “Tell me what the business wants – we will formulate how to get there.”

Resolution

In the morning the sun looked warmer… John finished his coffee and pressed the send button. His tomorrow’s Board presentation was ready and just went on to the CFO and CEO for preview. Once he formulated the “must do” topics as well as “need your guidance” ones, the entire picture made sense, at least as the immediate action plan for the combined company’s IT function. Much work was ahead but the path was clear. Half a day after the M&A news and the CEO directive John was ready and eager to start his team meeting.

Let us recap the discussion so far.

- Data is easily the most urgent topic for the PMI activities.

- Combined company reporting becomes the critical capability which balances both the compliance needs (“must have”) and executive insight imperatives – and stands on the solid data foundation.

- As the companies start operating as one, shared services, or Enterprise Business Services (EBS) become the “common denominator” which can glue the companies together; reporting is just one of such EBS but the list of shared services is much larger.

- As the Board is “on the hook” for reportable synergies, business should define key source areas and IT should devise the roadmap to realization, taking into consideration the evolution of the architecture and new technologies available to turn this vision into reality.

Does this roadmap tell the full picture? Of course, not. This is merely a summary of key actions and focus areas during a typical PMI. Each company situation is unique and may differ based on the “pre” architecture, industry and market dynamics, urgency, constraints, and a multitude of other factors. In other words, your specific situation - and therefore roadmap - may differ. But we hope that this discussion may help you to frame your roadmap process based on the experiences of many SAP customers.

One question arises in relation to this picture: what lies ahead in the longer term? In other words, what is to the right of this graph? We cannot answer this question in simplistic terms: the further away we look into the future, the more the paths diverge. However, let us finish this discussion with one customer example. This organization went through a series of significant M&A/D transactions aimed both at creating more muscle and tuning it up (making it leaner, if you will). This is how they formulate their next horizon goals in terms of revenue and growth, direct-to-consumer business, Free Cash Flow and so on:

Epilogue

Party was in full swing. First anniversary as a combined company was indeed a great achievement. John glanced at his combined team and recalled the start of this merger. Much changed since then, and his team members – located across the globe and rooted in both companies – came a long way since a year ago when they barely knew and trusted each other. He smiled and raised a toast to all who turned a vision of the successful integration into reality.

Labels:

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,658 -

Business Trends

93 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

67 -

Expert

1 -

Expert Insights

177 -

Expert Insights

301 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

GraphQL

1 -

Kafka

1 -

Life at SAP

780 -

Life at SAP

13 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

346 -

Replication Flow

1 -

REST API

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,873 -

Technology Updates

429 -

Workload Fluctuations

1

Related Content

- Sapphire 2024 user experience and application development sessions in Technology Blogs by SAP

- Support for API Business Hub Enterprise in Actions Project in Technology Blogs by SAP

- Demystifying the Common Super Domain for SAP Mobile Start in Technology Blogs by SAP

- IoT - Ultimate Data Cyber Security - with Enterprise Blockchain and SAP BTP 🚀 in Technology Blogs by Members

- SAP Signavio is the highest ranked Leader in the SPARK Matrix™ Digital Twin of an Organization (DTO) in Technology Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 34 | |

| 17 | |

| 15 | |

| 14 | |

| 11 | |

| 9 | |

| 8 | |

| 8 | |

| 8 | |

| 7 |