- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- First Insights on UAE eInvoicing : What You Need t...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

The United Arab Emirates eInvoicing has been a topic of conversation for quite some time now.

Recently, at the E-Invoicing Exchange Summit, some exclusive insights were shared about the latest developments, rollout plans, and mandates about the UAE eInvoicing through the UAE eInvoicing program. The UAE Ministry of Finance seeks to leverage the latest technological advancements to streamline invoicing procedures, minimize the risk of errors, and facilitate real-time data exchange between taxpayers and the Federal Tax Authority (FTA).

The program's primary objectives are to improve the taxpayer and user experience, optimize cost and core operations, reduce the tax gap, increase compliance, and address the shadow economy. This, in turn, is expected to enhance transparency, reduce the chances of tax evasion and fraud, and improve the country's overall business environment..

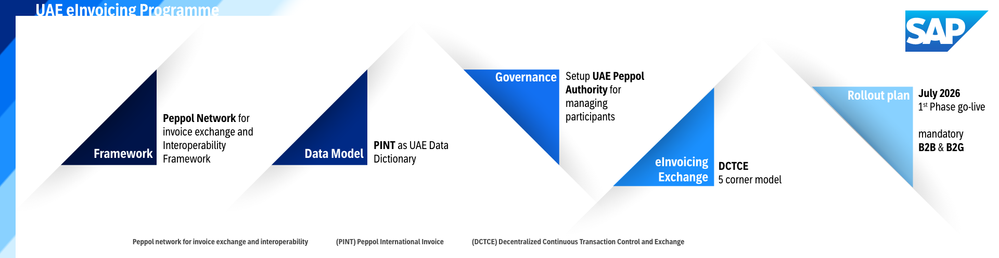

UAE eInvoicing framework

The UAE is evaluating the usage of the Peppol network for invoice exchange and interoperability, and Peppol International (PINT) is the UAE Data Dictionary. Additionally, the UAE is considering establishing the UAE Peppol Authority.

UAE eInvoicing Exchange Transactions

The exchange of eInvoicing transactions between buyers and sellers through the certified Service Provider for both Business-to-Business (B2B) and Business-to-Government (B2G).

UAE eInvoicing model

The Decentralized Continuous Transaction Control and Exchange (DCTCE) model, also known as the 5-corner model, has been selected for the UAE eInvoicing framework. The Peppol Network for DCTCE is under evaluation by the UAE Ministry of Finance.

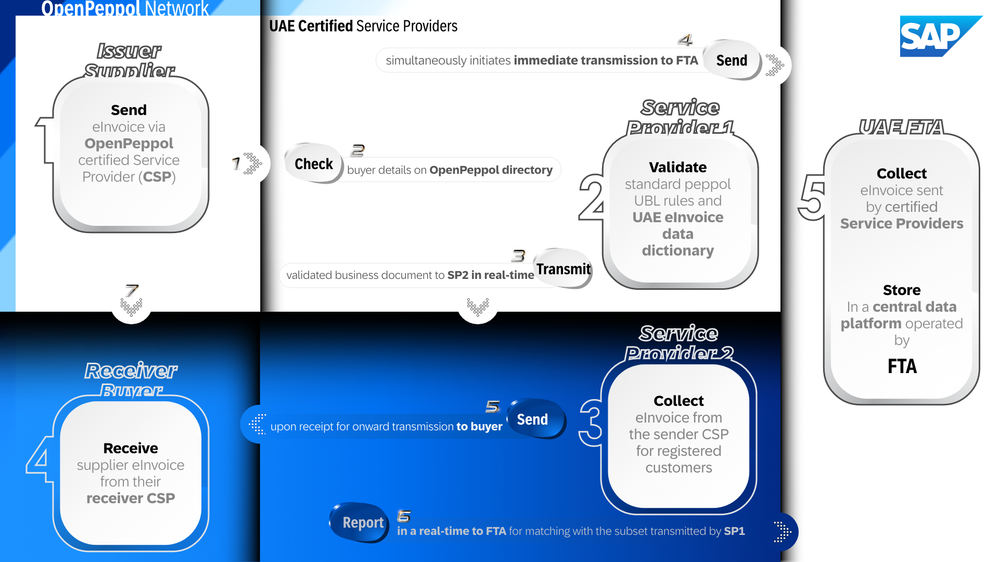

The 5 Corners of all parties involved in the DCTCE model

- Corner One (C1) is the Supplier (Sender of eInvoice)

- Corners Two (C2) and Three (C3) are the certified Service Providers by the Federal Tax Authority as Access Points.

- Corner Four (C4) is the Customer (Receiver of eInvoice)

- Corner Five (C5) is the Federal Tax Authority

OpenPeppol is a community that includes members from both the public and private sectors. It consists of Peppol Authorities, service providers, and end-users. The number of OpenPeppol members continues to grow as the adoption of Peppol expands globally. At the start of 2022, there were nearly five hundred members from forty different countries.

Procedure for Transaction Steps:

By following these steps, the transaction can be successfully completed while adhering to the regulatory requirements and standards will be set forth by the FTA.

- The C2 sender and C3 receiver Service Providers must complete the CTC certification process in accordance with the requirements established by the Federal Tax Authority (FTA).

- Upon receipt of a business eDocument from the Supplier (C1), the C2 performs real-time validation to ensure compliance with defined requirements.

- During the validation process, C2 confirms adherence to the standard Peppol content validation requirements based on the UAE country-specific VAT requirements and the additional UAE country-specific validation requirements.

- Additionally, C2 confirms compliance with the data dictionary, which is currently under consultation with the Peppol community by the FTA..

- C2 sends the validated business eDocument to C3 in real-time

- C2 initiates the immediate transmission of the business eDocument to the FTA (C5) eInvoicing Framework.

- Upon receipt of the business eDocument, C3 forwards it to C4 for onward transmission.

- It is not confirmed whether C4 can be assigned the responsibility to send return communication, such as rejection or approval (invoice response) of the received business eDocument, to C1.

- It is not confirmed whether C4 can be assigned the responsibility to send return communication, such as rejection or approval (invoice response) of the received business eDocument, to C1.

- The FTA (C5) retains the right to decide whether to require reporting of invoice responses.

- The exchange of a business eDocument remains possible between C1 and C4, thus providing a crucial link in the transaction process.

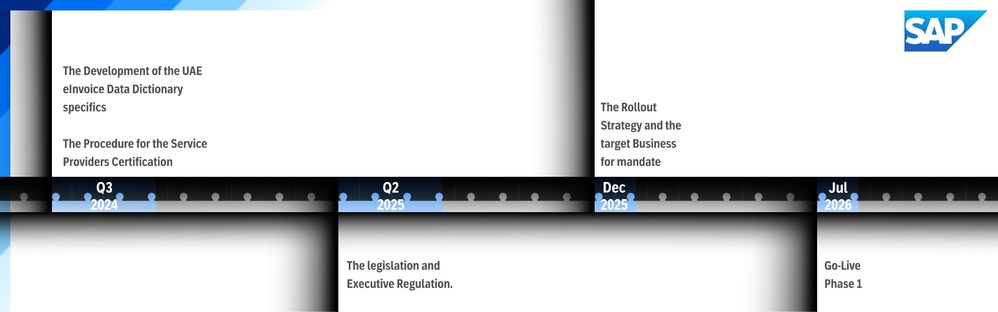

The potential timeline for the UAE eInvoicing Programme

FAQ on the UAE eInvoicing Programme and the DCTCE model

Q: What is the UAE eInvoicing Programme?

A: The UAE eInvoicing Programme is an initiative to increase transparency, improve audits, reduce human intervention, and contribute to the growth and competitiveness of the economy. It aims to enhance the taxpayer and user experience, optimize cost and core operations, reduce the tax gap, maximize compliance, and tackle the shadow economy.

Q: What is the Decentralized Continuous Transaction Control and Exchange (DCTCE) model?

A: The Decentralized Continuous Transaction Control and Exchange (DCTCE) model, also known as the 5-corner model, is a type of Continuous Transaction Control (CTC) system. In this model, the supplier enters invoice data into their business software and initiates the invoicing process via their accredited Service Provider (SP), who is the sender's Peppol access point. The sender SP validates the invoice data and transmits it to the customer's SP, who is the receiver's Peppol access point. The receiver SP sends the invoice data to the business software of the customer in the format of their choice.

As per the guidelines outlined in the UAE eInvoicing Programme, only Service Providers who are certified by the Federal Tax Authority (FTA) are permitted to transmit the required eInvoice data, including the UAE data dictionary, to a centralized platform managed and maintained by the FTA.

Q: What are the main benefits of the DCTCE?

A: The DCTCE Model is a decentralized CTC model that offers several benefits.

- It provides step-by-step deployment, tax control customization, and leveraging existing B2G infrastructures. The model is modular and can be deployed gradually without a central CTC Platform in place.

- The model is SME-friendly and future-proofs existing business investments. SMEs can be integrated into the exchange network through low-cost or free-access interfaces.

- It uses widely accepted technologies and technical standards, with no single point of failure or dependency. This meticulous approach guarantees the smooth functioning of supply chains and ensures that the businesses involved are always well-prepared to handle any unexpected challenges that may arise.

- VAT compliance and data confidentiality are built into the regular business processes with no additional operational burden imposed on economic operators.

- Tax administrations can customize their reporting requirements, and existing e-invoicing infrastructures can continue to play a role in the new DCTCE ecosystem.

Q: What are the benefits of DCTCE for all parties?

A: The implementation of the Digital Continuous Transaction Control and Enforcement (DCTCE) model offers a host of benefits to all parties involved by streamlining processes, reducing administrative burden, and enhancing efficiency in the tax system.

Tax Authority

The model provides a reliable source of VAT information, aiding in the closure of VAT gaps without the need for centralized government platforms that require significant resources to maintain.

Businesses

For businesses, the DCTCE model simplifies and streamlines processes by establishing a single interface to connect with their tax authority. Through digital automation, businesses can expedite payment processes and reduce the steps required to provide tax authorities with the necessary information.

Service providers

Service providers also stand to benefit from the DCTCE model as it provides them with the opportunity to exchange information freely in the market, thereby enabling them to compete fairly and secure electronic supply chain business. They can seamlessly connect with other providers, supply tax authorities with their VAT information, and provide their customers with an automated supply chain process.

In conclusion, the UAE eInvoicing Programme is a government initiative to increase transparency, reduce human intervention, and contribute to the growth and competitiveness of the economy. The program aims to optimize cost and core operations, reduce the tax gap, maximize compliance, and tackle the shadow economy. The Decentralized Continuous Transaction Control and Exchange (DCTCE) model, also known as the 5-corner model, has been selected for the UAE eInvoicing framework. The rollout plan is divided into several phases, with the Phase 1 Go-Live for Reporting scheduled for Jul 2026. Under the UAE eInvoicing mandate, (B2B) and (B2G) invoicing will be mandatory. The UAE is considering the use of the Peppol network to exchange and standardize invoices, and Peppol International (PINT) is the UAE Data Dictionary.

- SAP Managed Tags:

- SAP S/4HANA Cloud Localization,

- Localization,

- SAP Document and Reporting Compliance

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,658 -

Business Trends

93 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

67 -

Expert

1 -

Expert Insights

177 -

Expert Insights

301 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

GraphQL

1 -

Kafka

1 -

Life at SAP

780 -

Life at SAP

13 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

346 -

Replication Flow

1 -

REST API

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,873 -

Technology Updates

430 -

Workload Fluctuations

1

- Partner-2-Partner Collaboration in Professional Services in Technology Blogs by SAP

- Initial Release of SAP Analytics Cloud Just Ask in Technology Blogs by SAP

- CAP vs. RAP: Navigating the Choice of SAP Programming Models for Your Projects in Technology Blogs by Members

- Move to the cloud with SAP Analysis for Microsoft Office in Technology Blogs by SAP

| User | Count |

|---|---|

| 26 | |

| 18 | |

| 15 | |

| 13 | |

| 11 | |

| 9 | |

| 8 | |

| 8 | |

| 8 | |

| 7 |