- SAP Community

- Products and Technology

- Supply Chain Management

- SCM Blogs by SAP

- SAP Hydrocarbon Value Chain Optimization Model – P...

Supply Chain Management Blogs by SAP

Expand your SAP SCM knowledge and stay informed about supply chain management technology and solutions with blog posts by SAP. Follow and stay connected.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-07-2020

5:25 PM

Interlacing the digital threads to bind the intelligent hydrocarbon value chain

We have been experiencing a resurgence of projects for Hydrocarbon Value Chain (HVC) optimization. There are many reasons why companies are seeking additional HVC optimization in today’s chaotic market conditions of suppressed oil price and the COVID-19 pandemic. The simplest answer is, “the greater the HVC optimization, the greater shareholder value a company can achieve”. Optimizing the HVC delivers repeatable, incremental value which can quickly impact the top line revenue and profits.

The market stress on oil and gas companies is significant due to this double impact of COVID-19 and escalating tension between oil producing nations, resulting in lower oil prices and demand. HVC optimization with automation is critical in minimizing supply disruptions, and the dynamic rebalancing of demand and delivery of products. Oversupply of crude, and in some regions, natural gas, is creating storage capacity overruns with demand reduction. Refineries and fields are operating at lower capacity due to lack of demand and now, skilled worker shortages. Gasoline, jet fuels, and lubricants are seeing significant demand reductions, driving to a decline in revenue for many oil and gas companies throughout the world. Companies need an HVC that provides resilience, automation, and collaboration to respond to dynamic market conditions.

I would like to take a few minutes to share SAP’s perspective on Hydrocarbon Value Chain (HVC) Optimization, along with some examples where companies have digitized and automated their HVC to unlock additional hidden value for their shareholders. This article cannot properly explore the depth and breadth of such a critical and complex set of processes. What I can do, however, is provide high level insights into SAP’s approach for HVC Optimization across several critical HVC business process areas.

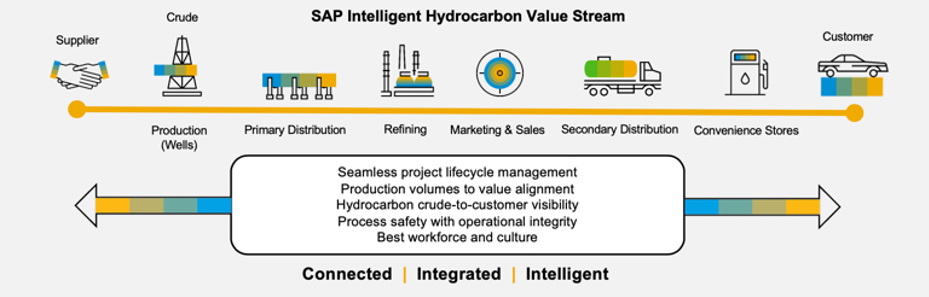

The HVC represents the sequence of activities that occur from the supply sources to trading mechanisms, by which oil and gas are sold and oil derivatives traded for hedging purposes. This process includes upstream (exploration and production), midstream (transportation and storage) and downstream (refining, marketing & sales, and retail markets).

The representation of HVC optimization serves as a way of expressing the increase in shareholder value that is created as crude is bought or sold from upstream production, transported and stored (midstream), processed or refined downstream into petroleum products, and eventually sold at wholesale or retail prices.

The intent of this article is to provide standardization of SAP’s HVC Optimization Model to assist in educating the industry on SAP’s approach, thought leadership, strategy, and maturity in supporting the digital threads needed for hydrocarbons from wells-to-wheels (wellhead to customer vehicle). A “follow the molecule” methodology is used, which provides full transparency across all business units (e.g., trading, scheduling, marketing and sales, finance, etc.) through the entire hydrocarbon value chain.

Traditional (or legacy) hydrocarbon value chains are broken. Here are just a few examples of the challenge’s companies have shared with me about why their existing HVC strategies are not able to deliver on today’s dynamic business and technology requirements:

Legacy assets, logistics and technology located/structured to serve existing markets and compete against historically large, slow competitors

Business silos with siloed operating models, business collaboration and data is disconnected, which generates human intervention and manual processes. This creates delayed and inaccurate decision making and impedes agile growth

No real-time financial insights due to increasingly a complex cost accounting structure, and a multitude of systems, spreadsheets and manual efforts that are increasing exposure/risk

Lack of value chain visibility from customer’s-customer to customer, from deal to warehouse, from specialty plant, to refinery, all driving higher costs of product and logistics and impacting base service levels and “guarantee of experience”

Difficulty, limitations and delays in conducting key business investigation, completing analysis, forming insight, and taking action based on data from disparate systems

Multiple, disparate technology solutions, applications, integrations, supply chain, marketing, and financial cost data. The disconnection creates cumbersome business processes, lowers productivity and effectiveness, and is driving higher supply chain, workforce and inventory costs

Ongoing challenges of merging data from proprietary technologies and manual processes into a common view that is familiar to their operational and marketing personnel

This new “hydrocarbon molecular management and costing” approach replaces the decades old “business as usual approach” of a full reckoning after the final hydrocarbon sale and then back- allocation of multiple overhead cost, asset costs, margin pools and physical position records. This new innovation approach is more commonly known as “follow the molecule”. A digital thread for hydrocarbon management and inventory optimization linked to direct and indirect costs. This approach is also complemented/engrained with robotic process automation that will both reduce the routine processes for the hydrocarbon management teams and will build upon recognized patterns to develop and provide predictive refining, marketing and distribution.

This future resilient HVC optimization approach will also dramatically reduce the lost opportunity cost of unused yet available revolving credit lines, schedule arbitrage, asset maintenance coordination, inventory buffers, channel management and full chain predictive analysis. The energy company moves more to a progressive-push operating model to become autonomous and enables full price-setting and market-setting rather than price-taking capability / behavior.

Logical business functional areas by each oil and gas segment need to support the entire end-to-end HVC. Integrated and automated HVC optimization is very complex and not an easy thing to accomplish, but it can be done as proven by several industry customers. SAP is the only vendor that provides you with a single platform approach across the entire value chain for interlacing the hydrocarbon digital threads. Companies need the SAP Core (SAP S/4HANA Enterprise Management) as a foundation. SAP integrated industry solutions for oil and gas provide a single suite to produce, track, manage, and sale hydrocarbons. This industry core also requires openness for 3rd-party connectivity, which provides integration, automation, and intelligent analytics across the entire enterprise. In the following section we will highlight SAP’s HVC Optimization Model, which provides insights on how your organization can “follow the molecule” using SAPs’ industry core and SAP’s HVC Optimization Model.

SAP Hydrocarbon Value Chain (HVC) Optimization Model is a capabilities model used to describe the approach to trading, planning, transporting, and selling activities of hydrocarbons in the energy industry. The model is validated against multiple third-party models for HVC optimization.

The SAP HVC Optimization Model (SAP HVC OM) is a capabilities model used to describe the approach to production, planning, transporting, and selling activities of hydrocarbons in the oil and gas industry.

We built this model based upon six optimization levels. It has been validated and proven to unlock hidden shareholder value within each company that is able to increase their HVC Optimization with each level of incremental improvement (from left to right). The ultimate goal is to create an Autonomous (Touchless) HVC that provides a digital thread of automation and transparency across the entire value chain for hydrocarbon management. It provides a digital twin of your hydrocarbons, network, assets, costs, contracts, sales, partners, and customers. This is enabled with our core technology platform in real-time with integration across your different business units for complete transparency. It also provides the openness needed to integrate existing non-SAP solutions and technologies by leveraging the SAP Cloud Platform.

SAP has over 30 years of experience in the oil and gas industry developing applications and delivering value across the oil and gas HVC. We have combined SAP’s decades of industry experience and knowledge, along with customers, partners, and analysts, to build the first SAP HVC Optimization Model we are sharing with you today in this article. We also led several HVC consortiums (workstreams) with our customers and partners over a two-plus year period to define and build this model. Companies like ExxonMobil, Chevron, Citgo, Valero, Andeavor, Phillips 66, Shell, and many others directly contributed to this SAP HVC OM via the downstream consortium collaborations. The model you see here are those results and has been used as an adoption guide for our customers over the past several years of co-innovation and development for the industry.

The reality is; very few companies have solidly completed the Integrate level of the SAP HVC OM. Companies, however, have been making significant improvements and can quickly move up the HVC optimization model levels. One such example is SASREF who made a jump upward in their SAP HVC optimization model. “SASREF’s refinery is among the pioneers in the industry to apply unit-based product costing on actual refinery material flows. With improvements such as real-time inventory and accurate lifting schedules, customer satisfaction is up. The supply process has been streamlined end to end from supplier registration through contracting, billing, and contract closure.”

Another example is how real-time analytics help Vivo Energy respond quickly to changing customer demand. “We can track and predict demand for particular products and automate replenishment,” says McCormick. “This reduces stock-out situations and helps ensure an outstanding customer experience.”

As mentioned, SAP provides the industry hydrocarbon digital core needed for optimized shareholder value at each level of the optimization model discussed. The HVC is extremely complex and to obtain desired optimizations we need to leverage existing 3rd-party and custom applications and technologies. Automation requires integration. Every HVC optimization level requires integration and advanced analytics to be successful. This is why SAP provides an open framework for this integration and innovations leveraging the latest emerging technologies in the cloud at scale. The SAP Cloud Platform provides the platform, emerging technologies, and customer application integration needed to seamlessly integrate your existing solutions.CESPA is just one such example of a company that leverages this approach to provide collaboration and visibility across their entire HVC.

In part 2 of 2 of we will breakdown each one of the SAP HVC Optimization Model levels and spotlight some of the key capabilities needed for each level to improve your HVC and help unlock more hidden value for your shareholders.

I hope you found this informative and please let me know what you think about the 6 levels of the SAP HVC Optimization Model.

Additional Reading

Fueling Change in the Energy Sector Enabled by Digital Technology - SAP White paper

The Intelligent Enterprise for the Oil and Gas Industry – SAP White paper

- SAP Managed Tags:

- Oil, Gas, and Energy,

- SAP Integrated Business Planning for Supply Chain

Labels:

- CESPA

- Consortium

- CTRM

- digital energy

- digital thread

- downstream

- energy

- ETRM

- follow the molecule

- HVC

- hydrocarbon logistics

- hydrocarbon value chain

- intelligence

- intelligent enterprise

- midstream

- oil and gas

- oilandgas

- optimization

- primary distribution

- risk management

- SAP HVC OM

- SASREF

- secondary distribution

- trading

- upstream

- value chain

- Vivo Energy

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Business Trends

169 -

Business Trends

24 -

Catalog Enablement

1 -

Event Information

47 -

Event Information

4 -

Expert Insights

12 -

Expert Insights

41 -

intelligent asset management

1 -

Life at SAP

63 -

Product Updates

500 -

Product Updates

66 -

Release Announcement

1 -

SAP Digital Manufacturing for execution

1 -

Super Bowl

1 -

Supply Chain

1 -

Sustainability

1 -

Swifties

1 -

Technology Updates

187 -

Technology Updates

17

Related Content

- SAP Business Network for Logistics 2404 Release – What’s New? in Supply Chain Management Blogs by SAP

- 5 Reasons why Planners Should Consider the RISE with SAP Advanced Supply Chain Planning Package in Supply Chain Management Blogs by SAP

- Transforming Cell Gene Therapy Operations: The Power of Integrated Scheduling and Resource Planning Systems in Supply Chain Management Blogs by SAP

- SAP Integrated Business Planning- Time-Series Vs Order Series Planning Engines Comparison in Supply Chain Management Blogs by Members

- Supply Chain Predictions 2024: AI, Sustainability Top Of Mind in Supply Chain Management Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 7 | |

| 5 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 1 |