- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- IFRS Update – 2021 H1 Publications

Financial Management Blogs by SAP

Get financial management insights from blog posts by SAP experts. Find and share tips on how to increase efficiency, reduce risk, and optimize working capital.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member18

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-19-2021

8:39 AM

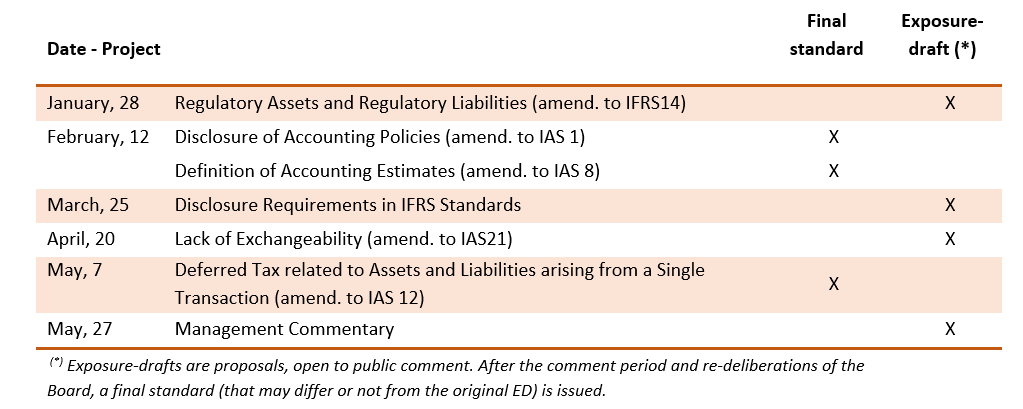

As IFRS (International Financial Reporting Standards) are evolving fast, we continue our focus on the latest IASB’s (International Accounting Standards Board) updates. Since our last blog published in January 2021, the following publications have been issued by the IASB:

Disclosure of accounting policies (IAS 1) and definition of accounting estimates (IAS 😎

These amendments have been issued together as they both relate to the major project “Better Communication in Financial Reporting”.

Amendments to IAS 1 change the requirements regarding disclosure of accounting policies. Companies will now have to disclose material accounting policies instead of significant accounting policies. IAS 1 gives more guidance and examples to help identifying what is material and what is not. The objective is to reduce useless information about accounting policies, such as information that only duplicates or summarizes the requirements of IFRS standards.

Amendments to IAS 8 clarify the definition of accounting estimates (“monetary amounts in financial statements that are subject to measurement uncertainty”). Until then, the definition was unclear and made it sometimes difficult to distinguish a change in accounting estimates (which is accounted for prospectively) and a change in accounting policies (which is accounted for retrospectively).

Amendments to IAS 12 (Income Taxes)

These amendments relate to transactions in which assets and liabilities are simultaneously recognized, such as leases or decommissioning costs. In the previous version of IAS 12, the exemption to the initial recognition of a deferred tax asset or liability applied to transaction “that is not a business combination and affects neither accounting nor taxable profit”. It was not clear whether this exemption should apply to leases or decommissioning costs. In practice, interpretations varied from a company to another and resulted in a lack of comparability.

The new amendments now specify that this exemption does not apply when the transaction gives rise to equal taxable and deductible temporary differences. As a consequence, companies will now have to recognize deferred tax assets and liabilities on such transactions.

This major project is divided into three topics: primary financial statements (ED published in December 2019, currently under deliberations), disclosure initiative and management commentary. Regarding these two last subjects, exposure-drafts have been recently published.

As regards management commentary, this report complements a company’s financial statements and usually consists in narrative information. It is not part of mandatory financial information under IFRS (depends on local jurisdictions). We will therefore not comment further on this project.

The exposure-draft “Disclosure Requirements in IFRS Standards” has been developed on the basis of the feedback received on the discussion paper published in 2017. According to many respondents, financial statements often include too much irrelevant information and not enough relevant one. Most companies, and their auditors, apply the “checklist approach”, giving all disclosure listed in IFRS standards whether or not they are relevant, whether or not they are sufficient.

The exposure-draft proposes a new guidance for disclosure requirements that the Board should use when developing new standards and tests this new approach for two standards (IFRS 13 and IAS 19).

In short, the Board proposes to develop objective-based disclosure requirements and to reduce as much as possible lists of specific items to be disclosed. We will not get into more detail as exposure-drafts are only proposals that may significantly change when adopted as standards. The comment period is open until 21 October 2021.

Other exposure-drafts published in H1 2021 do not call for further comments.

The latest workplan is available here on the official IFRS website.

Final standards

Disclosure of accounting policies (IAS 1) and definition of accounting estimates (IAS 😎

These amendments have been issued together as they both relate to the major project “Better Communication in Financial Reporting”.

Amendments to IAS 1 change the requirements regarding disclosure of accounting policies. Companies will now have to disclose material accounting policies instead of significant accounting policies. IAS 1 gives more guidance and examples to help identifying what is material and what is not. The objective is to reduce useless information about accounting policies, such as information that only duplicates or summarizes the requirements of IFRS standards.

Amendments to IAS 8 clarify the definition of accounting estimates (“monetary amounts in financial statements that are subject to measurement uncertainty”). Until then, the definition was unclear and made it sometimes difficult to distinguish a change in accounting estimates (which is accounted for prospectively) and a change in accounting policies (which is accounted for retrospectively).

Amendments to IAS 12 (Income Taxes)

These amendments relate to transactions in which assets and liabilities are simultaneously recognized, such as leases or decommissioning costs. In the previous version of IAS 12, the exemption to the initial recognition of a deferred tax asset or liability applied to transaction “that is not a business combination and affects neither accounting nor taxable profit”. It was not clear whether this exemption should apply to leases or decommissioning costs. In practice, interpretations varied from a company to another and resulted in a lack of comparability.

The new amendments now specify that this exemption does not apply when the transaction gives rise to equal taxable and deductible temporary differences. As a consequence, companies will now have to recognize deferred tax assets and liabilities on such transactions.

“Better Communication in Financial Reporting”: new exposure-drafts

This major project is divided into three topics: primary financial statements (ED published in December 2019, currently under deliberations), disclosure initiative and management commentary. Regarding these two last subjects, exposure-drafts have been recently published.

As regards management commentary, this report complements a company’s financial statements and usually consists in narrative information. It is not part of mandatory financial information under IFRS (depends on local jurisdictions). We will therefore not comment further on this project.

The exposure-draft “Disclosure Requirements in IFRS Standards” has been developed on the basis of the feedback received on the discussion paper published in 2017. According to many respondents, financial statements often include too much irrelevant information and not enough relevant one. Most companies, and their auditors, apply the “checklist approach”, giving all disclosure listed in IFRS standards whether or not they are relevant, whether or not they are sufficient.

The exposure-draft proposes a new guidance for disclosure requirements that the Board should use when developing new standards and tests this new approach for two standards (IFRS 13 and IAS 19).

In short, the Board proposes to develop objective-based disclosure requirements and to reduce as much as possible lists of specific items to be disclosed. We will not get into more detail as exposure-drafts are only proposals that may significantly change when adopted as standards. The comment period is open until 21 October 2021.

Other exposure-drafts published in H1 2021 do not call for further comments.

Update of the Board’s Work Plan

The latest workplan is available here on the official IFRS website.

- SAP Managed Tags:

- SAP BusinessObjects Financial Consolidation

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Business Trends

145 -

Business Trends

15 -

Event Information

35 -

Event Information

9 -

Expert Insights

8 -

Expert Insights

29 -

Life at SAP

48 -

Product Updates

521 -

Product Updates

63 -

Technology Updates

196 -

Technology Updates

10

Related Content

- SAP ECC Conversion to S/4HANA - Focus in CO-PA Costing-Based to Margin Analysis in Financial Management Blogs by SAP

- Get peace of mind for evolving compliance requirements with SAP advanced compliance automation in Financial Management Blogs by SAP

- Update Exchange rate in a posted Journal Entry in Financial Management Q&A

- Unveiling the new functionality in 2024 of SAP PAPM Cloud: Welcome to Universal Model! in Financial Management Blogs by SAP

- AI in SAP GRC Public Cloud in Financial Management Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 |