- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- Demystifying S4HANA Group Reporting

Financial Management Blogs by SAP

Get financial management insights from blog posts by SAP experts. Find and share tips on how to increase efficiency, reduce risk, and optimize working capital.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-10-2019

1:10 PM

Group Reporting is the newest tool embedded in SAP S/4HANA providing statutory as well as managerial financial consolidation capabilities for both On-Premise and Cloud customers.

Overview and Positioning of Group Reporting and know more about the basic building blocks.

The blog post covers the Rationale for Group Reporting, Product positioning and differentiation, and a detailed look at the key Building Blocks in terms of Key Configuration Elements and Master Data.

The focus is on On-Premise solution as of release 1809. This document touches on the pre-configured settings of the best practice content.

I will aim at covering the Consolidation Processes, Settings and Reporting in my subsequent blog post.

Preparation of Consolidated Financial Statements is mandatory for Statutory compliance, example IFRS10. Applicable Accounting Principles outline the requirements for producing such statements.

SAP’s Group Reporting tool facilitates not just in the preparation Financial Statements as per Statutory regulations, but also has added capabilities for facilitating managerial consolidation and analytics.

Details of these will be covered in a separate blog post.

SAP S/4HANA for Group reporting is SAP’s strategic consolidation solution moving forward, in particular for customers implementing SAP S/4HANA irrespective of deployment option (cloud or on premise) as well as for customers looking for a public cloud stand-alone offering. Group reporting can be used independently from operational accounting or other ERP functions in SAP S/4HANA if desired.

The picture below taken from SAP’s presentation on product vision, explains how Group Reporting fits into the landscape.

The new Group Reporting Tool combines the best of the features and capabilities of existing tools, leveraging and well-integrated with Sap Analytics for Cloud.

A mandatory prerequisite for running S4H Group Reporting is to install the best practices configuration content for the solution. You can only make changes to consolidation-relevant settings in Customizing for SAP S/4HANA for Group Reporting afterwards. For more information on installing the best practices content, see the administration guide on SAP Help Portal

Relevant Scope Item in the Building Block Builder is XX_1SG_OP.

Key configurable Elements in Group Reporting are explained below

A consolidation Ledger contains the Source Ledger and the Currency. So for consolidation as per differing accounting principles, you can create requisite number of consolidation ledgers.

Notes:

2. Version: A consolidation version is used for identifying a separate data area in the consolidation database. Versions make it possible to consolidate different sets of financial data.

A Version may also be created if you want to perform separate methods of consolidation on the same set of underlying data.

For example – You create a version for consolidating Plan Data alongside one for consolidating Actual Data.

You may also create a new version for performing Restatement of Actual Data.

Notes:

3. Dimension : Dimension reflects the basis for consolidation. Default delivered dimension is Company. So as of the current release, Consolidation process happens at Company level.

4. Financial Statement Items: This is the most crucial element in Group Reporting.

FS Items replaces the old world ‘Group CoA’. FS Items are linked to the Operating accounts in the Consolidation system. The basic accounting system (ex: SAP FICO) remains untouched by the FS Item.

SAP delivers a comprehensive set of FS items as part of the best practice content. FS items form the backbone of the consolidation process. Definition of FS Item contains:

Notes:

FS Items are grouped into Reporting Items, which in turn are grouped into reporting Hierarchies. ‘Manage Global Accounting Hierarchies’ App allows a quick look into understanding the construct, making edits or even creating your own Reporting Hierarchies.

On expanding an item, you see the details like below

Mass upload of mapping of FS Items to GL account is done using below app

The dropdown has the following options

5. Sub items : Sub items help in getting a horizontal build of an account. Consolidation Transaction Types are for Balance sheet accounts and Functional Area are for Profit and Loss accounts.

It is possible to add more sub items by way of configuration.

The Sub items are largely organized into Categories.

SAP Best Practices provides the following two Sub item Categories –

At the Sub item level, some could be reserved for exclusive use in the consolidation system. This can be realized by checking ‘No Posting/Entry’ check box.

Notes:

Example : For FS Item denoting ‘Provisions’, transaction types (Sub item category 1) are mandatory. So the Breakdown Category tagged to the FS Item should have Transaction type as mandatory and could additionally specify a set of permissible transaction types as well.

Default Sub Item assignment ensures population of default values for the data in consolidation system

6. Document types : Like in the SAP transaction system (SAP FICO), document types are used to segregate operations within the consolidation system.

Controls within Document Type -

List of pre-delivered document types -

Controls provided in the Document Type definition

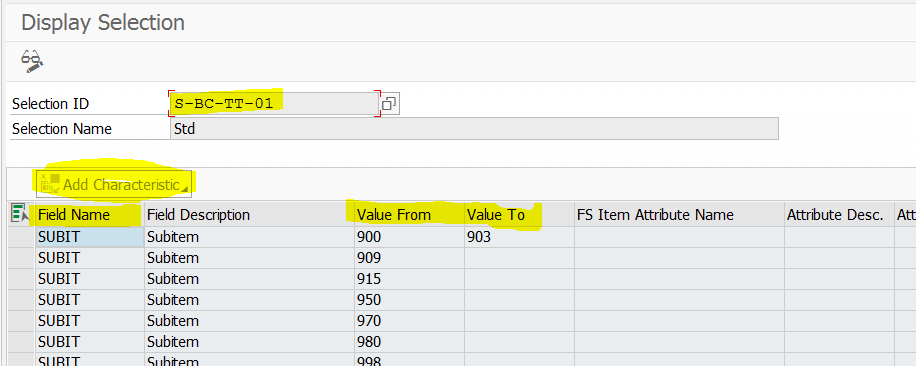

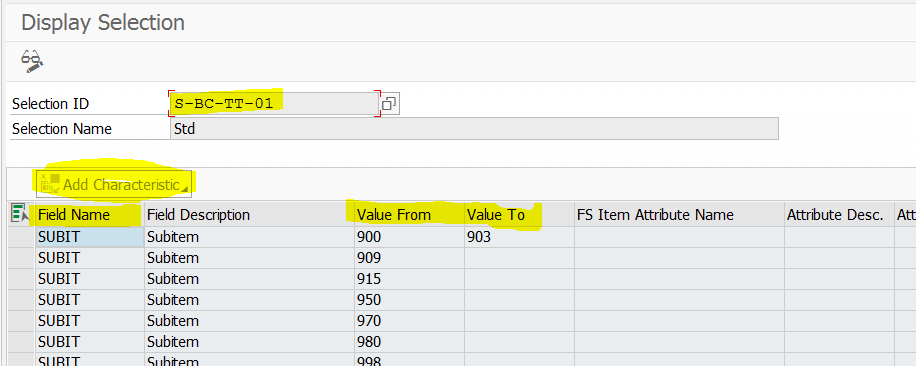

7. Selection IDs : Selections are a group or set of consolidation master data like FS Items, Sub items, Document types etc to be used in consolidation-related settings.

They resemble the "set" in the SAP FICO system, just that Selection IDs can contain more than one field parameter.

Example : For a requirement where Opening balances on certain Balance sheet items are to be translated at Average Rate – you would define a Selection ID with the specific FS Items representing the Balance sheet items and add the transaction type that denotes Opening balance. Now this Selection ID could be called inside the Currency Translation Method and tagged to the Average Rate.

Selection ID with more than one field parameter, namely FS Items and Transaction type is shown below

Selection ID with single field parameter - Transaction Type is shown below

Where-used list helps in tracing down the usage of a particular Selection ID

Below interesting features part of the product vision will simplify complex and advanced processes in Consolidation :

Matrix Consolidation

Group Structure and Ownership Manager

Multiple subgroup currencies

Integration into Financial Closing Cockpit,

Automated InterUnit Profit Elimination from Inventory

Integration Scenarios with planning applications

Advanced Intercompany Reconciliation

Intelligent Data Validation leveraging Machine Learning

Some of these features are already available in the Cloud Edition, for instance Matrix Consolidation, Group Structure & Ownership Manager.

SAP Help

SAP Best Practice

This post intends to give a round up on Group Reporting and the basic elements.

Thank you for going through the post.Your feedback and comments will help me make it more relevant to the community.

What you will learn from the Blog Post

Overview and Positioning of Group Reporting and know more about the basic building blocks.

Summary

The blog post covers the Rationale for Group Reporting, Product positioning and differentiation, and a detailed look at the key Building Blocks in terms of Key Configuration Elements and Master Data.

The focus is on On-Premise solution as of release 1809. This document touches on the pre-configured settings of the best practice content.

I will aim at covering the Consolidation Processes, Settings and Reporting in my subsequent blog post.

Why Group Reporting

Preparation of Consolidated Financial Statements is mandatory for Statutory compliance, example IFRS10. Applicable Accounting Principles outline the requirements for producing such statements.

SAP’s Group Reporting tool facilitates not just in the preparation Financial Statements as per Statutory regulations, but also has added capabilities for facilitating managerial consolidation and analytics.

Overview of Key Capabilities

- Local and Group Close in the same tool

- Flexible rules for Data Validation

- Currency Translation

- Inter-Unit Elimination

- Consolidation of Investments

- Data Collection options - Release from Universal Journal, Flexible Upload of Reported Financial Data, or Published APIs from Other SAP or Customer applications.

- Possibility to perform Data entry at desired level within the consolidation system.

- Record Ownership information using Journal entries on Statistical items.

- Manual Top-up Adjustment for Elimination where ever needed

Details of these will be covered in a separate blog post.

Product Positioning

SAP S/4HANA for Group reporting is SAP’s strategic consolidation solution moving forward, in particular for customers implementing SAP S/4HANA irrespective of deployment option (cloud or on premise) as well as for customers looking for a public cloud stand-alone offering. Group reporting can be used independently from operational accounting or other ERP functions in SAP S/4HANA if desired.

The picture below taken from SAP’s presentation on product vision, explains how Group Reporting fits into the landscape.

Group Reporting vis-à-vis other Consolidation Products

The new Group Reporting Tool combines the best of the features and capabilities of existing tools, leveraging and well-integrated with Sap Analytics for Cloud.

- Embedded in S4HANA, hence no need of an ETL or Data Warehousing Tool like BW to intermediate between the transaction system and the consolidation system. Data flow from transaction system to the Consolidation system is Realtime.

- Fully enabled drill-through from Group Reporting to the line-items of the entity, leveraging all details of the underlying Universal Journal.

- Introducing FS Items, replacing the Group CoA. The set up and maintenance of FS Items is managed inside Group Reporting, which means Operating Chart of Accounts are not disturbed.

- Rule based Eliminations and Reports, with data generation by desired breakdown items.

- Local close and group close share the same master data / rules.

- SAP Group Reporting Data Collection is an additional Cloud-based Data Collection application delivered on the SAP Cloud Platform, with native integration to S/4 HANA Group Reporting

- Roadmap for integration to Disclosure Management.

Building Blocks

Technical

A mandatory prerequisite for running S4H Group Reporting is to install the best practices configuration content for the solution. You can only make changes to consolidation-relevant settings in Customizing for SAP S/4HANA for Group Reporting afterwards. For more information on installing the best practices content, see the administration guide on SAP Help Portal

Relevant Scope Item in the Building Block Builder is XX_1SG_OP.

Functional

Key configurable Elements in Group Reporting are explained below

- Consolidation Ledger: A ledger to store documents generated by the consolidation tool.

A consolidation Ledger contains the Source Ledger and the Currency. So for consolidation as per differing accounting principles, you can create requisite number of consolidation ledgers.

Notes:

- As of the current release, system allows creation of Consolidation Ledger code starting with “C”.

- All Consolidation Groups should carry the same Ledger in one Version, to ensure consistency in Global parameters.

2. Version: A consolidation version is used for identifying a separate data area in the consolidation database. Versions make it possible to consolidate different sets of financial data.

A Version may also be created if you want to perform separate methods of consolidation on the same set of underlying data.

For example – You create a version for consolidating Plan Data alongside one for consolidating Actual Data.

You may also create a new version for performing Restatement of Actual Data.

Notes:

- Further specifications of Special Version allows you to use different methods or rules for achieving the specific Consolidation effect.

3. Dimension : Dimension reflects the basis for consolidation. Default delivered dimension is Company. So as of the current release, Consolidation process happens at Company level.

4. Financial Statement Items: This is the most crucial element in Group Reporting.

FS Items replaces the old world ‘Group CoA’. FS Items are linked to the Operating accounts in the Consolidation system. The basic accounting system (ex: SAP FICO) remains untouched by the FS Item.

SAP delivers a comprehensive set of FS items as part of the best practice content. FS items form the backbone of the consolidation process. Definition of FS Item contains:

- Types of the Item – Classification on the basis of Nature of the Item

- INC: Income items in P&L statements

- EXP: Expense items in P&L statements

- AST: Asset items in balance sheets

- LEQ: Liabilities and equity items in balance sheets

- STAT: Statistical items that can be used to record financial and non-financial data. This data is not directly linked into P&L statements or balance sheets, such as headcount information.

- REPT: Reporting items that are used in reporting. Dedicated hierarchies can be defined for reporting items, and respective reporting rules can be defined to derive values of the reporting items.

- Attributes relevant for automating the consolidation processes like Currency Translation, Elimination and Consolidation of Investment (CoI).

- Controls input of further parameters such as consolidation transaction types, Functional Areas, Partner Unit etc – called Breakdown Category

- Balance Sheet and P&L structure in hierarchical fashion

Notes:

- Fiori App ‘Import Master Data for Consolidation Fields’ has predefined template of FS Items with all these associated attributes. Click on ‘Download Template’ and select ‘Financial Statement Item’ in the Master Data Type Selection dropdown.

- Creation of New FS Items should carefully consider all parameters starting from transaction recording up until reporting.

- Tagging FS Item to Operational Chart of Accounts is a prerequisite to read data directly from the Universal Journal. App ‘Assign FS Item Mapping’ can be used. For mass load, you can download the template and upload it with relevant data using App ‘Import Master Data for Consolidation Fields’.

- There are separate settings to specify how the FS Items should be Carried forward to the next year.

- Separate configuration setting is available to specify Automatic posting FS Items, like FS Item for P&L Net Income, FS Item for Rolling that up into a Balance Sheet, FS Items for posting Deferred Tax, etc.

- Every newly created GL account should be mapped to an FS Item (existing or new FS Item). So the periodic Operating CoA maintenance activity should include this important step.

FS Items are grouped into Reporting Items, which in turn are grouped into reporting Hierarchies. ‘Manage Global Accounting Hierarchies’ App allows a quick look into understanding the construct, making edits or even creating your own Reporting Hierarchies.

On expanding an item, you see the details like below

Mass upload of mapping of FS Items to GL account is done using below app

The dropdown has the following options

5. Sub items : Sub items help in getting a horizontal build of an account. Consolidation Transaction Types are for Balance sheet accounts and Functional Area are for Profit and Loss accounts.

It is possible to add more sub items by way of configuration.

The Sub items are largely organized into Categories.

SAP Best Practices provides the following two Sub item Categories –

- Transaction Types

- Functional Areas

At the Sub item level, some could be reserved for exclusive use in the consolidation system. This can be realized by checking ‘No Posting/Entry’ check box.

Notes:

- Sub items are linked to the FS Items through ‘Breakdown Categories’. Breakdown categories define the status and permissible list of sub items for an FS Item, and are assigned to FS Item.

Example : For FS Item denoting ‘Provisions’, transaction types (Sub item category 1) are mandatory. So the Breakdown Category tagged to the FS Item should have Transaction type as mandatory and could additionally specify a set of permissible transaction types as well.

- Default value assignment for sub items is possible too.

Default Sub Item assignment ensures population of default values for the data in consolidation system

6. Document types : Like in the SAP transaction system (SAP FICO), document types are used to segregate operations within the consolidation system.

Controls within Document Type -

- Posting level – indicates the type and level of consolidation adjustment. Posting level enables a selection of data by content.

- Data Source - manual or automatic posting, file upload, or API

- Automatic Reversal and Reversal spilled over to next year– whether the document is valid only for one period of the current year, and whether the reversal should be restricted to the current year alone.

- Currencies – Control on the currency relevant for the posting

- Deferred Income Tax – whether the document type is relevant for deferred tax posting

- Balance check – whether the document needs to balance to zero and consequent reaction if it doesn’t.

List of pre-delivered document types -

Controls provided in the Document Type definition

7. Selection IDs : Selections are a group or set of consolidation master data like FS Items, Sub items, Document types etc to be used in consolidation-related settings.

They resemble the "set" in the SAP FICO system, just that Selection IDs can contain more than one field parameter.

Example : For a requirement where Opening balances on certain Balance sheet items are to be translated at Average Rate – you would define a Selection ID with the specific FS Items representing the Balance sheet items and add the transaction type that denotes Opening balance. Now this Selection ID could be called inside the Currency Translation Method and tagged to the Average Rate.

Selection ID with more than one field parameter, namely FS Items and Transaction type is shown below

Selection ID with single field parameter - Transaction Type is shown below

Where-used list helps in tracing down the usage of a particular Selection ID

Roadmap

Below interesting features part of the product vision will simplify complex and advanced processes in Consolidation :

Matrix Consolidation

Group Structure and Ownership Manager

Multiple subgroup currencies

Integration into Financial Closing Cockpit,

Automated InterUnit Profit Elimination from Inventory

Integration Scenarios with planning applications

Advanced Intercompany Reconciliation

Intelligent Data Validation leveraging Machine Learning

Some of these features are already available in the Cloud Edition, for instance Matrix Consolidation, Group Structure & Ownership Manager.

Further References

SAP Help

SAP Best Practice

This post intends to give a round up on Group Reporting and the basic elements.

Thank you for going through the post.Your feedback and comments will help me make it more relevant to the community.

Labels:

73 Comments

- « Previous

-

- 1

- 2

- Next »

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Business Trends

145 -

Business Trends

15 -

Event Information

35 -

Event Information

9 -

Expert Insights

8 -

Expert Insights

29 -

Life at SAP

48 -

Product Updates

521 -

Product Updates

63 -

Technology Updates

196 -

Technology Updates

11

Related Content

- Error while Generating GSTR1 reports in S4Hana public cloud in Financial Management Q&A

- Payment Batch Configurations SAP BCM - S4HANA in Financial Management Blogs by Members

- SAP ECC Conversion to S/4HANA - Focus in CO-PA Costing-Based to Margin Analysis in Financial Management Blogs by SAP

- Unveiling the new functionality in 2024 of SAP PAPM Cloud: Welcome to Universal Model! in Financial Management Blogs by SAP

- Standard Reports in Trade Finance in S4Hana in Financial Management Q&A

Top kudoed authors

| User | Count |

|---|---|

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |