- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by Members

- Consistency check report in RAR

Financial Management Blogs by Members

Dive into a treasure trove of SAP financial management wisdom shared by a vibrant community of bloggers. Submit a blog post of your own to share knowledge.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Former Member

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

12-03-2018

5:23 AM

Consistency check report

Consistency check report will provide the ability to validate the database in revenue accounting and give an overview of contract management data.

Customer should be able to determine inconsistencies at an early point of time. Also, they could run after each posting period or at any point of time to know the number of issue.

Report name - RFARR_CONS_MONITOR

Transaction code - FARR_CONTR_MON

Below is Input selection screen for consistency check report.

Report can be executed with below two options:

“Read data online” - It extracts data online which means that it will extract data from different RA table and process it and result will be display in output.

“Read data from error table” – It extracts data directly from error log table FARR_D_CONS which is saved by the mass processing transaction FARR_CONTR_CHECK.

Also, new version of report has one additional option “Save result to error table” which will help to store the data directly in error log table if contract have any error.

Mass consistency check report

In this transaction the user can check RA relevant data for specific accounting principles and company codes. The result of consistency checks will be saved in database table FARR_D_CONS.

Report name - RFARR_PP_CONTRACT_CHECK_START

Transaction code - FARR_CONTR_CHECK)

We have 20 error categories (E1 to E19 & E25). I have mentioned some of the important error category in the blog.

Error E1 - The total amount of allocation effects (amount for CORR condition) for all performance obligations (POB) of a contract should be zero. If it is not zero, then it comes under E1 error. This check is performed on contract level.

Report check only latest entry for CORR condition from FARR_D_DEFITEM table to get the allocation effect value.

Error E2 – It checks allocated amount and revenue scheduled amount. If allocated amount is not equal to the revenue schedule of a performance obligation (POB) then will get E2 error. This check is performed on POB level.

Get allocated amount from table FARR_D_DEFITEM (fields DOC_AMT_CUMULATIVE & PRO_AMT_CUMULATIVE) and sum of revenue schedule is calculated from tables FARR_D_DEFITEM & FARR_D_FULFILLMT. Also, you can see revenue schedule data directly from revenue schedule UI screen.

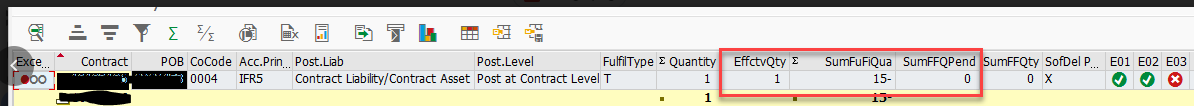

Error E3 – It compares POB effective quantity and fulfilled quantity for a POB. The fulfilled quantity consists of quantities that are both suspended and not suspended from posting.

Soft deleted POB: - If POB is soft deleted and fulfilled qty is not equal to ZERO, then it displays as E3 error.

Non-Soft deleted POB: -

- Time based POB – If effective Qty is not equal with fulfilled Qty then report will display E3 error.

- Non-Time-based POB (Event/POC based) – Report checks E3 error when POB is fully fulfilled only and effective qty is grater than the fulfilled qty then E3 will be displayed.

Example for time based POB

There are few exception cases where E3 won't be display in report output.

- If contract have validation error.

- If POB belongs to BOM case.

- If fulfillment type is E and event type is CI and POB is value relevant

Error E4 – It compares Quantity between fulfilment table and Def item table and caused for E4 error if have any difference between them.

There are following four fields in consistency check report which is used to check E4 error.

Sum of fulfilled Qty - Extract all un-suspended entries from fulfillment table and summed up data fields QTY_NOMINATOR/ QTY_DENOMIATOR for time-based POB and REPORTED_QTY for non-time-based POB.

Reported Qty – Extract all un-suspended entries from Fulfillment table and summed up reported qty for time based and non-time-based POB.

Total Qty of POB - It takes only last entry from FARR_D_DEFITEM table and get this values after summing up 3 fields value ( REV_QTY_DELTA + REV_QTY_POSTED + PRO_QTY_CUMULATIVE).

Sum of planned qty – It extracts all the data from FARR_D_DEFITEM and used REV_QTY_DELTA_NR & REV_QTY_DELTA_DN to calculate Sum of planned qty for time-based POB. For non-time-based POB, it uses REV_QTY_DELTA.

If Reported Qty is not equal to total Qty of POB and/or Sum of fulfilled qty is not equal to sum of planned qty then consistency check report shows as “E4” error.

** Un-suspended entries means that where Fulfillment status is blank in FARR_D_FULFILLMENT table.

Below are two examples where we can see that how E4 error are being displayed in report output.

Reported qty <> Total Qty of POB

Sum of fulfilled Qty <> Sum of planned Qty

Error E5 – If latest entry flag for a deferral item is incorrect or missing then will get E5 error.

Error E6 – It compares data between FARR_D_DEFITEM and FARR_D_POSTING table and found any discrepancy between them caused for E6 error.

It compares value between the sum of planned revenue and sum of posted revenue.

Sum of planned revenue = Sum of fields FARR_D_DEFITEM-REV_AMT_DELTA for all closed recon key

Sum of posted revenue = Sum of fields FARR_D_POSTING-BETRW (where posting category is RV) for all closed recon key.

E7 error - It compares Invoice data between FARR_D_DEFITEM and FARR_D_POSTING table and found any discrepancy between them caused for E7 error.

It compares value between the sum of differed Invoice and sum of posted Invoice.

Sum of Def item Invoice = Sum of fields FARR_D_DEFITEM-INV_AMT_DELTA for all closed recon key

Sum of posted Invoice = Sum of fields FARR_D_POSTING-BETRW (where posting category is IC) for all closed recon key.

Error E8 - This error category check the special indicator flag in FARR_D_DEFITEM. If special indicator flag is incorrect or missing then will get E8 error.

Error E9 – It check the transaction price, allocated amount and allocation effect of a POB and if they are inconsistent then it come under E9 error.

The allocation effect of a performance obligation (POB) must be equal to the allocated price of a POB, minus the transaction price. In this comparison, the transaction price and allocated amount are derived from the POB master data and the allocation effect is calculated based on the corresponding allocation effect condition in the deferral item.

- SAP Managed Tags:

- SAP Revenue Accounting and Reporting

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Assign Missing Authorization Objects

1 -

Bank Reconciliation Accounts

1 -

CLM

1 -

FIN-CS

1 -

FINANCE

2 -

GRIR

1 -

Group Reporting

1 -

Invoice Printing Lock

2 -

Mapping of Catalog & Group

1 -

Mapping with User Profile

1 -

matching concept and accounting treatment

1 -

Oil & Gas

1 -

Payment Batch Configurations

1 -

Public Cloud

1 -

Revenue Recognition

1 -

review booklet

1 -

SAP BRIM

1 -

SAP CI

1 -

SAP RAR

1 -

SAP S4HANA Cloud

1 -

SAP S4HANA Cloud for Finance

1 -

SAP Treasury Hedge Accounting

1 -

Z Catalog

1 -

Z Group

1

Related Content

- Payment Batch Configurations SAP BCM - S4HANA in Financial Management Blogs by Members

- SAP ECC Conversion to S/4HANA - Focus in CO-PA Costing-Based to Margin Analysis in Financial Management Blogs by SAP

- DOCUMENT NUMBER GENERATION USING BAPI_ACC_DOCUMENT_POST. in Financial Management Q&A

- Negative budget transfer restriction in funds management in Financial Management Q&A

- SAP Review Booklet Designer – Enhancement to Reporting in Financial Management Blogs by Members