- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by Members

- CLM in SAP S/4HANA Public Cloud

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Introduction:

In SAP S/4HANA Public Cloud, SAP introduces Contract and Lease Management (CLM) as the tool to register lease contracts. CLM is based on the existing solution Flexible Real Estate (RE-FX). This solution has proven itself during more than 20 years. In 2018 RE-FX was enriched with the functionality to register lease-in contracts according to IFRS16. This meant that the lease-in contracts could be activated on the balance sheet if they were valuation relevant.

Since CLM is based on RE-FX, it has the same functionalities regarding the lease-in contracts. The missing functionalities are in the area of Master data and Service Charges.

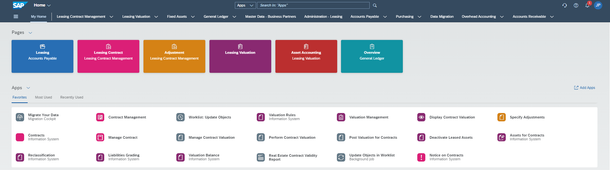

CLM overview:

SAP provides a number of Best Practices to implement CLM in a Public Cloud system. These Best Practices cover Lease-in contracts (Local GAAP, US GAAP and IFRS), Lease-out contracts (Local GAAP, US GAAP and IFRS), Sublease contracts (Intercompany), Sales based rent for lease-out contracts and Service contracts. The available Best Practices depend on the country in which the product will be used. SAP is continuously delivering new functionality in the cloud releases.

This blog focusses on customers moving to Public Cloud with lease-in contracts relevant for IFRS16. If they choose to activate the best practices Lease-in Accounting (1T6), Lease-in Accounting Group Ledger (21P) or Lease-in Accounting Group Ledger US GAAP (34N), they receive a tool to manage a lease contract database which generates postings in the different ledgers.

New lease contracts:

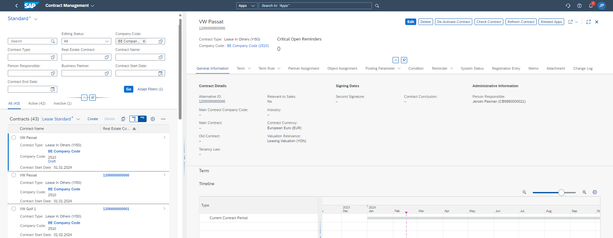

The first step is to create lease contracts. This is done individually with the app Contract Management. This app is used by the Contract specialist and they enter the basic data of the lease contract like the name, term (renewal/notice), partner (supplier/lessor), object (building/vehicle) and conditions (lease rates).

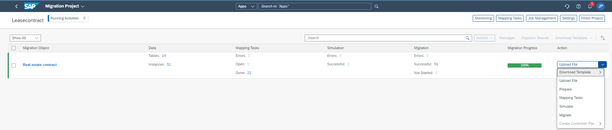

If the data is complete the contract must be activated. The initial load of the lease contracts is done with the app Migrate your data. An object is provided for the lease contract with a template to fill and create the lease contracts. The app is used if new contracts should be created in mass while the system is already active.

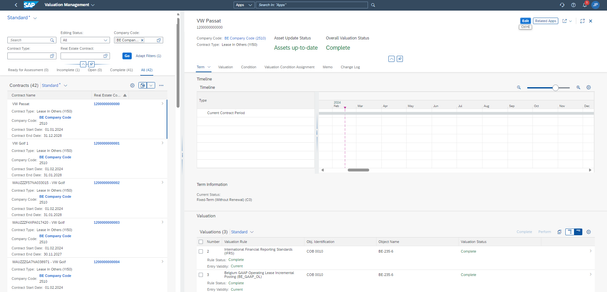

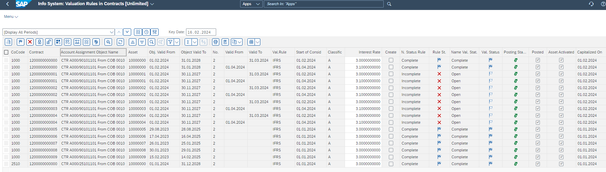

The contracts created in mass must be activated and this is achieved by using the app Worklist: Update Objects (background). In order to valuate the contracts, valuation rules are assigned. Depending on the country, valuation rules must be added for IFRS, US GAAP and/or Local GAAP. For individual lease contracts the app Manage contract valuation is used. In this app the valuation rules are assigned and after completing the rules the values are calculated, an asset is created and the cash flow is generated.

In future releases when Universal Parallel Accounting is active the app Valuation management is used for this purpose.

If more than one contract must be valuated, the app Valuation rules is available. This app is a combination of a report and a mass change transaction. By using the correct selections and selecting Change, the report shows either contracts where a new valuation rule is generated or existing valuation rules which are changed. If the report is used to generate new rules, an interest rate must be entered (or taken over from a reference interest rate table). Now the valuation rules must be completed, which create the asset, and the system calculates the values and generates the cash flow.

Processing the lease contracts:

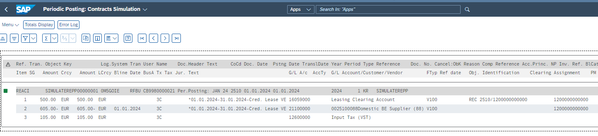

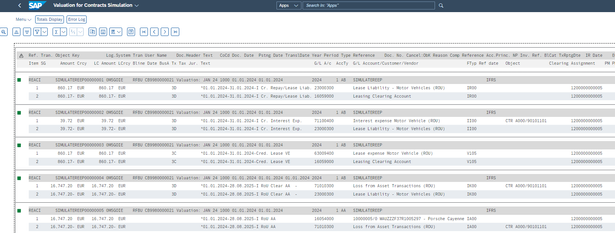

Depending on the conditions in the lease contracts a periodic posting is done. This periodic posting generates open items on the supplier/lessor which are paid according to the contract agreements. This follows a self-billing scenario. In case the supplier/lessor sends invoices this posting is not done, but the invoice is posted and generates an open item on the supplier/lessor. However it also means that the invoice must be checked against the contract conditions to make sure they are in line.

The lease contracts have generated a valuation cash flow. This valuation cash flow is posted periodically and depending on the type of valuation rule it generates postings. For IFRS this means postings on the RoU asset, liabilities, clearing of the invoice and interest postings. But for Local GAAP it is only a posting into an expense account.

Changes in the lease contracts:

During the lifetime of the lease contracts changes can occur. These changes must be reflected in the lease contract. Depending on the kind of change the valuation needs to be updated and recalculated.

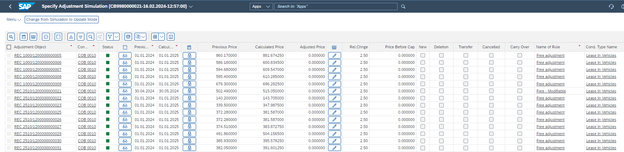

A mass change on conditions is executed in the app Specify adjustments. The adjustment rule in the lease contract is used to calculate a new lease amount. When the adjustment is activated also a new valuation timeslot must be created. This is done in mass via the app Valuation rules.

Other changes like the interest rate or a new cost center assignment are done in the app Valuation rules or directly in the lease contract.

In any case the app Valuation rules must be checked before posting the valuation to see if there are any Incomplete valuation rules or Open valuations which will not be posted.

At the end of the lease contract:

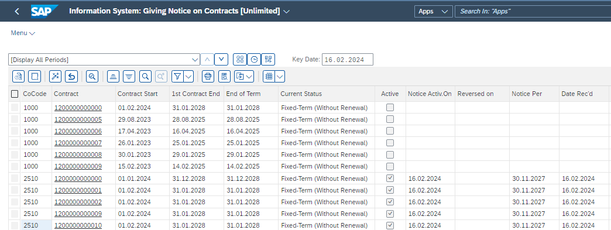

If lease contracts need to be terminated in mass the app Notice on contracts is available. In this app lease contracts are selected and in mass terminated. Also in this case a new valuation timeslot must be created.

The termination can also be done directly in the lease contract.

If the contract is terminated and it is certain that it will not be renewed in the future, the asset must be deactivated. For this the app Deactivate leased assets is available. In this app all terminated contracts are shown for which the asset is deactivated and the final asset posting is done.

Reporting:

In CLM different standard reports are available to support the process of lease contracts. At any time an overview can be created for:

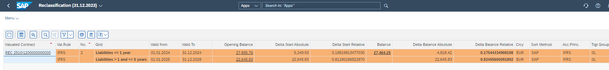

- Reclassification (display of liability <1 year, between 1 and 5 years or > 5 years)

- Liability grading different overview for the reclassification of liabilities

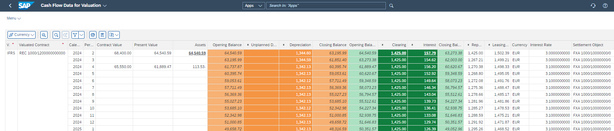

- Display contract valuation to show the valuation processes and valuation cashflow

- Overview of contracts

- Business partners of contracts

- Notice on contracts

- Assets for contracts

- Term of contracts

Conclusion:

If SAP S/4HANA Public Cloud is selected as enterprise software CLM is an option to consider. It is a standard solution embedded in SAP with all necessary integrations to Finance and Asset Accounting. If the current lease contracts are registered in an Access database or another custom software solution, SAP brings a standard solution following the IFRS guidelines. There are still configuration options in case additional needs exist.

- SAP Managed Tags:

- SAP Real Estate Management,

- FIN Real Estate

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Assign Missing Authorization Objects

1 -

Bank Reconciliation Accounts

1 -

CLM

1 -

FIN-CS

1 -

Finance

2 -

GRIR

1 -

Group Reporting

1 -

Invoice Printing Lock

2 -

Mapping of Catalog & Group

1 -

Mapping with User Profile

1 -

matching concept and accounting treatment

1 -

Oil & Gas

1 -

Payment Batch Configurations

1 -

Public Cloud

1 -

Revenue Recognition

1 -

review booklet

1 -

SAP BRIM

1 -

SAP CI

1 -

SAP RAR

1 -

SAP S4HANA Cloud

1 -

SAP S4HANA Cloud for Finance

1 -

SAP Treasury Hedge Accounting

1 -

Z Catalog

1 -

Z Group

1

- Error while Generating GSTR1 reports in S4Hana public cloud in Financial Management Q&A

- how to check business catalog to be assigned For custom in app application in sap s4hana cloud? in Financial Management Q&A

- Revaluation values for Fixed Assets reversed when created using Migrate Your Data-Migration Cockpit in Financial Management Q&A

- Evaluation groups for Fixed Assets in Financial Management Q&A

- Manage dates-driven planning processes with SAP Analytics Cloud in Financial Management Blogs by SAP