- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- What’s New for In-House Banking with SAP S/4HANA C...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

02-02-2023

9:55 AM

Co-Author: Lasse Becker

Welcome to the new innovations in in-house banking with SAP S/4HANA Cloud, public edition 2302 release. If you missed our earlier update, click here for recap.

You might already know that we can maintain fixed interest rates for our in-house bank accounts by defining conditions with validity period. With 2302 release, you can also maintain risk-free reference rates for interest calculation. Lets see in details with the Manage In-House Bank Condition Fiori App.

Define interest conditions

With this app, you can manage financial conditions by setting interest calculation based on the account balance situation (either in credit, debit or overdraft). Conditions are defined together with validity (valid from and valid to). A condition can be set at three different levels, a single account level, a group of accounts level or at a bank area level. You can define conditions on bank area level and all accounts within this level get the defined accounts. You can define a group and link accounts to that group, or you define the conditions on single account level. In case an in-house bank account has more than one condition at the multiple levels, the system applies the condition determination logic that the single account level condition always has the highest priority, while the bank area level condition has the lowest priority.

Reference Interest Rate

This rate is taken directly as the contract interest rate for the variable interest calculation or is part of the formula for calculating the contract interest rate.

Example

Examples of reference interest rates are ESTER (1-day interbank interest rate for the Euro zone) and SOFR (Secured Overnight Financing Rate). Internal base interest rates, to which financial transactions such as loans or interests can be linked, are also treated as reference interest rates.

Mark Up/Mark Down %: A mark up or mark down is a percentage value to be added to or subtracted from the base interest rate.

Interest Lockout Period: The interest lockout period defines a period in days at the end of the balancing period for which the same reference interest rate will be applied. The use case for defining an interest lockout period is that variable reference interest rates might not be available in time when calculating the interests for the balancing period. Therefore, a previous interest rate serves as forecast for a potentially missing rate.

Interest Adjustment Period: If a lookback period of two days has been defined for an interest condition. When determining the reference interest rate for 14th of September, the corresponding interest fixing date will be 12th of September. Therefore, reference rate on 12th of September will be applied for the corresponding interest adjustment date on 14th of September.

Interest Weight: When calculating interest, the length of a period that is associated with an interest adjustment date might vary. Therefore, weights are required to compensate interest calculation for longer/shorter periods. In case a lookback period is configured, the interest rate weighting methods defines how/at which points in time the weight should be distributed. Example - You have configured an interest lookback period of 2 days with weighting method S - Based on Interest Fixing Date. For the adjustment date on Tuesday 06.09.2022, this would mean that the reference rate of Friday 02.09.2022 would apply with weight 3. Alternatively with weighing method L - Based on Interest Rate Adjustment Date, the rate of Friday 02.09.2022 will be applied with weight 1 for the adjustment date on Tuesday 06.09.2022.

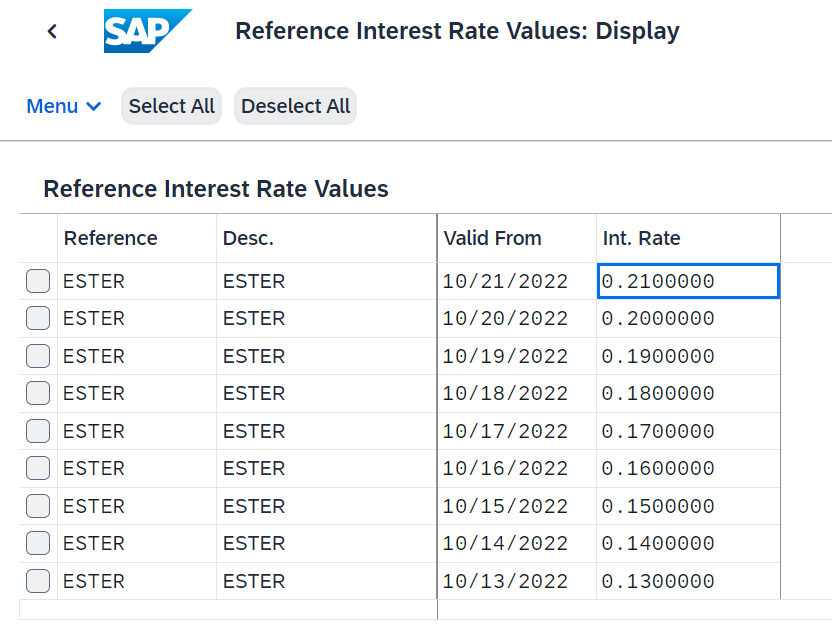

Use this app to assign interest values to reference interest rates, which are used for item interest calculation.

You have defined a reference interest rate in the configuration activity Define Reference Interest Rates.

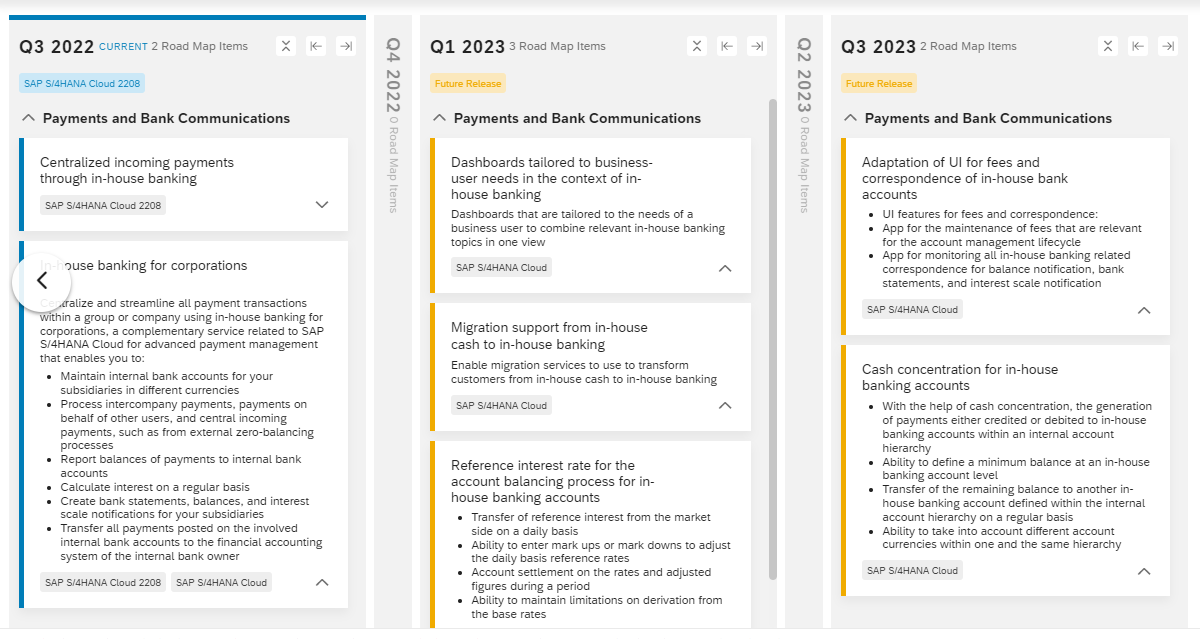

There are more innovations planned for SAP In-House Banking with the upcoming release of SAP S/4HANA Cloud. Visit SAP Roadmap Explorer to know the details.

Let us know your thoughts on the new In-House Banking solution in the comments section below.

If you want to learn more and actively engage with SAP subject matter experts on SAP S/4HANA Cloud, join our SAP S/4HANA Cloud Community – now fully integrated with SAP Community. The community brings together SAP S/4HANA Cloud customers, partners and SAP experts and has a clear mission: deliver an interactive community to engage with one another about best practices and product solutions. We invite you to explore the new SAP S/4HANA Cloud Community ‘one-stop shop’ as the central place for all resources, tools, content questions, answers and connect with experts to guide you through your SAP S/4HANA Cloud journey.

Advanced Payment Management

Define Reference Interest Rate Values | SAP Help Portal

More Information on SAP S/4HANA Cloud, public edition –

Welcome to the new innovations in in-house banking with SAP S/4HANA Cloud, public edition 2302 release. If you missed our earlier update, click here for recap.

You might already know that we can maintain fixed interest rates for our in-house bank accounts by defining conditions with validity period. With 2302 release, you can also maintain risk-free reference rates for interest calculation. Lets see in details with the Manage In-House Bank Condition Fiori App.

Manage In-House Bank Conditions

Define interest conditions

With this app, you can manage financial conditions by setting interest calculation based on the account balance situation (either in credit, debit or overdraft). Conditions are defined together with validity (valid from and valid to). A condition can be set at three different levels, a single account level, a group of accounts level or at a bank area level. You can define conditions on bank area level and all accounts within this level get the defined accounts. You can define a group and link accounts to that group, or you define the conditions on single account level. In case an in-house bank account has more than one condition at the multiple levels, the system applies the condition determination logic that the single account level condition always has the highest priority, while the bank area level condition has the lowest priority.

Reference Interest Rate

This rate is taken directly as the contract interest rate for the variable interest calculation or is part of the formula for calculating the contract interest rate.

Example

Examples of reference interest rates are ESTER (1-day interbank interest rate for the Euro zone) and SOFR (Secured Overnight Financing Rate). Internal base interest rates, to which financial transactions such as loans or interests can be linked, are also treated as reference interest rates.

Mark Up/Mark Down %: A mark up or mark down is a percentage value to be added to or subtracted from the base interest rate.

Interest Lockout Period: The interest lockout period defines a period in days at the end of the balancing period for which the same reference interest rate will be applied. The use case for defining an interest lockout period is that variable reference interest rates might not be available in time when calculating the interests for the balancing period. Therefore, a previous interest rate serves as forecast for a potentially missing rate.

Interest Adjustment Period: If a lookback period of two days has been defined for an interest condition. When determining the reference interest rate for 14th of September, the corresponding interest fixing date will be 12th of September. Therefore, reference rate on 12th of September will be applied for the corresponding interest adjustment date on 14th of September.

Interest Weight: When calculating interest, the length of a period that is associated with an interest adjustment date might vary. Therefore, weights are required to compensate interest calculation for longer/shorter periods. In case a lookback period is configured, the interest rate weighting methods defines how/at which points in time the weight should be distributed. Example - You have configured an interest lookback period of 2 days with weighting method S - Based on Interest Fixing Date. For the adjustment date on Tuesday 06.09.2022, this would mean that the reference rate of Friday 02.09.2022 would apply with weight 3. Alternatively with weighing method L - Based on Interest Rate Adjustment Date, the rate of Friday 02.09.2022 will be applied with weight 1 for the adjustment date on Tuesday 06.09.2022.

Define Risk-free or Reference Interest Rate Values

Use this app to assign interest values to reference interest rates, which are used for item interest calculation.

You can use this app to:

You can use this app to:

- Assign an interest value to a reference interest rate, and a date from which this interest value is valid.

- Display the maintained interest values for all reference interest rates.

Prerequisite

You have defined a reference interest rate in the configuration activity Define Reference Interest Rates.

Roadmap

There are more innovations planned for SAP In-House Banking with the upcoming release of SAP S/4HANA Cloud. Visit SAP Roadmap Explorer to know the details.

Your Voice Matters!

Let us know your thoughts on the new In-House Banking solution in the comments section below.

If you want to learn more and actively engage with SAP subject matter experts on SAP S/4HANA Cloud, join our SAP S/4HANA Cloud Community – now fully integrated with SAP Community. The community brings together SAP S/4HANA Cloud customers, partners and SAP experts and has a clear mission: deliver an interactive community to engage with one another about best practices and product solutions. We invite you to explore the new SAP S/4HANA Cloud Community ‘one-stop shop’ as the central place for all resources, tools, content questions, answers and connect with experts to guide you through your SAP S/4HANA Cloud journey.

References –

Advanced Payment Management

Manage In-House Bank Conditions

Define Reference Interest Rate Values | SAP Help Portal

More Information on SAP S/4HANA Cloud, public edition –

- SAP S/4HANA Cloud, public edition release info here

- Latest SAP S/4HANA Cloud, public edition release blog posts here and previous release highlights here

- Product videos on our SAP S/4HANA Cloud, Public Edition and SAP S/4HANA YouTube playlist

- SAP S/4HANA PSCC Digital Enablement Wheel here

- Early Release Webinar Series here

- Inside SAP S/4HANA Podcast here

- openSAP Microlearnings for SAP S/4HANA here

- Best practices for SAP S/4HANA Cloud, public edition here

- SAP S/4HANA Cloud, Public Edition Community: here

- Feature Scope Description here

- What’s New here

- Help Portal Product Page here

- Implementation Portal here

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance,

- SAP S/4HANA Public Cloud

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

29 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

27 -

Expert Insights

114 -

Expert Insights

177 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,682 -

Product Updates

261 -

Roadmap and Strategy

1 -

Technology Updates

1,500 -

Technology Updates

96

Related Content

- Understand Upgrading and Patching Processes of SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Preferred Success Round Table Discussion with SAP Customers on 29th April @ SAP NOW India. in Enterprise Resource Planning Blogs by SAP

- Preliminary What’s New Information for SAP S/4HANA Cloud Public Edition 2402.3 in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Service in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Asset Management in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 14 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |