- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- SAP Credit management: Functional overview

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

pablo_mejias

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

05-30-2018

5:11 AM

In this blog we will make a brief summary of the most important points about SAP Credit Management

First, the difference between "FI-AR Credit Management" and SAP Credit Management is detailed

SAP Credit Management takes information in real time from the SD and FI modules. Allowing a credit analysis on the flight and gives us the certainty of an accurate analysis of the clients

Frequently asked questions we ask about Credit Management:

What allows to create SAP Credit Management ?

Credit Limit Management

- Implement a company wide credit policy

- Manage a customer credit profile

- Central credit management in a distributed system landscape

Credit Case

- Credit case for structured processing of credit limit applications

- Track status and result of credit limit applications

Credit Rules Engine

- Categorize customers by scoring rules

- Automatically calculate and assign a customer-specific credit limit

- Credit check rules

- Model and implement own customer credit score cards

Credit Information

- Interface to external credit agencies

- Input parameters for scoring rules

Credit Manager Analytics

- Role-based access to credit management information and analysis

What allows Credit Rules Engine?

Calculate internal credit scoring

In the scoring you can combine customer master data and transactional data (e.g. payment behavior) to score a customer.The scoring is based on formula that can be freely defined by the user.

In the scoring method you can include ratings from external sources. Multiple external ratings can be mapped to an internal rating to make them compareable

Use a black-rated customer list to prevent business with high risk customers

Example credit management process:

- A sales order that is entered in the sales system can be checked automatically in the credit management system.

- If the check fails, the order is blocked and the credit manager can review the customer credit profile.

- He can request credit report from an external source. (e.g. D&B)

- Based on new external information the scoring and a new proposal for credit-limit can be automatically calculated by the system

Based on the new credit limit the credit manager can release the sales order now

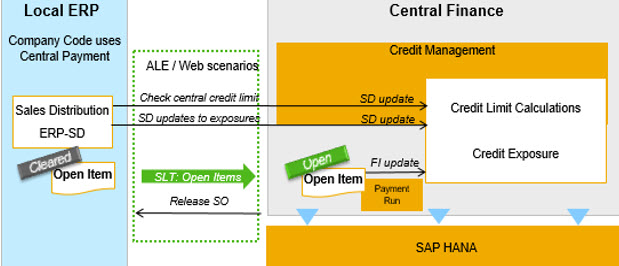

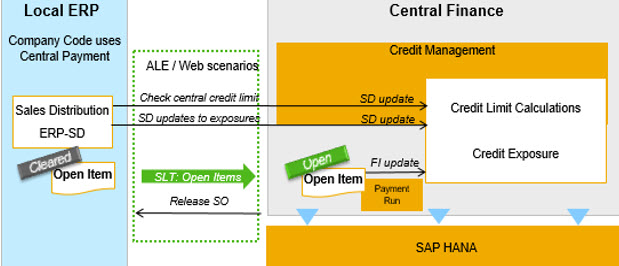

Credit Management with Central Payments

You can also use SAP Credit Management with Central Payments in Central Finance

For this scenario it is necessary to implement SLT and through IDoc / ALE, etc. You can send the SD module information from the source system to the target system.

First, the difference between "FI-AR Credit Management" and SAP Credit Management is detailed

SAP Credit Management takes information in real time from the SD and FI modules. Allowing a credit analysis on the flight and gives us the certainty of an accurate analysis of the clients

Frequently asked questions we ask about Credit Management:

What allows to create SAP Credit Management ?

Credit Limit Management

- Implement a company wide credit policy

- Manage a customer credit profile

- Central credit management in a distributed system landscape

Credit Case

- Credit case for structured processing of credit limit applications

- Track status and result of credit limit applications

Credit Rules Engine

- Categorize customers by scoring rules

- Automatically calculate and assign a customer-specific credit limit

- Credit check rules

- Model and implement own customer credit score cards

Credit Information

- Interface to external credit agencies

- Input parameters for scoring rules

Credit Manager Analytics

- Role-based access to credit management information and analysis

What allows Credit Rules Engine?

- Create a scoring formula and credit limit formula by using the formula editor. Parameters (for example, business partner data) and functions are used as input parameters.

- One scoring formula and several credit limit formulas (for each credit segment) are assigned to the rule for scoring and credit limit calculation, which is assigned to each customer in the credit profile. The risk class is determined directly from the score.

- In customizing, specific score ranges which do not overlap are assigned to each risk class. For the check rule, the system determines the steps which are taken to check the creditworthiness of a customer when a sales order is created. This may include the static check of the credit limit or acheck of the highest dunning level.

- Customer-specific process chains in SAP Credit Management can be defined through events which trigger follow-up actions

Calculate internal credit scoring

In the scoring you can combine customer master data and transactional data (e.g. payment behavior) to score a customer.The scoring is based on formula that can be freely defined by the user.

In the scoring method you can include ratings from external sources. Multiple external ratings can be mapped to an internal rating to make them compareable

Use a black-rated customer list to prevent business with high risk customers

Example credit management process:

- A sales order that is entered in the sales system can be checked automatically in the credit management system.

- If the check fails, the order is blocked and the credit manager can review the customer credit profile.

- He can request credit report from an external source. (e.g. D&B)

- Based on new external information the scoring and a new proposal for credit-limit can be automatically calculated by the system

Based on the new credit limit the credit manager can release the sales order now

Credit Management with Central Payments

You can also use SAP Credit Management with Central Payments in Central Finance

For this scenario it is necessary to implement SLT and through IDoc / ALE, etc. You can send the SD module information from the source system to the target system.

Labels:

10 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

25 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

25 -

Expert Insights

114 -

Expert Insights

167 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

240 -

Roadmap and Strategy

1 -

Technology Updates

1,501 -

Technology Updates

89

Related Content

- SAP Enterprise Support Academy Newsletter May 2024 in Enterprise Resource Planning Blogs by SAP

- Return to Supplier in SAP S4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- TRM(Treasury management ) risks and functions for SAP IAG or GRC in Enterprise Resource Planning Q&A

- Recap of SAP S/4HANA 2023 Highlights Webinar: Service in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Asset Management in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 17 | |

| 5 | |

| 5 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |