- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Question: Is Technology investment a Capex or Core...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

ravish_ojha2

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

06-12-2022

12:55 PM

Question: Is Technology investment a Capex or Core business strategy?

Technology is at the forefront of any business today, whether the business is operating in the mining, high-tech manufacturing, services and consulting domain. Investments in the tech space is something that the organizations have learned to embrace for many reasons, ranging from keeping up with competition and market, customer service, and deriving value to stakeholders. Organizations look for ways to gain market share and optimize business operations through investments in technology. Organizations that have grown organically in their respective business segments or have acquired businesses to remain relevant have both invested heavily in technology as an ‘intangible asset’. However, some organizations took the path of investments in tech space as a launch pad and later utilized the tech investment cases to build the business case around it. Today, we shall look at this space on how these 2 sets of companies utilize tech and derive value out of it.

Technology use-case:

Before that, lets check out what does investment in tech space hold. Usually, organizations invest in tech to:

To address most of the above requirements, organizations implement an ERP system capable of scaling up as the business operations scale along with time, geography, revenues etc. ERP system is a generic word used in this regard to encompass all the systems which serve the purpose. Overall, we can conclude that investment into an efficient and capable ERP system is a need, if not a choice.

However, the point worth noting is whether organizations invest into this tech space before starting business operations or after? Yes, that’s the paradigm shift being noticed as far as the ‘new age tech’ companies are concerned. The investments into any kinds of data gathering and assimilation system is done much before any ‘real’ operations kick start.

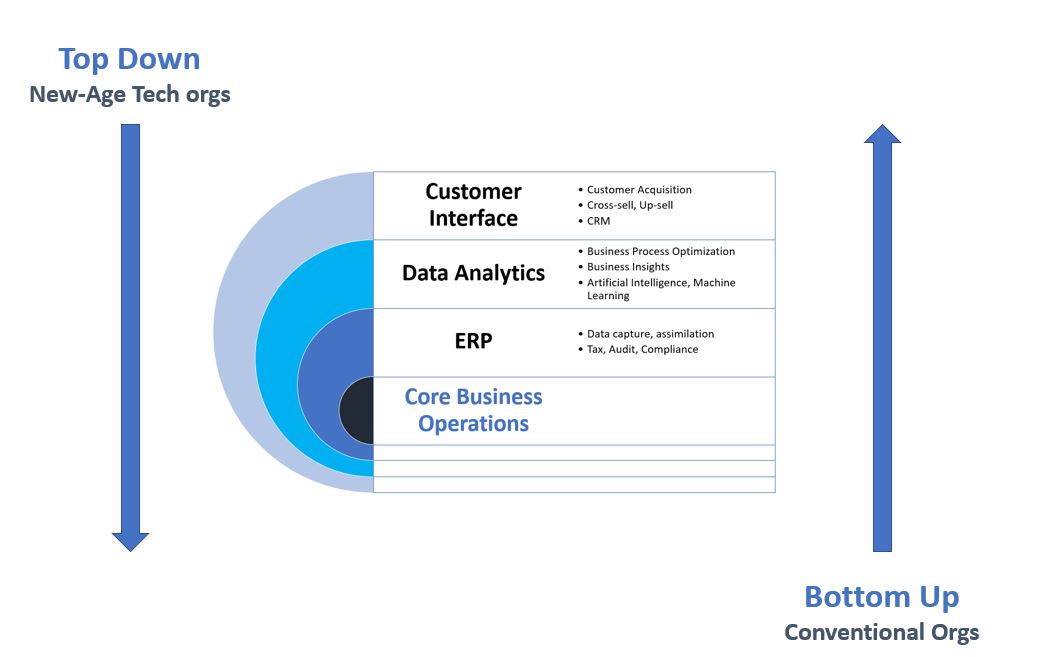

As depicted in the image above, the focus of the organization revolves around serving the core business operations and the customers. The core business could be anything from selling software, insurance solutions, manufacturing and selling FMCG products, to mining operations. For the sake of this discussion, we prefer to call them 'Conventional business'.

ERP: Core data strategy

Next comes the ERP layer, wherein the entire data is captured, and this data set forms the skeleton of the data strategy of the organization. Any additional tech investment case revolves around the core ERP solution. Organizations may choose to implement and utilize analytical software solutions to gain insights from the data acquired through the ERP systems. These insights help organizations:

Customer Interfaces: Organizations may choose to further up the game by investing into customer interface-oriented software solutions by rolling out mobile apps, CRM systems etc. These software solutions are used to:

Traditionally, organization have chosen this path to grow in revenues or geographies by focusing on core-business first and then bring in technology to support the business strategy.

Capital Infusion into technology:

Conventional businesses have to rely on traditional methods of raising capital for investments into technology which are:

On the other hand there is a whole new set of organizations that have chosen to disrupt this approach. These organizations have not only disrupted the path to tech implementation but also have disrupted the business operations of their competition, adjacent market and finally the way customers consume their respective products or services.

Capital Infusion:

Here we talk about the companies, funded by the VC universe, getting access to easier n cheaper capital, bypassing the traditional route of funding.This faster access to capital meant companies not relying on the above marked sources of funds [comparing to Conventional Businesses] to wait for growing the business to meaningful size before investing into technology space. Companies directly go from implementation of customer interface to gather customer and market insights and shape their business strategies.

The companies engaged in this business model range from:

On the surface, the companies appear to be engaged in logistics and aggregation businesses however in reality they are technology driven businesses; aggregating products n services for their customers.

Top-Down Approach:

We choose to call it Top-Down approach. Companies first focus on the CAM [Customer Acquisition Model] to acquire n retain as many potential customers as possible. Gain insights into their spending, social media, and behavior patterns. They may choose to skip few steps in this approach however the ultimate target is to:

All this exercise is done prior to launch of products or services to garner the maximum value out of the business. These insights are utilized to value the business and market opportunity. The market opportunity also addressed as TAM [Target Addressable Market]; is the buzz word in the VC community for valuing the ‘new age tech’ firms. Once, the opportunity is ripe, the products or services are rolled out to the customers acquired through the platforms. Initially, these products or services are usually highly discounted, to increase market adoption.

Conclusion:

The whole contrast in [Conventional vs New-Age business] approaches lies on what to prioritize and focus upon. Conventional businesses have focus on building core business operations first and later invest into technology to maximize the value for the stakeholders.

The new-age tech businesses have reversed this approach by investing heavily in technology first and later build business strategy around the insights gained from the tech investments. Once the stakeholders are convinced on the strategy around the acquired insights, the products or services are launched to the potential customers.

For New-Age tech oriented businesses, the tech investment is their core-business strategy and not a capex requirement.

Both the business models have dire need to raise capital to invest into technology to remain relevant in today's fast changing business cycles. The survival of any business today relies on how fast the business is able to adapt to ever-evolving customer requirements and how fast they react to the competition.

Technology is at the forefront of any business today, whether the business is operating in the mining, high-tech manufacturing, services and consulting domain. Investments in the tech space is something that the organizations have learned to embrace for many reasons, ranging from keeping up with competition and market, customer service, and deriving value to stakeholders. Organizations look for ways to gain market share and optimize business operations through investments in technology. Organizations that have grown organically in their respective business segments or have acquired businesses to remain relevant have both invested heavily in technology as an ‘intangible asset’. However, some organizations took the path of investments in tech space as a launch pad and later utilized the tech investment cases to build the business case around it. Today, we shall look at this space on how these 2 sets of companies utilize tech and derive value out of it.

Technology use-case:

Before that, lets check out what does investment in tech space hold. Usually, organizations invest in tech to:

- Gather customer and operations data.

- Make organization Tax, Audit, Regulatory compliant.

- Derive Information out of gathered historical data.

- Add value to stakeholders by providing insights.

- Service and engage with customers, vendors, and partners.

To address most of the above requirements, organizations implement an ERP system capable of scaling up as the business operations scale along with time, geography, revenues etc. ERP system is a generic word used in this regard to encompass all the systems which serve the purpose. Overall, we can conclude that investment into an efficient and capable ERP system is a need, if not a choice.

However, the point worth noting is whether organizations invest into this tech space before starting business operations or after? Yes, that’s the paradigm shift being noticed as far as the ‘new age tech’ companies are concerned. The investments into any kinds of data gathering and assimilation system is done much before any ‘real’ operations kick start.

Conventional Business:

As depicted in the image above, the focus of the organization revolves around serving the core business operations and the customers. The core business could be anything from selling software, insurance solutions, manufacturing and selling FMCG products, to mining operations. For the sake of this discussion, we prefer to call them 'Conventional business'.

ERP: Core data strategy

Next comes the ERP layer, wherein the entire data is captured, and this data set forms the skeleton of the data strategy of the organization. Any additional tech investment case revolves around the core ERP solution. Organizations may choose to implement and utilize analytical software solutions to gain insights from the data acquired through the ERP systems. These insights help organizations:

- Sharpen focus on business strategies

- Target new market segments

- Target new geographies

- Grow inorganically, either acquire competitors or diversify operations

- Provide insights to stakeholders and investors

Customer Interfaces: Organizations may choose to further up the game by investing into customer interface-oriented software solutions by rolling out mobile apps, CRM systems etc. These software solutions are used to:

- Profile existing customers

- Target new and adjacent customer segments

- Cross-sell and up-sell products or solutions

- Enhance customer engagement and retention

Traditionally, organization have chosen this path to grow in revenues or geographies by focusing on core-business first and then bring in technology to support the business strategy.

Capital Infusion into technology:

Conventional businesses have to rely on traditional methods of raising capital for investments into technology which are:

- Raising capital from Banks, Financial institution e.g., Debt, Bonds, Debentures

- Public funding e.g., Equity

- Gaining capital by internal accruals and process efficiencies e.g., Reserves, Earnings, Cash Flows

New-Age business:

On the other hand there is a whole new set of organizations that have chosen to disrupt this approach. These organizations have not only disrupted the path to tech implementation but also have disrupted the business operations of their competition, adjacent market and finally the way customers consume their respective products or services.

Capital Infusion:

Here we talk about the companies, funded by the VC universe, getting access to easier n cheaper capital, bypassing the traditional route of funding.This faster access to capital meant companies not relying on the above marked sources of funds [comparing to Conventional Businesses] to wait for growing the business to meaningful size before investing into technology space. Companies directly go from implementation of customer interface to gather customer and market insights and shape their business strategies.

The companies engaged in this business model range from:

- Food n grocery delivery startups

- Logistics service providers

- Financial product aggregators

- EdTech Startups

On the surface, the companies appear to be engaged in logistics and aggregation businesses however in reality they are technology driven businesses; aggregating products n services for their customers.

Top-Down Approach:

We choose to call it Top-Down approach. Companies first focus on the CAM [Customer Acquisition Model] to acquire n retain as many potential customers as possible. Gain insights into their spending, social media, and behavior patterns. They may choose to skip few steps in this approach however the ultimate target is to:

- Profile the target and potential customers

- Gain insights into existing product segments

- Build market segment knowledge

- Acquire n retain customers

- Analyze customer behavior and spending patterns

All this exercise is done prior to launch of products or services to garner the maximum value out of the business. These insights are utilized to value the business and market opportunity. The market opportunity also addressed as TAM [Target Addressable Market]; is the buzz word in the VC community for valuing the ‘new age tech’ firms. Once, the opportunity is ripe, the products or services are rolled out to the customers acquired through the platforms. Initially, these products or services are usually highly discounted, to increase market adoption.

Conclusion:

The whole contrast in [Conventional vs New-Age business] approaches lies on what to prioritize and focus upon. Conventional businesses have focus on building core business operations first and later invest into technology to maximize the value for the stakeholders.

The new-age tech businesses have reversed this approach by investing heavily in technology first and later build business strategy around the insights gained from the tech investments. Once the stakeholders are convinced on the strategy around the acquired insights, the products or services are launched to the potential customers.

For New-Age tech oriented businesses, the tech investment is their core-business strategy and not a capex requirement.

Both the business models have dire need to raise capital to invest into technology to remain relevant in today's fast changing business cycles. The survival of any business today relies on how fast the business is able to adapt to ever-evolving customer requirements and how fast they react to the competition.

- SAP Managed Tags:

- RISE with SAP,

- SAP ERP,

- MAN (Manufacturing),

- Industry Cloud

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

27 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

26 -

Expert Insights

114 -

Expert Insights

170 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

242 -

Roadmap and Strategy

1 -

Technology Updates

1,501 -

Technology Updates

90

Related Content

- Unleash the power of Business AI across your Cloud ERP environment! in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Data Migration and Master Data Management Best Practices with SAP BTP in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Overview - Gen AI and Sustainability in Enterprise Resource Planning Blogs by SAP

- SAP Activate methodology Prepare and Explore phases in the context of SAFe. in Enterprise Resource Planning Blogs by SAP

- Working with SAFe Epics in the SAP Activate Discover phase in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 22 | |

| 6 | |

| 6 | |

| 5 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 3 |