- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Quality of Life Updates for the Tax Declaration Re...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

We wanted to let you know about a couple of changes that your G/L accountants may notice within the Tax Declaration Reconciliation app.

And, as with so many things, a picture is worth a thousand words, so I’ll double that up and give you two in sequence:

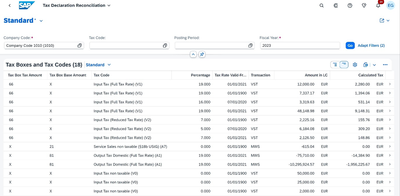

This first screenshot is the previous version of the app. Look at the left-hand side of the results table, where there are discrete columns for Tax Box Tax Amount and for Tax Box Base Amount. In these columns, you’ll generally see a number in one column and an X in the other. These indicate the corresponding tax box number on the reporting form for the respective amount, while the X indicates that there is no value here. So a number in the Tax Box Tax Amount column will correspond to an X in the Tax Box Base Amount column, because the amounts for that reporting box number are for the tax amount, not the base amount. (And some lines have Xs in both columns; these are for non-taxable transactions.)

And now, after the QoL improvement:

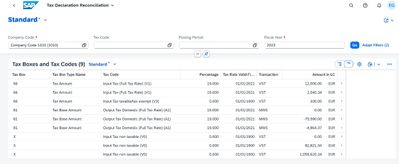

Look at the same area in the table—this time, there’s only one column for the Tax Box, and one for the Tax Box Type Name. So instead of a number an an X, or two Xs, it’s a number and then the information as to whether the amount and box in question deal with the tax amount or with the tax box base amount.

Tip: You can use the Settings button to add columns to your table, such as the Tax Box Structure Type or the Tax Box Structure column, both of which provide additional helpful information about your data as it pertains to your tax reporting preparation.

We’ve also made an additional QoL improvement behind the scenes, adjusting the way the system treats the Tax Group. This change cleans up system behavior when navigating between the document header level and the line items with regard to how the tax groups are read and processed, and prevents some potential inconsistencies in how your data is collected and shown in the app.

One more note: We have an updated version of the product assistance available via SAP Note 3423872 . Have a look at the revised documentation (attached to the Note as a PDF) for additional important information regarding this app.

- SAP Managed Tags:

- SAP S/4HANA Finance,

- FIN Posting and Taxes

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

164 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

237 -

Roadmap and Strategy

1 -

Technology Updates

1,501 -

Technology Updates

89

- Environment, Health and Safety in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 2 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Private Edition | 2023 FPS01 Release – Part 1 in Enterprise Resource Planning Blogs by SAP

- Sustainability with SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

- Product Compliance in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 11 | |

| 7 | |

| 7 | |

| 5 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 |