- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Enable Withholding Tax for Non-Localized Countries...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

former_member46

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

02-06-2023

10:51 AM

Introduction

In the SAP Business ByDesign system, you can configure withholding tax content for purchasing side and for SAP country versions only.

This blog describes how to use the SAP Cloud Applications Studio to enable withholding tax for purchasing side for a non-localized country/region, that is, in a country/region for which SAP has not delivered a country version.

Prerequisites

- To create the tax content, you have installed the latest release of the SAP Cloud Applications Studio.

- The country/region you want to configure is available in the list of tax countries/regions delivered by SAP.

For the list of delivered tax countries/regions, see Tax Basic Countries.

Note: You can only create tax content for the countries/regions included in this list. If a country/region is not listed here, please contact SAP Business ByDesign Globalization team through the Customer Influence and mark the area as ‘Globalization’ in the request.

Limitations

- PDI currently supports only the standard tax procedure for withholding tax. If a special withholding tax procedure is required, it has to be created by partners. For more information please refer to the section 'Configure Tax Calculation Procedure (Optional)' in this blog.

- The creation of a tax declaration profile with both a summary and detailed declaration is not supported.

- Grouping criteria based on partner extension field is not supported for withholding tax.

Steps of Configuration

Configure Withholding Tax Types

Tax types in the tax engine represent the type of tax a particular transaction attracts. Each country/region will have a set of tax types and each tax type will have a set of rate types assigned to it, such as withholding standard rate, withholding reduced rate, and so on.

Tax rates specify the type of tax rates, such as, standard, reduced or zero, and so on. You can create new tax rates by specifying the description and codes as per your requirements. You can create tax types in the SAP Cloud Applications Studio by following the steps below :

- In the Solution Explorer, right-click on your solution name and select Add New Item. Select the Business Configuration node and then select Business Configuration Set. The Business Configuration Set Wizard

- Under Business Configuration Object Type, select Use SAP Business Configuration Object.

- Enter a name and a description.

- Under Business Configuration Object -> Name, select Tax Type from the list.

- Click Next to open a new window.

- Select the Tax Type node and enter the values as below:

- CountryCode: Specify the country code for which you need to configure the tax type.

Note: The country you want to configure must be available in the tax country table already delivered by SAP. For the list of delivered tax countries, see Tax Basic Countries.

Before specifying the country code, please see the 'Prerequisites' section mentioned above.

- Code/Content: Specify a new tax type code according to your requirements.

- TaxCategoryCode: Specify the category of tax, which is withholding tax in this case.

- Name/Content: Enter a description for the newly created tax type code.

- Select the Tax Rate Type node and enter the values as below:

- CountryCode: Enter the country/region code as outlined above.

- TaxTypeCode/Content: Choose the tax type code created in the above node

- Code/Content: Specify a new tax rate type code according to your requirements.

- Standard: Select the checkbox to specify that the tax rate type is Standard.

- Name/Content: Enter a description for the newly created tax rate type.

- Verify the values in the Review your Business Configuration Set If you want to make any changes, click Back to proceed with the task. If all the values are correct, save the content by clicking Finish.

9. To activate the BC set, right-click on it in the Solution Explorer view. After activation, this content will be available for you to configure other steps.

Configure Tax Calculation Procedure (Optional)

Note: Please check whether the tax procedures delivered by SAP meet your requirements.

Tax calculation procedure is an element of tax calculation which defines how the tax calculation occurs. You can use one of the tax calculation procedures delivered by SAP or define a new one and implement the same via ABSL scripts.

You can do the following via the tax calculation procedure:

- Influence the tax base amount (to achieve Tax on Tax scenarios).

- Influence the sequence of which tax type is calculated first.

You can create a new tax calculation procedure in the studio by following the steps below:

- Under Business Configuration Object-> Name, select TaxCalculationProcedure

- Click Next to continue.

- Select the Tax Procedure Node and enter the values as mentioned below:

- Tax Calculation Procedure: Specify the new tax calculation procedure based on your requirement.

Preferably start with the prefix ‘Y’ or ‘Z’.

- Standard Tax Calculation Procedure: Indicates whether this calculation procedure is a standard procedure or not. Do not mark this.

- Description: Enter a description explaining your tax calculation procedure.

- Select the Tax Procedure Country Assignment node, and enter the details as below:

- Tax Calculation Procedure: Enter the defined tax calculation procedure.

- Country: Enter the country/region for which this tax calculation procedure is to be assigned.

Now that the creation of the tax calculation procedure is done, the next step is to define this tax calculation procedure.

- Add a new Enhancement Implementation.

- Under the Filter tab enter the following details:

- Filter for Country: Enter the country/region you which you created the tax calculation procedure.

- Filter for Tax Calculation Procedure: Enter the tax calculation procedure created in the previous step.

- Under the ABSL section you can now influence the tax base amount and the tax percent.

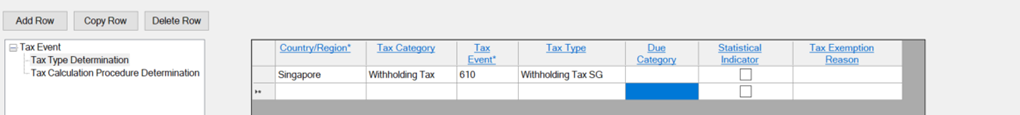

Configure Withholding Tax Events

Tax Event is a central element in tax calculation that represents the particular tax scenario. Tax event is the first level of determination in the tax process, for example, domestic purchase.

Tax events represent certain use cases from a tax point of view. Each country/region has a list of tax events for product tax and a separate list of tax events for withholding tax.

- Follow steps 1 and 2 of section 'Configure Withholding Tax Types' above, then continue with the below steps.

- Under Business Configuration Object -> Name, select TaxEventType from the list.

- Click Next to open a new window.

- Select the Tax Event node and enter the values as follows:

- Country/Region: Specify the country/region for which you need to configure the tax event.

Note: The country/region you want to configure must be available in the tax country table already delivered by SAP. For the list of delivered tax countries/regions, see Tax Basic Countries.

Before specifying the country/region code, please see the 'Prerequisites' section mentioned above.

- Tax Category: Specify the category of tax, which should be withholding tax in this case.

- Tax Event: Specify a new tax event code according to your requirements.

- Valid From: Specify the tax event validity start date. If you do not know the exact date on which the tax code became valid, it is sufficient to specify a date that is earlier than the tax date of business transactions that will be processed in your system.

- Valid To: Specify the date on which the validity of the tax event ends. In case the tax event does not have a defined end of validity, enter 31.12.9999.

- Non-Taxable Event: If the event is valid for non-taxable scenarios, select the checkbox.

- Tax Event Direction: Select Incoming because withholding tax can only be implemented for purchases.

- Description: Enter a description explaining the tax event.

- Select the Tax Type Determination node and enter the values as below:

- Enter the Country/Region, Tax Category, and Tax Event as specified above.

- Tax Type: Specify the tax type created in the section 'Configure WithholdingTax Types' mentioned above.

- Do not specify any value for the other fields, that is, leave the other fields blank.

- Select the Tax Calculation Procedure Determination node and enter the values as below:

- Enter the Country/Region, Tax Category, and Tax Event as specified above.

- Valid From: Specify the date on which the validity of the assignment of the tax procedure to the tax event starts. If you do not know the exact date, it is sufficient to specify a date that is earlier than the tax date of the business transactions that will be processed in your system.

- Tax Calculation Procedure: Select Withholding Tax (Standard) or the tax procedure that you have created. For more information please refer to the section 'Configure Tax Calculation Procedure (Optional)' mentioned above.

7. To activate the new BC set, follow steps 7 and 8 in the section 'Configure Withholding Tax Types' mentioned above.

Configure Income Types

- In the Solution Explorer, follow the steps as specified above to navigate to Business Configuration Object -> Name. Select Withholding TaxIncomeType from the list.

- Click Next to open a new window.

- Open the Tax Type node and enter the values as below:

- Country/Region: Specify the country/region for which you need to configure the income type.

Note: The country/region you want to configure must be available in the tax country table already delivered by SAP. For the list of delivered tax countries/regions, see Tax Basic Countries.

Before specifying the country/region code, please see the 'Prerequisites' section in this blog mentioned above.

- TaxType: Select the tax type from the dropdown list.

- Withholding Tax Income Type: Specify the withholding tax income type according to your requirements.

Configure Withholding Tax Codes

A tax code is the unique combination of tax event, tax type, and rate type code for a particular country/region.

You can configure tax codes in the SAP Cloud Applications Studio following the steps below:

- In the Solution Explorer, follow the steps as above to navigate to Business Configuration Object -> Name, and select Withholding Taxation Characteristics from the list.

- Click Next to open a new window.

- Select the Withholding Taxation Characteristics_cn node and enter the values as below:

- Country/Region: Select the country/region for which you need to configure tax code.

Note: The country/region you want to configure must be available in the tax country table already delivered by SAP. For the list of delivered tax countries/regions, see Tax Basic Countries.

Before specifying the country/region code, please see the 'Prerequisites' section in this blog above.

- Withholding Taxation Characteristics: Specify the new tax code according to your requirements.

- Withholding Tax Event: Specify a tax event type code, accordingly to your requirements, for example, one which you already created in the section 'Configure Withholding Tax Events' mentioned above in this blog.

- Valid From: Specify the tax code validity start date. If you do not know the exact date on which the tax code became valid, it is sufficient to specify a date that is earlier than the tax date of the business transactions that will be processed in your system.

- Valid To: Specify the tax code validity end date. In case the tax code does not have a defined end of validity, enter 31.12.9999.

- Description: Enter a description for the new tax code.

- Select the Assignment node and enter the values as below:

- The Country/Region and Withholding Taxation Characteristics is populated automatically from step 4.

- Select the required Tax Type, Tax Rate Type, and Withholding Tax Income Type from the dropdown lists.

- To activate the new BC set, right-click on it in the Solution Explorer After activation, this content will be available for you to configure other steps.

Note: The withholding tax code is a unique combination of its attributes. Though it is technically possible, it is not recommended to create tax codes with different tax IDs and with same attributes, as this will cause an error when you book/pay the documents.

Create Withholding Tax Configuration

- In the Solution Explorer, follow the steps as above to navigate to Business Configuration Object -> Name, and select WithholdingTaxConfiguration from the list.

- Click Next to open a new window.

- Specify the values for each field as below:

- Country/Region: Specify the country/region code for which you need to configure withholding tax.

Note: The country/region you want to configure must be available in the tax country table already delivered by SAP. For the list of delivered tax countries/regions, see Tax Basic Countries.

Before specifying the country/region, please see the 'Prerequisites' section in the blog above.

- TaxTypeCode/content: Select the tax type from the dropdown list.

- WhtBaseDet: Specify the determination type, such as Net or Gross, which is used during the withholding tax calculation to calculate the withholding tax base amount.

- WhtRateDet: From the dropdown list, select one of the values as below:

- Supplier and entire line item base amount: Select this value if you want the withholding tax rate to be determined by a tax rate type.

- Income type and entire line item base amount: Select this value if you want the withholding tax rate to be determined by an income type.

- Income type and percentage line item base amount: Select this value if you want the withholding tax rate to be determined by an income type and reduced withholding tax base amount. In case you need to select this value, you have to create your own calculation procedure following the steps outlined in the section 'Configure Tax Calculation Procedure (Optional)' in the blog above. As the SAP delivered standard calculation procedure doesn’t support this value/combination.

- Supplier w. time dependency and entire line item base amount: Select this value if you want the withholding tax rate to be determined by a tax rate type which has a time dependency in the supplier master data. This value is currently not supported for partner implementation.

- WhtDueDet: Specify when the withholding tax amount has to be posted to accounting. There are two possibilities: choose either “WHT due at invoice and not relevant for down payment” or “WHT due at payment and relevant for down payment”, depending on the country/region specific requirements.

- WhtThreshold: Leave this field as blank (not currently supported).

- DiscRedWHTBaseAtPay: Select this checkbox if you want to reduce the withholding tax base amount by discounts such as cash discount, payment terms, or other discounts specified during the payment of an invoice. This checkbox is relevant only in case the due determination is “WHT due at payment and relevant for down payment”.

- WhtIncome TypeAtBP: Select this checkbox if you want to enable the Income Type field in the supplier master data. In the Supplier master data, this field is available under View All -> Financial Data-> Tax Data -> Withholding Tax Classifications.

- WhtExemptionReasonAtBP: Select this checkbox if you want to enable the Tax Exemption Reason field in the Supplier work center in the SAP Business ByDesign system. In the Supplier work center, this field is available under Financial Data-> Tax Data -> Withholding Tax Classifications. Currently, this field is applicable only for India (IN) and the United States (US).

Configure Withholding Tax Rates

You can create withholding tax rates in the studio following the steps below:

Depending on the withholding rate determination specified in the above section 'Create Withholding Tax Configuration', create the tax rate BC set as described below:

- In the Solution Explorer, follow the steps as above and navigate to Business Configuration Object -> Name. Select the relevant object from the list as outlined below:

WithholdingTaxTypeRateAssignment - If the withholding tax rate determination WhtRateDet from the above section is specified as Supplier and entire line base amount or Supplier w. time dependency and entire line item base amount. OR

WithholdingTaxRateIncomeTypeAssignment: If the withholding tax rate determination WhtRateDet from the above section is specified as Income type and entire line item base amount.

OR

WithholdingTaxBasePercentageAndRateIncomeTypeAssignment: If the withholding tax rate determination WhtRateDet from the above section is specified as Income type and percentage line item base amount.

- Click Next to open a new window.

- Specify the values for the relevant fields as below. Depending on what you have chosen in Step 1, not all the fields described below are available to be filled:

- Country/Region: Specify the country/region code for which you need to configure the tax type.

Note: The country/region you want to configure must be available in the tax country table already delivered by SAP. For the list of delivered tax countries/regions, see Tax Basic Countries.

Before specifying the country/region code, please see the 'Prerequisites' section of this blog.

- TaxType: Specify a tax type according to your requirements.

- Withholding Tax Income Type: Select the income type from the dropdown list.

- Withholding Tax Base Percentage: Specify the value for the calculation of the withholding tax base amount according to your requirements.

- Tax Rate Type: Specify if the tax rate type applied should be standard, reduced, zero, or special.

- Validity Start Date: Specify the validity start date.

Tax Calculation Tax Rate Withholding Tax Rate: Specify the withholding tax rate percentage for calculation according to requirements.

Configure Tax Declaration Type

The tax declaration type code defines a unique type of tax return prevalent in a particular country. For each tax return in a country, a distinct tax return type code should be created using this configuration.

This tax return type code is further used in other different tax-related configurations that define the various configurations of a tax return.

- In the Solution Explorer, right-click on your solution name and select Add New Item.

- Right-click the Business Configuration node and select Create Business Configuration Set. The Business Configuration Set Wizard opens.

- Under Business Configuration Object Type, select Use SAP Business Configuration Object.

- Enter a name and description.

- Under Business Configuration Object -> Name, select Tax Declaration Type from the list.

- Click Next to continue.

- Enter the values in the node as described below.

- Code/Content: Specify a new tax declaration type code according to your requirements.

- Country Code: Specify the country/region code for which you need to configure the tax declaration type.

Note: The country/region you want to configure must be available in the tax country table already delivered by SAP. For the list of delivered tax countries/regions, see Tax Basic Countries.

Before specifying the country/region code, please see Prerequisites.

- Name/Content: Enter a description for the newly created tax declaration type code.

- If all the values are correct, click Finish to save the content.

9. Right-click on the BC set that you created in the Solution Explorer view and select Activate to activate it. After activation, you will be able to use this content to configure other steps.

Configure Tax Declaration Profile

For each tax declaration type and country/region combination, a tax declaration profile specifies the reporting combinations of tax types and tax events or income types. Furthermore, it specifies the format and the business context of a tax declaration type.

The Tax Declaration Profile is used both for withholding taxes and product taxes.

- In the Solution Explorer, right-click on your solution name and select Add New Item. Select the Business Configuration node and select Create Business Configuration Set. The Business Configuration Set Wizard

- Under Business Configuration Object Type, select Use SAP Business Configuration Object.

- Enter a name and description.

- Under Business Configuration Object -> Name, select Tax Declaration Profile from the list.

- Click Next to open a new window.

- Enter the values in the Tax Return Types node as described below.

- Tax Return Type: Select one of the previously created tax declaration type(s).

- Country/Region: Specify the country/region code for which you need to configure the tax declaration profile.

Note: The country/region you want to configure must be available in the tax country table already delivered by SAP. For the list of delivered tax countries/regions, see Tax Basic Countries.

Before specifying the country/region code, please see the 'Prerequisites' section in this blog above.

- Name/Content: Enter a description for the newly created tax declaration type code.

- Restricting Tax Return Type: Enter the Tax Return Type that should report specific items before they are reported by this tax declaration profile. This is usually used if specific transactions need to be reported on a monthly basis and then in total for a yearly return.

- Deferred Tax: For withholding taxes, no entry is necessary.

- Reporting Tax Corrections: Specifies whether all or only changed/corrected items are reported in a tax correction run.

- Level of Detail:

- Summary: Used for declarations that aggregate transactions to box numbers.

This configuration is not supported for partner implementation.

- Subtotal: Aggregates transaction depending on specific/field values.

- Detailed: Do not use.

- Object Type Code: Specifies whether withholding taxes or product taxes shall be reported. For withholding taxes, enter ‘134’.

- Nil Return: Indicates whether the creation of a tax declaration is required, even if there are no tax items in the reporting period (nil return).

Do not use the following indicators:

- State Relevant: Indicates whether this type of return can be created per state, for example, withholding taxes relevant in two different states need to be reported separately in the system.

- Jurisdiction Relevant: Indicates whether this type of return can be created per jurisdiction, for example, withholding taxes relevant in two different cities need to be reported separately in the system.

- Tax Reporting Unit Relevant: Indicates whether tax reporting units can be configured in the system and then assigned to one company tax arrangement.

- Payment Required: Set this indicator if the tax return is payment relevant. If the Payment Required indicator is set, open the Payment Attributes node and enter the values as below:

o Tax Return: Specify the tax return type created above

o Country/Region: Specify the country/region as above.

- Configuration of Tax Event node and the Summary Layout sub node is not required for withholding tax.

- If you have selected this or one of your tax declaration(s) as a Subtotal, select the Group Criteria for Sub Totaling node and enter the following data:

- Country/Region: Enter the country/region you entered on the Tax Return Types

- Tax Return Type: Enter the corresponding value of the type you specified on the Tax Return Types

- Grouping Section: The grouping section allows you to define several sections for a tax return. This is required if the tax-relevant data must be declared in several views, for example, first view - listed by tax type independent of company and second view - listed by company. The grouping section field accepts any numerical value greater than or equal to 1. Users can define as many sections as they wish. These sections differ in grouping criteria. Each section has its own individual line in the grouping criteria node.

Hence, if you have two sections defined, then there will be two lines in that node - 1 for the first section and another for the second section.

- Grouping Level: The grouping level allows you to create a hierarchy within a grouping section. This field accepts any numerical value greater than or equal to 1. Within a section, grouping levels can differ. Therefore, you may have 2 grouping levels or criteria sets for the same section.

- Group1-Group5: The values entered here define the attributes that will be used during the creation of the tax declaration to aggregate all withholding tax transactions, for example, if you define the Customer/Supplier as a group, all withholding tax transactions will be aggregated and reported per supplier.

- Summary Required: Setting this field allows you to assign the aggregated results to box numbers.

- Section Usage: Controls whether or not a section is included in a tax declaration.

- Regular Tax Items Relevance: Ensure this indicator is selected.

- Configuration of Tax Type node is not required for withholding tax.

- Select the Income Type node and enter the values as described below:

- Country/Region: Enter the country/region you entered on the Tax Return Types

- Tax Return Type: Enter the corresponding value of the type you specified on the Tax Return Types

- Tax Type: Enter all the previously created tax types that should be reported by the tax declaration that is being configured.

- Income Type: Enter all the previously created income types that should be reported by the tax declaration that is being configured.

- Summary tax declaration is not supported for withholding tax in PDI. Therefore, the Summary Layout sub node under the Income Type node is not relevant.

- If all the values are correct and you want to save the content, click Finish.

13. Right-click on the BC set that you created in the Solution Explorer view and select Activate to activate it. After activation, you can use this content to configure other steps.

Implement BAdI for Check Master Data during tax return creation

Note: Implement Check Master Data BAdI only if there are any country/region specific checks required for master data while creating Tax Return. It is not mandatory.

You must implement the CheckMasterData BAdI to check on the master data and raise message if some master data is missing. The system implements this BAdI, during the creation of the tax return.

Follow the steps below to create the implementation:

- In the solution explorer, right-click the solution name and select Add New Item. Select Enhancement Implementation and click on Add.

- In the next screen, enter the namespace and BAdI name as given below.

- This BAdI has 2 filter parameters – Country Code and Tax Declaration Type Code. Specify these filter parameters as shown below.

- The importing parameter of the operation Check_Master_Data of this enhancement method has three parts, which are defined below:

- CompanyTaxArrangment:

| CompanyID | ID of the company |

| CompanyUUID | UUID for company |

| SystemAdministrativeData | |

| TaxAuthorityCountryCode | Country/Region of the Tax Authority |

| TaxAuthorityInternalID | ID of the Tax Authority |

| TaxAuthorityJurisdictionCode | Jurisdiction code of the Tax Authority |

| TaxAuthorityRegionCode | Region code of the Tax Authority |

| TaxAuthorityUUID | UUID of the Tax Authority |

| TaxWithholdingRequiredIndicator | Indicator to set if the company can withhold taxes |

| ValidityPeriod | The period between which the company tax arrangement will be valid |

- TaxReturnArrangement:

| CarryForwardRequiredIndicator | Is set if carry forward is allowed |

| ElectronicSubmissionRequiredIndicator | Is set if the file is available for tax return |

| ID | Tax Return Arrangement ID |

| IsInitial | (NA) |

| PaymentCalendarDayRecurrence | Provides the details on frequency of payment, period of payment like month or week day selection. |

| PrintFormRequiredIndicator | Is set if the print form is available for tax return |

| ResponsibleBusinessPartnerUUID | UUID of the person responsible maintained at company tax arrangement level |

| SupportingDocumentsSeparatelySubmittedIndicator | Set if the documents to be submitted separately from the tax return |

| SystemAdministrativeData | Provides the details on creation date and time as well as last changed date and time (NA) |

| TaxAdvisorID | ID of the Tax Advisor maintained at company tax arrangement |

| TaxAdvisorUUID | UUID of the Tax Advisor |

| TaxDeclarationCalendarDayRecurrence | Tax reporting recurrence details like yearly /monthly reporting date /month etc. |

| TaxDeclarationTypeCode | Tax return type code |

| TaxPaymentRequiredIndicator | Is set if the tax return is payment relevant |

| TaxRefundAmountTolerance | Tax refund amount /currency details |

| ThresholdAmount | Threshold amount for reporting tax return |

| ThresholdRelevanceIndicator | Is checked then threshold amount must not be blank. |

| UUID | UUID for Tax Return Arrangement |

| ValidityPeriod | Validity period of the tax return arrangement |

- CorrectionDeclarationIndicator: Is set if the return created is correction relevant

- ProductTaxRelevantIndicator: Is set if the return is product tax relevant

- VATGroupIndicator: Is set if the companies belong to the same VAT group

- EndDate: End date of the tax return run which created this tax return

- StartDate: Start date of the tax return run which created this tax return

- WithholdingTaxRelevantIndicator: Is set if the return is withholding-tax relevant

- Save and activate the solution.

You can now create withholding tax return arrangements for the non-localized countries/regions in the SAP Business ByDesign System.

For more information, see:

Configure Account Determination

Create a new partner BC set for SAP BCO Account Determination Withholding Tax Countries. Since most postings in the system are done automatically, the required accounts need to be determined according to predefined rules.

Automatic account determination must be set up for each chart of accounts. To do this, follow the steps below:

- Create a New Usage Type

- Create Field Names

Create a New Usage Type

- In the Solution Explorer, follow the steps as above and navigate to Business Configuration Object -> Name. Select AccountDeterminationWitholdingTaxCountries from the list.

- Select Next to open a new window.

- Select the Account Determination Withholding Tax Countries node, and specify the values for each field as below:

- CountryUsageType: Enter a numerical value of your choice.

- CountryUsageCategory: Select Withholding Tax.

- Name/Content: Enter a description for the new country usage type.

- Select the Country Usage Type Assignment node and enter the country usage type you have defined above. Under CountryCode, assign the country/region for which you need to configure withholding tax account determination. For example, Tunisia, as shown in the example below.

5. Activate the new BC set.

Create Field Names

Create a new partner BC Set for SAP BCO Account Determination User Interface Control. When you create the fields in the studio, a corresponding field will be available for your use in the SAP Business ByDesign System.

- In the Solution Explorer, follow the steps as above and navigate to Business Configuration Object -> Name, and select AccountDeterminationUserInterfaceControl from the list.

- Select Next to open a new window.

- Select the node Account Determination User Interface Control Root. Under Country Usage Type, choose the value that you have defined in the section 'Create a New Usage Type' in this blog above.

- Select node Account Determination User Interface Control Field Country Assignment and enter the values as described below:

- CountryUsageType: Choose the value that you have defined in the section 'Create a New Usage Type' in this blog above.

- AccountDeterminationFieldNameType: For withholding tax, you have to assign any of the following Account Determination Field Name Types for withholding tax account determination.

- Withholding Tax: This account is used for all operational postings with withholding tax. This can be payments and clearings, if withholding tax is posted at payment time. It can also be invoices, if withholding tax is posted at invoice time.

- Grossing Up: Withholding Tax: This account is used, if the grossing up withholding tax posting procedure is used.

- Tax Payables: Withholding Tax: This account is used for posting the withholding tax declaration.

- Pre-Payments: Withholding Tax: This account is used for posting the withholding tax pre-payment transaction.

- Exchange Rate Differences: Withholding Tax: The withholding tax exchange rate difference account is posted in instances where documents are posted in a foreign currency.

- Tab Withholding Tax: This field type activates the tab Withholding Tax in tax account determination in the SAP Business ByDesign system.

- CountryCode: Each Account Determination Field Name Type must be assigned to the account determination profile country for which withholding tax will be activated. In the following example, this is Tunisia.

- Activate the new BC Set.

Deploy the Solution to the SAP Business ByDesign System

To use the content in the SAP Business ByDesign system, go to the Solution Explorer and right-click your solution, then select Deploy Business Configuration.

Create a Tax Decision Tree

In order to determine the withholding taxes automatically, you need to create a tax decision tree.

For more information, see:

Note: You need to perform again the step 'Deploy the Solution to the SAP Business ByDesign System' mentioned above in this blog, if you want to deploy the Tax Decision Tree and to test the tax determination in the SAP Business System.

Assign the Withholding Tax Country in the SAP Business ByDesign System

- In the SAP Business ByDesign System, go to the Business Configuration work center and navigate to the Charts of Accounts, Financial Reporting Structures fine tuning activity.

- Open the activity and select Account Determination->Tax.

- Assign the withholding tax country/region to the account determination profile. You can reuse an existing account determination profile or create a new account determination profile especially for the country enabled for withholding tax.

4. Click OK. The Withholding Tax tab appears. Maintain the withholding tax accounts under the tabs: Withholding Tax, Differences, and Tax Payments

Enable Withholding Tax Calculation in the SAP Business ByDesign System

- In the SAP Business ByDesign system, navigate to Tax Management>Tax Authorities> Company Tax Arrangement.

- To enable withholding tax calculation for your company, select the Withholding Tax Required checkbox.

Note: The withholding tax calculation can only be triggered if the country/region of the company and the tax country/region of the line item in the supplier invoice are the same.

3. To enable the withholding calculation in supplier invoices, the supplier should be classified for withholding tax. To do so, navigate to the Supplier Master Data -> Financial Data->Tax Data, and maintain the withholding tax classification.

Summary

When you deploy this add-on, the system will enable tax calculation for withholding tax for purchasing side for non-localized countries/regions.

- SAP Managed Tags:

- SAP Business ByDesign Localization,

- SAP Business ByDesign,

- SAP Cloud Applications Studio

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

29 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

28 -

Expert Insights

114 -

Expert Insights

187 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

414 -

Life at SAP

2 -

Product Updates

4,679 -

Product Updates

270 -

Roadmap and Strategy

1 -

Technology Updates

1,499 -

Technology Updates

99

Top kudoed authors

| User | Count |

|---|---|

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 |