- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Electronic submission of the UK VAT Return using S...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-14-2023

12:19 PM

In this blog post, I would like to provide a step by step guide on how to configure and integrate the Document and Reporting Compliance (DRC) service with S/4HANA Cloud in order to electronically submit the VAT Return to the tax authorities. This blog will specifically cover the setup and configuration of the VAT return for the United Kingdom – a list of some other statutory reports and countries supported by DRC can be found here.

Let’s now look at the concrete steps involved in configuring the end-to-end process flow for this use-case.

Hopefully, this blog post gave you a detailed walkthrough of the steps needed to setup and configure the automatic electronic submission of the UK VAT Return. With this one-time setup, the users can benefit from a seamless integration between S/4HANA Cloud and the DRC service through which the reports are securely and instantly submitted to the HMRC authorities.

Please note that the SAP Document and Reporting Compliance service with SAP Document and Reporting Compliance, cloud edition in the near future. For more information about the new version of the service, please refer to the official roadmap and this SAP note.

*Thanks to Christin Hoepfner, Erika Buson and Sam Karbani for their support during the course of the implementation of this integration scenario*

On a high-level, this is what the end-to-end architecture of the data flow looks like. The value of the integration between S/4HANA Cloud and DRC lies in the fact that one simply needs to setup the various steps shown below one time initially – once this is done, a single click to submit the report from S/4HC triggers the entire flow so that that the government authorities HMRC automatically receive the VAT return.

High-level process architecture

Let’s now look at the concrete steps involved in configuring the end-to-end process flow for this use-case.

- Step 1: (S/4HC functional setup): In the first step, the functional finance consultant would need go through the necessary customizing activities in S/4HC – you can find the necessary steps here

- Step 2: (S/4HC communication management setup): In the next step, you will need to setup the communication management needed to trigger the outbound service that will send the VAT return from S/4HC to the DRC service.

- The steps to be carried out can be found here

- *Depending on what is setup in the customer’s BTP subaccount, you can use a simple user and password, or OAuth 2.0 as an outbound user for authentication. To see how to create outbound users in the BTP subaccount, refer here

- Step 3: (DRC gateway setup). The final step involves configuring the report communication on the DRC side.

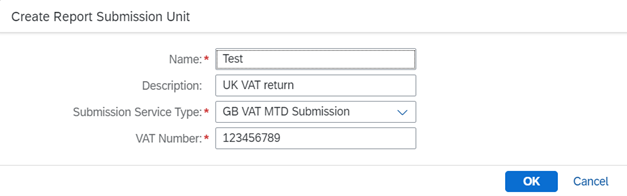

- Within DRC, open the Fiori app “Configure Report Communication”.

- There maintain the details of the submission unit for the UK VAT return. Make sure to choose “GB VAT MTD Submission” as the service type.

- After creating the submission unit, click on the link Grant Authority link, upon which you will be forwarded to the HMRC portal and prompted to authenticate yourself.

- Here, you will have to provide your productive HMRC login credentials (user and password), so make sure you have the credentials of the customer available. While granting authority for the DRC productive tenant, you will additionally have a two-factor authentication step, where the user who is registered with HMRC will have to confirm a code.

- *Keep in mind, that this grant has to be renewed every 18 months.

- Once you have successfully authenticated yourself in the HMRC portal, the event status of the submission unit will be updated to “Completed” and you will see the following popup.

- After creating the submission unit, click on the link Grant Authority link, upon which you will be forwarded to the HMRC portal and prompted to authenticate yourself.

- Step 4: (Submission of the Report) With that final step, the entire gateway from start to finish has been setup. You can now test the data flow by using the app “Run Statutory Reports” in S/4HANA Cloud. Search for the report name “GB_VAT_DCL” and filter for the correct reporting year. Navigate into the item and under activities, drill down further into “GB VAT Return Statement”. Click on New Run to generate a new report, and subsequently click on Submit. With this step, the VAT return will be submitted to HMRC. If the submission is not successfully submitted, you can view the error message in the "Report Communication Logs" app in the DRC service.

Hopefully, this blog post gave you a detailed walkthrough of the steps needed to setup and configure the automatic electronic submission of the UK VAT Return. With this one-time setup, the users can benefit from a seamless integration between S/4HANA Cloud and the DRC service through which the reports are securely and instantly submitted to the HMRC authorities.

Please note that the SAP Document and Reporting Compliance service with SAP Document and Reporting Compliance, cloud edition in the near future. For more information about the new version of the service, please refer to the official roadmap and this SAP note.

*Thanks to Christin Hoepfner, Erika Buson and Sam Karbani for their support during the course of the implementation of this integration scenario*

Labels:

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

164 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

236 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- New Reporting Activities for Withholding Tax Declarations in SAP Document and Reporting Compliance in Enterprise Resource Planning Blogs by SAP

- SAP Document and Reporting Compliance Brazil: Dashboard do Usage Analytics in Enterprise Resource Planning Blogs by SAP

- Learn about Localization with SAP’s Experts at the DSAG-SAP Globalization Symposium 2024 in Enterprise Resource Planning Blogs by SAP

- SAP Document and Reporting Compliance Brazil: Atualizações no CT-e MDF-e in Enterprise Resource Planning Blogs by SAP

- NF-e Nota Técnica 2019.001 v1.62 novos campos adicionados à nota fiscal in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 7 | |

| 5 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 3 |