- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- New Assets accounting SAP S/4 HANA 1809 – with New...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

saikat_sen2

Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-19-2019

8:49 AM

Hi All ,

I am going to describe / explain about the New Assets Accounting features, along with almost all the configuration steps with screen shots & changes that has come into SAP S/4 HAHA 1809 versions. And some transaction also that I have posted & related screen shots are also given below.

Please keep that in mind that if you are having more than ONE Depreciation are, you have to have assign your Accounting Principle into all your Depreciation areas.

One more thing is that in SAP S/4 HANA if you have more that one ledger ( Standard-means leading + Non- Standard ledger -means non leading ledger but not extension ledger ) then you also have to create more then one depreciation area and you have to assign Accounting Principle to both the areas.

For now on in New Assets Accounting New G/L Functionality should be ACTIVE although it is no necessary that the Client will or should use New G/L Functionality afterwards.

In New Assets Accounting you can use either Ledger Base / Account Base approach, both the Functionality are not going to use simultaneously.

Let's begin:-

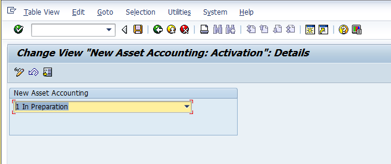

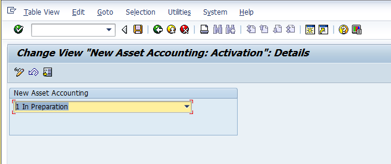

Activate Asset Accounting (New):-

& press F6 and choose 0DE--Sample chart of depreciation: Germany - & give any naming convention.

Please note that this COD is Country specific so if you are going to implement for Australia Country – copy that COD as a sample.

2. Specify Description of Chart of Depreciation:

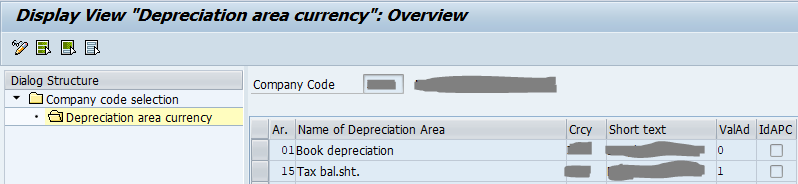

3. Copy/Delete Depreciation Areas: Here in my case there is 2 dep area – 01 and 15 for Income tax where Group assets concept is applicable and it is applicable only for Dep area 15.

Put your Charts of Depreciation in this Blank space.

4.Assign Chart of Depreciation to Company Code:

5. Specify Number Assignment Across Company Codes ( optional ) –this is applicable for Cross company code if you have that then you need to define this step like this as per below screen shot:-

6.Assets class

Create Assets class as per your company requirement

a. Specify Account Determination

b.Create Screen Layout Rules:-

c. Define Number Range Interval:-

Put your company code & click on Change interval

d.Define Asset Classes

& 2-click on class & see below:-

& 2-click on class & see below:-

7. Now go to below path:

Define How Depreciation Areas Post to General Ledger:-

Now click on each and every dep area & see the configuration – it is mandatory that for your company code also same setting will be applicable but mostly same.

8.Assign G/L Accounts: ( AO90):

Now select COA and click on Account Determination on the left side. See below:-

& select the respective Account determination and click on the Balance sheet accounts on the left side:-

Here - Bal.Sh.Acct APC account always be an Asset reconciliation account with short key 018 and G007 should be your Field status variant.

Contra Account is also a B/sheet account not a reconciliation account.

Under retirement account assignment:-

Loss Made on Asset Retirement w/o Reven , Clearing Acct. Revenue from Asset Sale , Gain from Asset Sale , Loss from Asset Sale , Clear. revenue sale to affil. company - All these accounts are expenses / income kind of GL accounts .

Revaluation Acquis. And Production Costs: - is a B/sheet account and recon account also under “A” and short key 018 and G007 is your field status variant.

Offsetting Account: Revaluation APC is a B/sheet account but not a reconciliation account.

Now come to Depreciation:-

Acc.dep. accnt.for ordinary depreciation: this GL account B/sheet account under accumulated dep + recon account under “A” short key 018 and FSV-G007 and expenses account of Ordinary dep is a expenses account Cost element category 01 and click on post automatically only.

Revenue from write-up on ord.deprec – Under this the same Expenses GL account will come because this GL account is the reverse gl account of dep – at the time Assets sale. Suppose you acquire an asset and run the dep for the period like-01, 02, etc and in the period 03 suddenly you have to sale the assets – now the changed depreciation on period 03 is being reverse due to sale. I will show you screen by screen in below last.

Why we use Contra account of Acquisition value:

Here you can find any Vendor reconciliation account – where as if you post any document F-90 with any vendor the accounting entry is like below:-

Look the difference above ⇑

Now if you pass any Credit memo by ABGL – then also that Contra account will impact- see below.

So here if you notice the I reduce the value of Credit memo from AB01 Tcode where I have re-acquire the asset with the value of Rs: 400000

Note: You can’t post higher value in Credit memo either it is same amount or lesser than the Acquisition value from the Tcode- AB01.

Now see the effect of AW01N:

Here you notice:-

A.30.03.2019- 1st acquisition was held.

B. At that time you notice APC value was 1500/-.

C.Now acquisition value is 51500/- and ordinary dep has also increased- see below screen shot.

D. 01.04.2019- New Acquisition value is Rs: 400000/-

E. Credit memo has raised of Rs: 350000/- this difference value is added with prior APC value.

Now run depreciation & see the effect. SAP has provided new Tcode of Depreciation :AFABN:

In case of Dep reversal then please assign the GL account in Revenue from write-up on ord.deprecthe same Gl account which you have assign in Expense account for ordinary depreciat.

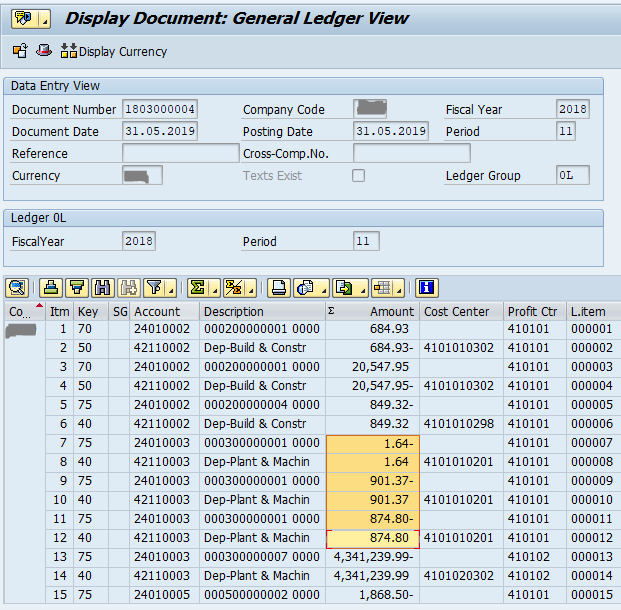

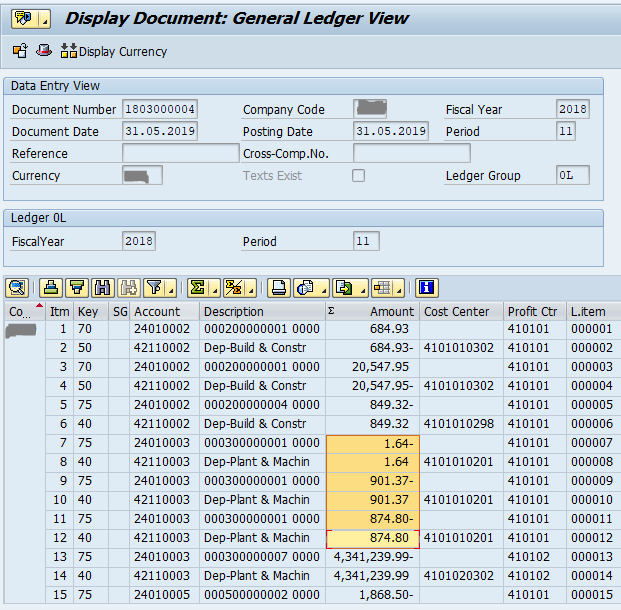

Depreciation A/C Dr XXXX (posting key 40) (this entry will happen once your Dep gets posted)

To Accumulated Depreciation A/C XXXX (posting key 75)

In case dep reverse then below accounting entry will happen:-

Accumulated Dep A/c Dr XXXXX (posting key 75)

To Depreciation A/c XXXXX (posting key 50)

Now let’s have a test case of Dep reversal:-

Now acquire that assets & see the accounting entry:

And also click on Assets accounting :-

Now run the depreciation by new tcode suggested by SAP – AFABN same as AFAB:-Here our Fiscal Year is not V3.

I have posted the depreciation see below and in the last period up to which I have posted depreciation I am going to sale the same assets – result will show below:-

Now you understand the below scenario:-

A. I have purchase this asset as on 01.01.2019 which is the current year- now in this situation if you want to sale this assets system is throwing this error, see below :-

Now accounting entry is shown but when you click on Assets Accounting then:-

Here one point you have to remember that if your assets is acquire in the current year like -01.01.2019 then sale is not possible for the same month , you can do it in the next month onwards:- see below , if I sale the assets as on either 01.02.2019 or 28.02.2019 then system will allow.

Although my selling date is 01.06.2019 then accounting entry is below:-

Here click on Assets Accounting to see the entry & post it.

Now have a look on AW01N:-your dep amount got reverse/ assets value date has changed /Gain has come / Ord dep has reduced-

Now post the dep for the month of 12 & then see the report below:-

& see the comparisons tab also:-

Just have looks on the dep accounting entry also:-

In my case Group assets concept is there, now see in AW01N:- From here

As you all know Group assets depreciation is posted based on WDV method for Income tax purpose- so let’s see in posted values and comparisons tab. I have created a new one & show to you.

As my dep rate is 10% so each year is it reduced in WDV method.

9. Asset Classes:-

A. Select Specify Account Determination and press new entry and do as per your Business (Assets class) & save.

B. Create Screen Layout Rules: Create new entry & save.

C. Define Number Range Interval: Create Number ranges

Put your company code & click on Change interval

D. Define Asset Classes: Create and assign the inputs which you have created earlier like this:-

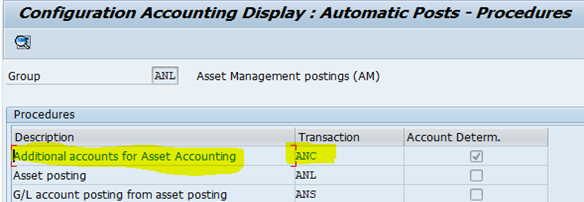

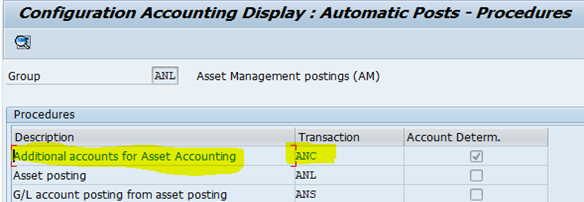

10. Integration with General Ledger Accounting:- one part we have seen in AO90, now second part is

pending. Go to Technical Clearing Account for Integrated Asset Acquisition – now why

Technical Clearing Account has come into picture, I am explaining.

See earlier what happen if you acquire an assets then what will be the accounting entry

Assets A/c Dr Xxxxxxx

To Vendor A/c cr xxxxxx --------- This is only from the Valuation perspective, but it has two part one operational and another is valuation perspective. So now the entry has like below:

Now if you see the above entry you see the 1st line item is with Assets class related and the 2nd line item is the Technical clearing a/c, now come into more details:

Now here if you notice that your PRIMYA NOTE is your KR ,I mean to say this Technical clearing a/c is with Vendor account as well as your Assets accounting with Posting key 70 and 75 and as we all know now it is MANDATORY to assign your Accounting Principle to your each and every Dep area, in a nutshell there are 2 document for each document – see the Table also:-

Under the below screen shot yellow marked Item is called as Priyama Nota .

For operational part (vendor related ) the system makes a posting to all accounting principles against the technical clearing account for asset acquisitions and for the valuating part the system also post accounting-principle specific document --that it also posts against the technical clearing account for asset acquisitions in SAP S/4 HANA.

Have you notice why these 2 Technical clearing Account has given:-

A. Define Technical Clearing Account for Integrated Asset Acquisition: Here you have to put your Technical Clearing account assets acquisition.

B. Define Different Technical Clearing Account for Required Field Control:

Why this account is same because it acts like Zero Balance clearing account, its balance always should be ZERO. And this Account should be an Assets Reconciliation account always.

11. Specify Posting Key for Asset Posting: Here you need to maintain :-

This account DR & CR are same but not a Reconciliation account. U can use it an IUL account of FA.

12. Assign Input Tax Indicator for Non-Taxable Acquisitions: Here you put VO & AO in respect to your company code.

13. Specify Financial Statement Version for Asset Reports: Here you have to assign FSV exact reason I forget the reason else you will get an error while transaction posting of Fi-AA.

14. Post Depreciation to General Ledger Accounting:-

Go to

A. Specify Document Type for Posting of Depreciation and create and save with your Own Document type for Dep posting. See below:-

B. Document Type for Cross-Company Code Cost Accounting in External Co Code:-

C. Specify Intervals and Posting Rules:-

& select CC and click on Posting rule & select as per your Business needs.

15. Segment Reporting:

A. Click on Activate Segment Reporting:

16. Additional Account Assignment Objects:

B. Specify Account Assignment Types for Account Assignment Objects:

Select the company code & click on Dep area, this is a Mandatory setting to post the Depreciation at least for Cost center – see below:-

C. Process Error Table:

17. Depreciation Areas:

a. Define Depreciation Areas: click on Define Depreciation Areas and put the COD and create:-

b. Specify Area Type:

C. Define Depreciation Area for Quantity Update: put the COD of yours & do the configuration:-

D. Specify Transfer of APC Values:

E. Specify Transfer of Depreciation Terms:

18. Determine Depreciation Areas in the Asset Class:

19. Currencies:

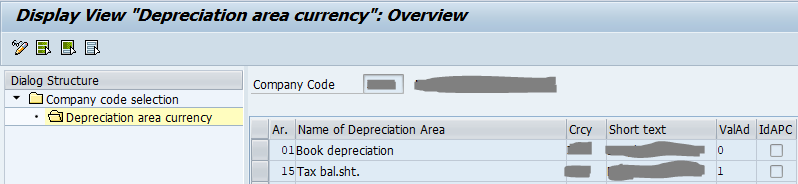

A. Define Depreciation Areas for Foreign Currencies:

B. Specify the Use of Parallel Currencies: If you have multiple currencies then you need to define here.

20. Group Assets: If you are using Group assets then you need to define here:- And this is basically for Income tax dep area where WDV dep rate will be calculated separately.

A. Specify Depreciation Areas for Group Assets: Tick is Mandatory for Group assets under dep

B. Specify Asset Classes for Group Assets:

21.Depreciation: Click on Ordinary dep and see below – configuration.

A. Determine Depreciation Areas:

B. Assign Accounts: As I have shown earlier – you have assign GL accounts in respect to Dep posting.

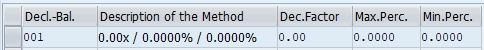

22. Valuation Methods: Under this you need to define different Dep Methods as per your Business

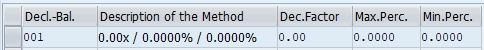

Click on dep key and calculation methods:

A. Define Base Methods:

B. Define Declining-Balance Methods:

C. Define Maximum Amount Methods: Here you can put a maximum amount of Dep amount –on that your Dep amount can’t be exceeds

D. Define Multi-Level Methods:

And click on Levels, then

E. Maintain Period Control Methods: Period controls method controls the dep posting – 1st month / next month etc ..

23. Maintain Depreciation Key:

Click on Dep key & see below:-

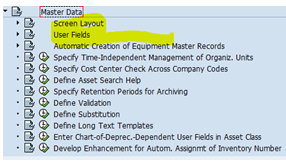

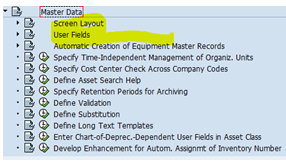

24. Master Data:-

Select Screen layout:

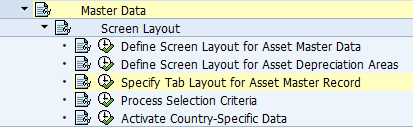

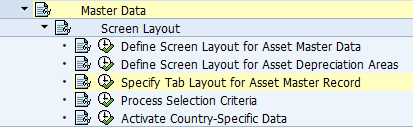

A. Define Screen Layout for Asset Master Data: Here you need to define screen layout for AS01.

Click on Define Screen Layout for Asset Master Data: Select Asset Class and click on Logical field groups and select any one for which you want to define, again click on Field group rules and see below:

B. Create Screen Layout Rules for Asset Master Record:

C. Define Screen Layout for Asset Depreciation Areas: Same path next step : here you define which field is required / Optional / suppress etc, it depends as per your CLIENT requirement .

D. Specify Tab Layout for Asset Master Record: Here if want to assign / de-assign any TAB in AS01 then this config is required and assign the same to particular assets class.

25. Asset Data Transfer:

A. Click on Define Transfer Date and Additional Parameters: see the below screen shot, it depends on client to client, this Date is very vital. Make sure about that.

B. Specify Offsetting Account for Legacy Data Transfer: Here you have to specify the Initial Upload Ledger account means your Offsetting account.

C. After complete the Legacy plz don’t forget to close the Legacy data transfers after wards in the specified company codes.

it is never be a Reconciliation account. It is a B/sheet account.

26. Now this STEP is TOTALLY NEW IN SAP S/4 HANA SIMPLE FINANCE ASSETS ACCOUNTING- see below:-

Check Consistency:-

Click one by one & see the results.

27. Last but not the least – you can have a look all the below steps but don’t perform , if you want to perform the just above 2 like- Reset Company Code & Reset Year-End Closing ,need to perform into your Test system .

28. Check Active Charts of Depreciation for Asset Accounting:

Tcode : FAA_CHECK_ACTIVATION

Execute:-

29. Display Migration log:

Apart from you can try with these Tcodes also : oak1 , oak2 , oak3 , oak4 , oak5 , oak6.

So, hope , Now you understand about the the concepts of New Assets Accounting , configuration steps which are normally required as well as some new features which were previously not available but in SAP S/4 HANA it it available.

Thank you all .

Regards

Saikat.

I am going to describe / explain about the New Assets Accounting features, along with almost all the configuration steps with screen shots & changes that has come into SAP S/4 HAHA 1809 versions. And some transaction also that I have posted & related screen shots are also given below.

Please keep that in mind that if you are having more than ONE Depreciation are, you have to have assign your Accounting Principle into all your Depreciation areas.

One more thing is that in SAP S/4 HANA if you have more that one ledger ( Standard-means leading + Non- Standard ledger -means non leading ledger but not extension ledger ) then you also have to create more then one depreciation area and you have to assign Accounting Principle to both the areas.

For now on in New Assets Accounting New G/L Functionality should be ACTIVE although it is no necessary that the Client will or should use New G/L Functionality afterwards.

In New Assets Accounting you can use either Ledger Base / Account Base approach, both the Functionality are not going to use simultaneously.

Let's begin:-

Activate Asset Accounting (New):-

- Copy Reference Chart of Depreciation/Depreciation Areas: Click on Copy Reference Chart of Depreciation

& press F6 and choose 0DE--Sample chart of depreciation: Germany - & give any naming convention.

Please note that this COD is Country specific so if you are going to implement for Australia Country – copy that COD as a sample.

2. Specify Description of Chart of Depreciation:

3. Copy/Delete Depreciation Areas: Here in my case there is 2 dep area – 01 and 15 for Income tax where Group assets concept is applicable and it is applicable only for Dep area 15.

Put your Charts of Depreciation in this Blank space.

4.Assign Chart of Depreciation to Company Code:

5. Specify Number Assignment Across Company Codes ( optional ) –this is applicable for Cross company code if you have that then you need to define this step like this as per below screen shot:-

6.Assets class

Create Assets class as per your company requirement

a. Specify Account Determination

b.Create Screen Layout Rules:-

c. Define Number Range Interval:-

Put your company code & click on Change interval

d.Define Asset Classes

& 2-click on class & see below:-

& 2-click on class & see below:-

7. Now go to below path:

Define How Depreciation Areas Post to General Ledger:-

Now click on each and every dep area & see the configuration – it is mandatory that for your company code also same setting will be applicable but mostly same.

8.Assign G/L Accounts: ( AO90):

Now select COA and click on Account Determination on the left side. See below:-

& select the respective Account determination and click on the Balance sheet accounts on the left side:-

Here - Bal.Sh.Acct APC account always be an Asset reconciliation account with short key 018 and G007 should be your Field status variant.

Contra Account is also a B/sheet account not a reconciliation account.

Under retirement account assignment:-

Loss Made on Asset Retirement w/o Reven , Clearing Acct. Revenue from Asset Sale , Gain from Asset Sale , Loss from Asset Sale , Clear. revenue sale to affil. company - All these accounts are expenses / income kind of GL accounts .

Revaluation Acquis. And Production Costs: - is a B/sheet account and recon account also under “A” and short key 018 and G007 is your field status variant.

Offsetting Account: Revaluation APC is a B/sheet account but not a reconciliation account.

Now come to Depreciation:-

Acc.dep. accnt.for ordinary depreciation: this GL account B/sheet account under accumulated dep + recon account under “A” short key 018 and FSV-G007 and expenses account of Ordinary dep is a expenses account Cost element category 01 and click on post automatically only.

Revenue from write-up on ord.deprec – Under this the same Expenses GL account will come because this GL account is the reverse gl account of dep – at the time Assets sale. Suppose you acquire an asset and run the dep for the period like-01, 02, etc and in the period 03 suddenly you have to sale the assets – now the changed depreciation on period 03 is being reverse due to sale. I will show you screen by screen in below last.

Why we use Contra account of Acquisition value:

- We have heard the interim account, so this is a kind of interim account.

- Suppose you are going to purchase an asset without any vendor then see below if you put the GL account on Contra Account of Acquisition value :-

Here you can find any Vendor reconciliation account – where as if you post any document F-90 with any vendor the accounting entry is like below:-

Look the difference above ⇑

Now if you pass any Credit memo by ABGL – then also that Contra account will impact- see below.

So here if you notice the I reduce the value of Credit memo from AB01 Tcode where I have re-acquire the asset with the value of Rs: 400000

Note: You can’t post higher value in Credit memo either it is same amount or lesser than the Acquisition value from the Tcode- AB01.

Now see the effect of AW01N:

Here you notice:-

A.30.03.2019- 1st acquisition was held.

B. At that time you notice APC value was 1500/-.

C.Now acquisition value is 51500/- and ordinary dep has also increased- see below screen shot.

D. 01.04.2019- New Acquisition value is Rs: 400000/-

E. Credit memo has raised of Rs: 350000/- this difference value is added with prior APC value.

Now run depreciation & see the effect. SAP has provided new Tcode of Depreciation :AFABN:

In case of Dep reversal then please assign the GL account in Revenue from write-up on ord.deprecthe same Gl account which you have assign in Expense account for ordinary depreciat.

Depreciation A/C Dr XXXX (posting key 40) (this entry will happen once your Dep gets posted)

To Accumulated Depreciation A/C XXXX (posting key 75)

In case dep reverse then below accounting entry will happen:-

Accumulated Dep A/c Dr XXXXX (posting key 75)

To Depreciation A/c XXXXX (posting key 50)

Now let’s have a test case of Dep reversal:-

Now acquire that assets & see the accounting entry:

And also click on Assets accounting :-

Now run the depreciation by new tcode suggested by SAP – AFABN same as AFAB:-Here our Fiscal Year is not V3.

I have posted the depreciation see below and in the last period up to which I have posted depreciation I am going to sale the same assets – result will show below:-

Now you understand the below scenario:-

A. I have purchase this asset as on 01.01.2019 which is the current year- now in this situation if you want to sale this assets system is throwing this error, see below :-

Now accounting entry is shown but when you click on Assets Accounting then:-

Here one point you have to remember that if your assets is acquire in the current year like -01.01.2019 then sale is not possible for the same month , you can do it in the next month onwards:- see below , if I sale the assets as on either 01.02.2019 or 28.02.2019 then system will allow.

Although my selling date is 01.06.2019 then accounting entry is below:-

Here click on Assets Accounting to see the entry & post it.

Now have a look on AW01N:-your dep amount got reverse/ assets value date has changed /Gain has come / Ord dep has reduced-

Now post the dep for the month of 12 & then see the report below:-

& see the comparisons tab also:-

Just have looks on the dep accounting entry also:-

In my case Group assets concept is there, now see in AW01N:- From here

As you all know Group assets depreciation is posted based on WDV method for Income tax purpose- so let’s see in posted values and comparisons tab. I have created a new one & show to you.

As my dep rate is 10% so each year is it reduced in WDV method.

9. Asset Classes:-

A. Select Specify Account Determination and press new entry and do as per your Business (Assets class) & save.

B. Create Screen Layout Rules: Create new entry & save.

C. Define Number Range Interval: Create Number ranges

Put your company code & click on Change interval

D. Define Asset Classes: Create and assign the inputs which you have created earlier like this:-

10. Integration with General Ledger Accounting:- one part we have seen in AO90, now second part is

pending. Go to Technical Clearing Account for Integrated Asset Acquisition – now why

Technical Clearing Account has come into picture, I am explaining.

See earlier what happen if you acquire an assets then what will be the accounting entry

Assets A/c Dr Xxxxxxx

To Vendor A/c cr xxxxxx --------- This is only from the Valuation perspective, but it has two part one operational and another is valuation perspective. So now the entry has like below:

Now if you see the above entry you see the 1st line item is with Assets class related and the 2nd line item is the Technical clearing a/c, now come into more details:

Now here if you notice that your PRIMYA NOTE is your KR ,I mean to say this Technical clearing a/c is with Vendor account as well as your Assets accounting with Posting key 70 and 75 and as we all know now it is MANDATORY to assign your Accounting Principle to your each and every Dep area, in a nutshell there are 2 document for each document – see the Table also:-

Under the below screen shot yellow marked Item is called as Priyama Nota .

For operational part (vendor related ) the system makes a posting to all accounting principles against the technical clearing account for asset acquisitions and for the valuating part the system also post accounting-principle specific document --that it also posts against the technical clearing account for asset acquisitions in SAP S/4 HANA.

Have you notice why these 2 Technical clearing Account has given:-

A. Define Technical Clearing Account for Integrated Asset Acquisition: Here you have to put your Technical Clearing account assets acquisition.

B. Define Different Technical Clearing Account for Required Field Control:

Why this account is same because it acts like Zero Balance clearing account, its balance always should be ZERO. And this Account should be an Assets Reconciliation account always.

11. Specify Posting Key for Asset Posting: Here you need to maintain :-

This account DR & CR are same but not a Reconciliation account. U can use it an IUL account of FA.

12. Assign Input Tax Indicator for Non-Taxable Acquisitions: Here you put VO & AO in respect to your company code.

13. Specify Financial Statement Version for Asset Reports: Here you have to assign FSV exact reason I forget the reason else you will get an error while transaction posting of Fi-AA.

14. Post Depreciation to General Ledger Accounting:-

Go to

A. Specify Document Type for Posting of Depreciation and create and save with your Own Document type for Dep posting. See below:-

B. Document Type for Cross-Company Code Cost Accounting in External Co Code:-

C. Specify Intervals and Posting Rules:-

& select CC and click on Posting rule & select as per your Business needs.

15. Segment Reporting:

A. Click on Activate Segment Reporting:

16. Additional Account Assignment Objects:

B. Specify Account Assignment Types for Account Assignment Objects:

Select the company code & click on Dep area, this is a Mandatory setting to post the Depreciation at least for Cost center – see below:-

C. Process Error Table:

17. Depreciation Areas:

a. Define Depreciation Areas: click on Define Depreciation Areas and put the COD and create:-

b. Specify Area Type:

C. Define Depreciation Area for Quantity Update: put the COD of yours & do the configuration:-

D. Specify Transfer of APC Values:

E. Specify Transfer of Depreciation Terms:

18. Determine Depreciation Areas in the Asset Class:

19. Currencies:

A. Define Depreciation Areas for Foreign Currencies:

B. Specify the Use of Parallel Currencies: If you have multiple currencies then you need to define here.

20. Group Assets: If you are using Group assets then you need to define here:- And this is basically for Income tax dep area where WDV dep rate will be calculated separately.

A. Specify Depreciation Areas for Group Assets: Tick is Mandatory for Group assets under dep

B. Specify Asset Classes for Group Assets:

21.Depreciation: Click on Ordinary dep and see below – configuration.

A. Determine Depreciation Areas:

B. Assign Accounts: As I have shown earlier – you have assign GL accounts in respect to Dep posting.

22. Valuation Methods: Under this you need to define different Dep Methods as per your Business

Click on dep key and calculation methods:

A. Define Base Methods:

B. Define Declining-Balance Methods:

C. Define Maximum Amount Methods: Here you can put a maximum amount of Dep amount –on that your Dep amount can’t be exceeds

D. Define Multi-Level Methods:

And click on Levels, then

E. Maintain Period Control Methods: Period controls method controls the dep posting – 1st month / next month etc ..

23. Maintain Depreciation Key:

Click on Dep key & see below:-

24. Master Data:-

Select Screen layout:

A. Define Screen Layout for Asset Master Data: Here you need to define screen layout for AS01.

Click on Define Screen Layout for Asset Master Data: Select Asset Class and click on Logical field groups and select any one for which you want to define, again click on Field group rules and see below:

B. Create Screen Layout Rules for Asset Master Record:

C. Define Screen Layout for Asset Depreciation Areas: Same path next step : here you define which field is required / Optional / suppress etc, it depends as per your CLIENT requirement .

D. Specify Tab Layout for Asset Master Record: Here if want to assign / de-assign any TAB in AS01 then this config is required and assign the same to particular assets class.

25. Asset Data Transfer:

A. Click on Define Transfer Date and Additional Parameters: see the below screen shot, it depends on client to client, this Date is very vital. Make sure about that.

B. Specify Offsetting Account for Legacy Data Transfer: Here you have to specify the Initial Upload Ledger account means your Offsetting account.

C. After complete the Legacy plz don’t forget to close the Legacy data transfers after wards in the specified company codes.

it is never be a Reconciliation account. It is a B/sheet account.

26. Now this STEP is TOTALLY NEW IN SAP S/4 HANA SIMPLE FINANCE ASSETS ACCOUNTING- see below:-

Check Consistency:-

Click one by one & see the results.

27. Last but not the least – you can have a look all the below steps but don’t perform , if you want to perform the just above 2 like- Reset Company Code & Reset Year-End Closing ,need to perform into your Test system .

28. Check Active Charts of Depreciation for Asset Accounting:

Tcode : FAA_CHECK_ACTIVATION

Execute:-

29. Display Migration log:

Apart from you can try with these Tcodes also : oak1 , oak2 , oak3 , oak4 , oak5 , oak6.

So, hope , Now you understand about the the concepts of New Assets Accounting , configuration steps which are normally required as well as some new features which were previously not available but in SAP S/4 HANA it it available.

Thank you all .

Regards

Saikat.

- SAP Managed Tags:

- SAP S/4HANA Cloud for Asset Management,

- FIN Asset Accounting

29 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- Portfolio Management – Enhanced Financial Planning integration in Enterprise Resource Planning Blogs by SAP

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

- New material type (non-valuated, no accounting view) for asset materials. in Enterprise Resource Planning Q&A

- SAP S/4HANA Cloud Extensions with SAP Build Best Practices: An Expert Roundtable in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 9 | |

| 4 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |