- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- Intrastat 101 - SAP S/4HANA for international trad...

Financial Management Blogs by SAP

Get financial management insights from blog posts by SAP experts. Find and share tips on how to increase efficiency, reduce risk, and optimize working capital.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-11-2023

5:22 AM

What is Intrastat?

Intrastat is a statistical reporting system used in the European Union (EU) to collect information on the movement of goods between EU member states. It is a means of monitoring and analyzing trade flows within the EU's single market. Intrastat is implemented in each EU member state and requires businesses to provide detailed data on their intra-EU trade activities.

The Intrastat system applies to businesses that exceed certain thresholds for the value of goods dispatched (sales to other EU member states) and the value of goods acquired (purchases from other EU member states). The thresholds vary by country.

Under Intrastat, businesses must report specific details about their cross-border transactions, including the commodity code, value, quantity, and partner country of the goods traded. These details enable national statistical agencies to gather data on intra-EU trade and compile statistics on imports and exports within the EU.

The information collected through Intrastat is used for various purposes, such as economic analysis, policy-making, and monitoring trade patterns within the EU. In addition, it helps governments and organizations gain insights into market trends, identify potential imbalances, and assess member states' economic performance.

Businesses subject to Intrastat requirements are responsible for accurately and timely submitting the required Intrastat declarations to their respective national statistical agencies. These declarations are typically submitted monthly.

In summary, Intrastat is a reporting system used in the EU to collect statistical data on the movement of goods between member states. It helps monitor intra-EU trade and supports the analysis and planning of economic activities within the single market.

Intrastat vs. Customs Declarations vs. VAT Reporting

It's important to note that Intrastat is distinct from customs declarations and VAT reporting.

Intrastat focuses solely on statistical data collection on trade between member states.

Customs' main focus is product legitimacy and import duties (and import VAT) on goods crossing the EU customs border.

VAT Reporting focuses mainly on the taxation of goods and services within a member state.

SAP Solutions for Intrastat Reporting

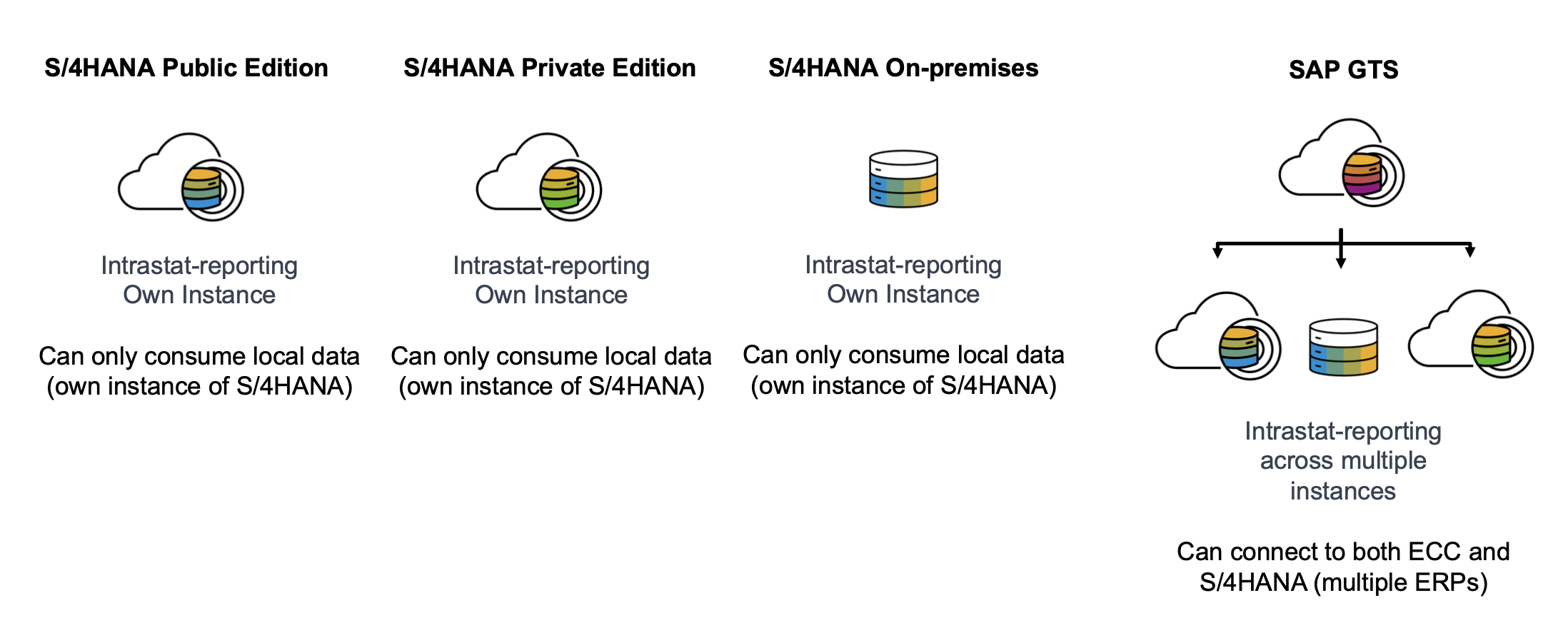

SAP is providing equal functionality for Intrastat reporting across SAP Global Trade Services, edition for SAP HANA and the international trade module of both SAP S/4HANA Public edition and SAP S/4HANA Private edition.

Whereas SAP GTS, edition for SAP HANA can do Intrastat-reporting across multiple ERP systems, both SAP ECC and SAP S/4HANA, Intrastat-reporting within the international trade module of SAP S/4HANA can only consume data from its own instance.

Intrastat Reporting Process Flow

Each separate company code (independent accounting unit) must submit an Intrastat report monthly, for each country in which this company code has plants from which goods are delivered into EU countries (SD side) or into which goods are received from an EU country (MM side). If a company code has plants abroad (in countries relevant for Intrastat), then a separate selection must be started for each of these countries.

Example: "XX Company Germany" has, in addition to its local plants, also plants in France and Austria. For the company code of "XX Company Germany," a total of three selections must be started: one for each country.

Source Documents - Intrastat Arrivals

For Intrastat Arrivals, the source documents are Purchase Orders and MM Scheduling Lines.

Some parts of the data required for the Intrastat report can be taken directly from the purchase order.

The delivered quantities (goods receipts) and the values provided by the vendor in the invoice (invoice receipts) must be determined from the PO history (document flow). There is no direct link between the individual goods receipts and the invoice receipts; the assignment happens chronologically.

This declaration currency is predefined by country. As documents can also be created in different currencies, a conversion into the declaration currency is often necessary.

The SAP solutions provide a choice between 4 different "Selection Logics."

Default Selection Logic - Report GR and Wait for IR / Import Data from PO

- If there is a GR in the reporting month, then it is reported if there is also a matching IR.

- If there is no IR for the GR in the same month, then the GR is not reported; its reporting is postponed until the following month. Then in the following month, the GR is reported regardless of whether a matching IR is available by then!

Alternative Selection Logic A - Report GR and Wait for IR / Import Data from Inbound Delivery

The logic is identical to the default selection logic. The difference is that with selection logic "A" also the deliveries are evaluated.

Alternative Selection Logic B - Report Invoice Receipt (IR) / Import Data from MM Purchase Order

- Goods receipts are not considered at all! Only invoice receipts are relevant. For this reason, only the PO history of the selected reporting month is included.

Alternative Selection Logic C - Report Goods Receipt (GR) / Import Data from MM Purchase Order

- If there is a GR in the reporting month, it is reported regardless of whether there is a matching IR.

Source Documents - Intrastat Dispatches

For Intrastat Dispatches, the source documents are Billing Documents.

Billing documents are created for goods already delivered to customers. These billing documents contain all the values required for Intrastat, including the invoice and statistical values.

The declaration currency is predefined by country. As documents can also be created in different currencies, a conversion into the declaration currency is often necessary.

The following SD sales document categories are processed by the Intrastat programs:

- M Invoice

- N / S Invoice cancellation

- O Credit memo

- P Debit memo

- 5 Intercompany invoice

- 6 Intercompany credit memo

During the processing of the credit memos, it is decisive whether the credit memo is a credit memo with a goods movement (= return: the customer sends the goods back completely or partially) or a credit memo without a goods movement (e.g., the goods arrive damaged and are immediately discarded or a part of the goods is lost underway).

The four illustrations below illustrate the system's behavior and the partner's responsibility given different scenarios for Dispatch reporting.

Declaration Content and Key Data Elements

Mandatory data elements may vary slightly between member states. Every state also has its own data format and provides different means for electronic filing. To cater for country specifics requirements field controls are used. The field controls are defined and delivered by SAP. Any requests for changing/adjusting the field controls should be addressed to SAP.

The illustration above is illustrative only. We will now look closer at two of the most important elements; the commodity code and the country of origin.

Where is the Commodity Code Maintained?

SAP ECC

- A commodity code is assigned to the material at the plant level

- Stored in table MARC field STAWN

- The assignment is done in the 'Create Materials' and 'Change Materials' apps.

SAP S/4HANA Public and Private edition.

- The commodity code is assigned to material with a start and end date, i.e., the assignment is time-dependent.

- Valid for a country or multiple countries

- Stored in table /SAPSLL/MARITC

- The assignment is done in the 'Classify Products - Commodity Codes' and 'Reclassify Products - Commodity Codes' apps.

How is the Commodity Code Determined for a Transaction?

Purchasing document items with material number:

- Select commodity code from the inbound delivery item (available as of S/4H 2020 SP01)

- If no commodity code in the inbound delivery item, select the one from the classification of materials

Purchasing document items without material number

- Select commodity code from the inbound delivery item (available as of S/4H 2020 SP01)

- If no commodity code in the inbound delivery item, select the one from the purchasing document item

Billing document items

- Select the commodity code from the billing document item (available as of S/4H 2020 SP01), which is copied from the delivery item when creating the billing document.

- If no commodity code in the billing document item, select the one from the classification of materials.

How is the Country of Origin Determined for a Transaction?

Purchasing document items with material number

- Select the country of origin from the inbound delivery item (available as of S/4H 2020 SP01)

- If no country of origin in the inbound delivery item, select the one from the batch.

- If no country of origin in the batch, select the one from the purchasing info record.

- If no country of origin in the purchasing info record, select the one from the material master

Purchasing document items without material number

- Select the country of origin from the inbound delivery item (available as of S/4H 2020 SP01)

- If no country of origin in the inbound delivery item, select the one from the purchasing info record.

Billing document items

- Select the country of origin from the billing document item (available as of S/4H 2020 SP01), which is copied from the delivery item when creating the billing document.

- If there is no country of origin in the billing document item, select the one from the batch.

- If no country of origin is in the batch, select the one from the material master.

Credits

This blog would never have been made without the previous work of

waldemar.kramer

rohit.trivedi

szilvia.hilken

and many more.

Note: This blog describes Intrastat in the SAP S/4HANA On-premises, Private, and Public editions. The selection logic and use of source documents vary slightly compared to Intrastat reporting in SAP ECC.

- SAP Managed Tags:

- SAP Global Trade Services,

- SAP S/4HANA

Labels:

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Business Trends

145 -

Business Trends

17 -

Event Information

35 -

Event Information

9 -

Expert Insights

8 -

Expert Insights

31 -

Life at SAP

48 -

Product Updates

521 -

Product Updates

69 -

Technology Updates

196 -

Technology Updates

11

Related Content

- The Where, the Who, the What, and the Why of Trade Compliance and How Different SAP Solutions Keep Your Company Safe in Financial Management Blogs by SAP

- Security Safeguards for SAP Cloud Services: Addressing the Threats to Cloud Computing in Financial Management Blogs by SAP

- Intrastat Reporting with SAP S/4HANA and SAP Global Trade Services, edition for SAP HANA in Financial Management Blogs by SAP

- Intrastat 401 - Intrastat Reporting and Tax Abroad in Intercompany Sales in Financial Management Blogs by SAP

- Intrastat 301 - Intrastat and Plants Abroad/Foreign Plant in Financial Management Blogs by SAP