- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Reverse Charge VAT in SAP Business One

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-29-2022

3:37 PM

Company supplying products or services has to issue an invoice to its customer with the value-added tax (VAT) and subsequently forwards the VAT amount to the tax office. In the reverse charge procedure VAT liability is shifted from the supplier to the recipient of the goods/services. Cases where this procedure can be applied is described in the legal acts of every country. The common way for this procedure application in B2B operations is that Supplier issues the Invoice with Net amount only and Receiver pays VAT to the tax authorities and claims it as input tax (in case when there are no legal exceptions).

Let us look how this procedure can be applied in SAP Business One.

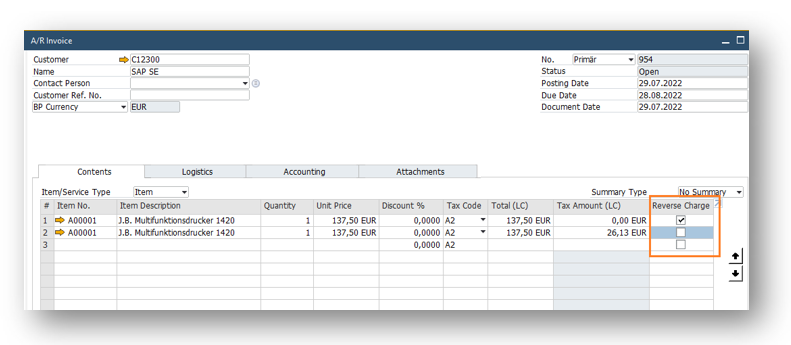

So, you need to issue the invoice to your customer with applying the reverse charge procedure. Here How it looks like in SAP Business One:

You can see that in the line with Reverse Charge the Tax Amount is zero. However that Tax Code is the same. Tick on the Reverse Charge for the second line and check the layout that you are going to send to your customer:

and the report:

It is simple, isn’t it?

Please, be aware that in case you use the Reverse Charge feature you need to have Federal Tax ID filled in the Invoice as part of the legal requirement:

In case it is not filled you will receive an error: "Federal Tax ID" must contain a value when "Reverse Charge" is selected.

Field is automatically filled out with value in the Business Partner Master Data. I would recommend using the already described feature about VAT number verification in SAP Business One shared here earlier. So you can be sure that the Invoice you are issuing is correct and answers all legal requirements.

The feature was released in SAP Business One in version 10.0 FP2108 with the Note Reverse Charges for A/R Marketing Documents and Nondeductible Tax Codes

I hope you find this information helpful and I’m looking forward to your feedback in the comments section below. To receive notifications about new blog posts, please follow my profile.

Let us look how this procedure can be applied in SAP Business One.

So, you need to issue the invoice to your customer with applying the reverse charge procedure. Here How it looks like in SAP Business One:

You can see that in the line with Reverse Charge the Tax Amount is zero. However that Tax Code is the same. Tick on the Reverse Charge for the second line and check the layout that you are going to send to your customer:

and the report:

It is simple, isn’t it?

Please, be aware that in case you use the Reverse Charge feature you need to have Federal Tax ID filled in the Invoice as part of the legal requirement:

In case it is not filled you will receive an error: "Federal Tax ID" must contain a value when "Reverse Charge" is selected.

Field is automatically filled out with value in the Business Partner Master Data. I would recommend using the already described feature about VAT number verification in SAP Business One shared here earlier. So you can be sure that the Invoice you are issuing is correct and answers all legal requirements.

The feature was released in SAP Business One in version 10.0 FP2108 with the Note Reverse Charges for A/R Marketing Documents and Nondeductible Tax Codes

I hope you find this information helpful and I’m looking forward to your feedback in the comments section below. To receive notifications about new blog posts, please follow my profile.

- SAP Managed Tags:

- SAP Business One

Labels:

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

24 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

160 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

220 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Advance Return Management complete configuration(SAP ARM) in Enterprise Resource Planning Blogs by Members

- BUSINESS TRANSACTION IN SAP S/4HANA CLOUD, PUBLIC EDITION in Enterprise Resource Planning Q&A

- Exchange rate update for existing transactions for foreign vendors and customers in sap b1 in Enterprise Resource Planning Q&A

- Revolutionizing Taxation: Navigating VAT in the Digital Age (ViDA) in Enterprise Resource Planning Blogs by SAP

- Demystifying Transformers and Embeddings: Some GenAI Concepts in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 11 | |

| 10 | |

| 8 | |

| 8 | |

| 7 | |

| 7 | |

| 6 | |

| 5 | |

| 4 | |

| 4 |