- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- Introduction to EU Taxonomy

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Hi, everyone, my name is Jingnan Wang, I work in SAP Profitability and Performance Management sustainability content development team and I would like to give you an introduction to EU Taxonomy. In particular what is EU Taxonomy, how to calculate the EU Taxonomy alignment, as well as to walk you through the EU Taxonomy part of the Financing and Investment Sustainability sample content.

What is EU Taxonomy?

The EU Taxonomy is a classification system aimed at investors, companies, financial institutions and policymakers, helping them establish whether an activity can be considered environmentally sustainable. It is intended to facilitate allocation of capital towards sustainable activities and projects, and therefore, navigate the transition to a low-carbon economy and meet the EU’s climate and energy targets. The EU Taxonomy establishes an EU-wide list of economic activities which meet the EU’s environmental requirements across a broad range of industry sectors enlisted below (based on NACE Classification):

- Forestry

- Environmental protection and restoration activities

- Manufacturing

- Energy

- Water supply, sewerage, waste management and remediation

- Transport

- Construction and real estate activities

- Information and communication

- Professional, scientific and technical activities

- Financial and insurance activities

- Education

- Human health and social work activities

- Arts, entertainment and recreation

The EU Taxonomy Regulation was published in the Official Journal on 22 June 2020 and entered into force on 12 July 2020. On 21 April 2021 the European Commission adopted an ambitious and comprehensive package called: Sustainable finance package, which includes, inter alia, updates on the EU Taxonomy regulation. A first delegated act on sustainable activities for climate change adaptation and mitigation objectives (The EU Taxonomy Climate Delegated Act) was published on that day and it was formally adopted on 4 June 2021. A second delegated act for the remaining objectives will be published in 2022. (reference: https://ec.europa.eu/info/business-economy-euro/banking-and-finance/sustainable-finance/eu-taxonomy-...).

According to the taxonomy regulation, an economic activity is qualified as "environmentally sustainable" if it makes a “substantial contribution” to one of the following six environmental objectives:

- Climate change mitigation

- Climate change adaptation

- Sustainable use and protection of water and marine resources

- Transition to a circular economy

- Pollution prevention and control

- Protection and restoration of biodiversity and ecosystems

At the same time, the activity should "do no significant harm” to any other environmental objective and should comply with minimum “social safeguards”.

Large undertakings which are required to publish non-financial information under the Non-Financial Reporting Directive (NFRD) must disclose 3 KPI’s: Turnover, CapEx and OpEx, for each economic activity and the total KPIs for all economic activities, with regards to the EU Taxonomy.

In order to assess the EU Taxonomy alignment at instrument, issuer and portfolio level in SXV sample content, the following steps were taken:

Step 1 – Identify EU-Taxonomy eligible activities

Step 2 – Identify environmental objective/s to which the activity is making a substantial contribution

Step 3 – Identify the category of each of the eligible activities (transitional or enabling)

Step 4 – Check if the substantial contribution criteria for the selected environmental objective is met

Step 5 – Check if the “do no significant harm” criteria for the remaining environmental objectives is met

Step 6 – Check if there are any negative impacts on minimum safeguards

Step 7 – Calculate the EU Taxonomy alignment

Step 8 – Calculate the taxonomy aligned, not-aligned and not eligible KPIs for Turnover, CapEx and OpEx (where relevant), as well as the taxonomy alignment results for different environmental objectives, including proportions of taxonomy-alignment (turnover) for climate change mitigation - transitional / enabling, climate change adaptation - transitional / enabling.

How to calculate EU Taxonomy alignment? -- A walk-through the EU Taxonomy part of the SAP Profitability and Performance Management sample content

One of the features of the SAP Profitability and Performance Management Financing and Investment Sustainability Management Sample Content is the EU Taxonomy Assessment which can be performed at 3 levels: issuer level, instrument level and portfolio level. More details on this assessment are provided below.

EU Taxonomy Assessment (Issuer level)

Firstly, the taxonomy-aligned turnover, CapEx and OpEx (%) per activity and per issuer are calculated, as long as a given economic activity passes all six steps of the EU Taxonomy screening test described above. Then, taxonomy alignment for climate change mitigation environmental objective – enabling and transitional activities, as well as for climate change adaptation enabling and transitional activities is calculated (CAEUT calculation function). For example, taxonomy alignment for mitigation-enabling activities is calculated by summing up the taxonomy-aligned turnover (%) per activity of each issuer if the environmental objective is "CCM" and category of activity is "enabling".

CAEUT calculation function in the modelling environment:

Overview of results in the report:

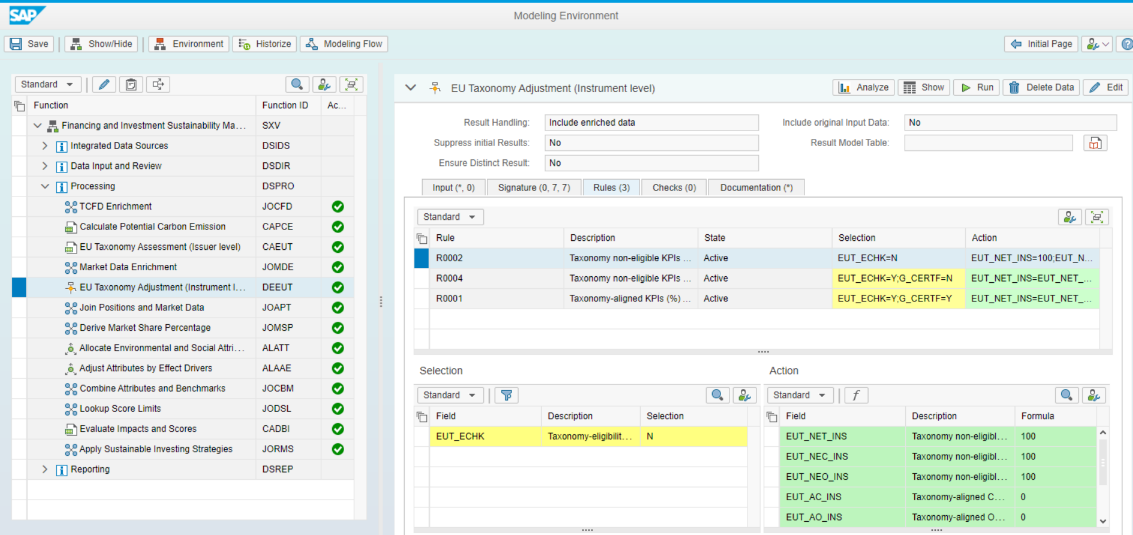

EU Taxonomy Assessment (Instrument level)

The alignment results from the first step – EU Taxonomy Assessment at the Issuer Level – are adjusted in the derivation function DEEUT, based on Green certification (G_CERTF) and Taxonomy-eligibility check based on purpose (EUT_ECHK). If an instrument's Taxonomy-eligibility check is "No", then it is considered to be Taxonomy non-eligible directly, i.e. the results of Taxonomy non-eligible turnover / CapEx / OpEx (%) need to be adjusted to 100%. If an instrument has green certificate, then it is considered as Taxonomy aligned, i.e. the results of Taxonomy-aligned turnover / CapEx / OpEx (%) equal 100%. Green flag will be assigned to a specific instrument if its Taxonomy-aligned turnover (%) exceeds 90% (“Green flag” is a threshold which can be customized by the user, in this sample content it’s set to 90%).

DEEUT derivation function in the modelling environment:

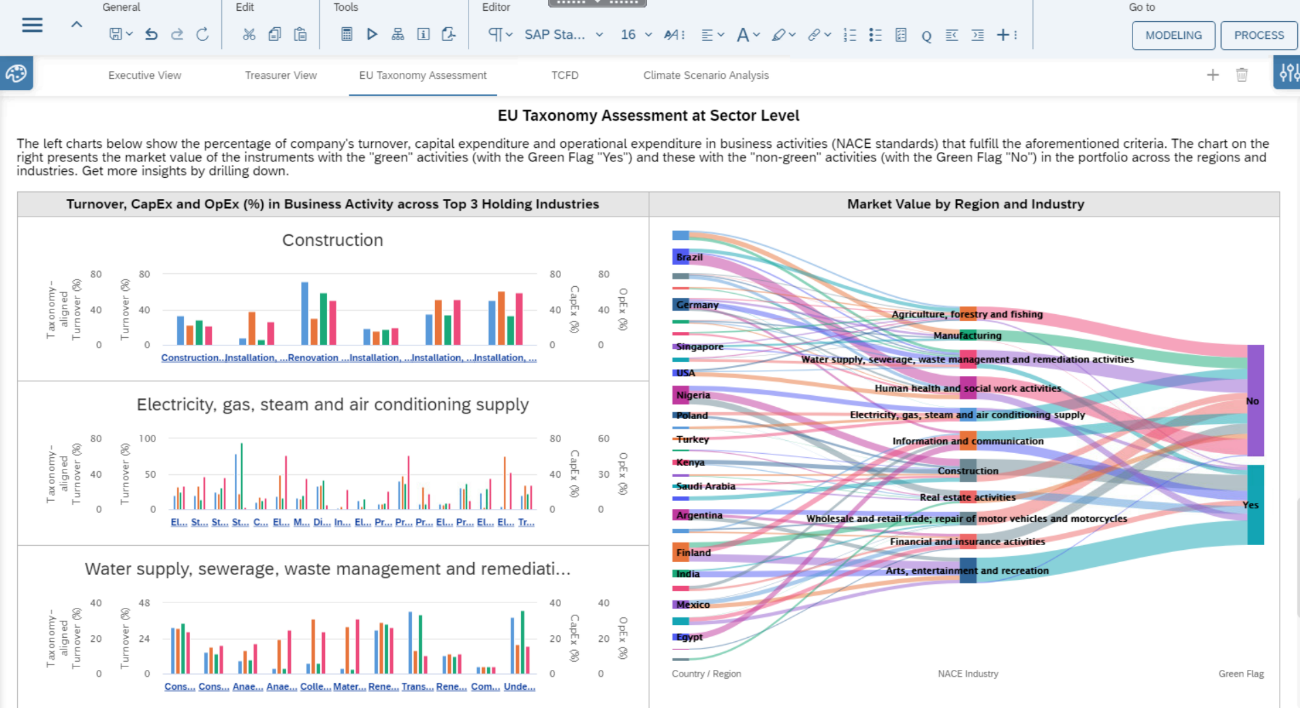

Overview of results in the report:

EU Taxonomy Assessment (Portfolio level)

Finally, in the calculation function CADBI, I calculate EU Taxonomy alignment results at the level of the whole portfolio, including proportions of Taxonomy aligned / not-aligned / non-eligible activities. I also calculate the taxonomy alignment results for different environmental objectives, including proportions of taxonomy-alignment (turnover) for climate change mitigation environmental objective for transitional and enabling activities, climate change adaptation environmental objective for transitional and enabling activities. After multiplying the assessment results at instrument level by the weight of instruments in the portfolio, the KPIs for Turnover, CapEx and OpEx can be obtained by summing the results of this multiplication.

CADBI calculation function in the modelling environment:

Overview of results in the report: the dashboards below represent the overall assessment results at portfolio level for EU Taxonomy part.

Thank you for reading this blog post. In the next EU Taxonomy section blog, I will demonstrate how the Taxonomy alignment calculations are performed at a company level.

- SAP Managed Tags:

- SAP Analytics Hub,

- SAP Profitability and Performance Management

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,658 -

Business Trends

93 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

66 -

Expert

1 -

Expert Insights

177 -

Expert Insights

300 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

780 -

Life at SAP

13 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

345 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,873 -

Technology Updates

429 -

Workload Fluctuations

1

- Supporting Multiple API Gateways with SAP API Management – using Azure API Management as example in Technology Blogs by SAP

- Business Partner customizing for Automotive Industry in Technology Blogs by Members

- Customer & Partner Roundtable for SAP BTP ABAP Environment #12 in Technology Blogs by SAP

- Consuming SAP with SAP Build Apps - Mobile Apps for iOS and Android in Technology Blogs by SAP

- Composite Data Source Configuration in Optimized Story Experience in Technology Blogs by SAP

| User | Count |

|---|---|

| 42 | |

| 25 | |

| 17 | |

| 14 | |

| 9 | |

| 7 | |

| 6 | |

| 6 | |

| 6 | |

| 6 |