- SAP Community

- Groups

- Interest Groups

- Application Development

- Blog Posts

- About Checked Credit Value at Credit Management

Application Development Blog Posts

Learn and share on deeper, cross technology development topics such as integration and connectivity, automation, cloud extensibility, developing at scale, and security.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Jigang_Zhang张吉刚

Active Contributor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-08-2021

9:41 AM

Checked Credit Value is wildly used in credit management. Sometimes it could be a little confused as it does not always equal the total credit value of the sales order. The simplest scenario, it's the input amount value when performing a simulation of a credit check for a specific business partner along its credit segment. The log of results of UKM_BP simulation and its credit check displays like below:

The Checked Credit Value is the difference between current commitment and old commitment. For BP credit check simulation, it'll be the input amount value which is the delta of old& new commitments.

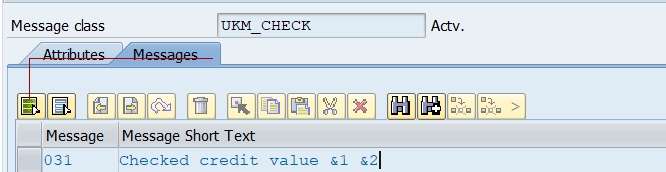

It's been collected into message '031' using the message type 'ukm_check'.

And finally, it could be stored as an attribute(UKM_DCD_ATTR-DCD_CHKDRISKAMT) of DCD(Documented Credit Decision) like below if credit check trigger DCD creation or update.

But when comes to DCD, the checked credit value will be dynamic compared with a pure credit check for a Business partner. SAP provides the documentation for Checked Credit Value like below:

In short, there're 3 scenarios for checked credit value at DCD.

The logic of filling the field Checked Credit Value is described in SAP note 2473178 – SAP Credit Management: Checked Credit Value in DCD is not the total value of the sales order:

Besides:

1. the method 'GET_DCD_ATTR_CREDIT_CHECK_LOG' of class 'CL_UKM_LOG_GATE' can be used to fetch this value and convert it into checked credit value at DCD.

2. It's hard to skip credit checks (OVA8 or VOFM->requirements->credit check) by comparing checked credit value and order value from my aspect. Cause OVA8 entry is called ahead of Checked Credit Value been calculated by the system, then we have to calculated by ourselves. Just imagine how many scenarios need to be considered... Maybe it's workable at check steps.

Please correct me if I'm wrong : P

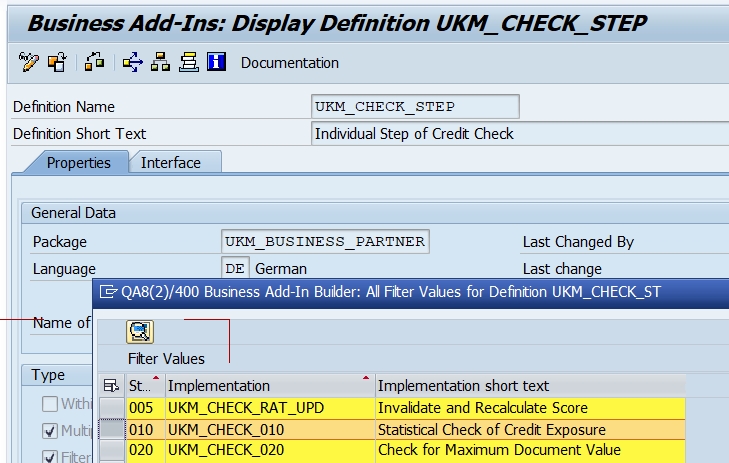

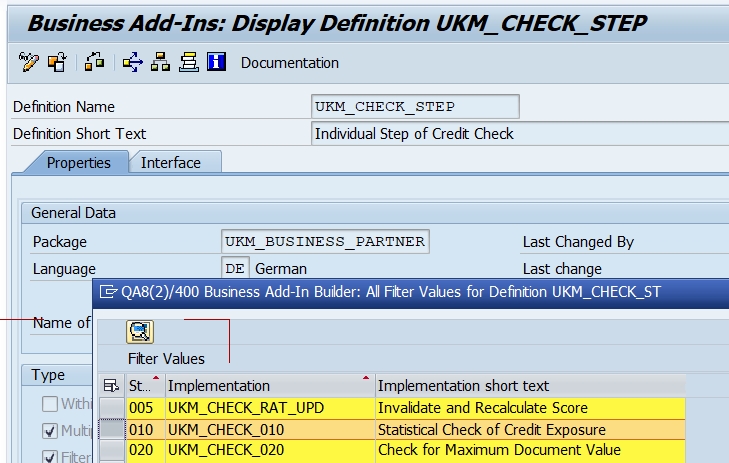

The process of credit check involved checked credit value is directly impacted by individual check step: 010 (Statistical Check of Credit Exposure) which is standard BADI implementation 'UKM_CHECK_010' of BADI: 'UKM_CHECK_STEP'. (As well as UKM_CHECK_030 Dynamic Limit Check with Credit Horizon). Those steps can be triggered during BP simulation but not the DCD creation processing cause different mechanisms.

The Checked Credit Value is the difference between current commitment and old commitment. For BP credit check simulation, it'll be the input amount value which is the delta of old& new commitments.

It's been collected into message '031' using the message type 'ukm_check'.

And finally, it could be stored as an attribute(UKM_DCD_ATTR-DCD_CHKDRISKAMT) of DCD(Documented Credit Decision) like below if credit check trigger DCD creation or update.

But when comes to DCD, the checked credit value will be dynamic compared with a pure credit check for a Business partner. SAP provides the documentation for Checked Credit Value like below:

Checked Credit Value

Specifies the value checked by the system during the latest credit check with regard to the credit risk.

Example

1. A credit analyst enters a new order with a value of EUR 100. Following the related credit check, the system enters the value 100 in this field.

2. As the customer has reduced his order by EUR 10, the credit analyst also makes this change in the system. Following the related credit check, the system enters - 10 (minus 10) in this field.

3. If the credit analyst checks the order again later without making any changes, the system enters the value 0 (zero) in this field.

In short, there're 3 scenarios for checked credit value at DCD.

- Checked Credit Value = Total credit value of the sales order (order creation)

- Checked Credit Value not = Total credit value of the sales order (price relevant order updated like partially confirmed)

- Checked Credit Value = ZERO. (order updated without relevant to price)

This blog from Sergey Pryanishnikov provides the below info:

The logic of filling the field Checked Credit Value is described in SAP note 2473178 – SAP Credit Management: Checked Credit Value in DCD is not the total value of the sales order:

Besides:

1. the method 'GET_DCD_ATTR_CREDIT_CHECK_LOG' of class 'CL_UKM_LOG_GATE' can be used to fetch this value and convert it into checked credit value at DCD.

2. It's hard to skip credit checks (OVA8 or VOFM->requirements->credit check) by comparing checked credit value and order value from my aspect. Cause OVA8 entry is called ahead of Checked Credit Value been calculated by the system, then we have to calculated by ourselves. Just imagine how many scenarios need to be considered... Maybe it's workable at check steps.

Please correct me if I'm wrong : P

- SAP Managed Tags:

- ABAP Development

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

A Dynamic Memory Allocation Tool

1 -

ABAP

8 -

abap cds

1 -

ABAP CDS Views

14 -

ABAP class

1 -

ABAP Cloud

1 -

ABAP Development

4 -

ABAP in Eclipse

1 -

ABAP Keyword Documentation

2 -

ABAP OOABAP

2 -

ABAP Programming

1 -

abap technical

1 -

ABAP test cockpit

7 -

ABAP test cokpit

1 -

ADT

1 -

Advanced Event Mesh

1 -

AEM

1 -

AI

1 -

API and Integration

1 -

APIs

8 -

APIs ABAP

1 -

App Dev and Integration

1 -

Application Development

2 -

application job

1 -

archivelinks

1 -

Automation

4 -

BTP

1 -

CAP

1 -

CAPM

1 -

Career Development

3 -

CL_GUI_FRONTEND_SERVICES

1 -

CL_SALV_TABLE

1 -

Cloud Extensibility

8 -

Cloud Native

7 -

Cloud Platform Integration

1 -

CloudEvents

2 -

CMIS

1 -

Connection

1 -

container

1 -

Debugging

2 -

Developer extensibility

1 -

Developing at Scale

3 -

DMS

1 -

dynamic logpoints

1 -

Eclipse ADT ABAP Development Tools

1 -

EDA

1 -

Event Mesh

1 -

Expert

1 -

Field Symbols in ABAP

1 -

Fiori

1 -

Fiori App Extension

1 -

Forms & Templates

1 -

General

1 -

Getting Started

1 -

IBM watsonx

1 -

Integration & Connectivity

9 -

Introduction

1 -

JavaScripts used by Adobe Forms

1 -

joule

1 -

NodeJS

1 -

ODATA

3 -

OOABAP

3 -

Outbound queue

1 -

Product Updates

1 -

Programming Models

14 -

Restful webservices Using POST MAN

1 -

RFC

1 -

RFFOEDI1

1 -

SAP BAS

1 -

SAP BTP

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Build CodeJam

1 -

SAP CodeTalk

1 -

SAP Odata

1 -

SAP UI5

1 -

SAP UI5 Custom Library

1 -

SAPEnhancements

1 -

SapMachine

1 -

security

3 -

text editor

1 -

Tools

17 -

User Experience

5

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 |