- SAP Community

- Products and Technology

- Supply Chain Management

- SCM Blogs by Members

- Credit management (Documented Credit Decision) (S/...

Supply Chain Management Blogs by Members

Learn about SAP SCM software from firsthand experiences of community members. Share your own post and join the conversation about supply chain management.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

sergey_pryanish

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

07-13-2018

6:30 AM

The credit check concept for sales orders in FSCM-Credit Management implies that the credit controller does not review each sales order. When a situation occurs that the sales orders exceed the credit limit, a Documented Credit Decision object is automatically created. Documented Credit Decision undergoes the approval procedure. If approved, the associated sales order is automatically released.

Picture 1 schematically shows the process of create and approve Documented Credit Decision.

Picture 1. Create and approve Documented Credit Decision

Action 1 «Automatic creation of a Documented Credit Decision».

Configuration in the system in which SD is running:

Initiating the creation of a Documented Credit Decision occurs if a sales order has been blocked (VBAK-CMGST = ‘B’) because of a failed credit check. The method call CL_UKM_CLIENT_DCD=>MAINTAIN_DCD initiating the creation of a Documented Credit Decision are carried out in BADI_SD_CM=>FSCM_COMMITMENT_UPDATE_ORDER (in the case of using the implementation UKM_SD_FSCM_INTEGR1 "Connection of SD Documents to SAP Credit Management"). In the method CL_UKM_CLIENT_DCD=>MAINTAIN_DCD prepares data SD module and send it to the module FSCM-Credit management with service DocumentedCreditDecisionERPBusinessTransactionDocumentNotification_Out (exist BADI UKMRSE_3_DCD_MNTNO «BAdI: Sending a Documented Credit Decision» which extends this interface).

Configuration in the system in which SAP Credit Management is running

SAP Credit Management uses the Case Management component as the technical basis for processing the documented credit decision. The Documented Credit Decision data is stored in the UKM_DCD_ATTR table.

Necessary setting:

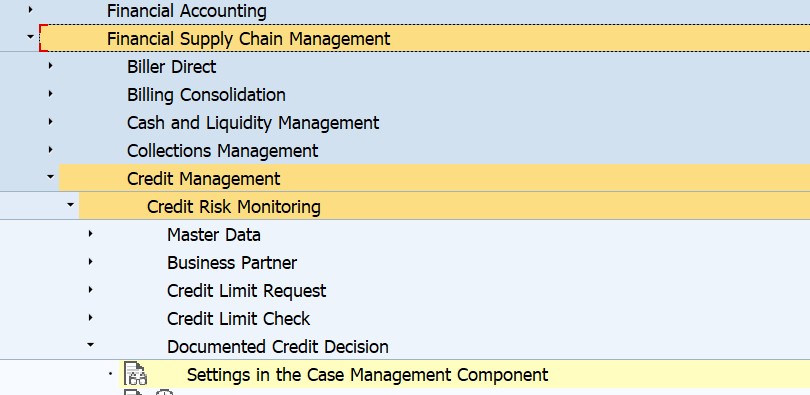

Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Define Case Type for Documented Credit Decision

Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Settings in the Case Management Component.

The menu item contains links to the settings of the main parameters of Case Type (such as: range of numbers, attributes, statuses, etc).

The algorithm of automatic filling the attributes of the Documented Credit Decision:

Picture 2. An example of a Documented Credit Decision

Action 2 « Processing of Documented Credit Decision by Credit Analyst».

After the Documented Credit Decision is created, the credit controller must process it.

The transition to the Documented Credit Decision is described by link: https://help.sap.com/erp2005_ehp_08/helpdata/en/13/d704dbcab04881ba70794d5b52ef93/content.htm?loaded...

In the process of processing a Documented Credit Decision, the credit analyst performs the following actions:

* If this is allowed by the reconciliation scheme, the credit analyst can release the sales order. In this case, the sales order will be released, and the Documented Credit Decision will set the status specified in the setting:

* In case of rejection of the sales order, the credit analyst must fill out the 'Reason for Rejection'. In this case, the sales order will be remains blocked, and the Documented Credit Decision will set the status specified in the setting:

Picture 1 schematically shows the process of create and approve Documented Credit Decision.

Picture 1. Create and approve Documented Credit Decision

Action 1 «Automatic creation of a Documented Credit Decision».

Configuration in the system in which SD is running:

Initiating the creation of a Documented Credit Decision occurs if a sales order has been blocked (VBAK-CMGST = ‘B’) because of a failed credit check. The method call CL_UKM_CLIENT_DCD=>MAINTAIN_DCD initiating the creation of a Documented Credit Decision are carried out in BADI_SD_CM=>FSCM_COMMITMENT_UPDATE_ORDER (in the case of using the implementation UKM_SD_FSCM_INTEGR1 "Connection of SD Documents to SAP Credit Management"). In the method CL_UKM_CLIENT_DCD=>MAINTAIN_DCD prepares data SD module and send it to the module FSCM-Credit management with service DocumentedCreditDecisionERPBusinessTransactionDocumentNotification_Out (exist BADI UKMRSE_3_DCD_MNTNO «BAdI: Sending a Documented Credit Decision» which extends this interface).

- In BADI UKM_R3_ACTIVATE in the DCD_ACTIVE method set the value of the parameter E_DCD_ACTIVE = 'X'.

Configuration in the system in which SAP Credit Management is running

SAP Credit Management uses the Case Management component as the technical basis for processing the documented credit decision. The Documented Credit Decision data is stored in the UKM_DCD_ATTR table.

Necessary setting:

- Select the Case Type to be used to automatically create a Documented Credit Decision.

Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Define Case Type for Documented Credit Decision

- General setting of Case Type.

Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Settings in the Case Management Component.

The menu item contains links to the settings of the main parameters of Case Type (such as: range of numbers, attributes, statuses, etc).

The algorithm of automatic filling the attributes of the Documented Credit Decision:

Picture 2. An example of a Documented Credit Decision

- Case Id. Internal number of Documented Credit Decision

- Card type (constant: DCD).

- It is not filled in automatically.

- It is not filled in automatically.

- Filled with the value "Open/New".

- Planned Close Date. The planned processing date for Documented Credit Decision. By default, this is filled with the creation date.

- Business Partner. The attribute is copied from the sales order.

- Credit Segment. The credit segment is defined based on the Credit control Area attribute of the sales order (VBAK-KKBER).

- Sales Document. The attribute is copied from the sales order.

- Document Status. The attribute is copied from the sales order.

- Case Type. The name of the Case Type, which is defined to automatically create a Documented Credit Decision

- External reference. The attribute is copied from the sales order. It is not filled in automatically.

- Escalation Reason. It is not filled in automatically.

- Credit Analyst. To automatically fill in the Credit Analyst attribute, you must add a relationship «Managed in Credit Management By» between the business partner of the buyer and the business partner of the credit analyst. Herewith credit analysts need to be created as Business Partners (BPs) as a Person with the Employee role. In the Employee role, you will find a section to maintain the SAP user ID. More details exist at the note 2656921 - "FSCM: How to maintain Credit Analyst?".

- Person Responsible.

- The system allows for different segments and risk classes to specify the number of approvers (up to four) for the Documented Credit Decision depending on the amount of the Sales Order / Delivery.Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Define Approval Process

- Risk Class. Copied from the business partner master record (the "Risk Class" attribute of the UKM000 "SAP Credit Management" role).

- Open Credit Amount. Open amount of the document in the segment currency.

- Checked Credit Value. The logic of filling the field «Checked Credit Value» is described in the note 2473178 - SAP Credit Management: Checked Credit Value in DCD is not the total value of the sales order:

- The currency segment.

- Bookmark «Notes». A message that was generated when a credit check on a Sales order or Delivery failed.

- Bookmark «Linked Objects». Link to the document that initiated the creation of the Documented Credit Decision (Sales order or Delivery) and on the PDF Snapshot.

- If SD and FSCM-Credit Management are run on different systems, then in the system in which FSCM-Credit Management is started, you need to configure business objects.Create and assign PDF Form to of Case Type is carried out in the setting:Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Assign Logical System to the Element Types for Business Objects

Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Define Derivation of Element Types

PDF Snapshot.

A snapshot is a form containing the data on which a negative credit decision was based.

Create and assign PDF Form to of Case Type is carried out in the setting:

Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → PDF Form for Snapshot

Also with help BADI UKM_DCD_SNAPSHOT_DATA possible change or enhance the contents for the snapshot of a documented credit decision. It is called before the system creates the snapshot.

- Bookmark «Log». History of attribute changes.

- There are the following BADIs with which you can change the algorithm for generating DCD:

- UKM_SE_SPOT_DCD «Acceptance of a Documented Credit Decision». With this BAdI you can change the contents of a documented credit decision. It is called in the inbound processing of the following enterprise service: DocumentedCreditDecisionERPBusinessTransactionDocumentNotification_In

- UKM_DCD_MAINTAIN « Attributes of the Documented Credit Decision». You can use this BAdI to adapt the attributes of the documented credit decision to meet your requirements. It is called when you create or change a documented credit decision.

Action 2 « Processing of Documented Credit Decision by Credit Analyst».

After the Documented Credit Decision is created, the credit controller must process it.

The transition to the Documented Credit Decision is described by link: https://help.sap.com/erp2005_ehp_08/helpdata/en/13/d704dbcab04881ba70794d5b52ef93/content.htm?loaded...

In the process of processing a Documented Credit Decision, the credit analyst performs the following actions:

- Check availability and approve Credit Limit Request. The transition is carried out by the button Credit Limit Request.

- Check, Release, or Reject Sales Document.

A credit analyst must perform one of the following actions:

* The function allows you to re-check the credit limit for a sales document.Example of use function from help.sap.com:

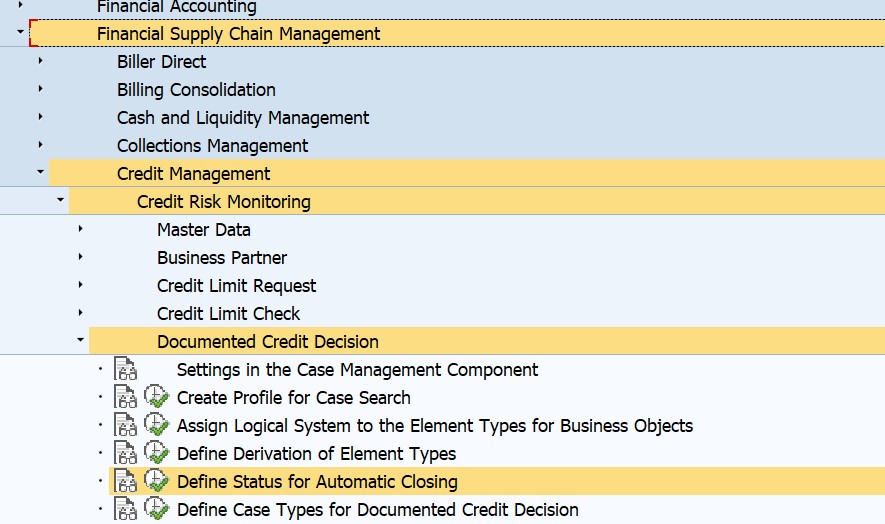

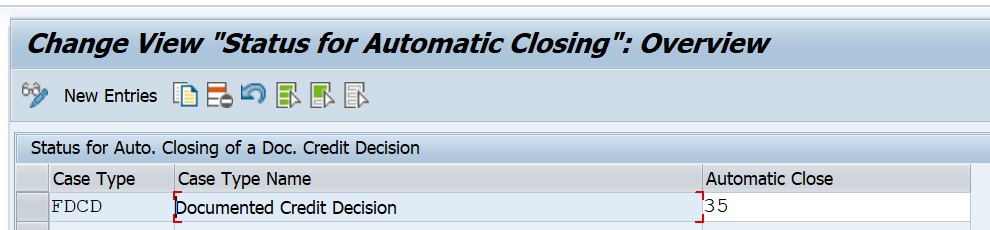

* If this is allowed by the reconciliation scheme, the credit analyst can release the sales order. In this case, the sales order will be released, and the Documented Credit Decision will set the status specified in the setting:

- Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Define Status for Automatic Closing

* In case of rejection of the sales order, the credit analyst must fill out the 'Reason for Rejection'. In this case, the sales order will be remains blocked, and the Documented Credit Decision will set the status specified in the setting:

- Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Define Status for Automatic Closing

- The description of operations check, release and reject Sales Document is described by reference:https://help.sap.com/erp2005_ehp_08/helpdata/en/95/22fb56efff4910a083706afe62c5e1/content.htm?loaded...

- Mass processing Documented Credit Decision.

- In a SCASE transaction, you can massively change the values of the Documented Credit Decision attributes.

The list of attributes of the Documented Credit Decision available for a mass change is specified in the Customizing:Financial Supply Chain Management → Credit management → Credit Risk Monitoring → Documented Credit Decision → Create Profile for Case Search

The description of mass processing is described by reference:

https://help.sap.com/erp2005_ehp_08/helpdata/en/3e/e4fa79c7b94901b626bf127c6a732f/content.htm?loaded... - Sending a Snapshot.

- A credit analyst can send a PDF Snapshot to a customer who explains why the sales document was blocked.The description of PDF Snapshot is described by reference:https://help.sap.com/erp2005_ehp_08/helpdata/en/d5/a8d0da83354e6aaa2a532e8cb52048/content.htm?loaded...

- Complying with the Approval Process:

- The system allows you to configure the number of conciliators Documented Credit Decision depending on the amount of sales document.The description of Complying with the Approval Process is described by reference:https://help.sap.com/erp2005_ehp_08/helpdata/en/95/15a77586b745dca112c213c63a5409/content.htm?loaded...

- SAP Managed Tags:

- SAP Financial Supply Chain Management,

- FIN Treasury

11 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

aATP

1 -

ABAP Programming

1 -

Activate Credit Management Basic Steps

1 -

Adverse media monitoring

1 -

Alerts

1 -

Ausnahmehandling

1 -

bank statements

1 -

Bin Sorting sequence deletion

1 -

Bin Sorting upload

1 -

BP NUMBER RANGE

1 -

Brazil

1 -

Business partner creation failed for organizational unit

1 -

Business Technology Platform

1 -

Central Purchasing

1 -

Charge Calculation

2 -

Cloud Extensibility

1 -

Compliance

1 -

Controlling

1 -

Controlling Area

1 -

Data Enrichment

1 -

DIGITAL MANUFACTURING

1 -

digital transformation

1 -

Dimensional Weight

1 -

Direct Outbound Delivery

1 -

E-Mail

1 -

ETA

1 -

EWM

6 -

EWM - Delivery Processing

2 -

EWM - Goods Movement

3 -

EWM Outbound configuration

1 -

EWM-RF

1 -

EWM-TM-Integration

1 -

Extended Warehouse Management (EWM)

3 -

Extended Warehouse Management(EWM)

7 -

Finance

1 -

Freight Settlement

1 -

Geo-coordinates

1 -

Geo-routing

1 -

Geocoding

1 -

Geographic Information System

1 -

GIS

1 -

Goods Issue

2 -

GTT

2 -

IBP inventory optimization

1 -

inbound delivery printing

1 -

Incoterm

1 -

Innovation

1 -

Inspection lot

1 -

intraday

1 -

Introduction

1 -

Inventory Management

1 -

Localization

1 -

Logistics Optimization

1 -

Map Integration

1 -

Material Management

1 -

Materials Management

1 -

MFS

1 -

Outbound with LOSC and POSC

1 -

Packaging

1 -

PPF

1 -

PPOCE

1 -

PPOME

1 -

print profile

1 -

Process Controllers

1 -

Production process

1 -

QM

1 -

QM in procurement

1 -

Real-time Geopositioning

1 -

Risk management

1 -

S4 HANA

1 -

S4-FSCM-Custom Credit Check Rule and Custom Credit Check Step

1 -

S4SCSD

1 -

Sales and Distribution

1 -

SAP DMC

1 -

SAP ERP

1 -

SAP Extended Warehouse Management

2 -

SAP Hana Spatial Services

1 -

SAP IBP IO

1 -

SAP MM

1 -

sap production planning

1 -

SAP QM

1 -

SAP REM

1 -

SAP repetiative

1 -

SAP S4HANA

1 -

SAP Transportation Management

2 -

SAP Variant configuration (LO-VC)

1 -

SD (Sales and Distribution)

1 -

Source inspection

1 -

Storage bin Capacity

1 -

Supply Chain

1 -

Supply Chain Disruption

1 -

Supply Chain for Secondary Distribution

1 -

Technology Updates

1 -

TMS

1 -

Transportation Cockpit

1 -

Transportation Management

2 -

Visibility

2 -

warehouse door

1 -

WOCR

1

Related Content

- RISE with SAP Advanced Logistics Package in Supply Chain Management Blogs by SAP

- Transforming Your Supply Chain: Introducing RISE with SAP Advanced Logistics Package in Supply Chain Management Blogs by SAP

- RISE with SAP advanced asset and service management package in Supply Chain Management Blogs by SAP

- RISE with SAP advanced PLM package in Supply Chain Management Blogs by SAP

- The Essential Role of Adverse Media Monitoring in Compliance and Risk Management in Supply Chain Management Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |