- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Configuring Canada Year End statement (T4 form) on...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

INTRODUCTION

In continuation to the previous document for Configuring Singapore Year End statements on ESS, the below document has been created to highlight the steps required to configure year end statement - T4 for Canada on ESS.

FORM-T4 OVERVIEW

T4 form is the year-end form for Canada which is used to report the amount paid to the employees and the statutory deductions that have been withheld from the employees over the given tax year during the course of his / her employment with the organization.

The tax year for Canada begins from January 1 to December 31.

PRE-REQUISITES

In order to configure year end statements on ESS, below are the steps that need to be taken care of. Detailed configuration will be shared in the later section.

- Webdynpro components- Ensure the required ESS applications have been activated

- Features- Configure the country specific feature in line with client requirements (if required)

- Payroll results exist for the given year

- Year-end reports have been executed for the given year in live run and ESS feature is ON using the run-viewer. In case this box is not checked in the report, the form will not be displayed on the portal.

- User id exists for the given employee, i.e., there is a valid record in the IT0105 (communications) subtype 0001 (System user name (SY-UNAME). (For testing purposes, assign the test user id to the required eligible employee)

CONFIGURATION

WEBDYNPRO

Below are the package details that are being used to enable ESS services. Ensure that these services are active. The package and details can be checked via t-code SE80 to call ABAP development workbench.

Form | Package | Webdynpro Application Configuration | Web Dynpro Application |

T4 Form | PAOC_ESS_REP_CA | HRESS_AC_REP_AU_PS | HRESS_A_REP_AU_PS |

Tcode SICF can be used to check if the services are active or not.

For some of the clients, the form may be displayed just by activating the above services and ensuring other pre-requisites are being taken care of. However, in some cases, the form may still not be displayed even after the 'ESS On' checkbox has been marked. Changes were provided via Note 2095767 in order to resolve the same. However SAP has come up with an alternate where Variant can be customized. In such cases, the additional solution is to implement the note 2166547#, which involves creation of feature – 07TXF for maintaining variant for tax form re-print on ESS.

# Details of the note can be checked via marketplace

FEATURES

Below feature may need to be configured for Canada, if activating the ESS services do not produce the required results. As shared in the above section, this can be done by implementing the note 2166547

- 07TXF - Maintain variant for tax form re-print on ESS

The given feature uses RPCYERK1 report to fetch values. Create a custom variant suiting your requirements and use that variant as the return value.

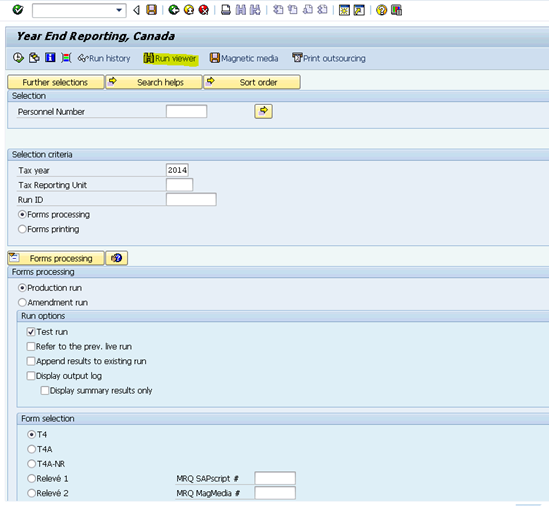

PROCESS

Execute country year-end report at backend as per BAU process (RPCYERK0); uncheck the box for test run to update the cluster.

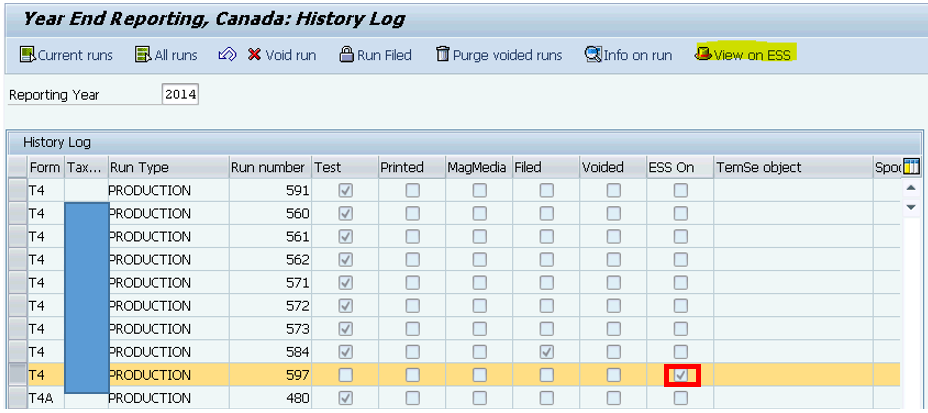

Once all the steps have been taken care of and the report has been executed in live run (test run unchecked), go to ‘run viewer’ and ensure the run number is marked as ‘View on ESS’

In case this box (marked in red) is not checked in the report, the form will not be displayed on the portal.

TESTING ESS SERVICE

T Code – SE80. Select the given package and the corresponding application configuration. Right click on the application configuration and click on test to view the output.

OUTPUT

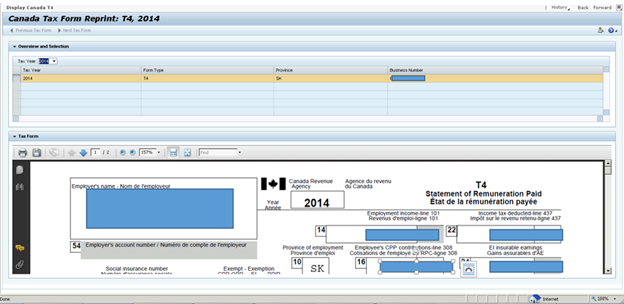

Original Form

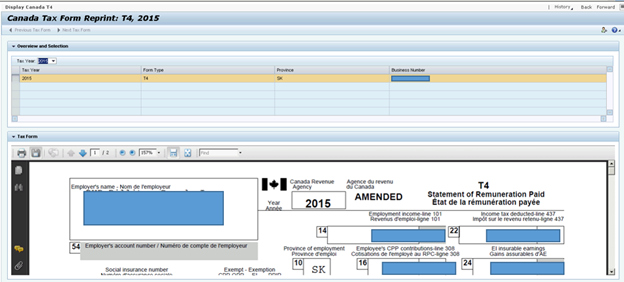

Amended Forms

Unlike year end forms for Singapore, for Canada only the latest form will be displayed. In case there has been amendment to the T4 form, the amended form will be displayed on the portal.

- SAP Managed Tags:

- HCM (Human Capital Management)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- New Installation of SAP S/4HANA 2023 FPS1 – Part 2 – Installation in Enterprise Resource Planning Blogs by SAP

- The configuration for E-BRS is complete, but there is an error while uploading the statement. in Enterprise Resource Planning Q&A

- The configuration for E-BRS is complete, but there is an error while uploading the statement. in Enterprise Resource Planning Q&A

- Historical Balances Migration in SAP S/4HANA Cloud, Public Edition in Enterprise Resource Planning Blogs by Members

- Decoding Data Types and Security in SAP Cloud Services in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 5 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |