- SAP Community

- Products and Technology

- Financial Management

- Financial Management Q&A

- Asset transfer ABUMN - partial transfer of wrongly...

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Asset transfer ABUMN - partial transfer of wrongly added acquisition value

- Subscribe to RSS Feed

- Mark Question as New

- Mark Question as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

4 weeks ago

Dear SAP experts

I have a question regarding the partial transfer of an asset using ABUMN.

In 2019 an asset was created (laptop). Use life : 3 years.

In 2023 (asset is already fully depreciated – NBV = zero), a new asset was created for the replacement of this old asset. But when posting the invoice, the old asset was used instead of the new one. So the acquisition value on the old asset increased with the value of the new asset. But because the initial asset was already fully depreciated, the new value did not depreciate.

Now I want to transfer the new value to the new created asset. How can I do this (partial) transfer ? I only want to transfer the new value to the new asset and keep the original value on the old asset.

When I try to do the partial transfer, using the new value, also a part of the accumulated deprecation will be transferred and that is not the purpose. I only want to transfer the new acquisition value, which has not been depreciated yet. Original acquisition value and accumulated depreciation (same amount because fully depreciated) should remain on the old asset.

Thank you for your input ! Much appreciated !

- SAP Managed Tags:

- SAP ERP,

- FIN (Finance),

- FIN Asset Accounting

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

I could not see the screenshot for AW01N which provided before. If I remember correctly, the acquisition posted on old asset is on fiscal year 2023. Would you please try to post the transfer with the same date of the acquisition posting posted on the old asset and then check the simulation result.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Report Inappropriate Content

Hello @beam_liang , can you check my reply below ? thanks !

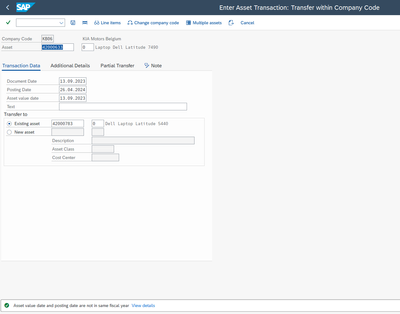

when I use parameters below, I get the message that asset value date and posting date are not in the same fiscal year. Simulation does not work.

Document date : 13.09.2023

Posting date : 26.04.2024

Asset value date : 13.09.2023

When I want to change the posting date into 13.09.2023 (same as asset value date), then I get the message that posting is not possible because the period 09 2023 is not open (fiscal year 2023 is closed) and also that the amount is too high. Simulation does not work either.

This is the message regarding the amount that is too high :

Diagnosis

The amount entered is higher than the amount 1.142,59 of acquisitions from previous years on the asset in depreciation area 01, based on the asset value date and the posting period.

Procedure

Check the retirement amount, the asset value date and the transaction type.

If new acquisitions were posted to the asset in the year of retirement, the retirement of the new acquistions has to be posted separately using a different transaction type.

- We are getting error of 'Do not post to equity group zzz' while doing tranfer posting in MIGO in Financial Management Q&A

- Climate Change Risk Scenario Analysis in SAP PaPM - 1/3: Climate Risk Management Introduction in Financial Management Blogs by SAP

- SAP Multi-Bank Connectivity (MBC) – Meaning-Legacy Application-Payment process in Financial Management Q&A

- Bank-to-Bank Transfer Web Service? in Financial Management Q&A

- SAP PaPM Cloud Universal Model: Deploy your environment via Manage Containers in Financial Management Blogs by SAP

| User | Count |

|---|---|

| 12 | |

| 3 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.