- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- New capitalized date Change in AS01 and recalculat...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Scenario: New change capitalization on date from present date to past date and re-calculate the depreciation which will post remaining depreciation on 13th month.

For example:

•Capitalized on new (Past) date: 06/30/2012

•Capitalized on old(present) date: 11/30/2012

Prerequisites:

1. Go to OA02 - substitutions in Mass change.

2. Again go to OA02 and enter your substitution and save

3. Go to AS02 and Enter the New capitalization on date in Ordered on Field for all selected assets for temporary purpose,

later need to delete the Ordered on date, once change to new capitalization date

4. Go to AR01 T code - Call Asset List

5. AR31 - Edit Work list.

6. Enter the work list number which is already created in AR01 T. Code and enter the parameters like above.

7. T code: AS02 to change Asset Note: Check whether new capitalization change or not,

if yes and remove the Dates at Ordered on field for all selected assets.

8. Run the Depreciation - AFAB

9. Final we can run the t code AW01N to see Test results for selected assets.

Proposed Solution to business:

Based on requirement, we cannot change Capitalized on date in asset master and it will not allowed changing the same.

So based on that, I have Proposed Solution to business through substitutions and I have run Successful thorough Substitutions.

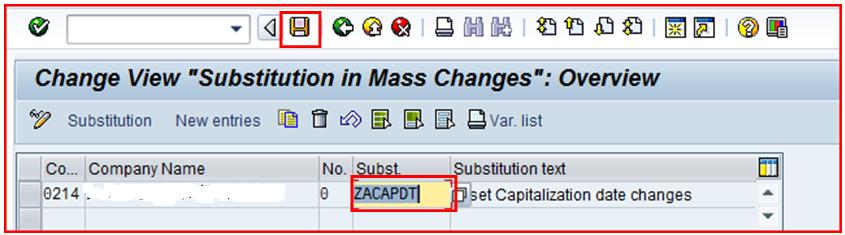

- Go go OA02 - substitutions in Mass change

Click on substitutions

Click on create Substitutions

And enter the Substitution Description like above.

Click on Step and select Table - ANLA and field-AKTIV and press enter.

And enter the Step Description like above and press enter.

Click on Prerequisite ,Double click on Company code and select the = icon

Click on Constant and enter your company code and press enter

Click on Substitutions and press F4 at Capitalization on field and select Table - ANLA and field- BSTDT , press enter and Save.

2. Again go to OA02 and enter your substitution and save

3. Go to AS02 and enter asset

4. Go to AR01 T code - Call Asset List

Enter above parameters and click Multiple selection button

First copy selected assets and Click on past button and click on execute button

5. AR31 - Edit Worklist

Enter the parameters and click Multiple selection button

First copy selected assets and Click on past button and click on execute button

Click on create worklist

Enter WL name and select the Change asset field and click on continue button

Press F4 at substitution and enter the substitution name: ZACAPDT and Click on continue ![]()

Like above work list number will create and please note the same.

6. Enter the worklist number which is already created in AR01 T. Code

And enter the parameters like above. And click on execute button

Select the work list, click on Release work list, and click refresh button.

7. T code: AS02 to chane Asset.

Check whether new capitalization change or not, if yes and remove the Dates at Ordered on field for all selected assets.

And change Ordinary depreciation start date as per requirement like – 06/01/2013 based on new capitalization date.

8. AFAB :- Depreciation Run

Enter the parameters like above and select the List assets, select the Test run check box

Remove the Test run check box, select the List assets, click on execute in background and complete the steps

9. Final we can ring the following t code to see Test results for selected assets

Asset Explorer - AW01N

In above screen, you can see the in 13 month depreciation posted successfully for adjusting depreciation values.

Please provide your vaulale suggestions on this document for changing any thing.

Hope this blog will helpful to All

Best Regards

Sudharshana Vamsi

- SAP Managed Tags:

- FIN Asset Accounting

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Recalculate depreciation S/4 Hana Cloud public in Enterprise Resource Planning Q&A

- Field inventory management (FIM) in the Medical Device Industry – Create capitalized assets and fulfill demo requests orders from sales representatives in Enterprise Resource Planning Blogs by Members

- SAP Asset Accounting End Year Close in Enterprise Resource Planning Blogs by Members

- Change Useful life of an expired asset in Enterprise Resource Planning Q&A

- Asset depreciation starting from capitalization date For Vietnam Localization in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |