We all are customers for many companies. As Customer, we

1 Can have multiple Product Portfolio

2 Can have multiple Interaction modes

3 Changes in profile

4 Require better, faster, and cheaper services

5 I am Unique

However we all face lot of problems. Let’s take a simple example of our everyday’s life.

We all use banks for various activities. Moreover we like to have 1 or 2 banks for every banking need instead of 10 banks to remember different banks for every service. E.g. Loans, Credit Card, Saving account, Deposits, Lockers etc. There is a classic example of lack of master data within a bank itself. I am customer of a reputed bank for saving account, shares trading account as well as credit card. All three accounts are even linked to my net banking. Bank automatically takes my credit card bill from my saving account. Also Bank used to take money automatically from my saving account for Shares purchases/sell. Thus bank was completely aware of my all accounts, their linking and their single owner. However to my horror when I changed my address in my saving account, I thought the bank will automatically change my credit card and trading account address as well. I guess everyone will agree on this. However this was not the case as my bank told me that I have to change address of everything separately. So I have a problem here that has to change everything separately and also miss out some important notices. Similarly bank has problem that it might loose some postal costs and bills. Now I had a valid reason to freak out at bank.

All this is because of small reason that my bank doesn’t maintain single version of customer master data.

As Customers we all face these kind of problems because organizations are having poor Customer master data :

1 Every system creates own customer master data even I am customer for another service. Eg we are customer for bank account, however bank ask you all papers again for credit card ?

2 Address change, in same example, if I change my address in credit card, I expect the same should be done automatically for bank account. However this is not happening even when credit card is linked to bank account ?

3 Even when I am their customer for credit card, I get regular calls from their marketing department to take their credit card ?

4 The flight attendant ask for seating preference in flights, smoking/non-smoking rooms in hotels, food preferences in hotel and flights even when we are platinum card customers ?

5 Every time I have to fill same forms in hotel even when we are platinum card customers ?

6 Companies take orders and payment without verifying stock. Later we have to go through delay in getting money back or delayed product delivery?

Similarly, companies also have losses below

1 Loss of Customer

2 Lose contact with Customer

3 Delay in getting payments

4 Waste of Postage casts

5 Waste of marketing efforts

6 Exposure to extended relationships with fraudulent customers

7 Mistreat customer based on inaccurate calculation of customer value

8 Frauds

9 Can’t identify source of fraud

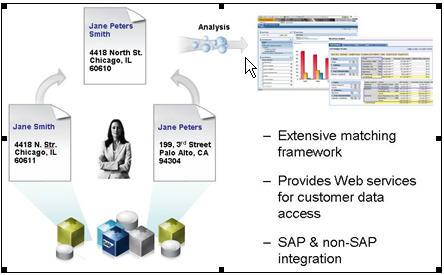

Now, How SAP CDI can solve customer master data problems for companies

1 Is the process of consolidating and managing customer data from all available sources

2 Ensures that all relevant departments in the company have constant access to the most up-to-date and complete view of customer data available

"

"

(CDI - Source SAP)

Benefits from MDM solution in place

1 360 degree view of Customers

2 Winning new customers and faith of existing customers

3 Keeping existing customers

4 Selling more to existing customers

5 Saving marketing efforts and costs

6 Improving customer service and also reducing customer complaints

7 Able to prevent Frauds

8 Saving in Maintenance of master data across organization

9 Decreasing time to market and Improving market share

SAP-CDI Benefits

1 Low Impact

2 Real-Time

3 Flexible

4 Scalable

5 Easy to Deploy

Company : SATYAM Computer Services Limited

Role: Projects Lead / Project Manager

Above shared views are my personal views and might not synchronize with my company views.