- SAP Community

- Products and Technology

- Additional Blogs by SAP

- How starter kits meet IFRS - IAS 27 (part 2)

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

This series of blogs describes how SAP® BusinessObjectsTM Financial Consolidation, Starter Kit for IFRS has been configured to meet International Financial Reporting Standards (IFRS).

In our previous blogs, we have covered the following topics:

- Brief overview of SAP BusinessObjects Financial Consolidation, Starter Kit for IFRS (How Starter kits Meet IFRS requirements - Introduction)

- Presentation of consolidated financial statements according to How Starter Kits meet IFRS - IAS 1 and How Starter Kits meet IFRS - IAS 7

- Translation of a foreign entity's financial statements as part of the consolidation process following the principles set out in How Starter Kits meet IFRS - IAS 21

- Current consolidation process How starter kits meet IFRS - IAS 27 (part 1)

In this blog, we will carry on our analysis of IAS 27 with a focus on the changes in the consolidation scope.

The recent revision of IFRS 3 and IAS 27 (Business Combinations II) has brought many changes in the way consolidation scope changes should be accounted for. The key principle is that only a change in control - but every change in control - is a significant event. Changes in control means: obtaining control over an entity or losing control of an entity. Once control has been achieved, any subsequent transactions that do not result in a loss of control are accounted for as equity transactions.

Loss of control and equity transactions are under the scope of IAS 27 whereas business combinations are covered by IFRS 3 (see How starter kits meet IFRS - IFRS 3). In this blog, we will focus on how to handle a loss of control.

Accounting principles

The loss of control of a subsidiary results in recognizing a gain or loss in the income statement. When the parent company loses control but retains an interest, it triggers recognition of gain or loss on the entire interest:

- a gain or loss is recognized on the portion that has been disposed of;

- a further gain is recognized on the interest retained, being the difference between the fair value of the interest and its book value.

Both are recognized in the income statement.

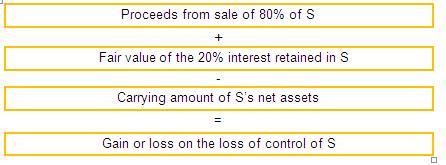

For example, if a parent company sells 80% of its former wholly-owned subsidiary S, retaining a 20% interest, gain or loss will be calculated as if the 100% interest has been sold:

When a parent loses control of a subsidiary, the parent should account for all amounts previously recognized in Other Comprehensive Income (OCI) in relation to that subsidiary on the same basis as would be required if the parent has directly disposed of the related assets or liabilities.

Therefore, if a gain or loss previously recognized in OCI would be reclassified to profit or loss on the disposal of the related assets or liabilities, the parent reclassifies the gain or loss from equity to profit or loss (as a reclassification adjustment) when it loses control of the subsidiary .

This "recycling process" applies to fair value reserve, hedging reserve and foreign currency translation reserve.

If the residual interest in the former subsidiary gives a significant influence or a joint control, the acquisition method is applied to this residual interest as if a new associate or joint-venture has been acquired.

In the starter kit

In SAP BusinessObjects Financial Consolidation, loss of control can result:

- in an entity leaving the scope (when the parent company does not keep any interest or when the remaining interest is under the consolidation threshold)

- in a change in consolidation method (subsidiary becoming an associate)

- in a change in consolidation rate (subsidiary becoming a joint-venture)

Outgoing entities

In the consolidation scope, outgoing entities are identified as "outgoing at the opening" or "outgoing during the period" depending on whether data are entered or not for the period. Data entered, if any, must correspond to the period lasting from the beginning of the year to the date when control is lost so that income and expenses of the subsidiary are included in the financial statements until the date when the parent ceases to control the subsidiary (as required by IAS 27).

All of the outgoing company's data at the date of the disposal is automatically reversed on a dedicated flow (F98). For accumulated OCI that has to be recycled, this flow is regarded as a reclassification adjustment in the statement of comprehensive income.

After gain or loss on disposal has been calculated, a manual journal entry has to be booked to adjust the gain or loss recognized in the parent's separate financial statements.

Changes in the consolidation method

In SAP BusinessObjects Financial consolidation, changes in consolidation method are handled as follows:

- Opening balances are reversed on the "old method" flow (F02)

- Opening balances are reloaded on the "new method" flow (F03) with the new consolidation method applying

As regards a change from full consolidation to equity method, it means that:

- the subsidiary's assets and liabilities are reversed and "replaced" by the line "Investments in associates"

- the equity accounts are reversed on the old method flow and reloaded on the new method flow taking into account the consolidation rate of the associate; allocation between group and indirect non-controlling interests (if any) is made on this flow according to the new interest rate

Any goodwill existing at opening is not reloaded on the new method flow. Indeed, it is part of the assets sold and is, therefore, taken into account to calculate the profit on "disposal". A new goodwill has to be calculated as part of the acquisition method process of the associate and declared by a manual journal entry using the new method flow.

Accumulated OCI at opening is automatically reclassified to retained earnings on the new method flow like for incoming entities. Reclassification adjustments displayed in the comprehensive income take into account the old method flow because change in consolidation method is handled as if the subsidiary was disposed of.

Manual journal entries are necessary to:

- adjust the gain or loss recognized in the parent's separate financial statements on the interest sold

- recognize a gain or loss on the remeasurement of the interest retained at fair value

- remeasure net identifiable assets of the new associate to fair value (as if it was an incoming entity)

- declare goodwill.

Change in the consolidation rate (subsidiary becoming a joint-venture)

In SAP BusinessObjects Financial Consolidation, the impact of the change in consolidation rate (from 100 % to x% in this case) is posted on a dedicated flow (F04).

Manual journal entries are similar to those explained above for a subsidiary becoming a joint-venture. However, as a change in consolidation rate - even when it results in a change in method from full to proportionate consolidation - is not regarded as a change in scope by the consolidation engine, additional manual journal entries may be necessary. In particular, recycling OCI is not made automatically.

What's next ?

In the How starter kits meet IFRS - IAS 27 (part 3), we will focus on equity transactions.

- Retained Earnings Account in Financial Management Blogs by Members

- FAQ on Upgrading SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- What you need to know about Finance in SAP S/4HANA Cloud, Public Edition in Technology Blogs by SAP

- SAP "EHS" Product Structure / R/3 <=> S/4 in Enterprise Resource Planning Blogs by Members

- Review and Adapt Business Roles after a Major Upgrade in the SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP