- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Update Certificazione Unica GEP File for Year 2023...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

03-02-2023

10:49 PM

An amended layout of the withholding tax single certification (Certificazione Unica) is required by the Ministry of Finance of Italy for declarations made for the year 2023.

If you currently not intend to upgrade to version 10 FP 2208 HF01 or higher of SAP Business One and SAP Business One, version for SAP HANA, you can update the previous layout of the withholding tax single certification to a new one for year 2023 using the steps described in this blog, including the update of header and tax date indicators.

Let's start

There are two GEP files for different databases: MS SQL and SAP HANA. The following procedure takes MS SQL as an example, and you will get a new GEP file for year 2023 for the database of MS SQL.

This solution can serve you next year as well if no other major changes will be required, and if you do not intend to go for immediate version upgrade.

More information can be found in SAP Notes: 3301826 and 3303978

and in the tax authorities site: https://www.agenziaentrate.gov.it/portale/web/guest/certificazione-unica-2023/infogen-certificazione...

Credits to: libin.yan

If you currently not intend to upgrade to version 10 FP 2208 HF01 or higher of SAP Business One and SAP Business One, version for SAP HANA, you can update the previous layout of the withholding tax single certification to a new one for year 2023 using the steps described in this blog, including the update of header and tax date indicators.

Let's start

There are two GEP files for different databases: MS SQL and SAP HANA. The following procedure takes MS SQL as an example, and you will get a new GEP file for year 2023 for the database of MS SQL.

- Download the official report template (PDF file) from the tax authority site (e.g. Modello sintetico CU 2023 - pdf). From this file you can find the header and tax date indicators for year 2023. Use your tool to capture them and save them as image files. It is recommended to save them in PNG format.

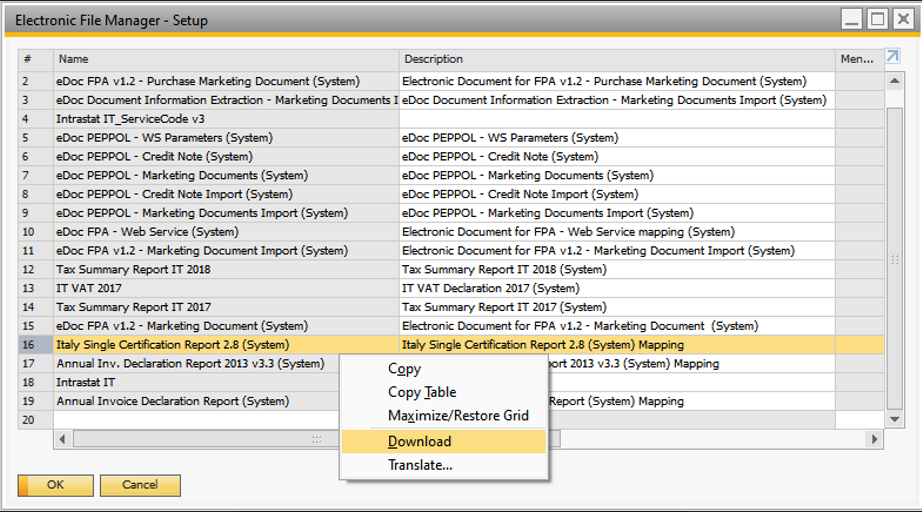

- Download the 2022 GEP file in the Electronic File Manager - Setup window (Administration → Setup → General → Electronic File Manager). Right-click row Italy Single Certification Report 2.8 (System) and choose Download. You now have the GEP file of version 2.8.

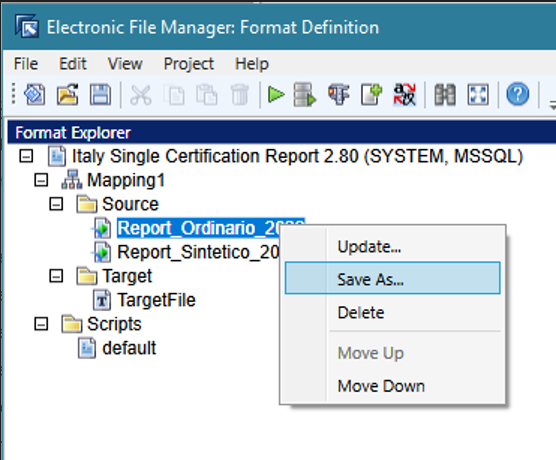

- Extract RPT files - Start the electronic file manager to open the 2022 GEP file downloaded in step 2. In the format explorer, you can see two RPT files: Report_Ordinario_2022 and Report_Sintetico_2022. Right-click each RPT file and choose Save As... to save them as the files to which you will make the changes.

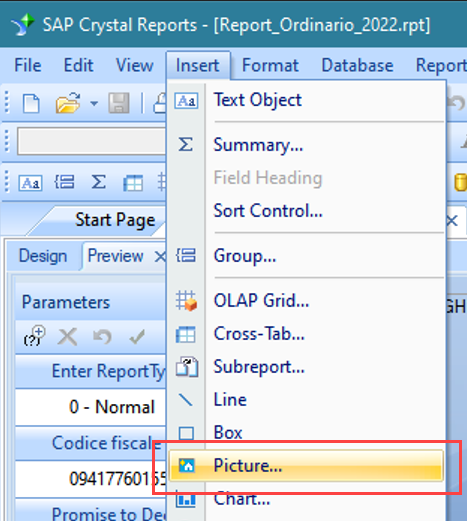

- Replace with new header of year 2023 – start SAP Crystal Reports to update the two files saved in step 3.

- Open the file saved from Report_Ordinario_2022.rpt, insert the images saved in step 1, and use them to cover the 2022 header on pages 1 and 2, and the 2022 tax date indicators on page 2. Save this RPT file as a new file Report_Ordinario_2023.rpt and close it.

- Open the file saved from Report_Sintetico_2022.rpt, insert the images saved in step 1, and use them to cover the 2022 header and tax date indicators on page 1. Save this RPT file as a new file Report_Sintetico_2023.rpt and close it.

- Package RPT into GEP - Return to the electronic file manager with the 2022 GEP file.

- Right-click Report_Ordinario_2022, choose Update, and select the new file Report_Ordinario_2023.rpt in step 4. A message appears when it is updated successfully. Delete the old file Report_Ordinario_2022.

- Right-click Report_Sintetico_2022, choose Update, and select the new file Report_Sintetico_2023.rpt in step 4. A message appears when it is updated successfully. Delete the old file Report_Sintetico_2022.

NOTE: in the format explorer, the ordinary report (Report_Ordinario_2023.rpt) must be above the simplified report (Report_Sintetico_2023.rpt). You can always use Move Up or Move Down in the right-click menu to change their order.

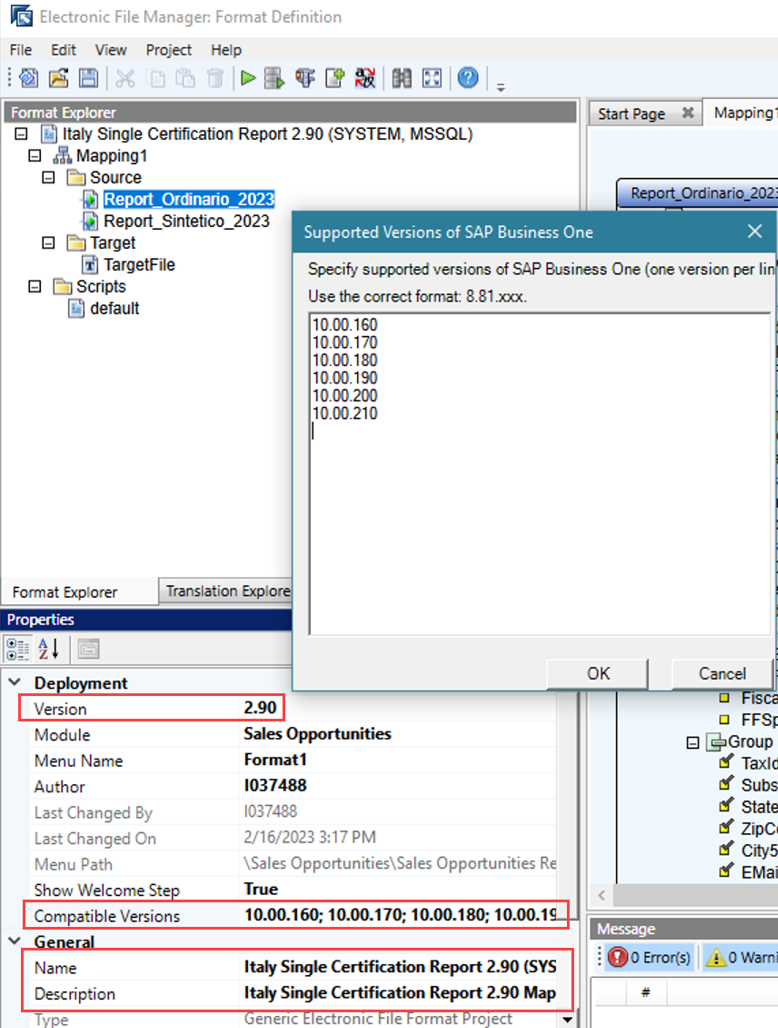

- Increase version - In the format explorer, select the root node (Italy Single Certification Report 2.80 (SYSTEM, MSSQL)), and update the version number to a new one, e.g., 2.9, in three properties: Version, Name, and Description.

NOTE: you can also add new entries in the supported version list, such as 10.00.200, 10. 00.210. However, this is not mandatory.

- Save new GEP file - Save the updated format as follows as a new GEP file, e.g. Italy Single Certification Report 2.9 (System).GEP. Upload this new GEP file to SAP Business One, and you can run the withholding tax single certification for year 2023 with this new format.

This solution can serve you next year as well if no other major changes will be required, and if you do not intend to go for immediate version upgrade.

More information can be found in SAP Notes: 3301826 and 3303978

and in the tax authorities site: https://www.agenziaentrate.gov.it/portale/web/guest/certificazione-unica-2023/infogen-certificazione...

Credits to: libin.yan

- SAP Managed Tags:

- SAP Business One,

- SAP Business One, version for SAP HANA

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

156 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

217 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- ITALY CU Withholding Tax Vendor Form- 2024 UPDATE in Enterprise Resource Planning Q&A

- SAP Business ByDesign – What’s New 24.02 in Enterprise Resource Planning Blogs by SAP

- #COE #BA01 Greece VAT Registration Number not appearing as saved in Italy eInvoice XMLs in Enterprise Resource Planning Q&A

- Sustainability with SAP S/4HANA Cloud, Public Edition 2308 in Enterprise Resource Planning Blogs by SAP

- Highlights of the SAP S/4HANA Cloud, Public Edition 2308 Release in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 10 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |