- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SuccessFactors Employee Central and Compensation I...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

In my previous blog I have covered Time Sheet feature in Employee Central (SuccessFactors Employee Central Time Sheet and Time Valuation) . In this blog we are going to see how Employee Central and Compensation modules are integrated and what features in Compensation would be impacted if Integration with EC is turned on.

Before going deeper let’s have a look at what is Employee Central and Compensation Planning in SuccessFactors.

Employee Central

Employee Central is SAP SuccessFactors Cloud based application. It intend to serve as company’s HR system of record (much similar to SAP PA/OM, Time Off and Time Sheet etc.. features) with ESS and MSS capabilities.

I am not going to cover much about EC as there are many good blogs written by experts on this area.

Compensation Planning

Compensation planning is the process of rewarding employees based on their individual performance and increasing the chances of retaining top performers.

How Compensation works with Employee Central

There are few significant changes from the configuration point of view in compensation module if integration with EC is enabled.

Without EC integration, compensation work sheet uses Employee Profile(EP) as the source to show employee personal data, job data, and salary data. So employee data must be imported through UDF (User Data File).

With EC integration, compensation worksheet uses EC as the source to show employee personal data, job data, and salary data.

Integrating Compensation with Employee Central

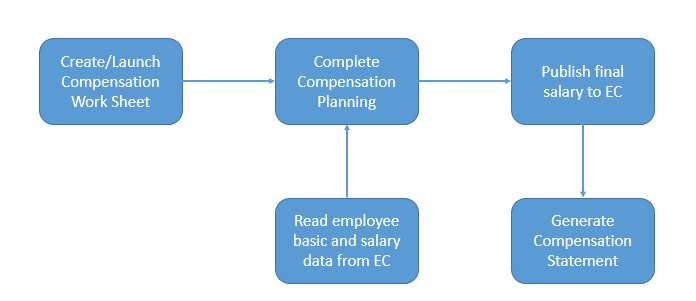

Employee Central-Compensation integration flow can be described as a 4 step process.

Step 1: Preparing compensation plan template for integration

To make the compensation plan template EC enabled, effectiveDate field must be included in comp-config tag. Once this field is included, the template expects all user data to come from Employee Central, so no employee data imports are allowed in compensation. Compensation work sheet reads data from EC which is active as of given effective date.

Remove all references of import-key, as EC enabled template doesn’t accept data from UDF file, so import-key must be removed from the fields if it is used for any field.

Step 2: Define data Source for compensation work sheet:

Fields which are being shown on compensation work sheet is important for compensation planner to take a fair decision.

With EC enabled compensation template now data must come from Employee Central instead of EP and Import file. One to one mapping must be defined between EC fields and compensation work sheet fields.

Below is the sample to define the mapping between EC field and compensation field.

Component Type | Component Type defines EC source entity . Only below possible entities are allowed currently. Job Info Comp Info payComponentRecurring payComponentNonRecurring personalInfo employmentInfo |

Field Name | EC source field name |

It is possible to map either a pay component or pay component group to current annual salary field in compensation.

Example: As per employee pay structure he/she is eligible for below pay components

Pay Components

Basic Salary = 50000 USD Per Annum

Car Allowance = 10000 USD Per Annam

Variable Pay = 10000 USD Per Annam

Pay Component Groups

Annual Fixed Salary = 60000 USD

Annual Variable Pay = 10000 USD

Annual Total Salary = 70000 USD

Based on the business requirement it is possible to map either pay component (either Basic Salary, Car Allowance etc.) Or pay component group (Annual Fixed Salary, Annual Total salary etc.) to current salary field in compensation.

Current Annual Salary in EC Compensation Information

Current Annual Salary in Compensation Worksheet

Step 3 Eligibility Rules and Pay Matrix

To define eligibility criteria ,both EC business rules as well as Compensation eligibility rules must be defined.

Without integration, rules are defined in compensation to determine who is not eligible and for which components he/she is in-eligible.

If integration is enabled, defining eligibility criteria is a two-step process. EC business rules are used to define who is not eligible and compensation module determines for which components he/she is not eligible.

As EC business rules are more powerful, so complex eligibility rules also can be defined without any issue.

Let’s look at the process to define eligibility rules if integration is enabled.

First Step: Define the business rules to exclude the population

Eligibility rules are defined in general to exclude the employees either from the complete compensation cycle or for some components (Merit, Lump sum, Bonus, Stock).

Example: For example employees who belongs to pay grade other than 13 are not eligible to participate in current compensation cycle. In this case define business rule to exclude the population in EC. In EC we only have to define if condition and then condition is always blank for eligibility rules (Then condition is defined in Compensation)

Second Step: Define the in-eligible components

Now it is time to define for which components population coming from EC (in this case employees belongs to pay grade other than 13) are not eligible and this has to be done in Compensation.

All the business rules created in EC now can be seen in Compensation. Here we can specify the components for which employee is not eligible.

Pay Matrix:

A salary pay matrix is a table that defines ranges of pay based on grade level and up to three additional attributes (such as, country, city, job level, and so on). Pay matrix define the minimum, midpoint, and maximum pay levels for each pay grade and are required for compa-ratio and range penetration calculations.

If EC integration is enabled, we can choose to use either EC salary pay matrix or salary pay matrix table defined with in compensation module itself. However it is always good to use EC salary pay matrix table if EC integration is enabled.

To use EC salary may matrix make sure that the associations defined with FO object Pay Range in EC are also defined as attributes in pay matrix in compensation plan template.

FO Object Pay Range in EC

Salary pay matrix attributes in Compensation

Note : Pay Grade should always be the first association in EC Pay range object and no need to define Pay Grade as an attribute in compensation pay matrix as system considers it by default.

Step 4 : Publish Compensation Results to Employee Central

Once the compensation planning is completed it is time to publish the final compensation results back to EC .

To publish the results to EC , mapping must be defined between source field in Compensation and target field in Employee Central.

It is important to define the target EC entity, component code, event reason and effective date event reason to be used to create the new compensation record in EC.

Component Type | Component Type defines EC target entity to which we are writing the data. Only below possible entities are allowed. Comp Info payComponentRecurring payComponentNonRecurring |

Component Code | External code of either paycomponent or paycomponent group |

Event Reason | Event reason to be assigned to new compensation record in EC. |

Effective Date | Start date for new compensation record in EC. |

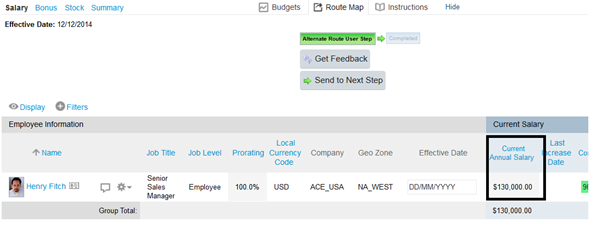

Compensation work sheet with new final salary.

Only completed compensation worksheets can be published to EC. Background job creates new compensation records in EC based on the effective date provided either in XML or in worksheet.

New EC compensation record.

New EC compensation record with event reason ( event reason must be assigned in XML , please refer above table)

Generate Compensation Statements

Once the data is published, statements can be generated so that employee can view the new compensation details.

- SAP Managed Tags:

- HCM (Human Capital Management)

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- SAP Enterprise Support Academy Newsletter April 2024 in Enterprise Resource Planning Blogs by SAP

- Asset Management for Resource Scheduling - External availabilities (Rostering) in Enterprise Resource Planning Blogs by SAP

- SAP Enterprise Support Academy Newsletter March 2024 in Enterprise Resource Planning Blogs by SAP

- Foundational Elements for Harnessing the Power of Business AI in Your SAP S/4HANA Cloud Public Ed. in Enterprise Resource Planning Blogs by SAP

- Enhancements, evolutions, and enabled innovations across SAP’s Public Sector solution portfolio in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |