- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- Installment Plans with Interest Calculation in SAP...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Introduction

Please read first:

- Installment Plans with Interest Calculation in SAP PSCD | Part 1 – Creating the Installment Plan

- Installment Plans with Interest Calculation in SAP PSCD | Part 2 – Processing Payments and Credits

In this last blog about interest calculation and installment plans, we focus on the following business use cases:

- As a collection agent, I can reclassify installments and related interests that are due in the next year to another G/L account.

- As an accountant, I can update the general ledger and the budget accounting accordingly.

Reclassification

In order to demonstrate the reclassification process, we first need an installment plan with some installments that have a due date in the next year. These installments need to be displayed separately on the balance sheet.

Let’s create two overdue open items on a contract account of a business partner and check the account balance in the Business Partner Overview (transaction FMCACOV).

Note the fact that the due dates of the original items have been set so that the installment plan is created with five installments from October 2023 to February 2024.

Business Partner Overview – Two open items are overdue

In the F5720 – Manage Installment Plans Fiori App, we can now create our installment plan, with the same characteristics as the installment plan created in the first blog of the series, but this time with a start date of October 1st, leading to the creation of two installments in the next year.

Installment Plan Creation – Managing the installments

In the Excel extract below you can check that the interest was calculated properly.

Interest Calculation in Excel

Using an installment plan analysis for a key date, let's create a snapshot of the installment plan due dates on this key date, as well as of the assignment of these due dates to the original items.

First, let's define the receivables, the adjustment, and the target accounts.

- In the customizing activity Define Receivables and Payables Accounts in IMG > Contract Accounts Receivable and Payable > Closing Operations > Reclassifications

IMG Customizing Activity - Define Receivables and Payables Accounts

- In the customizing activity Define Adjustment Accounts for Reclassification by Due Date in IMG > Contract Accounts Receivable and Payable > Closing Operations > Reclassifications

IMG Customizing Activity - Define Adjustment Accounts for Reclassification by Due Date

Note: in our chart of accounts, the following G/L accounts are defined

- 140020 Receivables due after 1 year

- 140099 Receivables (Adjustment acct)

Then, using an installment plan analysis for a key date, we can create a snapshot of the installment plan due dates on a key date, as well as of the assignment of these due dates to the original items.

In the SAP Easy Access screen, go to Record Status of Installment Plans for Key Date in Periodic Processing > Closing Preparation > Receivables Valuation (transaction code FPIPKEY), and enter the parameters for the job.

Record Status of Installment Plans for Key Date - Job Parameters and Job Log

The list of installment plan reports for a key date clearly identifies the two installments with a due date in the next year.

List of installment plan reports for a key date

Then, we can trigger the Key Date-Based Open Item List (transaction FPO1). The mass activity report Open Items at Key Date (transaction FPO1P) can be found in the SAP Easy Access screen, go to Record Status of Installment Plans for Key Date in Periodic Processing > Closing Preparation.

In this transaction, we set

- the key date to 31.12

- our company code

- the "Consider Installment Due Dates" as determined by the Installment Plan Analysis for a key date report

- the "Inst.Plan Due Dates Separate" to have the reclassification from installment plans on a separate reporting line in the execution log.

Open Items at Key Date - Selection parameters

Open Items at Key Date - Extract of the Execution Log

Finally, we can post the reclassifications by due date using Post Reclassifications by Due Date (transaction FPRECL_DUEGRID) in the SAP Easy Access screen, go to Record Status of Installment Plans for Key Date in Periodic Processing > Closing Preparation.

For the sake of clarity, we have changed the proposed reconciliation key to a new empty one and set the document type to SA for General Debit Document.

Post Reclassifications by Due Date

When hitting the Save button, the reclassification process is triggered, and two CA documents are created, one with a posting date of 31.12.02023 and one with a posting date of 01.01.2024.

CA documents created by the Reclassification Process

Updating the General Ledger

We have been using two reconciliation keys so far: one for the original items, charges, and interests, and one for the reclassification postings.

Let's first close the first reconciliation key using Fiori App F4531 - Manage Reconciliation Key.

Manage Reconciliation Key - Closing the first key

Note that the amounts have been aggregated according to the account assignments and the posting date.

We can now transfer the reconciliation key to General Ledger (transaction FPG1) in the SAP Easy Access screen, Accounting > Financial Accounting >Contract Accounts Receivable and Payable > Periodic Processing > Forward Postings > Execution

Transfer to General Ledger - Setting the parameters

We have to set the Test Run / Update Run parameter to "2" to trigger the Update Run.

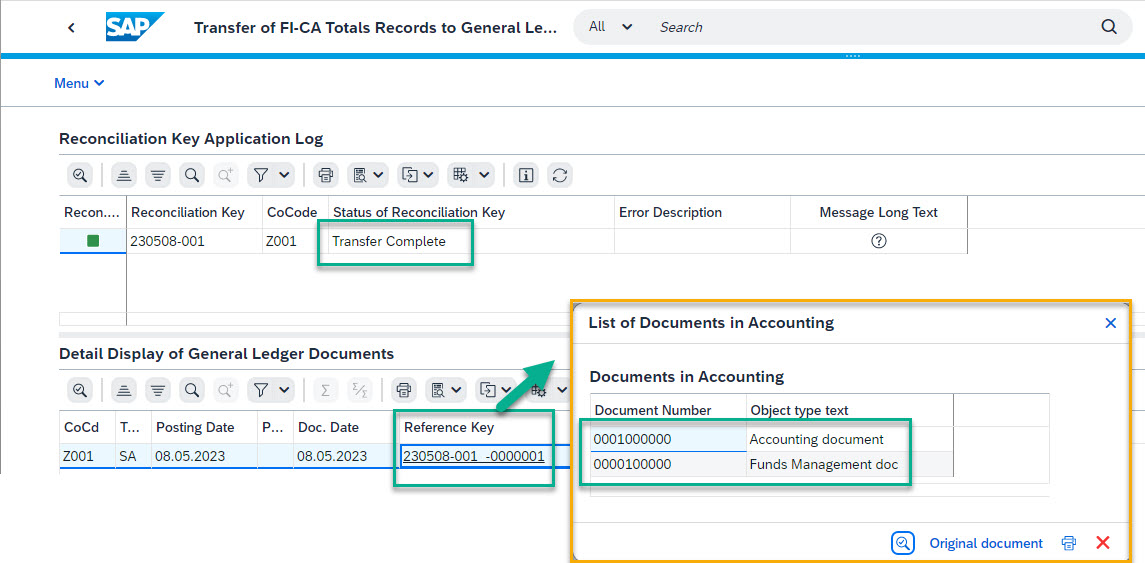

Transfer to General Ledger - Creating the FI and the FM documents

Two documents have been generated, one for the update of the general ledger in FI, and one for the update of the budget accounting in Funds Management.

Transfer to General Ledger - Displaying the FI/FM documents

The Fiori app F-3364 - Display Journal Entries in T-Account View gives a good overview of the postings made in the general ledger

F3664 - Display Journal Entries in T-Account View

We can now reproduce the same steps with our second reconciliation key, for the reclassification. After closing it, we can trigger the transfer to the general ledger, and two documents are created: one in 2023 and one in 2024.

Transfer to General Ledger - Transferring the reclassification

Now let's have a look again at the Journal Entries in T-Account View in 2023 and 2024.

Journal Entries in T-Account View in 2023

Journal Entries in T-Account View in 2024

Finally, if you need to carry forward summarized documents that were transferred from PSCD to Funds Management for an FM area and a fiscal year to the next fiscal year, please refer to the program documentation of report RFKKFMCK_NEW.

And this concludes the series of blog posts. All comments/corrections are welcome.

- SAP Managed Tags:

- Public Sector,

- SAP Public Sector Collection and Disbursement

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- GRC Process Control: How CCM can be leveraged to monitor HANA Databases in Financial Management Q&A

- Scale Up Subscription Initiatives with SAP Billing and Revenue Innovation Management in Financial Management Blogs by SAP

- SAP Treasury Hedge Accounting , Matching concept and Accounting treatment in Financial Management Blogs by Members

- Unveiling the new functionality in 2024 of SAP PAPM Cloud: Welcome to Universal Model! in Financial Management Blogs by SAP

- What is coming with first SAP CPQ release in 2024? in Financial Management Blogs by SAP

| User | Count |

|---|---|

| 5 | |

| 3 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |