- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- SAP Central Finance – Lessons Learned

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

nitin_gupta10

Active Participant

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

04-05-2023

10:37 AM

This blog is focused on lessons learned from SAP Central Finance projects. I have been part of almost 10 CFIN projects of different sizes and shapes where I have seen below scenarios.

- Only ONE SAP system in scope

- Multiple SAP systems in scope

- Only Non SAP systems in scope

- Mix of SAP & Non SAP systems

The content in this blog is collective experience of several projects. It may or may not be relevant for your project but I ma sure you can see the component from here in your CFIN Project.

Lets see the pillars of lessons learned as I have classified my learnings here into 5 pillars.

Now lets get into detail of each pillar and talk through

Product Placement

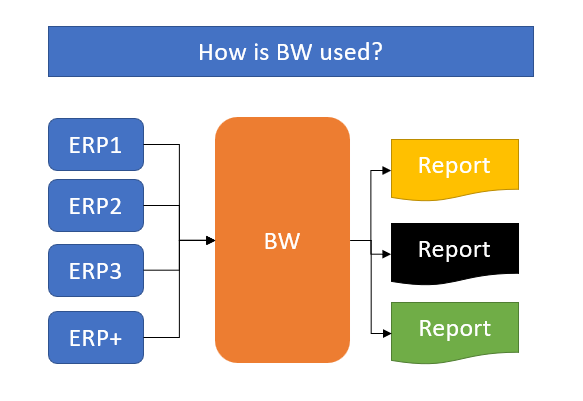

SAP Central Finance is a deployment option to S/4HANA and makes S/4HANA deployment as non-disruptive and easy to go. In my several projects experience I have seen that customers consider CFIN as just a data repository and compare it with BW. Since CFIN bring data from multiple source systems so sometimes it considered as equivalent to BW as customer are using today the BW system and that’s what it happens. The trial balance from several ERPs is loaded in BW and used for reporting purposes.

SAP Central Finance is not a reporting engine. It enables you to use S/4HANA and that’s an ERP so comparison between CFIN (S/4HANA) and BW is never justified.

Central Finance enables you to use the central processes, Group Reporting, SAC, ICMR etc on top of S/4 and you don’t need to disrupt your other non-financial business processes as legacy systems are still up and running.

It gives you time to plan your ERP strategy and get early advantage of S/4HANA transformation and all new processes and improvements which are delivered as part of S/4HANA

Program Management

This is another key aspect which I have seen in projects which can make or break the situation.

There are several aspects to this pillar namely

Planning – Program plan should be done with a view from business case as to what needs to be done when like phase1, phase 2, phase 3 however the planning should be realistic. It should accommodate time for all areas in a balance manner. Test cycles should be given sufficient time, just because we want to go live on certain date we just cant compromise on test cycles. Similarly design should be given due time so that people can really grab the design and it should be more of a show & tell concept and sprints should have sufficient time rather creating imaginary pressure. Initial Load and error handling takes time so if you plan for 3 test cycles, consider that timelines based on number of systems involved. Expert solution architect should be part of planning the CFIN project

People – Right people should be given right responsibilities. Just because someone is there in organization from long time doesn’t mean he or she can be CFIN architect. It’s a new product so knowledge is key – both for implementation team as well as customer. Do not hesitate to get temporary people as expertise as the level of expertise in project drives the success.

External View – During the project there should always be a component of quality assurance. It should be by some external party who have experience of CFIN quality assurance so that you as a customer are not just being fed by the implementation partner rather you have an external view also to challenge things and get better rather best of the investment. Things can be done differently in same system in same time that’s why experience has to be brought in the program

Scope – This is the most flexible component. Customers keep on changing. I have seen during UAT phases new company codes are included in scope of CFIN on even new requirements/scenarios are introduced which business was either not aware during design or they don’t want to highlight it at that time. Scope of phases should be built in a right manner. Like

- Central Payments should always go live with same gap of central finance. Design & test can always go in parallel.

- Currency, ledger etc settings should be considered one time

- Margin analysis should be designed during CFIN phase

- Group Reporting design can go in parallel to CFIN but GR should go live once CFIN is kind of stable

Communication – Program Management should be open & transparent in terms of communication. If there is a challenge right people should be consulted and not just consider it as a leadership level communication. There are always options for doing things and right choices can be made.

Business Involvement

Implementation of SAP Central Finance is not just a technological part. You are not just implementing a system rather you are looking to use that system in future. As CFIN is the foundation for S/4HANA the core building blocks needs to be set first time right.

Like Ledgers, Currencies, Document splitting etc all these setup needs to be well aligned with busine ss as once you set those up now you just cant change them anytime you need in future. Its complex to make changes in coding block.

Business needs to be involved for futuristic design, data management and sharing the clear business requirements. Requirements should not keep on changing as the vision should be clear. Also, business should not look in a way that technology have solution to every problem. Business problems should be first fixed at process level, change process as needed and then think about usage of technology. Don’t just talk technology in design sessions. SAP can do lot of things but processes are foundation. Process should run on SAP, SAP should not be the driver of process as long as its SAP best practices

Data Strategy

This is the most crucial component for the success of SAP central Finance project. Don’t think you can plan data later. Data is the foundation. Presently in number of ERP systems you have data sitting in different shapes and format and you are not even using it the way it should be.

With SAP Central Finance you have to plan for Data harmonization for most of the objects like Vendors, customers, Chart of Accounts payment terms, Cost centers, profit centers etc as you are setting up the new ERP for next decade or more so don’t rush in project to move to SAP s/4HANA and still carry the legacy of junk data. If you cant harmonize it now you can never do it

There has to be dedicated data stratum responsible for data management which includes cleaning of old data, clearing of historic open items, planning new chart of accounts and looking for harmonizing other master data like vendors, customers etc as today the same customer might exists in 4 ERPs but tomorrow you need only one record as you are implementing new age ERP.

Technological trends are evolving and they have one thing in common: they are heavily dependent on the quality as well as reliability of data. With CFIN implementation you must now shift your focus towards master data governance to facilitate the way for a successful business transformation which is the foundation for future business processes.

credit to the owner

Technology

There are some technology areas which should be considered as part of CFIN project and I will plan to put in in sequential manner.

- When you have SAP source systems in scope the projects start with implementation of SAP notes in your current SAP system (ECC or S/4HANA). Volume and effort depends on your current system release. For some systems its 500+ for some its 50 so you have to plan it in a way that before CFIN build starts this exercise should be complete and don’t forget for regression testing as you are changing/implementing lot of notes/code on your productive environment.

- Depending on the release of your S/4HANA you may get lot of issues. They are sometime due to internal process like you are writing a code which is not correct but sometimes they are standard bugs like reconciliation report is not reading the non-leading ledger documents from source system (this is just an example) so here you need to go to SAP to get the fix.

- Number of enhancements may play the role in timelines and testing. Try to keep the S/4HANA as simple as you can and do enhancements in standard SAP space. SAP has given several CFIN BADIs, try to use them and don’t try to solve business problems by enhancements and increasing technical debt

- When you have Non-SAP systems in scope, you are dealing with a completely new animal in the room. Consider the design and implementation based on business requirement. Just going with suggestions from SAP and implementation partner may not help. Sometimes you may plan to implement costly product because it delivers the value and technology desired (like real time replication from non SAP system) but if its just an excel extract (customer has to extract and give an excel template) and partner/product will load in CFIN so also look for custom solutions rather running behind existing products available in market as excel extract and load does not justify the purchase of million dollar product.

- Till the CFIN product gets stable and AIF errors are in control don’t let the team roll off. At least execute the first quarter end and reconcile the data before you move the product to support or AMS or maintenance (whatever you want to call it)

Hope this blogs helps you to plan and execute CFIN project. You can not do all mistakes to make your world perfect so sometimes you need to learn from what others did as a mistake 🙂

Happy reading and do share your experiences in comments.

1 Comment

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- User Experience in SAP S/4HANA Cloud Public Edition: New Microlearning Available in Enterprise Resource Planning Blogs by SAP

- Asset Management in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

- SAP User Experience in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

- Solution Order Management in SAP S/4HANA Cloud Public Edition 2402 in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |