- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- TDF: EFD-Reinf 2.1.1 – News in Preprocessing

Financial Management Blogs by SAP

Get financial management insights from blog posts by SAP experts. Find and share tips on how to increase efficiency, reduce risk, and optimize working capital.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Employee

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

03-31-2023

2:26 PM

Você quer ver esse blog post em português? Clique aqui.

Hello.

In this blog post, I will show you all what's new in the EFD-Reinf Preprocessing (/TMF/REINF_PRE_PROC) transaction. Before you continue this reading, if you do not know or remember the existing features in preprocessing, I invite you to read the blog post TDF-EFD-Rein: pré-processamento dos eventos R2010 e R2020 to remind you of the transaction’s details.

Prerequisites

You must have the TDF support package 17 installed and updated as per the list of prerequisite notes for the installation of the SAP Note:

Screen Parameters

To support the R-4000 series events, the transaction had some fields and features added. See the figure below:

Figure 1

Selection screen updated for the transaction EFD-Reinf Preprocessing.

- Parameter Ledger: Previously mentioned in the blog TDF EFD-Reinf 2.1.1 – Overview of the Income Postings/Payments with Retention table, this parameter was included here for the same purpose of allowing the selection of the active tax book. The parameter becomes mandatory when the value R-4000 is selected in the Event Types for Preprocessing parameter.

- Parameter Event Types for Preprocessing: To facilitate the usability for users, the EFD-Reinf Preprocessing transaction can be used for both the R-2000 and R4000 series events, more specifically speaking of R-2010, R-2020, and R-4000.

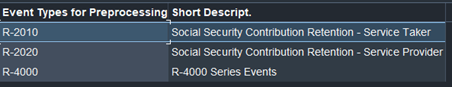

Figure 2

Possible values for the field Event Types for Preprocessing.

- Parameter Log Details: The entire preprocessing log interface has been improved to bring in the required information according to the type of event generated. By choosing "All Messages", the preprocessing transaction will display all the messages returned from the process execution. You can see the Processed Items – Details and Unprocessed Items – Details sections.

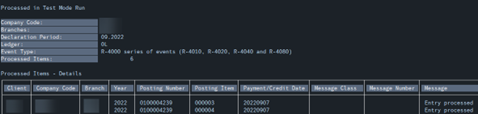

Figura 3

Example Processed Items – Details section result.

If the option “Error Messages Only” is selected, as the name says, only the error messages returned in the process are displayed.

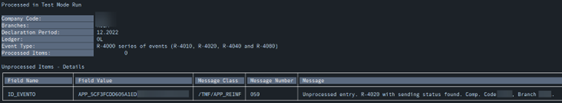

Figure 4

Example Result section Items Not Processed – Details.

To wrap up this first part of the blog, you can see the combination of the parameters for generating each even:.

Parameters for the events of the R-2000 series

- Company Code

- Branch

- CNPJ

- Period

- Event Types for Preprocessing (R-2010 or R-2020)

Parameters for the R-4000 Series Events

- Company Code

- Branch

- Period

- Ledger

- Event Types for Preprocessing (R-4000)

Processing

The processing for the R-2010 and R-2020 events did not have anything charged from what has already been delivered. If you have any questions about how it works, click here.

For the R-4000 series events, before processing them, access the TDF: EFD-Reinf 2.1.1 – Analysis of Scenario and TDF: EFD-Reinf 2.1.1 – How to Determine the Nature of Income blogs to understand all the details that will be taken into account in this processing.

As explained in the first blog post of the preprocessing, the allowed processing continues to be by background execution only due to the volume of data manipulated here.

You must perform preprocessing once for each of the event types supported by the transaction, if you have these scenarios in your company.

Taking as an example the first figure (which shows possible parameters for generating R-4000 series events), as a result of the process, the processed data will be placed in the table /TMF/D_LCTORENRT in case the Test Mode parameter is deselected.

All processed and unprocessed items information will be displayed on the screen according to the chosen Log Details parameter.

After the data is saved in the /TMF/D_LCTORENRT table, you can generate the direct event in the EFD-Reinf Report (/TMF/REINF). If you are not familiar with this process, go to TDF-EFD-Reinf: Solution for Generating and Sending the Events.

BAdI Reinf Preprocessing

As mentioned before, the preprocessing transaction was extended to generate the events of the R-2000 and R-4000 series. For the R-4000 series, you can implement business logic using the method MODIFY_LANC_REND_PAG_RETENCOES in the BAdI /TMF/BADI_REINF_PRE_PROC.

This is the last point of preprocessing before the data is written to a table. You can change the data in parameter CT_LCTORENRT to determine what will be saved. All fields of table /TMF/D_LCTORENRT can be changed here.

FAQ

In this section, we provide some answers to some common questions that you may have:

- Why are the events of the R-2000 series (R-2010 and R-2020) defined and those of the R-4000 series are not?

Due to the complexity of the scenarios for this event series, it’s not possible to determine at screen parameter level. However, as the data that will be read, the preprocessing will determine events R-4010 or R-4020.

- Can't I generate R-4040 or R-4080 through preprocessing?

Not as standard in preprocessing. In other words, not without implementing the BAdI mentioned above. However, if you have identified scenarios in your environment that need to create R-4040 and R-4080 events, you can implement the BAdI and include your business rule for it.

Remember that the R-4000 series events are defined through the CAT_LCTO field in the /TMF/D_LCTORENRT table. Click here to learn more.

In the next blog, I will go into details of the scenarios supported by the preprocessing for the R-4000 series.

We would love to have your feedback. If you have any questions or suggestions for an upcoming post, please leave your comment below. Apart from the comment section, you can also contact us through the Customer Influence platform, where you can propose ideas to improve our product, vote on previously released ideas and follow those ideas being currently implemented. Follow the SAP Tax Declaration Framework for Brazil tag here at the SAP Community to keep updated with the latest news on the TDF Add-On.

See you next time!

Rodolfo Felipe Celante

SAP TDF Development Team

#SAPGoGlobal #SAPLocalization

- SAP Managed Tags:

- SAP Tax Declaration Framework for Brazil

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

Related Content

- Statutory Reporting and EFD-Reinf: What changes with technical note 04/2023 in Financial Management Blogs by SAP

- REINF Preprocessing Program Adjustments in Financial Management Blogs by SAP

- TDF: EFD-Reinf 2.1.1 – Scenarios Supported by Preprocessing for event R-4010 in Financial Management Blogs by SAP

- TDF: EFD-Reinf 2.1.1 – How to Determine the Nature of Income in Financial Management Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 3 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |