- SAP Community

- Products and Technology

- Financial Management

- Financial Management Blogs by SAP

- TDF: EFD-Reinf 2.1.1 – Analysis of Scenario

Financial Management Blogs by SAP

Get financial management insights from blog posts by SAP experts. Find and share tips on how to increase efficiency, reduce risk, and optimize working capital.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Employee

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

03-16-2023

1:10 PM

Você quer ver esse blog post em português? Clique aqui.

Hello.

This is the second blog post in a series about the new layout of EFD-Reinf 2.1.1. The focus of this blog post is the analysis of the event Payments/credits to corporate beneficiaries (R-4020) and how to fill in the table Income Postings/Payments with Withholdings (/TMF/D_LCTORENRT) to meet the requirement for EFD-Rein 2.1.1.

Prerequisites

You must have Support Package 17 of TDF installed and updated according to the list of prerequisite notes for the installation of 3298145 - [TDF SP17] Note 046: EFD-Reinf - DDIC and Hana Views Updates.

Taxable Event

I will explain below how to fill in the field DT_FG of the table Income Postings/Payments with Withholdings (/TMF/D_LCTORENRT).

“Taxable event” is the term used to determine when the withholding of tax is carried out. This can occur at two different times: during the payment of the invoice or during the issuance of the tax invoice (nota fiscal).

The taxable event is identified in the table Withholding Tax Categories (T059P), where each tax is identified by the field Withholding Tax Category Code (T059P-WITHT) and is identified with its taxable event.

Example:

The image shows the Withholding Tax Categories table, where the taxable event for the taxes is identified. In the field Post. Time, the posting time options are displayed, with option "1" being the time of invoice entry and option "2" the time if payment.

You can see that taxes are withheld at different times, and we will have different dates for the selection of accounting entries. One scenario is the time of payment (BSEG-AUGDT), and another is the time of invoice entry (BSEG-BUDAT).

The same accounting document can be reported in different periods if it has taxes with withholdings made at different times.

Taxes

The relevant taxes for the 4000 series are the following:

- IR: Income tax withheld at source.

- Aggregate: Aggregate of taxes - CSLL, Cofins and PIS/Pasep.

- CSLL: Social Contribution on Net Income.

- COFINS: Contribution for the Financing of Social Security.

- PP: PIS/PASEP Social Integration Programs (PIS) and Training Programs for the Public Servants (PASEP).

Origin of Taxes in SAP

The amount of taxes can come from two different sources: FI and Nota Fiscal.

Table: Witholding tax info per W/tax type and FI line item (WITH_ITEM)

The entries with retention will have the values highlighted in this table. The fields Indicator for withholding tax type (WITH_ITEM-WITHT) and Withholding tax code (WITH_ITEM-WITCD) are responsible for determining the tax type for FI.

The fields Value and Base are provided by pelo Withholding tax amount (in local currency) (WITH_ITEM-WT_QBSHH) and Withholding tax amount in document currency (WITH_ITEM-WT_QBSHB), respectively.

When entries are made manually, you must consider the Indicator: Withholding tax amount entered manually (WITH_ITEM-WT_AMNMAN) and, in this case, de Value comes from the field Enter withholding tax amount in local currency manually (WITH_ITEM-WT_QBUIHH).

Table: Accounting Document Segment (BSEG)

The gross value of the entry item used in the calculation of the tax is available in the field Amount in document currency (BSEG-WRBTR).

Table: Nota Fiscal tax per item (J_1BNFSTX)

Some accounting entries don’t have the taxes calculated directly in FI and are persisted in the Nota Fiscal by the fields Base amount (BASE) and Tax value (TAXVAL).

Identification of Taxes

Taxes are identified by custom codes in FI and assigned to entries by the field Indicator for withholding tax type (WITH_ITEM-WITHT).

To identify which tribute this indicator is linked to, it’s necessary to make a “FROM – TO” of codes in order to classify them correctly. The classification is done through the customization table Withholding Tax Types (/TMF/D_WHTX_TYPE).

In the example below, the FI document item has the WITH_ITEM-WITHT with the value equal to “R2”. The customer must classify this value among the possible taxes to be reported (IR, CSLL, etc).

The image shows and example of classification done in the customizing Withholding Tax Types. The tax type “R2” is classified as Income Tax Withheld at Source (IR).

Note that this activity is mandatory for all types of taxes reportable in EFD-Reinf events, both for series 2000 and 4000.

Taxes in FI versus Taxes in Nota Fiscal

Depending on system configuration, it may happen that the values for some taxes are not highlighted in FI but are provided by the Nota Fiscal through the table J_1BNFSTX. Thus, it’s necessary to map the relationship of the tax specified in WITH_ITEM with the tax of J_1BNFSTX.

For example, in the image below, the field WITH_ITEM-WITH is filled in with the value “ZP” (which, in this scenario, means COFINS) and this tribute doesn’t have the values specified in the document. Usually, the base is replicated to the value field. In this case, it’s necessary to identify which Tax Type (TAXTYP) and Tax Group (TAXGRP) of the J_1BNFSTX is linked to the “ZP” tax.

The image shows an example of Tax Code and Tax Type in a document in the SAP system. The tax doesn’t have its values calculated in FI and the Cofins tax is identified as “ZP”.

The Nota Fiscal linked to this document has its value and base amount highlighted by the Tax Type ICOQ and the Tax Group WACO.

A imagem mostra um exemplo de valores retidos em uma nota fiscal no SAP. Estão destacados os campos Tax Type (preenchido com o valor “ICOQ”) e Tax group (preenchido com o valor “WACO”).

With this information, it’s necessary to fill in the table Customizing of whithholding taxes (/TMF/D_WH_TAXGRP). In this scenario, the table would be filled in as displayed in the image:

The image shows an example of entries configured in the view Customizing of withholding taxes. The following fields are displayed: Withholding Tax Type (filled in with the value “ZP”), Withholding Tax Code Type (filled in with the value “ZP”), and Nota Fiscal Tax Type (filled with the value “ICOQ”).

Value and Base of Taxes in CTR

The calculation of value and base amounts are provided by the view NF Withholding Taxes (NF_IMPOSTO_RETIDO) through the fields VLR_IRF and BASE_IRF.

This view extracts the values from WITH_ITEM and from J_1BNFSTX, with the data priority always being the second (J_1BNFSTX), regardless of the time of retention.

Using the document below as an example (which has the “ZP” tax classified as COFINS), it should be noted that the same must occur for the other taxes that will be moved to their respective columns.

The image shows an example of a document with lines of taxes withheld.

If the view /TMF/D_WH_TAXGRP is not filled in, we will have the following result for the VALUE and BASE fields. These values come from WITH_ITEM:

| NUM_LCTO | NUM_ITEM | VLR_BASE_COFINS | VLR_COFINS |

| 100004239 | 3 | 3.615,51 | 3.615,51 |

However, we have filled in the view for this scenario. Therefore, the result is based in the values of J_1BNFSTX, which are highlighted in the Nota Fiscal.

The image shows an example of taxes on a Nota Fiscal in the SAP system.

Note that the view NF_IMPOSTO_RETIDO already performs the proper logic of replacing the values, leaving the final result as shown in the following table. These values come from J_1BNFSTX:

| NUM_LCTO | VLR_BASE_COFINS | VLR_COFINS |

| 100004239 | 241.034,48 | 7.231,03 |

Gross Value of Taxes in CTR

The gross amount, unlike the other amounts (Base and Retained), originates from WITH_ITEM and is totaled by “Item” of the accounting document (BSEG); that is, it is not divided by type of tax. Therefore, the gross amount is presented for different taxes at the same time.

In the example below, the document has two taxes: “GP” and “RA”. In this scenario, both have the values highlighted directly in FI.

The images shows an example of withheld taxes on a document in the SAP system.

In the scenario shown here, these taxes were classified respectively as GP equals “Aggregate” and RA equals “Income Tax”.

The final result for this line of the document will be as shown in the table below:

| NUM_LCTO | VLR_BRUTO | VLR_BASE_COFINS | VLR_COFINS | VLR_BASE_AGREG | VLR_AGREG |

| 100004239 | 3.040,00 | 1.730,00 | 79,58 | 1.730,00 | 43,25 |

Selection Date of Accounting Entries

Postings must be selected by two different dates, the posting date (DT_LCTO) and the clearing date (DT_COMP).

By selecting these two criteria, we will have all entries made in the period to be reported; however, they do not necessarily have withholding taxes.

Based on these selected documents, the amounts will be classified and distributed according to the type of tax and time of withholding.

Expense Accounts Originating in the Accounting Entry

The expense account is not the supplier's account, but one of the accounts shown on the other lines of the entry.

In the image below, we can see that the line highlighted in red represents the posting for a supplier with account 160000. In yellow are the other accounts that can be considered as expense accounts (COD_CTA_DESP).

The image shows an example with existing accounts in a document in the SAP system.

To later determine the field Nature of Income (NAT_REND), it’s necessary to obtain a list of all the accounts involved in the document.

| NUM_LCTO | COD_PART | COD_CTA_DESP |

| 100004105 | CodPart1 | 191000 |

| 100004105 | CodPart1 | 177000 |

| 100004105 | CodPart1 | 154004 |

| 100004105 | CodPart1 | 154004 |

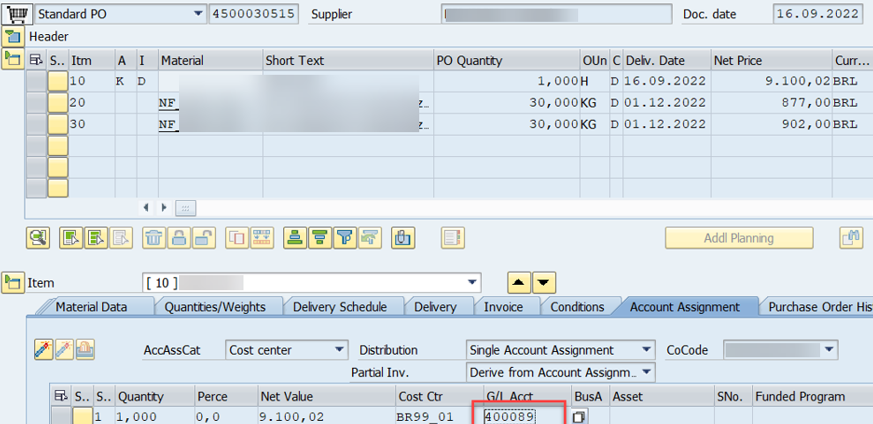

Expense accounts originating from the Purchase Order

For some entries, it’s necessary to use a clearing account and that is available in Account Assignment in Purchasing Document (EKKN).

The image highlights the account configured in the purchase document.

The link made between the tables Accounting Document Segment (BSEG) and Account Assignment in Purchasing Document (EKKN) is done through the fields EBELN and EBELP (present in both tables). Finally, the field where the account will be found is the EKKN-SAKTO.

To later determine the NAT_REND, it’s necessary to add this account next to the list of expense accounts found in the posting.

In the next example, the accounts highlighted in red are the accounts found in the posting (mentioned above) and in green the account found in the Purchase Order.

| NUM_LCTO | TIPO_DOC | COD_PART | COD_CTA_DESP |

| 100004105 | RE | CodPart1 | 191000 |

| 100004105 | RE | CodPart1 | 177000 |

| 100004105 | RE | CodPart1 | 154004 |

| 100004105 | RE | CodPart1 | 154000 |

| 100004105 | RE | CodPart1 | 400089 |

This concludes the analysis of several crucial points that will help you understand how to identify postings and their respective values. In the next blog post, we will describe how to determine the Nature of Income.

We would love to have your feedback. If you have any questions or suggestions for an upcoming post, please leave your comment below. Apart from the comment section, you can also contact us through the Customer Influence platform, where you can propose ideas to improve our product, vote on previously released ideas and follow those ideas being currently implemented. Follow the SAP Tax Declaration Framework for Brazil vtag here at the SAP Community to keep updated with the latest news on the TDF Add-On.

See you next time!

Rodolfo Felipe Celante

SAP TDF Development Team

- SAP Managed Tags:

- SAP Tax Declaration Framework for Brazil

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

Related Content

- SAP ECC Conversion to S/4HANA - Focus in CO-PA Costing-Based to Margin Analysis in Financial Management Blogs by SAP

- 3 Compelling Reasons to Attend the Webinar on SAP Analytics Cloud's Integration with SAP S/4HANA in Financial Management Blogs by SAP

- Margin Analysis: Substitution/Validation in Financial Management Blogs by SAP

- Percentage of Completion: "Down payment surplus"? in Financial Management Q&A

- GRC Tuesdays: What’s New in SAP solutions for Three Lines, Q3 2023 to Q1 2024 in Financial Management Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 3 | |

| 2 | |

| 2 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 | |

| 1 |