- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- What’s New in Finance for Engineer Products and Sy...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

The first releases of SAP S/4HANA Cloud, public edition focused on make-to-stock production, where a standard product is manufactured and delivered to anonymous stock and the sale to the customer is decoupled from the manufacturing process. SAP S/4HANA Cloud, public edition 2302 includes Engineer-to-Order as a new end-to-end process. Due to the customer-specific nature of the process, there is always a direct reference to the sales order to reflect the requirements of the customer, demand is initiated with reference to a WBS element and manufacturing takes place with reference to a production order that is linked with this WBS element. The focus of cost accounting is on bringing together these various elements to correctly value the project-related inventory and determine the contribution margin for the project itself and the associated market segments. Because of the longer timeframe involved, it is also important to report work in process and recognize revenue correctly.

Engineer-to-Order (ETO) Value Flow in SAP S/4HANA Cloud, Public Edition

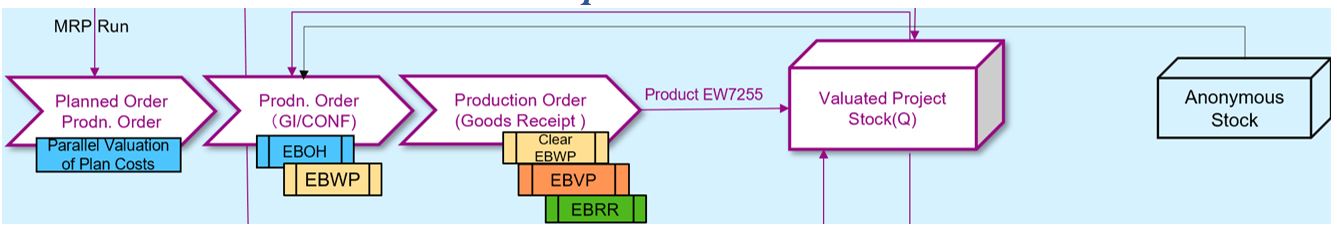

Figure #1 provides an overview of the ETO process, showing both the process flow and the steps that result in journal entries in Finance (the relevant business transactions are shown in the colored boxes). Notice the box for valuated project stock (special stock type Q) that provides the link between any components procured specifically for the project, the manufacturing process for the product and the delivery of the finished product to the customer. Underneath we see the reporting view where Margin Analysis provides a dedicated Fiori app showing the revenues for the product, the costs on the production order and the project and the market segments to which these revenues and costs can be associated via attribution.

Figure #1: Overview Value Flow

This blog post will guide you through the key value flows in finance for the Engineer-to-Order (ETO) solution (Scope Item 6GD) in SAP S/4HANA Cloud, public edition, release 2302, you can do the following:

- View event-based production cost postings like overhead, variance, Work in Process (WIP) and so on with reference to the project

- Recognize event-based revenue as the project progresses

- Run margin analysis reports to analyze project profitability

- Manage the project in a multi-ledger environment (Universal Parallel Accounting)

Before you start to explore this blog post, it is highly recommended that you read the blog post Discrete Industries in SAP S/4HANA, Public Edition 2302 from Markus Florian Oertelt, and watch the system demos inside his blog post for the whole ETO scenario. Key steps from a Finance point of view are:

- Project setup (for Engineer-to-Order it is important that the project carries revenue, and that inventory is managed as project stock)

- Settlement rule (there is no period-end settlement process in Engineer-to-Order, but this step is needed to ensure that the correct market segments for margin analysis are updated if multiple sales order items are linked with the project. Instead of settlement, event-based revenue recognition ensures that the correct accruals are posted in real time.)

- Create Sales Order with Project Stock and WBS Element Assignment (the WBS assignment to sales order items provides the link between the cost postings on the project and assigned production order, the revenue postings and the update of the inventory values)

- Production of Finished Goods (the production order is created with reference to the project and collects costs and ensures that work in process and project stock are valuated correctly until delivery to the customer)

- Create Outbound delivery (goods are issued from project stock and COGS updated for the sales order/WBS element)

You can also read the following topics to understand the existing key innovations relevant to the ETO scenario.

- Event-Based Production Cost

- Event-Based Revenue Recognition

- Margin Analysis

- Universal Parallel Accounting

Key Configuration and preliminary steps for Finance in ETO

For the preliminary steps, necessary roles, and the test procedure to run the whole ETO business scenario, please refer to the documentation for Scope Item 6GD in the SAP Best Practices Explorer. This blog post will focus on the value flows in finance, especially on event-based production costing, event-based revenue recognition, and margin analysis. The key configurations and preliminary steps to initiate the value flow in finance for ETO are as follows.

Figure #2: Event-Based Processing Key

The key configurations for the event-based production costing are conducted as demonstrated in the screenshot shown in figure #2 above. Notice that WIP is calculated at actual costs with each goods movement and confirmation, and production variances are split by category. After making the required settings here, event-based production costing can be initiated during the creation of the production order by selecting the Event-Based Processing Key. What changes compared to the make-to-stock process is that you can view the event-based production cost postings (including overhead, variance, WIP, and so on) on a project level as well as by production order. Please explore the blog post New in Production Accounting – Event-Based Production Cost Posting for more details.

To derive the values for the relevant Profitability Analysis (CO-PA) fields, please assign the G/L accounts with the Primary Costs or Revenue (P) account type to the WIP offsets account under the Define WIP Account Determination setting in the above configuration.

Figure #3: Event-Based Recognition Key

In addition to the settings for WIP calculation in the production order, we need to manage the settings for event-based revenue recognition in the project. The key configurations for conducting event-based revenue recognition (EBRR) for ETO are shown in figure #3 above. The default Recognition key is EPMFC (the cost-based percentage-of-completion method). With this cost-based method, the accrued revenue is calculated and posted when posting the price differences during Goods Receipts or Supplier Invoices from purchasing, posting production variances from the production order, posting Goods Issues for deliveries and Billings from the sales orders. This recognition key is automatically derived for the WBS element when the WBS element is assigned to a sales order item based on the mapping shown in figure #3 above.

Additionally, the recognition key EPMCC (completed contract method) and EPMFR (Project Revenue based PoC) are supported as well for the ETO scenario. Please refer to the SAP Help Portal for Event-Based Revenue Recognition to understand the general posting logic of the recognition keys.

Please note that this blog post will explain the event-based revenue recognition postings based on the default recognition key EPMFC (the cost-based percentage-of-completion method).

Figure #4: Assignment to a Profitability Segment

After the creation of the project, the settlement rule should be assigned in the profitability segments as shown in figure #4 above, so that project profitability can be analyzed (for example the Fiori apps Display Line Items – Margin Analysis or Project Profitability). The settlement rule provides the link between the project and the market segments in the sales order. If there is only one sales order item, there is no need to assign a separate settlement rule. No separate period-end settlement process is necessary, as the data shown in project profitability is based on G/L line items in real time. In case the attribute Multiple Sales Order Items Scenario on the project is flagged, then you must maintain the settlement rule manually to establish the link to the profitability segment for the billing element.

Figure #5: Project Planning

In case Multiple Sales Order Items Scenario is flagged during project creation, the creation of WBS packages via the Project Planning app (access via Related Apps during Project Creation) is mandatory. As shown in figure #5 above, under the Root WBS ETOFIN (the same ID as Project), there are two 2nd level WBS elements (ETOFIN1, ETOFIN2) created for the project. The root WBS ETOFIN is flagged as Billing Element.

Figure #6: Import Financial Plan Data

You need to plan your cost and revenue up front, as they are needed to determine the percentage of completion for the revenue recognition key EPMFC (the cost-based percentage-of-completion method). With the Fiori app Import Financial Plan Data, the financial planning data can be imported via a spreadsheet on a project level to G/L accounts and WBS elements for each period. The result is shown in figure # 6 above. In the above example, Percentage of Completion (PoC) = Actual Cost / 10000 and accrued revenue = PoC *12000.

Figure #7: WBS assignment to Sales Order

The sales order items represent the structure as agreed with the customer. During the creation of the Sales Order, the WBS Billing Element should be assigned to the Sales Order Item to build the connection between the Project and Sales Order as shown in figure #7. Additional sales order items and WBS elements can be added for the purposes of cost collection. It is also possible to create free-of-charge Sales Order Items for the WBS elements that will not be billed.

Figure #8: Recognition Key in Project

After the creation of the Sales Order, the system derives the Recognition Key under the Control tab in the project, based on the item category assigned in the sales order item. In the example shown in figure #8 above, the default Recognition Key EPMFC is updated, since the item category is assigned to the line item for the Billing WBS element ETOFIN. Please refer to figure #3 for the mapping between Recognition Key and item category. As shown earlier revenue recognition key EPMFC is derived from the item category CTAD in configuration.

Financial Value Flow in Procurement process

Figure #9: Procurement process

Now let’s look at the key financial value flow during the external procurement process. This will result in costs being assigned to the project stock and any price variances will impact revenue recognition. As shown in figure #9 above, Project Demand can be defined for materials to initiate the follow-up procurement process (Purchase Requisition→Purchase Order→Goods Receipt→Supplier Invoice). The EBRR postings are generated for Goods Receipt and Supplier Invoice in case price differences occur during the postings of Goods Receipt or Supplier Invoice.

Figure #10: Goods Receipt in Margin Analysis

After the Goods Receipt, EBRR postings (business transaction type TBRR) can be checked in the Fiori app Display Line Items – Margin Analysis as shown in figure #10 above. With the above example, the material procured is valuated at 50 Euro. However, we had to procure it at a higher price (100 EUR). Therefore, the price difference of 50 Euro is immediately considered as Actual Cost in EBRR. So Accrued Revenue = PoC (Actual Cost/Planned Cost) * Planned Revenue = 50/10000*12000 = 60.

Figure #11: Goods Receipt in EBRR

Accordingly, EBRR calculates and posts the revenue real-time, and potentially cost adjustments based on the assigned revenue recognition key (default key EPMFC). As shown in figure #11 above (SAP Fiori App Event-Based Revenue Recognition – Projects), there are updates on Income Statement and Balance Sheet after Goods Receipt. Continuing with the above example, in the Income Statements, the Revenue Adjustment is 60 Euro.The Recognized Margin = 60 Euro – 50 Euro = 10 Euro. The same logic applies for the Supplier Invoice posting.

Financial Value Flow in Production process

Figure #12: Production Process

Next, let’s check the key financial value flow in the production process integrated into ETO. As shown in figure #12 above, after the MRP runs for the Finished Goods, the production order can be converted from the planned order and keeps the reference to the WBS element. The planned cost (stored in table ACDOCP) of the production order is used as the price of goods movement for the produced material and to update the value of the project stock on delivery. In case a production variance occurs, the EBRR posting is generated after the goods receipt for the production order. As with the price difference before, the production variance amount is used as the actual cost for the calculation of revenue in EBRR.

Additionally, Universal Parallel Accounting for the parallel valuation of plan cost in production orders and event-based Overhead and Work in Process costs are also integrated with the ETO scenario. Please refer to the following 2 blog posts for details:

Figure #13: Event-Based Production Cost

After Goods Receipt of the Finished Goods, the variance of the production order can be checked in the Fiori app Order Cost Details - Event-Based. As shown in figure #13 above, the cost information is recorded on the production order, but this is linked through attribution to the WBS Element for the project. This means that you see the same information as for make-to-stock but with the ability to select via WBS element. The Total Variance (in this example 1868,07 Euro) is used as Actual Cost in the calculation of revenue adjustment for EBRR.

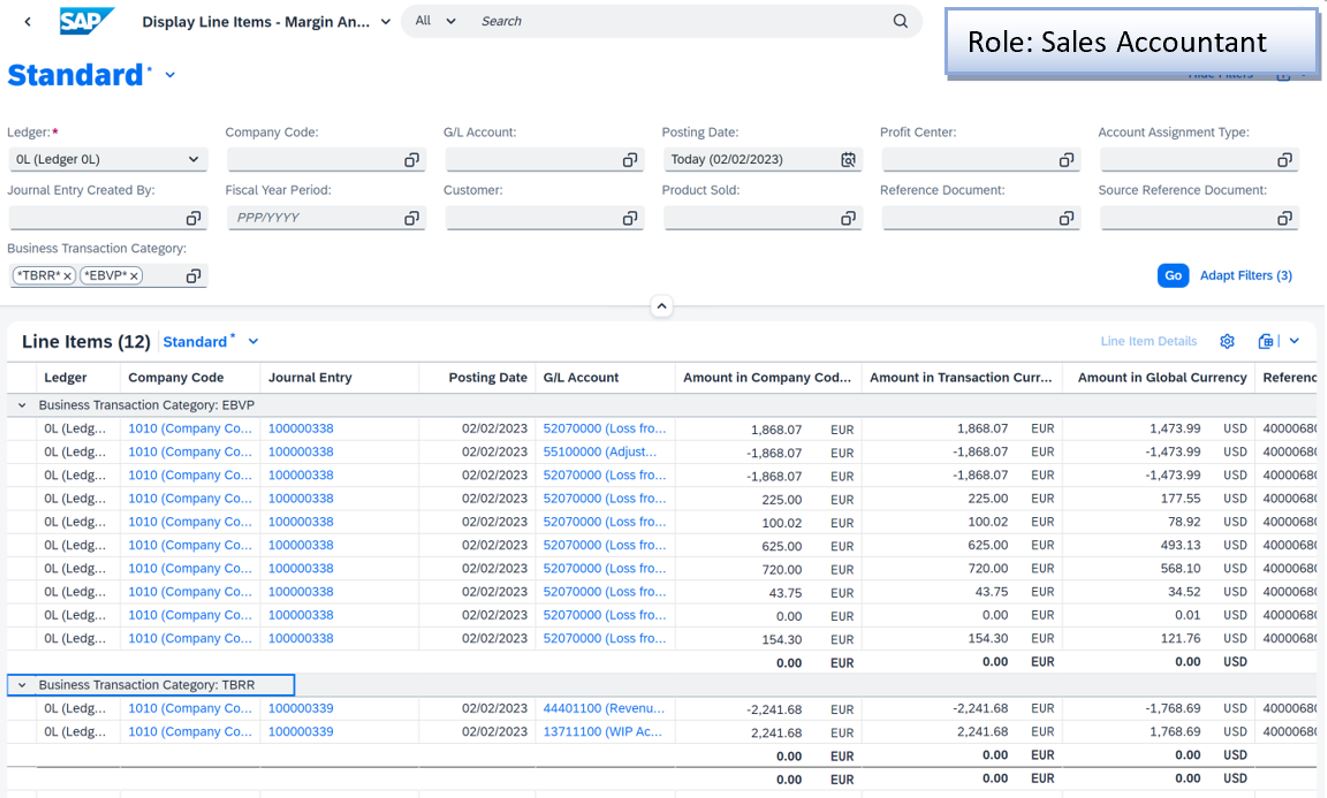

Figure #14: Production Variances in Margin Analysis

Now, let’s check what will be posted for EBRR. As shown in figure #14 above in the Fiori App Display Line Items – Margin Analysis, the Accrued Revenue from the EBRR posting (Business Transaction Type: TBRR) is 2241,68 Euro. This value is calculated based on the amount of actual cost (production variance), and the logic is as follows:

The Accrued Revenue = PoC*12000 = 1868,07/10000*12000 = 2241,68 Euro.

Figure #15: Production Variances in EBRR

Let’s also check the Fiori App Event-Based Revenue Recognition – Projects to see the updates in Income Statement for Revenue Recognition Key (EPMFC). As shown in figure # 15 above, the actual Recognized Revenue is updated to 2301,68 Euro. Since in figure #11 the Recognized Revenue is 60 Euro, the accumulated Recognized Revenue = 60 Euro + 2241,68 Euro (Figure #14) = 2301,68 Euro. Accordingly, the accumulated recognized cost against the project is 50 Euro + 1868,07 Euro = 1918,07 Euro. So, the actual Recognized Margin = 2301,68 – 1918,07 = 383,61 Euro.

Financial Value Flow in Sales process

Figure #16: Sales Process

Now let’s check the key financial value flow in the Sales Process integrated into ETO. As shown in figure #16 above, EBRR is also integrated into sales processes like Down Payment, Delivery to Customer, and Billing. It is possible to view relevant postings in the Fiori App Display Line Items – Margin Analysis and check actual updates in the Income Statement and Balance Sheet in the Fiori App Event-Based Revenue Recognition – Projects during the sales process.

Figure #17: Down Payment in Margin Analysis Line Item

Let’s check the posting after a Down Payment is posted for the Sales Order under the example Project. As shown in figure #17 above, a total Down Payment of 1200 Euro (output tax 228 Euro) is credited for the Sales Order under the WBS ETOFIN. There is no real-time EBRR posting for Business Transaction Type TBRR for the Down Payment.

Figure #18: Down Payment in EBRR

As shown in figure#18 above, the Down Payment Amount is updated accordingly under the Balance Sheet in the Fiori App Event-Based Revenue Recognition – Projects. Since the project shows accrued revenue of 2301,68 EUR and a liability of 1200 EUR, you could revalue the project with the Fiori App Event-Based Revenue Recognition – Projects, which would net the asset and liability position. This is the default behavior in SAP S/4HANA Cloud, public edition, which can be adjusted through an expert configuration.

Figure #19: Goods Issue to Customer in Margin Analysis

After the outbound delivery, the Goods Issue is posted to the customer, let us check the posting in the Fiori App Display Line Items – Margin Analysis. As shown in figure #19 above, the inventory cost for the Finished Goods is 4344,20 Euro. The Accrued Revenue in EBRR posting (Business Transaction Type: TBRR) will be calculated for the Revenue Recognition key EPMFC based on this value as follows:

- Accrued Revenue = 4344,20/10000*12000 = 5213,04 Euro

Figure #20: Goods Issue in EBRR

As shown in figure #20 above, the accumulated Recognized Revenue, Recognized COS, Recognized Margin are updated accordingly. The previous amount for Recognized Revenue is 2301,68 Euro, Recognized COS is 1918,07 Euro (refer to figure # 15). The Recognized Revenue from the Goods Issue is 5213,04 Euro and the total Recognized COS is 4344,20 Euro as explained in figure #19. So, the actual Income Statement is updated as follows:

- Recognized Revenue = 2301,68 Euro+ 5213,04 Euro = 7514,72 Euro

- Recognized COS = 1918,07 Euro + 4344,20 Euro = 6262,27 Euro

- Recognized Margin = Recognized Revenue - Recognized COS = 1252,45 Euro

Figure #21: Billing in Margin Analysis

After the creation of the Billing Document (amount 12000 Euro), there will be an EBRR posting as shown in figure #21 above.

Figure #22: Billing in EBRR (Income Statement)

The Income Statement shown in the Fiori App Event-Based Revenue Recognition – Projects is updated as shown in figure #22 above. The Billed Revenue is updated to 12000 Euro under Income Statement.

Figure #23: Revalue in EBRR

During the period closing, you can trigger the revaluation from the SAP Fiori App Event-Based Revenue Recognition – Projects. This function recalculates the values if you changed the planned cost or have received a down payment, as we mentioned earlier. You can simulate the revaluation before posting. Recalculated values are color-highlighted as shown in Figure #23.

Figure #24: Project Profitability

Last, but not least, the overall Project Profitability can be analyzed in the SAP Fiori App Project Profitability, as shown in figure #24 above. With this app, you can monitor your actual revenue and costs, the values determined during event-based revenue recognition and the value of the project stock. The data shown is based on G/L line items that are assigned to the semantic tags for the various KPIs, and you can drilldown to the journal entries for all KPIs with the Navigate To button. Please refer to Project Profitability in the SAP Help Portal for details.

Additional Information

- Scope Item 6GD in SAP Process Navigator

- SAP Help Portal: Event- Based Revenue Recognition

- SAP Help Portal: Margin Analysis

- SAP Help Portal: Project Profitability

- SAP Blog post: Discrete Industries in SAP S/4HANA, Public Edition 2302

- SAP Blog post: Revenue Recognition Key Documentation: The Key to Understanding the Posting Logic of Event-Based Rev...

- SAP Blog post: Event-Based Revenue Recognition for Universal Parallel Accounting in SAP S/4HANA 2022

- SAP Blog post: Universal Parallel Accounting

- SAP Blog post: New in Production Accounting – Event-Based Production Cost Posting

- SAP Blog post: Production Accounting for Universal Parallel Accounting

- SAP Blog post: Using Market Segments in Margin Analysis

- SAP Learning Hub: Engineer to Order end-to-end in SAP S/4HANA Cloud, Public Edition

- SAP Managed Tags:

- Industrial Manufacturing,

- SAP S/4HANA Public Cloud

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

- SAP S/4HANA Cloud, public edition, ABAP Environment Case 8: Material Shelf Life Management in Enterprise Resource Planning Blogs by SAP

- Building Low Code Extensions with Key User Extensibility in SAP S/4HANA and SAP Build in Enterprise Resource Planning Blogs by SAP

- Question about notification in SAPS/4HANA Public Cloud in Enterprise Resource Planning Q&A

- SAP S/4HANA Cloud Public Edition 2402.2: Final What's New & Product Assistance available in Enterprise Resource Planning Blogs by SAP

- SAP Preferred Success: A Day in a Life in Product Change Management with Change Records in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 8 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |