- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- SAP S/4HANA Cloud for group reporting 2302 is gene...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

02-06-2023

10:01 AM

We in SAP Product Engineering team are happy to announce the general availability of SAP S/4HANA Cloud for group reporting release 2302 on January 25, 2022. In the newest version of our next-generation consolidation software, you can benefit from the following new and enhanced features to help you run your group financial close better:

- Starter content for building forms to collect ESG data

- Package management supporting a staggered close

- Design questions and collect answers in forms

- Segregation of duties for manual journal postings with an approval workflow

- Method-change and OCI (at equity) automation in consolidation of investments

- Currency translation – company or posting date – specific exchange rate

- Assignment of margin analysis, journal entry, and other accounting fields to group reporting customer fields

- Upload infrastructure enhancements with new “Add” update mode

- Migration support for SAP Financial Consolidation data load into Group Reporting

- Export mapped data in a CSV file with SAP Group Reporting Data Collection's data mapping app

- Balance carryforward enhancements

- New public cloud APIs to read consolidation task groups, and consolidation unit task run

- Consolidation version enhancements

- Display Group Journal Entries app enhancements

- Consolidation global hierarchies’ enhancements

- Miscellaneous enhancements in Group Reporting master data, including Consolidation Unit on 18 characters

- Leaner data collection task log

- Improved performance in initial data load and efficient line validation log focusing on errors only

--

Starter content for building forms to collect ESG data

--

With 2302, SAP Group Reporting Data Collection (GRDC) package of sample data entry forms for ESG (environmental, social, corporate governance) metrics based on requirements of GRI and WEF SCM standards allows for quick and easy data collection from entities. Leverage Group Reporting’s existing abilities to manage and orchestrate global data collection processes for currencies, quantities, and texts for ESG scenario.

Sample forms include: Greenhouse gas emissions, Energy consumption, Water consumption and withdrawal, Personnel – diversity and inclusion, Personnel – discrimination cases, Anti-corruption training, Research and development projects description.

The ESG starter content helps you increase efficiency in building your own ESG data collection forms by making use of the example forms as reference, easily collect of ESG data from entities together with consolidation figures, and extend data entry forms for additional ESG metrics

Use sample data entry forms as is, or configure your own ESG data entry forms as required, including ESG metrics (statistical Financial Statement Items), comments and visual controls.

--

Package management supporting a staggered close

--

In 2302, you can use new features in the packager manager of SAP Group Reporting Data Collection forms and:

- Organize the availability of folders in the package by multiple steps of a staggered close data collection process

- Assign a collection of forms and folders to packages and steps

- Define the data entry context of each package by applicable versions, years, periods, consolidation units

- Define read and write document type values at package level, instead of form level (share same settings between multiple forms)

- Use productivity features such as specifying cons units by attribute, as of period or year, and copy or paste of packages

--

Design questions and collect answers in SAP Group Reporting Data Collection's forms

--

Textual information and notes play an important role in the group financial close process, for example to provide auditors with contextual information on the consolidated figures, deliver complementary information to the corporate financial reports or meet sustainability reporting requirements. To help you collect textual information at group level, new Questions and Answers feature is now available in SAP Group Reporting Data Collection (GRDC).

You can create questions when designing your forms in SAP Group Reporting Data Collection (GRDC). Questions and Answers enable you to guide your contributors and get the textual responses from your units. They can help improve the overall quality of your data, for example by asking for a sign-off or an assessment of the numbers provided. In addition, you can re-use questions, which saves time and enables the creation of overview forms. The new Questions and Answers feature is useful in business scenarios with the need for textual information in the final report, such as Notes to the annual statement or Sustainability or integrated reports.

--

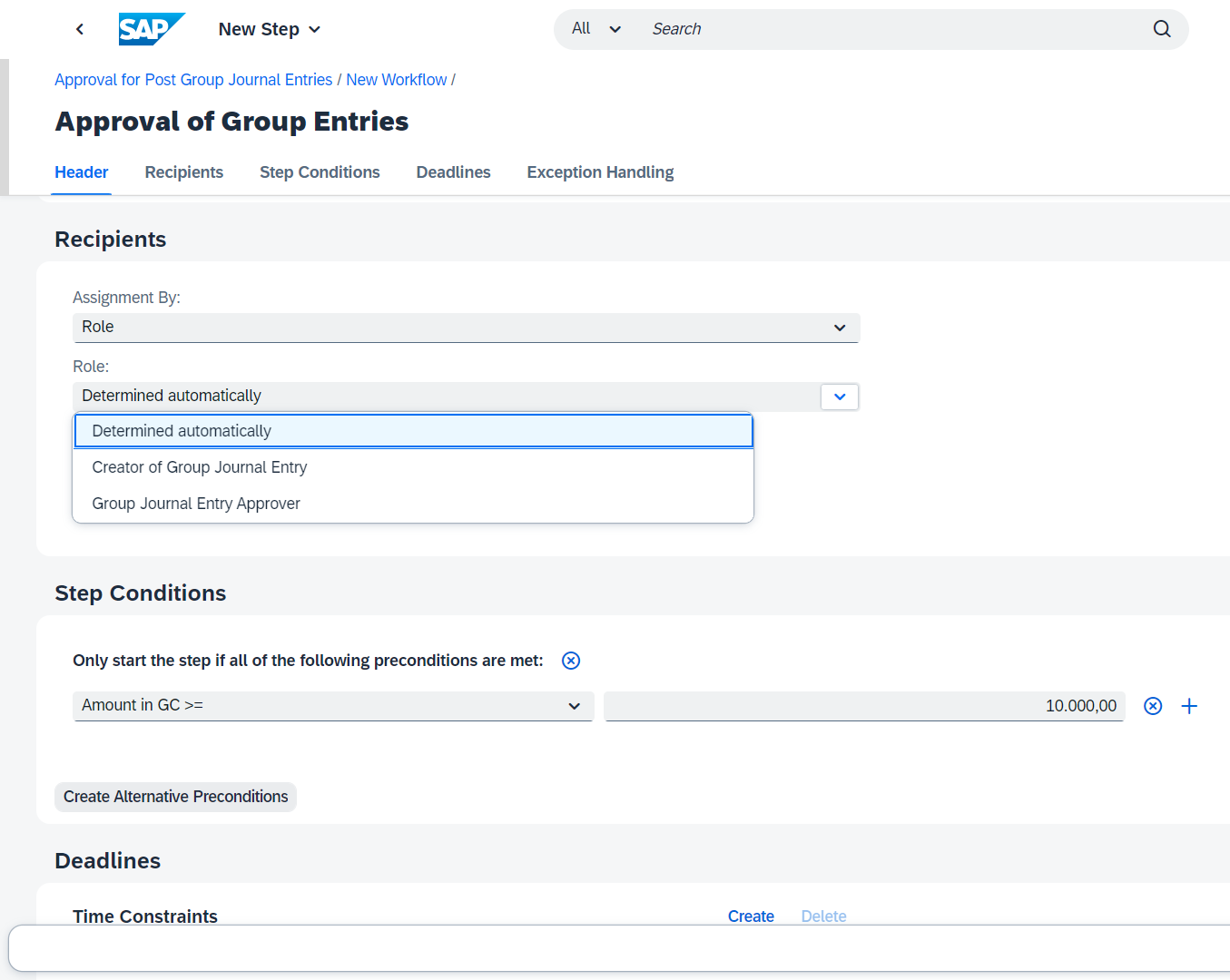

Segregation of duties for manual journal postings with an approval workflow

--

In 2302 you can now manage workflows for manual group journal entries. With the new workflow capability, you're able to validate your manually posted group journal entries within your organization before they are persisted in the database. Workflows can help streamline the review process with a "4-eye" principle. A workflow process helps your business end-users productively collaborate and make sure that submitted group journals are error free before they are posted. The workflow uses the Manage Teams and Responsibilities app, where you can create teams, and manage responsibilities and team member functions in workflows.

With the Manage Workflows for Manual Journal Entries app, you can define:

- The validity period for your approval workflow process

- Pre-conditions for the workflow to be executed (for example amounts, trigger the workflow only if group currency amounts are superior or equal to 10,000)

- Recipients by teams, or role (for example Group Journal Entry creator or approver, as shown in the screenshot below)

- Workflow steps

- Deadlines

- Exception handling

The main thing to note is that you when send a manual journal entry for approval, it's not yet posted. It'll be actually posted only it's approved. If you're an approver, you'll receive the manual journal entries in My Inbox. From there, you can approve, reject or ask for a rework of the journal entry (see the screenshot below). You can do this either for one specific journal entry, or via multi-selection of journal entries.

--

Method-change and OCI (at equity) automation in consolidation of investments

--

With 2302, you can now automate the consolidation method change (Purchase, Equity) assigned to a consolidation unit. This new feature includes:

- Method change in the Group Structure

- Definition of the Subitems for the method change

- Automatic adjustments in the Preparation for Consolidation Group Changes (PCC) task

- New C/I activities in Reclassification

- Automatic postings in activity-based consolidation of investments

In the Group Structure, you can now change overtime the method assigned to the consolidation unit. The overview screen indicates that a method change occurred during the assignment of a consolidation unit (see the screenshot below). Consolidation method change from Equity method to Purchase method and from Purchase method to Equity method are fully supported.

When the consolidation method is changed to Purchase Method, for balance sheet financial statement items, the financial data of periods before the change is posted to the "After Change of Consolidation Method" subitem. The Net Income balance sheet financial statement item is reclassified as "Net Income Prior to Method Change".

When the consolidation method is changed to Equity Method, for balance sheet financial statement items, the financial data of periods before the change is posted to the "Before Change of Consolidation Method" subitem. The Net Income balance sheet financial statement item is reclassified as "Net Income Prior to Method Change".

--

Currency translation – company or posting date – specific exchange rate

--

In 2302, in order to increase efficiency, reduce manual work, and enhance both transparency and auditability of currency translation, you can now translate the financial data of a consolidation unit using an exchange rate that is specific to this consolidation unit, or valid for the date of a transaction.

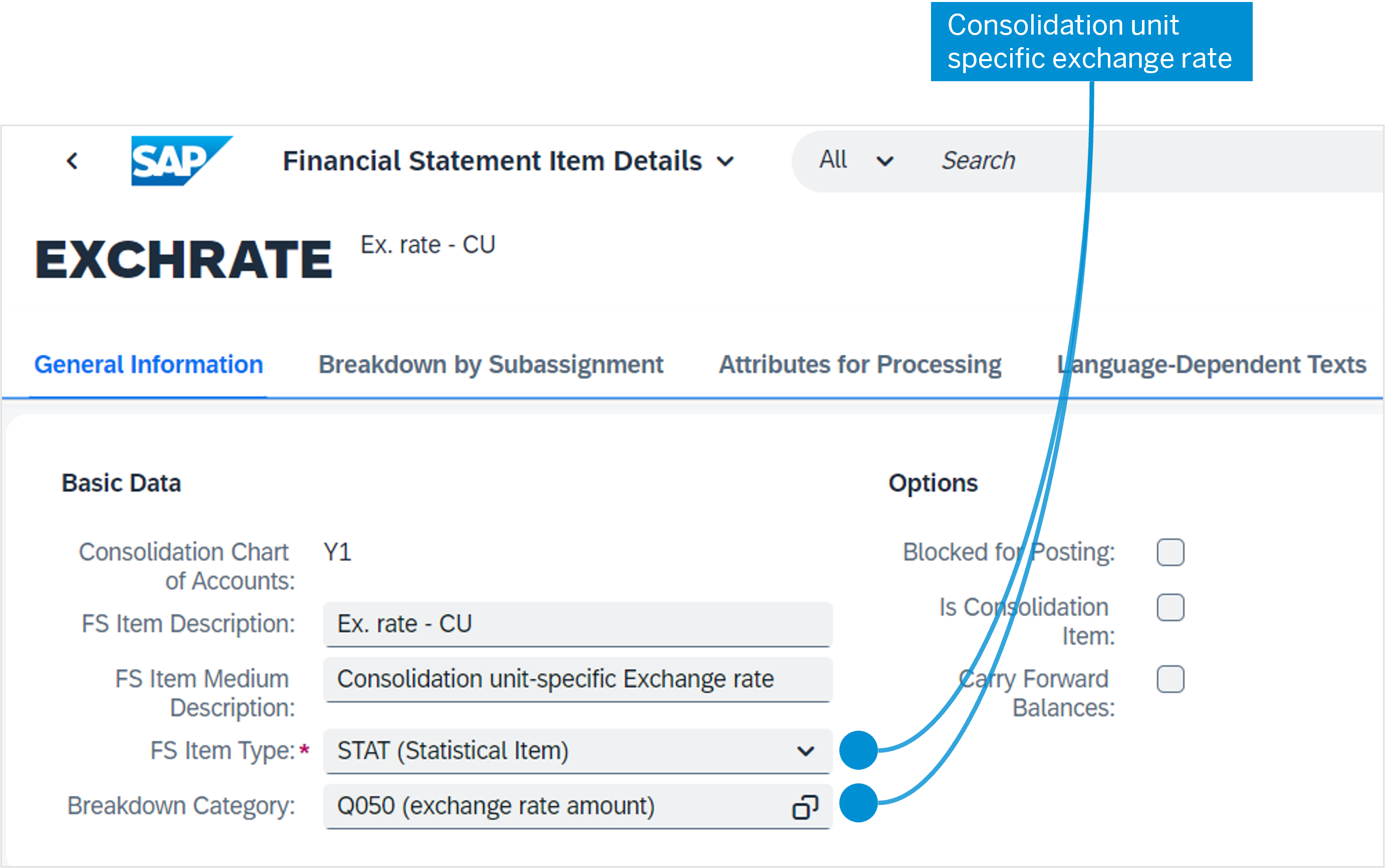

Consolidation unit-specific exchange rate

For example, in the current period you have two subsidiaries from the same country are acquired on different dates. You need to convert the acquired balance sheet using an exchange rate different between each consolidation unit. For this, you can record on a statistical FS item a rate for each consolidation unit, and translate the financial data using this specific rate.

Here's how you can define a consolidation unit-specific exchange rate:

- Define a statistical financial statement item to record the exchange rate (see the screenshot below)

- Define a selection to select the rate data on the relevant financial statement item

- The rate can be uploaded, manually entered in a form or posted in a journal entry like any other transaction data

- The currency translation will multiply the local currency amount by this rate. The factors defined for the currency pair are also considered.

In the currency translation log, a message mentions that a deviating rate was used:

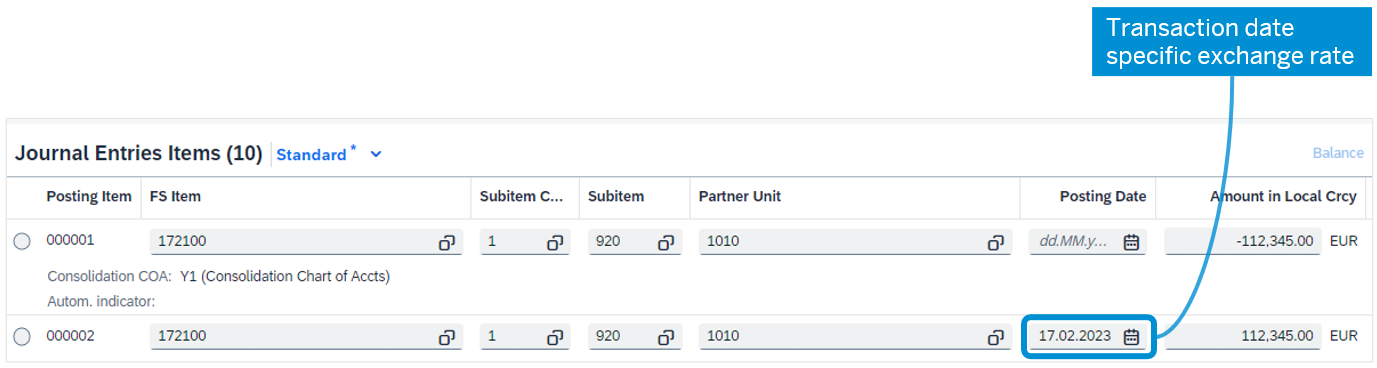

Transaction date-specific exchange rate

For example, you acquire an investment on 17.02.2023. You need to translate the values with the rate valid on this date. You can assign in the reported data the posting date of this transaction (17.02.2023) and translate the value using the rate valid on this date.

Transaction data is typically collected without the original posting date. When the translation using the rate of the posting date is needed (typically for changes in investments and equity), a manual journal entry can be posted or uploaded. In the example below, an acquisition of investments occurred on 17/02/2023, but the corresponding reported data is not assigned to the posting date. A journal entry is posted to assign the posting date.

The currency translation will fetch the spot exchange rate of this date to convert the amount.

--

Assignment of margin analysis, journal entry, and other accounting fields to group reporting customer fields

--

With 2302, you benefit from an enhanced integration of customer extended fields between accounting and group reporting beyond the accounting business context "accounting: coding block to consolidation journal entry", which the functionality is currently limited to.

You can use this innovation to assign additional accounting fields to group reporting customer fields for the following scenarios:

- Fields from accounting field extensibility business context "accounting market segment"

- Fields from accounting field extensibility business context "accounting journal entry item"

- Selected accounting standard fields

- Asset class

- Group asset

- Document type

- Business transaction type

- Closing step

- Subledger-specific line item type

- Source ledger

- Cost analysis resource

The ability you now have to transfer additional fields from accounting journal to group journal brings multiple benefits:

- Improve flexibility in defining data granularity for group reporting through direct data release from accounting data to group reporting

- Directly integrate extended fields from the business contexts "accounting market segment" and "accounting journal entry item", avoiding the need to choose alternative data transfer options such as SAP Group Reporting Data Collection with ACDOCA (the universal journal) as a source

- Simplify the exchange of business objects and improve data consistency by leveraging the suite quality "aligned domain models, APIs, and events”

- Engage one semantically aligned domain model across SAP solutions and end-to-end business processes for your intelligent sustainable enterprise

Check out for more in our SAP Help Portal "Release Universal Journals for Nonstandard Group Journal Entry Fields".

--

Upload infrastructure enhancements with new “Add” update mode

--

In 2302, when you use the Flexible Upload for Reported Data app or the Reported Financial Data - Bulk Import API, you can now use a new update mode “Add”.

With the new "Add" mode, only the uploaded records are added to the existing records. Any existing records including those which share the same financial statement items and all of the same sub-assignments remain unchanged. If the input file contains data with multiple combinations of version, period and consolidation unit then no records are added to the existing records.

--

Migration support for SAP Financial Consolidation data load into Group Reporting

--

In 2302, we now provide migration support functions to help you activate and go-live with SAP S/4HANA for group reporting with a focus on the transfer of data from SAP Financial Consolidation as "legacy" application.

The new migration support function includes:

- Export transactional data from SAP Financial Consolidation to Group Reporting Data Collection - Mapping

- Example mapping definition to transform transactional data of the SAP Financial Consolidation starter kit to SAP S/4HANA for group reporting best practice content item 1SG allowing to extract the transformed data into a flat file

- Import transformed transactional data file into SAP S/4HANA with a loader program provided as a service

- New SAP Financial Consolidation function for extraction via "report bundles" and calling GRDC mapping

- New SAP S/4HANA "data loader" program to import consolidated data from SAP Financial Consolidation to SAP S/4HANA for group reporting

For more information, you can check out the following:

- Activating access to SAP Group Reporting Data Collection

- Sending data to SAP Group Reporting Data Collection

You can also refer to our "How to Recover Historical Data from SAP Financial Consolidation" How-To-Guide in SAP Note 2659656 (Attachments tab), including:

- Introduction - Objective and Scope, Configuration Used

- Implementation Principles - Consolidation of Investments, Currency Translation

- Special Points to Consider - Subitems, Periodic vs. YTD Amounts, Sign Convention, Breakdown Analysis, Currency Translation with Method S0905, Financial Interest Rates, Manual Journal Entries, Multiple Group Currencies, Net Income Calculation, Specific Package for Equity Method

- Practical Guide - Scenarios, Global Parameters, Consolidation Master Data, Data Mapping and Data Upload, Data and Consolidation Monitors, Group Data Analysis

--

Export mapped data in a CSV file with SAP Group Reporting Data Collection’s data mapping app

--

With 2302, when using SAP Group Reporting Data Collection's Data Mapping Definition, you can now choose in the « Target Definition » section if the mapped data have to be directly uploaded in Group Reporting table (ACDOCU), or generated in a csv file. When running data mapping, you can download the csv file with mapped data.

--

Balance carryforward enhancements

--

In 2302, balance carry forward is enhanced. If you need to change the way to process consolidation entries, for example to change from an automatic document type to a manual document type, or if you need to merge some document types, you can now define a destination document type for balance carry forward for a timeframe.

You can now write your own program logic in the following areas:

- Use custom code to replace dimension values in the balance carried forward (BCF) in group reporting for additional and customer fields

- Change the document type of the BCF by defining a source and target document type in a configuration UI (no programing required)

- Call task APIs to:

- Retrieve task-status information in group reporting

- Run simple task actions in group reporting with direct responses such as block and unblock; (look for advanced task actions, such as run and test which are required for an asynchronous API call, in an upcoming release)

- Retrieve configuration settings on the task group definition

--

New public cloud APIs to read consolidation task groups, and consolidation unit task run

--

With 2302, we introduce three new Task APIs:

- Consolidation Task Group - Read API - this service enables you to read consolidation task groups and assignments of consolidation tasks

- Consolidation Task Group Assignment - Read API - this service enables you to read assignments of a consolidation task group to a data monitor and to a consolidation monitor. The assignment depends on the consolidation version, fiscal year, period, and period category.

- Consolidation Unit Task Run - Read API - this service enables you to read, block, unblock, and reset a consolidation task that is run for a consolidation unit. These actions are possible in the context of a consolidation chart of accounts, consolidation version, fiscal year, and period.

--

Consolidation version enhancements

--

In 2302, we improve the consolidation version UI. On the left pane of the maintenance screen for consolidation version you can now access (1) special versions, (2) consolidation versions, and (3) the assignment of the special versions to the consolidation version remains at the bottom of the maintenance screen - see the screenshot below.

When the Group Reporting Preparation Ledger is active, you can now optionally select the source value fields for the Release Task: Local Currency, Group Currency, and Quantity - see the screenshot below.

--

Miscellaneous enhancements in Group Reporting master data, including Consolidation Unit on 18 characters

--

In 2302, you benefit from the following master data enhancements:

- Financial statement item master data (introduction of offsetting target attribute, and removed check regarding financial statement item and hierarchy node in financial statement item hierarchies)

- G/L account mapping to financial statement items (changes of G/L Account Mapping to financial statement items in special periods are now supported)

- Consolidation unit master data (enhancement of consolidation unit key from 6 to 18 characters, adjusted check regarding local currency for integration with Group Reporting Preparation Ledger)

- Configuration of subitem categories and subitems (deletion of customer created subitem categories and subitems is now possible)

- Configuration of breakdown categories (deletion of customer created breakdown categories is now possible)

- Define consolidation master data fields (changes in configuration for additional master data fields and their superordinated fields)

--

Leaner data collection task log

--

In 2302, you can use a simplified UI of the data collection task log:

- Reduced to one row per each message and record

- Show only the message line including message type and message text

- Message line also includes Journal Entry Amount

--

Improved performance in initial data load and efficient line validation log focusing on errors only

--

With 2302, we introduce data load without real-time consistency check (posting level 0C enhancements). Especially when feeding data through system-2-system connections (such as SAC to GR data transfer, GRDC mapping, customer programmed interfaces) downstream consistency checks come with the following advantages:

- Improved performance in initial data load

- Efficient line validation log focusing on errors only

- Additional correction option within the system if corrections at source are not feasible in required time-frame

- Data are available for analytics even if they still need to be quality checked and potentially adjusted in details. (e.g. total sales revenues are already available even if a required breakdown by product is still missing)

- File upload, GRDC mapping and API can now be used to correct data from posting level blank on posting level 0C also

—

More information

—

- Finance in SAP S/4HANA Cloud, Public Edition 2302

- SAP S/4HANA Cloud for group reporting 2302 feature deck

- SAP S/4HANA Cloud for group reporting 2302 documentation

- Recap of SAP S/4HANA for group reporting releases

- SAP S/4HANA for group reporting Road Map Explorer

- Join our SAP S/4HANA for group reporting community

- Co-innovate online with Group Reporting's Product Engineering team

—

Labels:

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

157 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,684 -

Product Updates

218 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- Adjust settlement rule automatically created in IM for AuC in Enterprise Resource Planning Q&A

- Third Party with Subcontracting PREQ from Schedule line doesnt generate component requirement in Enterprise Resource Planning Q&A

- Stock Ageing Report just gone live of SAP S/4HANA Cloud Public Edition in Enterprise Resource Planning Q&A

- ISAE 3000 for SAP S/4HANA Cloud Public Edition - Evaluation of the Authorization Role Concept in Enterprise Resource Planning Blogs by SAP

- Peppol Integration Scenario Generates Inconsistencies in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 13 | |

| 11 | |

| 10 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |