- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Fixed Assets Revaluation in SAP Business One

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-24-2023

1:02 PM

Fixed Assets is a serious part in the balance sheet and is an object of check for auditors and tax authorities.

That is why we need to be sure that all transactions with fixed assets are transparent and clear. In this article I want to describe the most popular fixed assets transactions in SAP Business One. Under the most popular transactions I mean the fixed assets that are depreciated during some years with straight-line depreciation on net booking value dividing on the remaining useful life. In case nothing dramatic is caused with the asset like modernization or scrapping the depreciation amount is the same as for the straight-line depreciation on acquisition value dividing on total useful life.

-What can be the other case that fixed asset needs to be revaluated?

-Yes, exactly: when its net booking value does not correspond to the real market price.

The actual market price can be higher or lower than your asset net booking value (NBV).

To reflect the real market, you can create an Asset Revaluation document.

So, let’s look how it looks like and how journal entry transaction (JE) is when the actual market price is higher.

Here is example of the revaluation document in SAP Business One (B1):

Asset was capitalized with price 12,000 and the accumulated depreciation to the revaluation date is 1,332, so net booking value is 12,000 – 1,1132 = 10,668. New value 15,000 is the real market price. B1 calculates the difference 4,332 as the revaluation gain. The simple JE looks like:

Please, note that Revaluation Account was added recently, see Note https://launchpad.support.sap.com/#/notes/3083952. Note In the installed data bases this account was filled automatically with Balance Sheet account.

However, for the transparent view of the asset cost the values should be renewed. Before you add the Asset Revaluation document tick on IFRS Posting check box:

What do these amounts mean and how do they affect fixed assets values?

Let’s now look for the case that real market price is lower than asset new booking value.

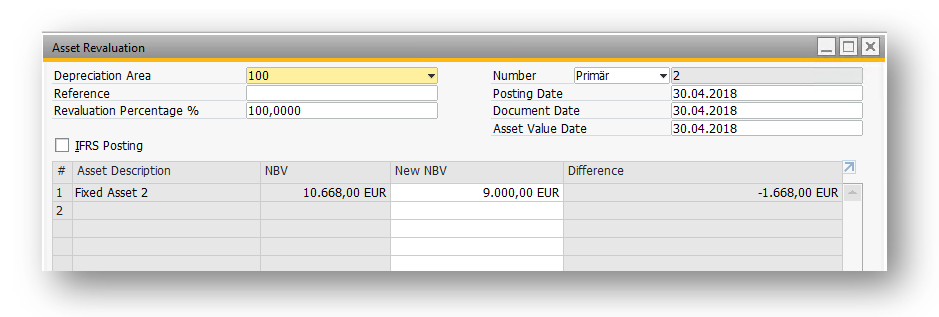

Here is example of the revaluation document in SAP Business One again:

Asset was capitalized with price 12,000 and the accumulated depreciation to the revaluation date is 1,332, like in the first case. But now we enter new value 9,000 as the real market price. The revaluation difference is booked as unplanned depreciation:

However, we have already said that for the transparent view of the asset cost the values should be renewed . So, before you add the Asset Revaluation document tick on IFRS Posting check box:

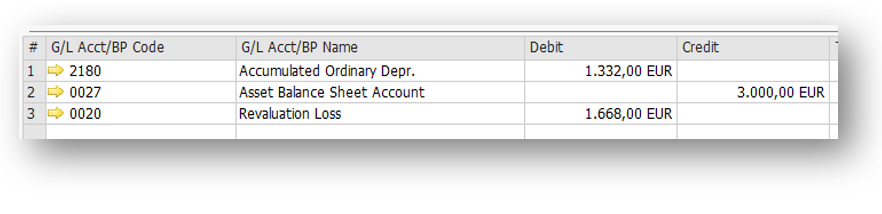

And as the result the JE dramatically changes to:

However, if you compare that with the previous transaction IFRS Revaluation gain you see that transaction is the same. The difference is only that result of revaluation (gain or loss) is booked to the different account. So, again, the accumulated Depreciation balance is zeroed, Asset balance sheet account balance shows the new cost.

Please, note that new transactions with IFRS postings are relevant only when the Posting of Depreciation is set as Indirect Posting in the Depreciation Areas – Setup:

IFRS postings transaction for fixed asset revaluation are possible since FP2202 of SAP Business One, SAP Business One version for SAP HANA, see details in SAP Note https://launchpad.support.sap.com/#/notes/3135917 .

That is why we need to be sure that all transactions with fixed assets are transparent and clear. In this article I want to describe the most popular fixed assets transactions in SAP Business One. Under the most popular transactions I mean the fixed assets that are depreciated during some years with straight-line depreciation on net booking value dividing on the remaining useful life. In case nothing dramatic is caused with the asset like modernization or scrapping the depreciation amount is the same as for the straight-line depreciation on acquisition value dividing on total useful life.

-What can be the other case that fixed asset needs to be revaluated?

-Yes, exactly: when its net booking value does not correspond to the real market price.

The actual market price can be higher or lower than your asset net booking value (NBV).

To reflect the real market, you can create an Asset Revaluation document.

So, let’s look how it looks like and how journal entry transaction (JE) is when the actual market price is higher.

Here is example of the revaluation document in SAP Business One (B1):

Asset was capitalized with price 12,000 and the accumulated depreciation to the revaluation date is 1,332, so net booking value is 12,000 – 1,1132 = 10,668. New value 15,000 is the real market price. B1 calculates the difference 4,332 as the revaluation gain. The simple JE looks like:

Please, note that Revaluation Account was added recently, see Note https://launchpad.support.sap.com/#/notes/3083952. Note In the installed data bases this account was filled automatically with Balance Sheet account.

However, for the transparent view of the asset cost the values should be renewed. Before you add the Asset Revaluation document tick on IFRS Posting check box:

With this check box setting the JE will be like:

What do these amounts mean and how do they affect fixed assets values?

- Accumulated Depreciation will have balance 0.00.

- Asset Balance Sheet Account 15,000 – new booking value, so 3,000 (New Booking Value 15,000 – Asset balance account 12,000 = 3,000) is booked to the debit of this account. In case the result (NBV – Asset Balance Sheet Act) is negative, then it will be booked to the credit of this account.

- Revaluation gain remained the same.

Let’s now look for the case that real market price is lower than asset new booking value.

Here is example of the revaluation document in SAP Business One again:

Asset was capitalized with price 12,000 and the accumulated depreciation to the revaluation date is 1,332, like in the first case. But now we enter new value 9,000 as the real market price. The revaluation difference is booked as unplanned depreciation:

However, we have already said that for the transparent view of the asset cost the values should be renewed . So, before you add the Asset Revaluation document tick on IFRS Posting check box:

And as the result the JE dramatically changes to:

However, if you compare that with the previous transaction IFRS Revaluation gain you see that transaction is the same. The difference is only that result of revaluation (gain or loss) is booked to the different account. So, again, the accumulated Depreciation balance is zeroed, Asset balance sheet account balance shows the new cost.

Please, note that new transactions with IFRS postings are relevant only when the Posting of Depreciation is set as Indirect Posting in the Depreciation Areas – Setup:

IFRS postings transaction for fixed asset revaluation are possible since FP2202 of SAP Business One, SAP Business One version for SAP HANA, see details in SAP Note https://launchpad.support.sap.com/#/notes/3135917 .

- SAP Managed Tags:

- SAP Business One,

- SAP Business One, version for SAP HANA

Labels:

14 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

20 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

22 -

Expert Insights

114 -

Expert Insights

148 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,687 -

Product Updates

200 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

85

Related Content

- An introduction into Service Management in S/4HANA Cloud Private Edition in Enterprise Resource Planning Blogs by SAP

- SAP Enterprise Support Academy Newsletter April 2024 in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Extensions with SAP Build Best Practices: An Expert Roundtable in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud Public Edition 财务-成本会计常见热点问题汇总FAQ in Enterprise Resource Planning Blogs by SAP

- User Experience in SAP S/4HANA Cloud Public Edition: New Microlearning Available in Enterprise Resource Planning Blogs by SAP

Top kudoed authors

| User | Count |

|---|---|

| 5 | |

| 5 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 4 | |

| 3 | |

| 3 |