- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- SAP S/4HANA Revenue Recognition with Result Analys...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Associate

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

01-10-2023

9:09 PM

Introduction:

In this blog you will see how SAP calculates the Project WBS Result Analysis and settlement postings as per the Multiple valuations like Legal Valuation, Group valuation and Profit center valuation and it also provides required configuration details relating to Result Analysis.

What you will learn from this Blog?

You will learn following key concept by going through this Blog.

As per the Accounting standard the Revenue should be recognized based on different methods and in this blog we are focusing on Cost based POC. We can understand better with the following example.

Let’s assume ABC ltd company manufacture heavy Equipment’s which may take longer periods to manufacture and assemble the equipment. Here the business requirement is to Calculate and recognize the Revenue as per Incurred Actual Cost with multiple valuations like Legal, Group and Profit center.

In the Engineering to manufacture scenario the component production process are assigned to a specific Project which will be the WBS element in SAP. Hence the Component manufacturing cost and relevant stock movements and inventory will always be assigned to Project (WBS).

Hence at each phase of the project you will incur various cost which may differ per valuation (Legal, Group and PCA) that will determine the Percentage of actual completion along with ‘Calculated Revenue’ for each valuation.

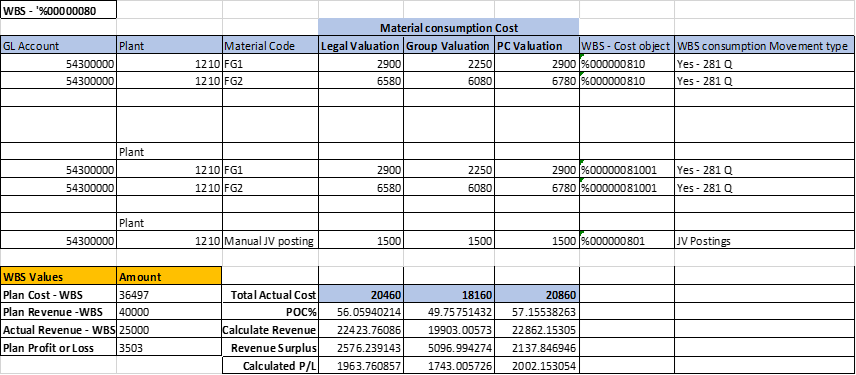

As per the Valuations based on the Cost based POC, the below is the example with calculation.

Here in the above mentioned excel you can see the material consumptions got booked against the P&L GL account 5430000 in plant: 1210 for material FG1 and FG2 having different amounts in legal, Group and PC valuation (as you have Transfer pricing mark-up scenario).

Note:

Planned cost and revenue of the project are maintained in CJ40 and CJ42 transaction with the WBS and GL account combination. The raw material component plan cost can also directly fetch from the Network orders depending on the Business requirement. Similarly the plan revenues can also fetch from the Sales order depending on the customization setup.

Actual cost and revenue The Actual expenses relating to the project are booked to WBS and Revenue relating to the project is also posted to WBS from SD billing.

RA Calculation Formula’s as per Cost based Percentage of completion:

Cost based POC% = (Actual Cost/Plan cost) *100

Revenue recognization as per Percentage of completion = Plan Revenue*POC%

Revenue in excess of billing or Revenue surplus scenario:

Case i: If Calculated Revenue < Actual Revenue (This is Revenue surplus scenario. Hence you need to reduce/debit revenue from P&L).

Accounting entry:

Dr. Sales Revenue (P&L)

Cr. Deferred Revenue (B/S)

Case II: If Calculated Revenue > Actual Revenue ( This is Revenue in Excess of Billing scenario. Hence you need to increase/Credit the Revenue from P&L).

Accounting entry:

Dr. Accured Revenue (B/S)

Cr. Sales Revenue (P&L)

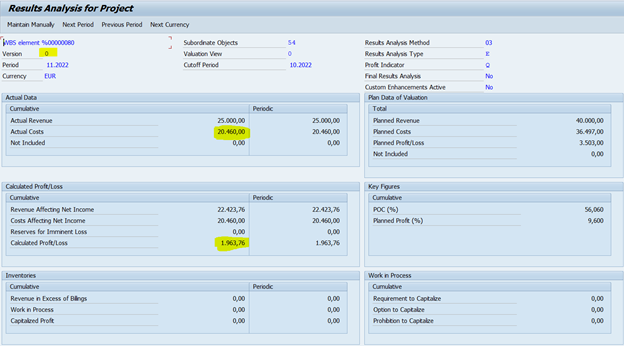

4. Result analysis calculation process steps & financial impact: Result Analysis Calculation as per Valuation: Transaction KKA2 – Period end closing activity

In this example Result Analysis is performed on the higher level WBS element. Here in this system technically will roll up the cost and revenues from lower level WBS to the next higher WBS.

System will consider the planned cost, planned revenue, actual cost, actual revenue and will calculate the POC%, Revenue Affecting Net incomes, Cost Affecting Net income and Calculated Profit/loss. This transaction just save the results and won’t generate accounting settlement entries.

Result analysis calculation as per Legal Valuation:

Result Analysis Calculation as per Group Valuation:

Result Analysis Calculation as per Profit center valuation:

Project Settlement - CJ88: Here system will flow the Actual Cost and Calculated Revenue to COPA.

FI Adjustment entry: Only Financial posting – No COPA posting

COPA posting: When you do the Settlement system will post the COPA document with Revenue and Cost as per Cost based POC method as per valuations. You can see below amounts as per company code currency (legal); Group currency group valuation (currency type: 31)and Group currency, profit center valuation( currency type: 32).

5. Key Configuration Consideration & steps:

Multiple Valuation Approaches/Transfer prices:

In this configuration step you need to define the ‘Currency and Valuation Profile’ and to assign to the controlling Area.

Define Ledger to CO Version:

Here in the below you can see the Leading ledger 0L got assigned to the multiple versions and Valuations like Legal, Group and PC Valuation.

In the below configuration step, you can see the ML type created with currency types 10, 31, 32. The same MT type needs to be assigned to the Plant/Valuation area in the next configuration steps in OMX1 and OMX3 transaction.

Create Result Analysis Key:

RA Key is a control parameter for Result Analysis calculation and is assigned to the WBS element. When an RA Key is assigned to a WBS it becomes Result Analysis relevant. The method assigned to RA Key will be considered when Result Analysis is executed.

Create Result Analysis Version:

Here in this step you can see the controlling area got assigned to the RA versions are per the valuation. Hence when you calculate the Result analysis for WBS - KKA2; you can see the RA at multiple valuations.

Define Valuation Method:

In this step you will assign the Percentage of completion based on the RA method i.e. Cost based or Revenue based or Qty based etc which is shown below and you can fine the status of Result analysis when you want to calculate the RA and cancel the RA. the config. maintenance is as per valuation.

Define Line ID and GL assignment for Result Analysis:

You need to define the Line ID like material cost, travel cost, activity cost, revenue, overhead and assign the relevant GL accounts to the respective Line ids.

Define Posting rules for Settlement for Financial Accounting:

This configuration is maintained with combination of CO Area, Company Code, RA Version and RA Category. Here in you need to map the GL accounts which needs to be posted as part of result analysis adjustments upon settlement. Result Analysis Category like POCI, RUCR, WIPR etc is the key for GL account determination.

6. Conclusion:

Hope you find the blog helpful. The intention of this blog is to give an overview of the Result Analysis concept along with the Legal, Group and Profit center valuation. Based on the Cost based method, you can learn other methods easily, but the valuation concept will be same across the RA method. Please let me know if anyone have doubt or I missed something.

In this blog you will see how SAP calculates the Project WBS Result Analysis and settlement postings as per the Multiple valuations like Legal Valuation, Group valuation and Profit center valuation and it also provides required configuration details relating to Result Analysis.

What you will learn from this Blog?

You will learn following key concept by going through this Blog.

- Business requirement

- Business Process flow

- Result Analysis calculation example

- Result analysis calculation process steps & financial impact.

- Key Configuration Consideration & steps.

- Conclusion.

- Business requirement:

As per the Accounting standard the Revenue should be recognized based on different methods and in this blog we are focusing on Cost based POC. We can understand better with the following example.

Let’s assume ABC ltd company manufacture heavy Equipment’s which may take longer periods to manufacture and assemble the equipment. Here the business requirement is to Calculate and recognize the Revenue as per Incurred Actual Cost with multiple valuations like Legal, Group and Profit center.

- Business process flow:

In the Engineering to manufacture scenario the component production process are assigned to a specific Project which will be the WBS element in SAP. Hence the Component manufacturing cost and relevant stock movements and inventory will always be assigned to Project (WBS).

Hence at each phase of the project you will incur various cost which may differ per valuation (Legal, Group and PCA) that will determine the Percentage of actual completion along with ‘Calculated Revenue’ for each valuation.

- Result Analysis Calculation:

As per the Valuations based on the Cost based POC, the below is the example with calculation.

Here in the above mentioned excel you can see the material consumptions got booked against the P&L GL account 5430000 in plant: 1210 for material FG1 and FG2 having different amounts in legal, Group and PC valuation (as you have Transfer pricing mark-up scenario).

Note:

Planned cost and revenue of the project are maintained in CJ40 and CJ42 transaction with the WBS and GL account combination. The raw material component plan cost can also directly fetch from the Network orders depending on the Business requirement. Similarly the plan revenues can also fetch from the Sales order depending on the customization setup.

Actual cost and revenue The Actual expenses relating to the project are booked to WBS and Revenue relating to the project is also posted to WBS from SD billing.

RA Calculation Formula’s as per Cost based Percentage of completion:

Cost based POC% = (Actual Cost/Plan cost) *100

Revenue recognization as per Percentage of completion = Plan Revenue*POC%

Revenue in excess of billing or Revenue surplus scenario:

Case i: If Calculated Revenue < Actual Revenue (This is Revenue surplus scenario. Hence you need to reduce/debit revenue from P&L).

Accounting entry:

Dr. Sales Revenue (P&L)

Cr. Deferred Revenue (B/S)

Case II: If Calculated Revenue > Actual Revenue ( This is Revenue in Excess of Billing scenario. Hence you need to increase/Credit the Revenue from P&L).

Accounting entry:

Dr. Accured Revenue (B/S)

Cr. Sales Revenue (P&L)

4. Result analysis calculation process steps & financial impact: Result Analysis Calculation as per Valuation: Transaction KKA2 – Period end closing activity

In this example Result Analysis is performed on the higher level WBS element. Here in this system technically will roll up the cost and revenues from lower level WBS to the next higher WBS.

System will consider the planned cost, planned revenue, actual cost, actual revenue and will calculate the POC%, Revenue Affecting Net incomes, Cost Affecting Net income and Calculated Profit/loss. This transaction just save the results and won’t generate accounting settlement entries.

Result analysis calculation as per Legal Valuation:

Result Analysis Calculation as per Group Valuation:

Result Analysis Calculation as per Profit center valuation:

Project Settlement - CJ88: Here system will flow the Actual Cost and Calculated Revenue to COPA.

FI Adjustment entry: Only Financial posting – No COPA posting

COPA posting: When you do the Settlement system will post the COPA document with Revenue and Cost as per Cost based POC method as per valuations. You can see below amounts as per company code currency (legal); Group currency group valuation (currency type: 31)and Group currency, profit center valuation( currency type: 32).

5. Key Configuration Consideration & steps:

Multiple Valuation Approaches/Transfer prices:

In this configuration step you need to define the ‘Currency and Valuation Profile’ and to assign to the controlling Area.

Define Ledger to CO Version:

Here in the below you can see the Leading ledger 0L got assigned to the multiple versions and Valuations like Legal, Group and PC Valuation.

- Material Ledger type:

In the below configuration step, you can see the ML type created with currency types 10, 31, 32. The same MT type needs to be assigned to the Plant/Valuation area in the next configuration steps in OMX1 and OMX3 transaction.

Create Result Analysis Key:

RA Key is a control parameter for Result Analysis calculation and is assigned to the WBS element. When an RA Key is assigned to a WBS it becomes Result Analysis relevant. The method assigned to RA Key will be considered when Result Analysis is executed.

Create Result Analysis Version:

Here in this step you can see the controlling area got assigned to the RA versions are per the valuation. Hence when you calculate the Result analysis for WBS - KKA2; you can see the RA at multiple valuations.

Define Valuation Method:

In this step you will assign the Percentage of completion based on the RA method i.e. Cost based or Revenue based or Qty based etc which is shown below and you can fine the status of Result analysis when you want to calculate the RA and cancel the RA. the config. maintenance is as per valuation.

Define Line ID and GL assignment for Result Analysis:

You need to define the Line ID like material cost, travel cost, activity cost, revenue, overhead and assign the relevant GL accounts to the respective Line ids.

Define Posting rules for Settlement for Financial Accounting:

This configuration is maintained with combination of CO Area, Company Code, RA Version and RA Category. Here in you need to map the GL accounts which needs to be posted as part of result analysis adjustments upon settlement. Result Analysis Category like POCI, RUCR, WIPR etc is the key for GL account determination.

| RA Category | Use |

| POCI | Revenue in Excess of Billings |

| RUCR | Revenue Surplus |

6. Conclusion:

Hope you find the blog helpful. The intention of this blog is to give an overview of the Result Analysis concept along with the Legal, Group and Profit center valuation. Based on the Cost based method, you can learn other methods easily, but the valuation concept will be same across the RA method. Please let me know if anyone have doubt or I missed something.

- SAP Managed Tags:

- SAP S/4HANA Finance

Labels:

7 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

156 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

217 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Intercompany Execution of Services (aka "Dual Order") in Enterprise Resource Planning Blogs by SAP

- Service with Advanced Execution and Resource-related Billing in Enterprise Resource Planning Blogs by SAP

- An introduction into Service Management in S/4HANA Cloud Private Edition in Enterprise Resource Planning Blogs by SAP

- Run Revenue recognition - Projects job - Is it possible to run the job and post in the 2 ledgers in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 10 | |

| 8 | |

| 7 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |