- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Revenue Recognition for Customer Return in SAP Bus...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

What is Customer Return?

Customer Return Processing is the management of products that are returned by customers. Products can be returned for a credit, replacement, or repair.

Prerequisites

Scoping

Navigate to Business Configuration >Choose the Open Activity List > Edit Project Scope > Make Sure that the Sales Order and Customer Return is in scope.

Figure1:Scoping

Make sure that the Sales and Profit Analysis under Financial and Management Accounting is in scope in the Business Configuration.

Figure2:Scoping

Enable the question “Do you want to use solution supported revenue recognition for sales order” in the Business Configuration.

Figure3:Enable the Question

Assign the Accrual Method for the Revenue type “Customer Return” in the finetuning activity “Edit Accrual Method Determination”.

Figure4:Edit Accrual Method

Enter the relevant GL accounts in the Chart of account and account determination for deferred net value , Deferred sales returns and Deferred Cost of Goods Sold on the Revenue Recognition- Deferrals tab of the Sales subledger. These accounts must be of the type ACLEAR > Accruals/Clearing.

Figure5:Enter the GL accounts and ADG mapping

Enter the accounts for Accrued Net Value, Accrued Sales Returns, and Accrued Cost of Goods Sold on the Revenue Recognition – Accruals tab of the Sales subledger .These accounts must be of the type ACLEAR – Accruals/Clearing.

Figure6:Enter the GL accounts and ADG mapping

Process Flow

Navigate to Sales order work center > Create new sales order > Enter all the mandatory details and click on Save

Figure7:Create sales order

Release the sales order

Figure8:Release sales order

Navigate to Outbound Logistics Control Workcenter > Customer Demand > Search for created sales order > Release the customer Demand

Figure9:Release customer demand

Navigate to Outbound Logistics Workcenter > search for created sales order > click on Post Goods Issue in order to outbound the goods to customer

Figure10:Click on PGI

Click on Propose Quantity and Release the outbound delivery

Figure11:Release Outbound delivery

Journal entry posted for outbound delivery

Figure12:JE for Outbound delivery

Navigate to Customer Invoicing Workcenter > Invoice request > Search for outbound delivery invoice request > Click on Invoice

Figure13:Outbound delivery invoice request

Release the customer invoice

Figure14:Release Customer invoice

Journal entry posted for Customer invoice

Figure15:Journal entry for customer invoice

Navigate to Sales Order Workcenter > Under Common task Create New Customer Return Notification with the reference of sales order

Figure16:Create customer return notification

In the next step "Edit Customer Return Delivery Notification" Specify the Return Quantity with reason

Figure17:Edit Customer Return Delivery Notification

After entering all the details check the “Customer return notification” document for consistency

Figure18:Check the document for consistency

Once the document is consistent Click on finish

Figure19:Click on finish

Click on “Post Goods Receipt for Customer Return Notification Document’” by doing which the company is going to receive the return quantity from the customer.

Figure20:PGR for return quantity

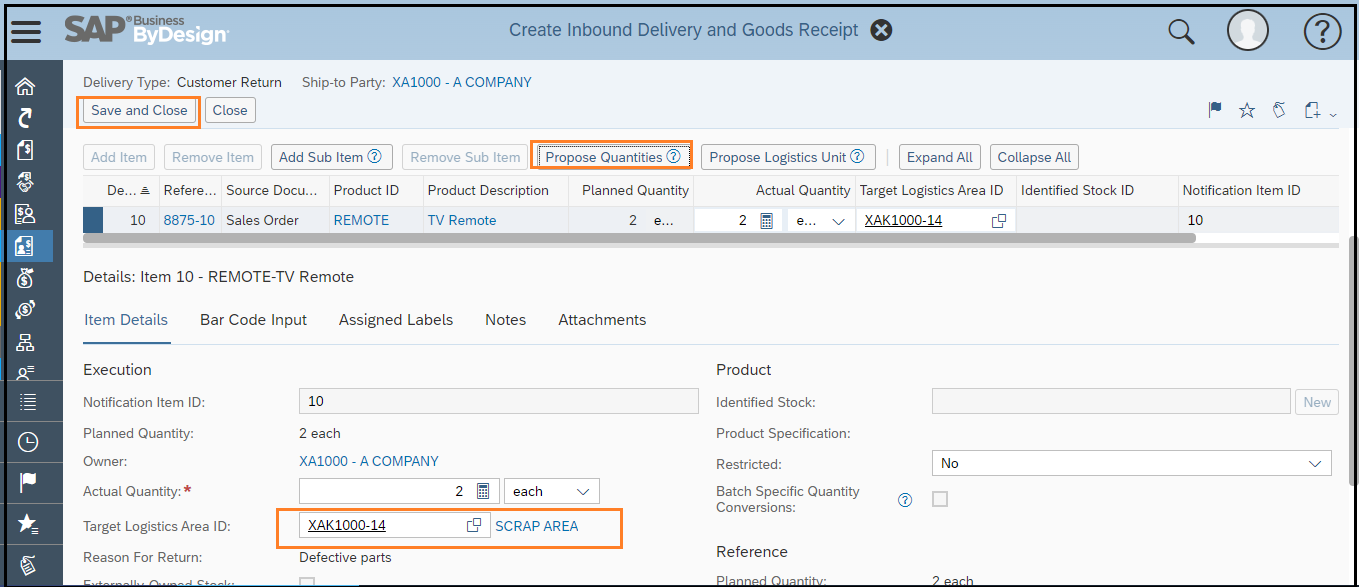

In the Inbound Delivery Document Click on Propose Quantity to update actual quantity which will directly go to the target scrap area > save and close the document .

Figure21:Inbound the return quantity

Journal entry posted for customer return

Figure22:JE for customer return

The “Customer Return” document is created in the document flow of Customer Return Notification or we can find it in the returns view of sales order work center

Figure23:Customer Return Created

Enter the Credit Memo quantity and Release Customer Return document with Credit Memo

Figure24:Release Customer return

Navigate to Customer Invoicing workcenter > Search for Customer Return Invoice Request in the Invoice Request view and click on invoice

Figure25:Customer return invoice request

Release the Credit Memo

Figure26:Release credit memo

Journal entry posted for Customer Credit Memo where Returns are posted to the Deferred Sales Returns account. This account is a balance sheet account, which means the returns are not yet recognized.

Figure27:JE for Credit Memo

Navigate to Cost and Revenue Workcenter > Sales document items view > Search for Customer Return Document > Click on Execute revenue recognition. Under Accounting data tab we can see the Accrual method “Recognize at point of Invoice” is assigned to corresponding Customer Return document .

Figure28:Execute Revenue Recognition

Enter all the mandatory details and click on ok

Figure29:Enter all the mandatory details

Journal entry posted for Revenue Recognition where if the credit memo has been posted, the revenue reduction and the reduction of the cost of sales are recognized. Returns are posted from the Deferred Sales Returns account to the Sales Returns account.

Figure30:JE for Revenue Recognition

Some of the Revenue recognition related documents from Help Library are:

https://help.sap.com/docs/SAP_BUSINESS_BYDESIGN/2754875d2d2a403f95e58a41a9c7d6de/2ccb31fb722d10148fa...

https://help.sap.com/docs/SAP_BUSINESS_BYDESIGN/2754875d2d2a403f95e58a41a9c7d6de/2c2c5b1f722d101481f...

https://help.sap.com/docs/SAP_BUSINESS_BYDESIGN/2754875d2d2a403f95e58a41a9c7d6de/2d00fa4e722d10148c8...

Have a look at my previous blog posts on ‘Revenue Recognition for Product Sales and Project sales in SAP Business ByDesign’ mentioned below

https://blogs.sap.com/2022/09/19/revenue-recognition-for-product-sales-in-sap-business-bydesign/

https://blogs.sap.com/?p=1641218?source=email-global-notification-bp-new-in-tag-followed

- SAP Managed Tags:

- SAP Business ByDesign,

- SAP Customer Relationship Management,

- SAP Financial Closing cockpit

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

learning content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Advanced WIP reporting in S/4HANA Cloud Public Edition in Enterprise Resource Planning Blogs by SAP

- Readiness for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Cloud, Private Edition for Service | 2023 FPS1 Product Update in Enterprise Resource Planning Blogs by SAP

- SAP S/4HANA Service and integration with SAP Field Service Management in Enterprise Resource Planning Blogs by SAP

- ISD (Input Service Distributer) GST registration in Enterprise Resource Planning Q&A

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |