- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- REVENUE RECOGNITION FOR SALE ORDER BASED ON ACCRUA...

Enterprise Resource Planning Blogs by Members

Gain new perspectives and knowledge about enterprise resource planning in blog posts from community members. Share your own comments and ERP insights today!

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

faisal_aslam124

Explorer

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-02-2022

7:08 PM

Introduction

This blog starts by providing a comprehensive understanding of revenue recognition runs that recognize revenue for Sales Order based on the Accrual Method assigned to them.

Audience

Consultants/Business Users/Beginners

Purpose

Understand the concept of Revenue Recognition for Sale Order Based on Accrual Method.

Revenue recognition:

So, we will say that Revenue recognition is that the method of assignment sales revenue to the periods during which it absolutely was accomplished and attained. the price of sales and any revenue deductions for returns related to the revenue got to be allotted to an equivalent accounting period because the revenue itself.

Accrual Method:

Accrual methods: they're mechanically allotted to sales order items; customers return items and customer contract items supported the assignment rules per business configuration. If you would like the system to use completely different accumulation strategies, you'll assign them during view.

The sales order method involves making sales orders for product or services consistent with specific terms with concerned conditions. The sales order is typically created by a sales worker, and might be generated out of a sales quote, a sales contract, or a chance. If services square measure required to meet the sales order, service things will be other. A service request will be created directly from the order if needed.

Navigate to Sales Order Work Center > Sales Order View > Click on Copy tab > Expand Submit tab > Click on Release to Service Execution > Note Down the Services Execution ID

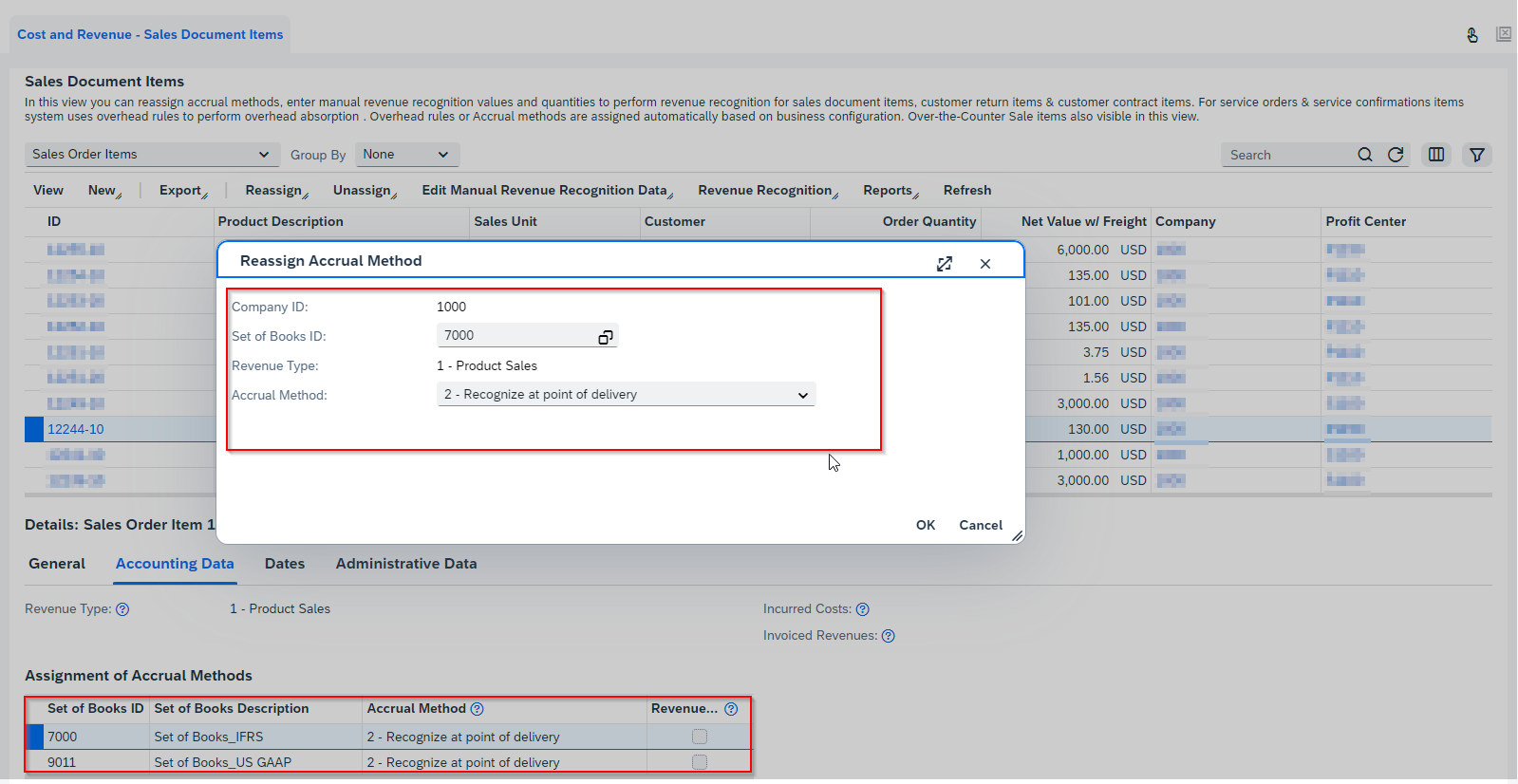

Navigate to Cost and Revenue Work Center > Sales Document Items View > Select the Sales Order that Created in Previous Step > Expand Reassign tab > Click on Accrual Method > A tab opens select Accrual Method “Recognize at Point of Delivery” > Click Ok

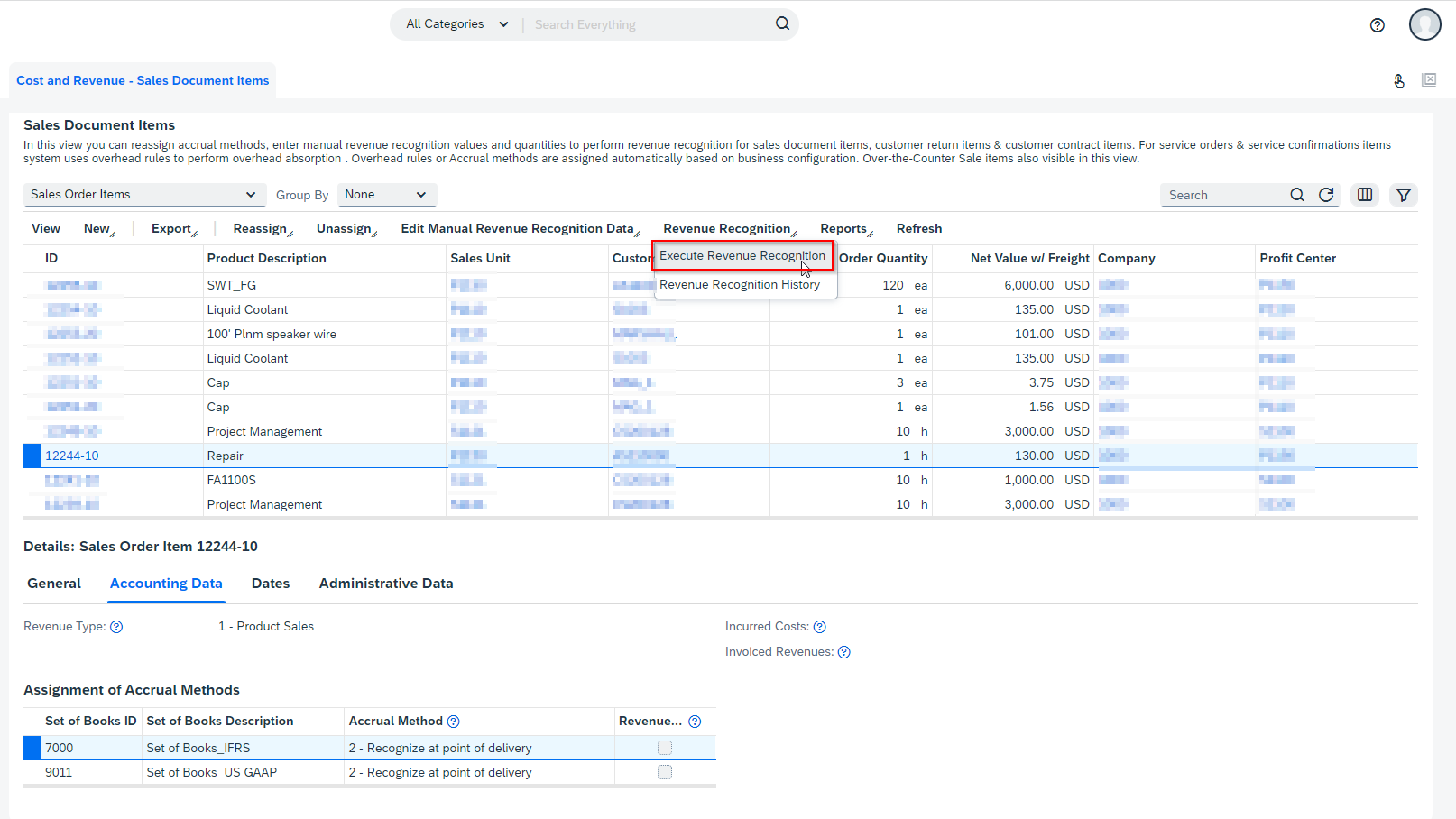

Navigate to Cost and Revenue Work Center > Sales Document Items View > Expand the Revenue Recognition tab > Click on Execute Revenue Recognition > A box opens select Operational Posting in the field of Closing Step > Uncheck the test run box > Click Ok

Do follow and would love to read some feedback and thoughts from your side in the comment section.

https://help.sap.com/docs/SAP_BUSINESS_BYDESIGN/2754875d2d2a403f95e58a41a9c7d6de/2ccb31fb722d10148fa...

https://help.sap.com/docs/SAP_BUSINESS_BYDESIGN/2754875d2d2a403f95e58a41a9c7d6de/2c2c5b1f722d101481f...

https://help.sap.com/docs/SAP_BUSINESS_BYDESIGN/2754875d2d2a403f95e58a41a9c7d6de/2d00fa4e722d10148c8...

https://blogs.sap.com/2018/06/08/understanding-revenue-recognition-over-time-an-explanatory-example/

This blog starts by providing a comprehensive understanding of revenue recognition runs that recognize revenue for Sales Order based on the Accrual Method assigned to them.

Audience

Consultants/Business Users/Beginners

Purpose

Understand the concept of Revenue Recognition for Sale Order Based on Accrual Method.

Revenue recognition:

Amounts received from customers could or might not be thought of as accomplished revenue recognized on the standing of delivery/legal transfer of title to the product or service. Revenue is recognized once accomplished or realizable is attained, usually when goods transferred or services rendered

So, we will say that Revenue recognition is that the method of assignment sales revenue to the periods during which it absolutely was accomplished and attained. the price of sales and any revenue deductions for returns related to the revenue got to be allotted to an equivalent accounting period because the revenue itself.

Accrual Method:

Accrual methods: they're mechanically allotted to sales order items; customers return items and customer contract items supported the assignment rules per business configuration. If you would like the system to use completely different accumulation strategies, you'll assign them during view.

Sales Order Processing

The sales order method involves making sales orders for product or services consistent with specific terms with concerned conditions. The sales order is typically created by a sales worker, and might be generated out of a sales quote, a sales contract, or a chance. If services square measure required to meet the sales order, service things will be other. A service request will be created directly from the order if needed.

Process Involves:

Navigate to Sales Order Work Center > Sales Order View > Click on Copy tab > Expand Submit tab > Click on Release to Service Execution > Note Down the Services Execution ID

Process Involves in Accrual Method:

Navigate to Cost and Revenue Work Center > Sales Document Items View > Select the Sales Order that Created in Previous Step > Expand Reassign tab > Click on Accrual Method > A tab opens select Accrual Method “Recognize at Point of Delivery” > Click Ok

Process Involves in Revenue Recognition:

Navigate to Cost and Revenue Work Center > Sales Document Items View > Expand the Revenue Recognition tab > Click on Execute Revenue Recognition > A box opens select Operational Posting in the field of Closing Step > Uncheck the test run box > Click Ok

I have tried to explain the process flow of Revenue recognition for sales order based on Accrual Method in simple terms. I hope it would be helpful for those who want to understand the basic process of ‘Revenue recognition for Sales Order based on Accrual Method’ in SAP Business ByDesign.

Do follow and would love to read some feedback and thoughts from your side in the comment section.

https://help.sap.com/docs/SAP_BUSINESS_BYDESIGN/2754875d2d2a403f95e58a41a9c7d6de/2ccb31fb722d10148fa...

https://help.sap.com/docs/SAP_BUSINESS_BYDESIGN/2754875d2d2a403f95e58a41a9c7d6de/2c2c5b1f722d101481f...

https://help.sap.com/docs/SAP_BUSINESS_BYDESIGN/2754875d2d2a403f95e58a41a9c7d6de/2d00fa4e722d10148c8...

https://blogs.sap.com/2018/06/08/understanding-revenue-recognition-over-time-an-explanatory-example/

- SAP Managed Tags:

- SAP Business ByDesign

3 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

2 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

Related Content

- Intercompany Execution of Services (aka "Dual Order") in Enterprise Resource Planning Blogs by SAP

- Service with Advanced Execution and Resource-related Billing in Enterprise Resource Planning Blogs by SAP

- Run Revenue recognition - Projects job - Is it possible to run the job and post in the 2 ledgers in Enterprise Resource Planning Q&A

- Service with Advanced Execution and Fixed Price Billing in Enterprise Resource Planning Blogs by SAP

- S/4 Public Cloud CBC:Event-Based Revenue Recognition Usage 302 for Loss Provision in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |