- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Landed Costs in SAP Business ByDesign - Landed C...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Employee

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

11-02-2022

1:19 PM

This blog post is part of a series of related blog posts highlighting the enhancements to address the handling of landed costs.

Link to main blog post.

The objective of this blog post is to explain how the new functionality works for materials with perpetual method standard. I will refer to the same business process example as used in the blog Inbound Process. The emphasis is to highlight the differences in financials compared to the moving average perpetual cost method.

Note: The process steps of how to handle landed costs do not change:

If the material has a perpetual cost method standard, and the landed costs need to be capitalized, the inventory costs as defined in the material master data must include both the material costs and the landed costs. Certain reports in SAP ByDesign can help you to calculate the unit costs, for example, Landed Cost – Line Items.

A) Process variant: Landed costs to be capitalized

1. Planned landed costs in purchase order

The process variant will be based on the following initial situation:

2. Post goods receipt and inventory valuation

The goods receipt is handled in the same way as any other goods receipt, independent of landed costs. The material unit costs are not impacted by the goods receipt.

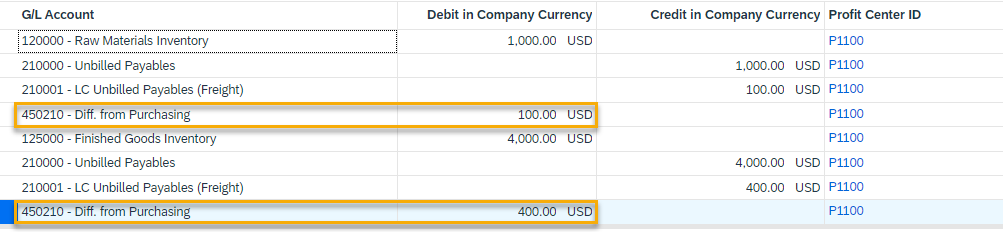

In financials, the planned landed costs will be posted on the credit side of the clearing account for Unbilled Payables related to the affected landed cost category (Freight in this example). In contrast to the moving average valuated material, the offset posting affects the difference account, maintained for differences from purchasing. This is the significant difference between the process variant with materials moving average valuated compared to a standard cost valuated material.

3. Supplier invoice for landed costs

This process step is identical to the one described in point (3) of the blog Inbound Process.

4. Allocation of the landed cost invoice items to the inbound delivery items

This process step is identical to the one described in point (4) of the inbound process blog.

5. Financial clearing and inventory update

This process step is identical to the one described in point (5) of the inbound process blog.

If the allocated landed costs cause landed cost clearing variances, they will not be cleared against the material ledger (thus not changing the material unit costs), but will be cleared against the same purchase price difference account as shown at goods receipt posting.

B) Process variant: Landed costs to be handled as expenses

In this case, in all postings where for moving average valuated materials the Difference from Purchasing account is posted, the Expense account is posted instead. This expense account must be assigned in the configuration to the corresponding landed cost category. The details regarding this configuration setting are explained in the prerequisites blog post.

Back to main blog post.

Link to main blog post.

Overview

The objective of this blog post is to explain how the new functionality works for materials with perpetual method standard. I will refer to the same business process example as used in the blog Inbound Process. The emphasis is to highlight the differences in financials compared to the moving average perpetual cost method.

Note: The process steps of how to handle landed costs do not change:

- Plan landed costs in the purchase order

- Post the goods receipts

- Post the landed cost invoice

- Allocate the landed cost invoice items to the goods receipts

- Set the landed cost clearing sets to “To be Cleared”

- Execute the landed cost clearing run

If the material has a perpetual cost method standard, and the landed costs need to be capitalized, the inventory costs as defined in the material master data must include both the material costs and the landed costs. Certain reports in SAP ByDesign can help you to calculate the unit costs, for example, Landed Cost – Line Items.

Details

A) Process variant: Landed costs to be capitalized

1. Planned landed costs in purchase order

The process variant will be based on the following initial situation:

| Material | Cost/Unit | Ordered Quantity | Planned Landed Costs |

| LC002 | 100 USD | 10 ea | 100 USD |

| LC004 | 200 USD | 20 ea | 400 USD |

2. Post goods receipt and inventory valuation

The goods receipt is handled in the same way as any other goods receipt, independent of landed costs. The material unit costs are not impacted by the goods receipt.

In financials, the planned landed costs will be posted on the credit side of the clearing account for Unbilled Payables related to the affected landed cost category (Freight in this example). In contrast to the moving average valuated material, the offset posting affects the difference account, maintained for differences from purchasing. This is the significant difference between the process variant with materials moving average valuated compared to a standard cost valuated material.

3. Supplier invoice for landed costs

This process step is identical to the one described in point (3) of the blog Inbound Process.

4. Allocation of the landed cost invoice items to the inbound delivery items

This process step is identical to the one described in point (4) of the inbound process blog.

5. Financial clearing and inventory update

This process step is identical to the one described in point (5) of the inbound process blog.

If the allocated landed costs cause landed cost clearing variances, they will not be cleared against the material ledger (thus not changing the material unit costs), but will be cleared against the same purchase price difference account as shown at goods receipt posting.

B) Process variant: Landed costs to be handled as expenses

In this case, in all postings where for moving average valuated materials the Difference from Purchasing account is posted, the Expense account is posted instead. This expense account must be assigned in the configuration to the corresponding landed cost category. The details regarding this configuration setting are explained in the prerequisites blog post.

Back to main blog post.

- SAP Managed Tags:

- SAP Business ByDesign

Labels:

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

Related Content

- SAP S/4HANA Cloud, public edition, ABAP Environment Case 8: Material Shelf Life Management in Enterprise Resource Planning Blogs by SAP

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- standard raw materials import and export process in SAP S4/HANA CLOUD PUBLIC EDITION in Enterprise Resource Planning Q&A

- standard raw materials import and export process in SAP S4/HANA CLOUD PUBLIC EDITION in Enterprise Resource Planning Q&A

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 8 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |