- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Landed Costs in SAP Business ByDesign - Overview

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Employee

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-28-2022

2:34 PM

This blog post is the entry point to a series of related blog posts highlighting the enhancements to address the handling of landed costs.

This solution is available with release 2211 of SAP Business ByDesign.

In this blog post, we give an overview of the landed cost solution with the business background and basic concepts behind it, as well as the links to more detailed blog posts. It starts by explaining why a landed costs solution is beneficial, followed by the main steps and how it is represented in financials.

Please also check out my video including an end-to-end system demo.

Essential landed cost process and prerequisites in detail:

Deviations and adjustment processes:

Scenario variations based on different valuation settings:

Others:

What are landed costs?

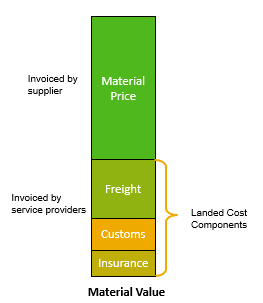

With the globalization of economy, goods are often purchased in countries that can offer a low material price. However, this might incur additional costs (such as freight, customs, insurance etc.) invoiced on top for a delivery. These are typically invoiced by a different supplier or service provider. Furthermore, these additional costs increase the total purchase costs and could have an impact on the purchasing decision. It also could have an impact on the inventory valuation if the landed costs are to be capitalized. Landed costs could also be considered as expenses in financials – depending on the set of books.

Before the introduction of the landed costs functionality, SAP Business ByDesign could address unplanned landed costs in the following way – which will also be supported in future.

Invoices which contain landed costs could be distributed to the posted material invoices. In this way, the landed costs are considered in inventory valuation with the next GR/IR run in case the product has material valuation moving average.

The disadvantage of this approach is that the landed cost invoice, and thus the consideration of landed costs in inventory valuation might only be much later that the goods receipt of the purchased materials. The inventory costs for these materials in production consumption or in costs of goods sold calculation (for sales) might be too low for the time between goods receipt and landed cost invoice plus GR/IR run.

This procedure is described in detail in the Blog Unplanned landed costs in Business ByDesign | SAP Blogs:

With SAP Business ByDesign's new solution approach, the following aspects and benefits are considered:

The following picture illustrates the main steps:

To start with, we assume the material perpetual cost method is moving average and the landed costs should be capitalized. The process consists of 5 main steps:

Besides the main process flow there are possible variations:

Furthermore, there are two additional scenario variants supported:

The following table gives an overview of all supported scenario variants and their impact to financial accounting:

Process sequence with the focus on financial accounting in a nutshell

The details of the following process steps are described in the blog Landed Costs in SAP Business ByDesign - Inbound Process (Moving average & capitalization)

(1) Purchase order – planning landed costs:

The process starts with landed cost planning in the purchase order. This step does not have an impact on financials.

(2) Goods receipt:

The goods receipt is handled the same way as any other goods receipt in the warehouse. The postings in financials automatically consider the planned landed costs and update the inventory valuation for materials valuated with a/the moving average. The posting of the Unbilled Payables will be split as follows:

Furthermore, for these landed cost category specific clearing accounts, a Landed Cost Clearing Set has been created.

(3) Supplier invoice for landed costs

The landed cost invoices will be captured without reference to any purchase order, whereby the invoiced amount may deviate from the planned landed costs. For the item type invoice item and credit memo item the user can specify that the invoice item refers to landed costs by assigning the landed cost component. The distinguishing feature is that the posting on the credit side goes to a dedicated In Transit G/L account corresponding to the landed cost category, for example, LC Purchase in Transit (Freight).

Also, for these landed cost category specific clearing accounts, a Landed Cost Clearing Set has been created.

(4) Landed cost allocation to goods receipts

The landed cost allocation is necessary to assign and distribute the invoiced landed cost to the goods receipt. The resulting journal entry swaps the G/L account Purchase in Transit – Freight from the clearing set of the landed cost invoice to the landed cost clearing sets of the goods receipt to which the landed costs have been assigned. In this way, the clearing set of the landed cost invoice is cleared, and the clearing sets of the goods receipts are in status open.

Please note that landed cost allocations do not update the moving average price of the materials yet.

(5) Financial Clearing and Inventory Update

With the landed cost clearing, the planned landed cost amounts used at the goods receipt are updated by the actual and allocated landed cost amounts in the material inventory accounts. The clearing does not happen automatically so as to avoid unwanted fluctuation in the moving average price, for example, in case of 2 or more expected landed cost invoices for a landed cost component for a goods receipt item that have only been partially invoiced. The goods receipts clearing of landed cost must be actively set to ‘To be Cleared’. The clearing will be carried out by the Landed Cost Clearing run that triggers the financial postings. The run is usually a scheduled run, to be executed at the end of the business day. The postings of this landed cost run clear the specific landed cost clearing accounts for Unbilled Payables and Purchase in Transit for the corresponding landed cost clearing categories. The differences will be posted on the corresponding inventory accounts and again update the inventory costs of the affected materials.

The enhancements made to the inbound process and in inventory valuation including landed costs are significant.

The sequence of goods receipts landed cost invoices and material invoices is now decoupled. This ensures for example:

Please also read the detailed blog posts and share your thoughts about this entire process enhancement in the procure to stock scenario.

This solution is available with release 2211 of SAP Business ByDesign.

Overview

In this blog post, we give an overview of the landed cost solution with the business background and basic concepts behind it, as well as the links to more detailed blog posts. It starts by explaining why a landed costs solution is beneficial, followed by the main steps and how it is represented in financials.

Please also check out my video including an end-to-end system demo.

Essential landed cost process and prerequisites in detail:

- Landed Costs in SAP Business ByDesign - Inbound Process (Moving average & capitalization)

- Landed Costs in SAP Business ByDesign - Prerequisites

- Landed Costs in SAP Business ByDesign - Analytical Enhancements

Deviations and adjustment processes:

- Landed Costs in SAP Business ByDesign - Changes of the Purchase Order

- Landed Costs in SAP Business ByDesign - Changes of the Goods Receipt

- Landed Costs in SAP Business ByDesign - Changes related to Landed Cost Invoices

- Landed Costs in SAP Business ByDesign - Changes of the Allocation

- Landed Costs in SAP Business ByDesign - Impact of Return to Supplier

Scenario variations based on different valuation settings:

- Landed Costs in SAP Business ByDesign - Landed costs as Expenses

- Landed Costs in SAP Business ByDesign - Materials with perpetual method Standard

- Landed Costs in SAP Business ByDesign - Miscellaneous

Others:

Introduction to the concept

What are landed costs?

With the globalization of economy, goods are often purchased in countries that can offer a low material price. However, this might incur additional costs (such as freight, customs, insurance etc.) invoiced on top for a delivery. These are typically invoiced by a different supplier or service provider. Furthermore, these additional costs increase the total purchase costs and could have an impact on the purchasing decision. It also could have an impact on the inventory valuation if the landed costs are to be capitalized. Landed costs could also be considered as expenses in financials – depending on the set of books.

Before the introduction of the landed costs functionality, SAP Business ByDesign could address unplanned landed costs in the following way – which will also be supported in future.

Invoices which contain landed costs could be distributed to the posted material invoices. In this way, the landed costs are considered in inventory valuation with the next GR/IR run in case the product has material valuation moving average.

The disadvantage of this approach is that the landed cost invoice, and thus the consideration of landed costs in inventory valuation might only be much later that the goods receipt of the purchased materials. The inventory costs for these materials in production consumption or in costs of goods sold calculation (for sales) might be too low for the time between goods receipt and landed cost invoice plus GR/IR run.

This procedure is described in detail in the Blog Unplanned landed costs in Business ByDesign | SAP Blogs:

With SAP Business ByDesign's new solution approach, the following aspects and benefits are considered:

- The option to plan landed costs in purchase orders, in addition to the material price, which helps the purchaser to gain greater transparency of the total costs.

- Consider the planned landed costs at goods receipt posting for inventory valuation to get an early impact on the inventory valuation for materials with material valuation moving average. The solution also supports materials with material valuation standard and landed costs that are expensed.

- Allocate invoiced landed costs to the goods receipt as a basis for updating the planned amounts with the actual amounts with its subsequent clearing in financials. The allocation is also possible in case no landed costs are planned upfront in the purchase orders.

- Analyze additional landed costs for a material and compare planned and actual amounts.

- Impact in financial accounting:

- Significant improvement in the accuracy of the subsequent cost of goods sold valuation, or WIP valuation when the material is sold or used, and of the profitability as well

- Ensure that partially invoiced landed costs do not lead to unwanted fluctuation of your inventory valuation. Customers can control when planned landed cost are to be cleared by actual allocated landed costs

- Use separate G/L accounts for landed cost categories to separate these G/L accounts from regular GR/IR clearing, which ensures the explanation of clearing accounts and financial auditability throughout the landed cost process steps

- Decide when to update the planned landed cost amounts as the basis for inventory valuation with the actual allocated invoiced amounts and perform the clearing

- Support the usage of multiple parallel sets of books with different capitalization requirements for landed costs

- Use of deviating currencies for purchase order and landed cost invoice

The following picture illustrates the main steps:

To start with, we assume the material perpetual cost method is moving average and the landed costs should be capitalized. The process consists of 5 main steps:

- In the purchase order, the planned landed cost amounts shall be maintained. In this example, it is freight.

- At goods receipt, the planned landed cost amounts are considered for inventory valuation.

- Thereafter, supplier invoices for the material are received. Also, landed cost invoices -typically from a different service provider - are received and identified as landed cost.

- Next, the landed cost invoice items must be allocated or distributed to the respective goods receipt items, which is the prerequisite for the next steps in financials

- Financials:

- For the material invoicing process, there is no change: The actual invoice values - and any differences compared to the planned values - are considered in the GR/IR, clearing the unbilled and in-transit G/L accounts and updating the material part of the inventory valuation

- For the landed cost invoice, the new landed cost clearing run will carry out similar postings for the landed cost component portion that have been allocated to the goods receipt. In this step, deviations between the initially planned landed costs amounts used at the goods receipt and the allocated amounts will alter the inventory valuation. Basically, this step is divided into two parts, which will be explained later in more detail.

Besides the main process flow there are possible variations:

- The planning of landed costs and using them at goods receipt is optional. You can start the process by allocating the actual landed cost invoice.

- Sequence: The posting and payment of landed cost invoices are possible before the goods receipt (for example, if in a long transport chain - with first a land transport and then an ocean transport - the land freight invoice might be received before the ship arrives). After the goods receipt happens, the allocation of the landed cost invoices and the subsequent financial steps can be done.

Furthermore, there are two additional scenario variants supported:

- Standard costs: This functionality also works for materials with perpetual cost method standard. In this case, the goods receipt is valuated at standard costs and the difference between the procurement price including landed costs will be posted to the difference accounts (Gain/Loss from Purchasing). The inventory cost of the material will not be adjusted.

- Posting to expense: The regulation regarding the capitalization of landed costs or posting as expenses can vary in different accounting principles, so it can be required to post certain landed costs as an expense instead of capitalization. Landed costs are also supported when using it differently in multiple set of books.

The following table gives an overview of all supported scenario variants and their impact to financial accounting:

Material Perpetual Method | Landed cost category is set To be capitalized | Landed cost category is set To be expensed |

| Moving average | Inventory accounts – main example – | Expense accounts |

| Standard costs | Difference accounts Gain/Loss from Purchasing | Expense accounts |

Process sequence with the focus on financial accounting in a nutshell

The details of the following process steps are described in the blog Landed Costs in SAP Business ByDesign - Inbound Process (Moving average & capitalization)

(1) Purchase order – planning landed costs:

The process starts with landed cost planning in the purchase order. This step does not have an impact on financials.

(2) Goods receipt:

The goods receipt is handled the same way as any other goods receipt in the warehouse. The postings in financials automatically consider the planned landed costs and update the inventory valuation for materials valuated with a/the moving average. The posting of the Unbilled Payables will be split as follows:

- The material net value of the material will be posted on the regular Unbilled Payables account

- The value of the planned landed cost will be posted on a specific account corresponding the landed cost category, for example, Unbilled Payables (Freight)

Furthermore, for these landed cost category specific clearing accounts, a Landed Cost Clearing Set has been created.

(3) Supplier invoice for landed costs

The landed cost invoices will be captured without reference to any purchase order, whereby the invoiced amount may deviate from the planned landed costs. For the item type invoice item and credit memo item the user can specify that the invoice item refers to landed costs by assigning the landed cost component. The distinguishing feature is that the posting on the credit side goes to a dedicated In Transit G/L account corresponding to the landed cost category, for example, LC Purchase in Transit (Freight).

Also, for these landed cost category specific clearing accounts, a Landed Cost Clearing Set has been created.

(4) Landed cost allocation to goods receipts

The landed cost allocation is necessary to assign and distribute the invoiced landed cost to the goods receipt. The resulting journal entry swaps the G/L account Purchase in Transit – Freight from the clearing set of the landed cost invoice to the landed cost clearing sets of the goods receipt to which the landed costs have been assigned. In this way, the clearing set of the landed cost invoice is cleared, and the clearing sets of the goods receipts are in status open.

Please note that landed cost allocations do not update the moving average price of the materials yet.

(5) Financial Clearing and Inventory Update

With the landed cost clearing, the planned landed cost amounts used at the goods receipt are updated by the actual and allocated landed cost amounts in the material inventory accounts. The clearing does not happen automatically so as to avoid unwanted fluctuation in the moving average price, for example, in case of 2 or more expected landed cost invoices for a landed cost component for a goods receipt item that have only been partially invoiced. The goods receipts clearing of landed cost must be actively set to ‘To be Cleared’. The clearing will be carried out by the Landed Cost Clearing run that triggers the financial postings. The run is usually a scheduled run, to be executed at the end of the business day. The postings of this landed cost run clear the specific landed cost clearing accounts for Unbilled Payables and Purchase in Transit for the corresponding landed cost clearing categories. The differences will be posted on the corresponding inventory accounts and again update the inventory costs of the affected materials.

Summary

The enhancements made to the inbound process and in inventory valuation including landed costs are significant.

- Landed costs can be planned on purchase order item level and these planned landed cost amounts will be used for the valuation of the goods receipt

The sequence of goods receipts landed cost invoices and material invoices is now decoupled. This ensures for example:

- a landed cost invoice can be saved and paid long before the goods are received and

- goods are received and valuated including planned landed cost, even if the landed costs invoices are received much later and can only be allocated after parts of the goods are already consumed or sold. This ensures a realistic change of the moving average unit cost based on planned amounts.

- The usage of dedicated landed cost clearing G/L accounts per landed cost category ensures that the remaining balances on these G/L accounts at fiscal period end or fiscal year end can be explained by:

- landed cost invoices not allocated yet (landed cost allocation document)

- goods receipt landed cost clearing sets where the initially used planned values have not been cleared by actual allocated landed costs.

- The ongoing changes to inventory valuation are transparent and can be audited step-by-step.

- The analytics reports specifically provided for landed costs allow detailed analysis, as well as aggregated analysis, for the financial department and procurement department.

- The entire set of enhancements are designed to work in a parallel set of books environment with potentially different settings in terms of landed cost capitalization or the perpetual method.

- The implications of the following business scenario variants are also supported:

- goods receipt adjustment

- return to supplier return

- landed cost invoice and credit memos

- non-deductible / deductible tax

- unplanned landed costs

- landed cost allocation corrections

- cash discounts applied to landed cost invoices

Please also read the detailed blog posts and share your thoughts about this entire process enhancement in the procure to stock scenario.

- SAP Managed Tags:

- SAP Business ByDesign

Labels:

9 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

206 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

87

Related Content

- Portfolio Management – Enhanced Financial Planning integration in Enterprise Resource Planning Blogs by SAP

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

- What You Need to Know: Security and Compliance when Moving to a Cloud ERP Solution in Enterprise Resource Planning Blogs by SAP

- Itemized Down Payment Clearing in MIRO in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 6 | |

| 5 | |

| 4 | |

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 |