- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Asset Accounting with Universal Parallel Accountin...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Advisor

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

10-24-2022

8:48 AM

The Asset Accounting component provided with the Universal Parallel Accounting business function as of SAP S/4HANA 2022 fully supports parallel accounting.

The Asset Accounting with Universal Parallel Accounting differs from the previous Asset Accounting (without business function) in several ways. The data structures for asset master data and for configuration data were simplified and are now free of redundancies with General Ledger data structures.

The posting logic has changed as well: All journal entries are now ledger-specific and they are posted to the universal journal. All currencies defined in the ledger settings for General Ledger Accounting are fully supported in Asset Accounting. Parallel depreciation areas and foreign currency areas are no longer needed. Reporting has changed accordingly: All analytical SAP Fiori apps can now display results per ledger and in all defined parallel currencies.

In the following sections of this blog, we will highlight what has changed in detail.

While you make the Customizing settings - as before - in the back-end system, you now use the front end with the SAP Fiori launchpad for your daily work as an asset accountant. This is because several important Asset Accounting apps are available as SAP Fiori apps only.

The new Implementation Guide Asset Accounting (Parallel Accounting) that is based on new and restructured configuration tables is much simpler and leaner than the previous Implementation Guide.

The accounting principle is now the main valuation entity throughout universal parallel accounting. The settings for ledgers, accounting principles, and currencies are only maintained once in the Financial Accounting Global Settings without redundant configuration in Asset Accounting or other components of universal parallel accounting. In Customizing for Asset Accounting, there is a new entity, the valuation view, which needs to be assigned to the accounting principle. The chart of depreciation, on the other hand, now only plays a subordinate role in Customizing for Asset Accounting: It merely bundles the depreciation keys that have to be assigned to an accounting principle. We strongly recommend that you define one chart of depreciation for each local accounting principle or local valuation.

There is a new concept in place for asset master data with simplified data structures. The new Manage Fixed Assets app (F3425) is built on these data structures. The app combines the asset worklist with the master data maintenance and the value display.

For mass processing of asset master data, you can use the new SOAP APIs. These replace the previous BAPIs in the new data model.

The Manage Fixed Assets app also provides navigation options to the posting apps of Asset Accounting as well as to the journal entry apps of General Ledger Accounting.

Selection and document display per ledger: On the selection screens of the posting apps, you can use the ledger as a selection criterion to restrict a posting to a ledger. The accounting principle is displayed for information purposes only. Furthermore, when displaying a journal entry, when simulating a posting, or when adjusting line items, you also do this per ledger.

Depreciation postings are also ledger-specific. This applies to the automatic depreciation posting run as well as for manual depreciation.

Manual depreciation and asset revaluation postings are now posted directly to the depreciation or revaluation account in the general ledger. Due to a specific transaction type category, the manual depreciation can be displayed separately in reporting.

Currency for postings: By default, the functional currency is the currency you use in the posting transactions. However, in some of the posting apps (such as Post Acquisition (Non-Integrated) - With Automatic Offsetting Entry and Post Post-Capitalization), the currency field is ready for input and therefore you can enter a currency of your choice. This means that you are able to post with the transaction currency even if the transaction currency is not identical to the company code currency or the functional currency.

Postings with quantities: Quantities are no longer stored in the asset master record, and quantity postings are no longer restricted to the leading ledger 0L. Instead, quantity postings are now possible in all ledgers. The ledger-specific quantity postings are thereby posted to the universal journal (table ACDOCA) in the general ledger. In the same way as for posting currency amounts, you can post different quantities for each ledger; the posting apps allow you to restrict quantity postings to specific ledgers. If you make adjustment postings with the Post Quantity – Adjustment app, you can make these ledger-specific, too.

All asset postings are posted to the universal journal in General Ledger Accounting.

This also applies to the so-called statistical postings, valid for Asset Accounting only. These postings were made for statistical depreciation areas (such as tax depreciation areas). The statistical transaction data will be posted to and reported from the same structure of the General Ledger as any other asset posting: the universal journal. There will be currency values available for all G/L-relevant currencies, also for the postings to statistical depreciation areas which are defined within a ledger per company code.

For statistical derived depreciation areas (used, for example, for accounting principles in Russia, Japan, and Thailand), the system no longer calculates the values on the fly but creates line items in the universal journal. This means, the system stores them in database table ACDOCA. As a result, you can report on derived depreciation areas using the analytical SAP Fiori apps.

All currencies defined in the ledger settings of the Financial Accounting Global Settings are fully supported in Asset Accounting. This allows you to have more parallel currencies in Asset Accounting than before.

Replacement of parallel depreciation areas: Parallel currencies are no longer mapped using parallel currency areas. To display values in a parallel currency, you no longer select depreciation areas. Instead, just one depreciation area will manage values in all currencies which are defined in the respective ledger and company code. This affects the asset value display transaction and reporting.

Replacement of foreign currency areas: Since you now have all currencies from General Ledger Accounting available in Asset Accounting, foreign currency areas are no longer supported in Asset Accounting.

Functional currency: The functional currency is the currency that is used as the primary working currency of an organization. This can be the company code currency, the group currency, or a currency that differs from these currencies. The functional currency is available for the value display of single assets, asset postings, and reporting.

For reporting purposes, you use the analytical SAP Fiori apps. Because the concept of parallel valuation areas has been replaced, the selection of valuation areas in reporting has changed: The values in the parallel currency are no longer mapped using special parallel currency areas. Therefore, if you want to display the reporting data for a depreciation area in a specific currency, you select the required currency or the required currency type for a depreciation area.

Asset Accounting supports the forecasting of depreciation values for fiscal years that are not yet open and that can be up to 5 years in the future. The system stores these forecast values in a specific table (ACDOCP).

The new solution for an alternative fiscal year variant (replacing the so-called lean solution with an additional ledger) is supported in Asset Accounting. The values belonging to the ledger with a non-calendar fiscal year are determined by period and used for asset reporting.

Regardless of whether you perform a manual or an automatic legacy transfer, the transfer of asset values takes place for each ledger and the system automatically translates the values into parallel currencies, by default.

For automatic legacy data transfer, you use the SAP S/4HANA Migration Cockpit together with separate migration templates for asset master data and for asset postings.

In addition to this, there are separate apps for the manual legacy data transfer of master data and postings.

The new and changed features mentioned above provide more flexibility and more consistency for postings and for the reporting of parallel values in Asset Accounting.

Want to learn more about Asset Accounting with Universal Parallel Accounting? - For more information, see:

We also recommend the central blog post on Universal Parallel Accounting at Universal Parallel Accounting in SAP S/4HANA, which contains further links.

The Asset Accounting with Universal Parallel Accounting differs from the previous Asset Accounting (without business function) in several ways. The data structures for asset master data and for configuration data were simplified and are now free of redundancies with General Ledger data structures.

The posting logic has changed as well: All journal entries are now ledger-specific and they are posted to the universal journal. All currencies defined in the ledger settings for General Ledger Accounting are fully supported in Asset Accounting. Parallel depreciation areas and foreign currency areas are no longer needed. Reporting has changed accordingly: All analytical SAP Fiori apps can now display results per ledger and in all defined parallel currencies.

In the following sections of this blog, we will highlight what has changed in detail.

User interface: The SAP Fiori launchpad is essential

While you make the Customizing settings - as before - in the back-end system, you now use the front end with the SAP Fiori launchpad for your daily work as an asset accountant. This is because several important Asset Accounting apps are available as SAP Fiori apps only.

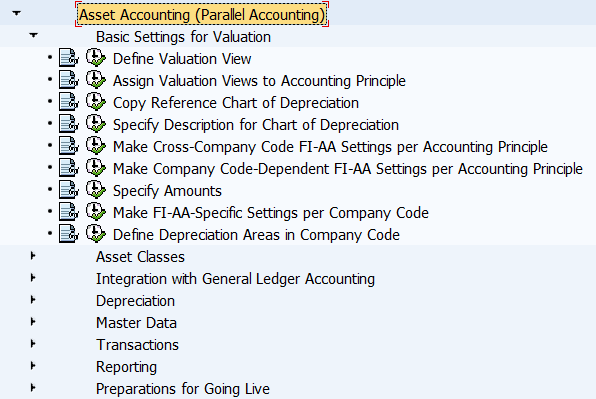

Customizing: Lean and simple

The new Implementation Guide Asset Accounting (Parallel Accounting) that is based on new and restructured configuration tables is much simpler and leaner than the previous Implementation Guide.

Figure 1: Implementation Guide Asset Accounting (Parallel Accounting)

The accounting principle is now the main valuation entity throughout universal parallel accounting. The settings for ledgers, accounting principles, and currencies are only maintained once in the Financial Accounting Global Settings without redundant configuration in Asset Accounting or other components of universal parallel accounting. In Customizing for Asset Accounting, there is a new entity, the valuation view, which needs to be assigned to the accounting principle. The chart of depreciation, on the other hand, now only plays a subordinate role in Customizing for Asset Accounting: It merely bundles the depreciation keys that have to be assigned to an accounting principle. We strongly recommend that you define one chart of depreciation for each local accounting principle or local valuation.

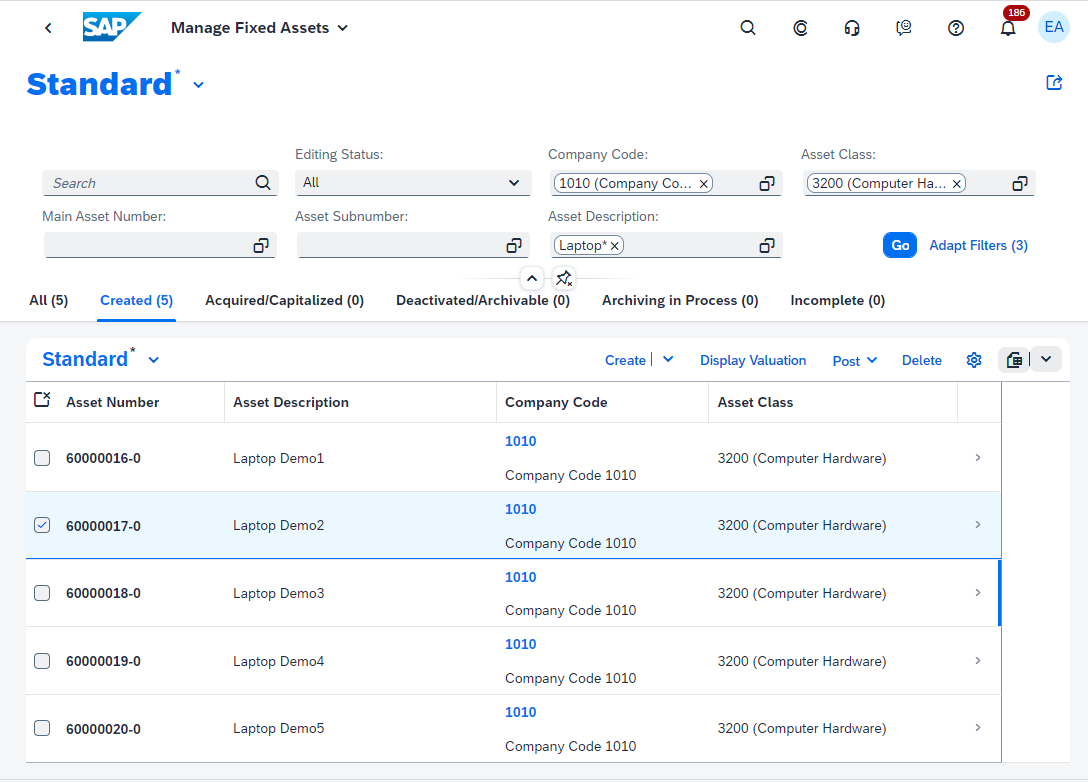

'Manage Fixed Assets' app: Central entry point - not only for master data

There is a new concept in place for asset master data with simplified data structures. The new Manage Fixed Assets app (F3425) is built on these data structures. The app combines the asset worklist with the master data maintenance and the value display.

Figure 2a: Manage Fixed Assets app: Worklist

Figure 2b: Manage Fixed Assets app: Master data maintenance

For mass processing of asset master data, you can use the new SOAP APIs. These replace the previous BAPIs in the new data model.

Figure 2c: Manage Fixed Assets app: Value display

The Manage Fixed Assets app also provides navigation options to the posting apps of Asset Accounting as well as to the journal entry apps of General Ledger Accounting.

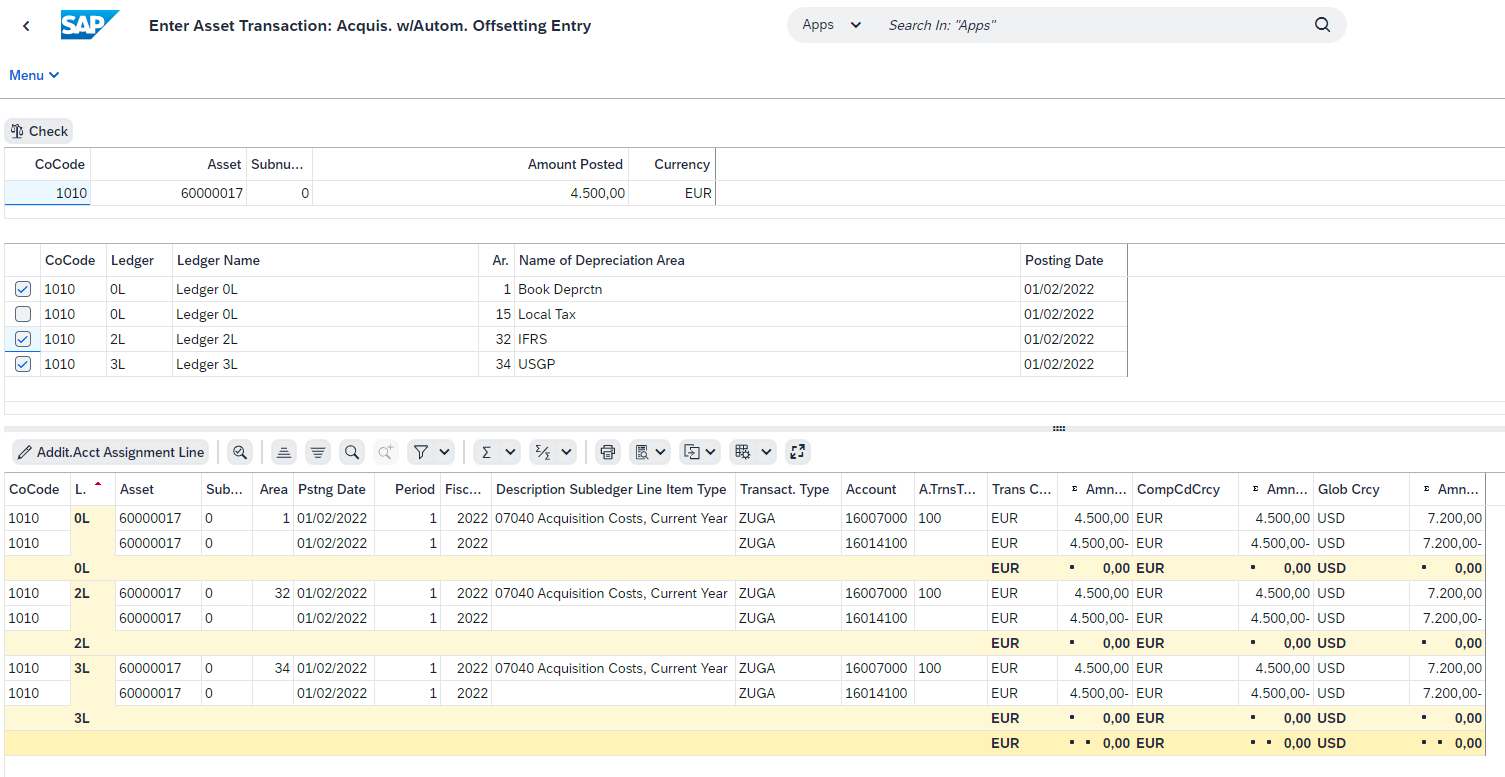

Asset postings are ledger-specific

Selection and document display per ledger: On the selection screens of the posting apps, you can use the ledger as a selection criterion to restrict a posting to a ledger. The accounting principle is displayed for information purposes only. Furthermore, when displaying a journal entry, when simulating a posting, or when adjusting line items, you also do this per ledger.

Figure 3: Simulating an asset acquisition in the app Post Acquisition (Non-Integrated) – With Automatic Offsetting Entry

Depreciation postings are also ledger-specific. This applies to the automatic depreciation posting run as well as for manual depreciation.

Manual depreciation and asset revaluation postings are now posted directly to the depreciation or revaluation account in the general ledger. Due to a specific transaction type category, the manual depreciation can be displayed separately in reporting.

Currency for postings: By default, the functional currency is the currency you use in the posting transactions. However, in some of the posting apps (such as Post Acquisition (Non-Integrated) - With Automatic Offsetting Entry and Post Post-Capitalization), the currency field is ready for input and therefore you can enter a currency of your choice. This means that you are able to post with the transaction currency even if the transaction currency is not identical to the company code currency or the functional currency.

Postings with quantities: Quantities are no longer stored in the asset master record, and quantity postings are no longer restricted to the leading ledger 0L. Instead, quantity postings are now possible in all ledgers. The ledger-specific quantity postings are thereby posted to the universal journal (table ACDOCA) in the general ledger. In the same way as for posting currency amounts, you can post different quantities for each ledger; the posting apps allow you to restrict quantity postings to specific ledgers. If you make adjustment postings with the Post Quantity – Adjustment app, you can make these ledger-specific, too.

All asset postings go to the universal journal in G/L

All asset postings are posted to the universal journal in General Ledger Accounting.

This also applies to the so-called statistical postings, valid for Asset Accounting only. These postings were made for statistical depreciation areas (such as tax depreciation areas). The statistical transaction data will be posted to and reported from the same structure of the General Ledger as any other asset posting: the universal journal. There will be currency values available for all G/L-relevant currencies, also for the postings to statistical depreciation areas which are defined within a ledger per company code.

For statistical derived depreciation areas (used, for example, for accounting principles in Russia, Japan, and Thailand), the system no longer calculates the values on the fly but creates line items in the universal journal. This means, the system stores them in database table ACDOCA. As a result, you can report on derived depreciation areas using the analytical SAP Fiori apps.

All G/L currencies are supported

All currencies defined in the ledger settings of the Financial Accounting Global Settings are fully supported in Asset Accounting. This allows you to have more parallel currencies in Asset Accounting than before.

Replacement of parallel depreciation areas: Parallel currencies are no longer mapped using parallel currency areas. To display values in a parallel currency, you no longer select depreciation areas. Instead, just one depreciation area will manage values in all currencies which are defined in the respective ledger and company code. This affects the asset value display transaction and reporting.

Replacement of foreign currency areas: Since you now have all currencies from General Ledger Accounting available in Asset Accounting, foreign currency areas are no longer supported in Asset Accounting.

Functional currency: The functional currency is the currency that is used as the primary working currency of an organization. This can be the company code currency, the group currency, or a currency that differs from these currencies. The functional currency is available for the value display of single assets, asset postings, and reporting.

Reporting

For reporting purposes, you use the analytical SAP Fiori apps. Because the concept of parallel valuation areas has been replaced, the selection of valuation areas in reporting has changed: The values in the parallel currency are no longer mapped using special parallel currency areas. Therefore, if you want to display the reporting data for a depreciation area in a specific currency, you select the required currency or the required currency type for a depreciation area.

Figure 4: Asset Transactions app

Asset Accounting supports the forecasting of depreciation values for fiscal years that are not yet open and that can be up to 5 years in the future. The system stores these forecast values in a specific table (ACDOCP).

Alternative fiscal year variant

The new solution for an alternative fiscal year variant (replacing the so-called lean solution with an additional ledger) is supported in Asset Accounting. The values belonging to the ledger with a non-calendar fiscal year are determined by period and used for asset reporting.

Legacy data transfer - also per ledger

Regardless of whether you perform a manual or an automatic legacy transfer, the transfer of asset values takes place for each ledger and the system automatically translates the values into parallel currencies, by default.

For automatic legacy data transfer, you use the SAP S/4HANA Migration Cockpit together with separate migration templates for asset master data and for asset postings.

In addition to this, there are separate apps for the manual legacy data transfer of master data and postings.

Figure 5: Manual legacy data transfer of postings: Entry of the cumulated values in the app Post Transfer Values – For Legacy Asset

Conclusion and more information

The new and changed features mentioned above provide more flexibility and more consistency for postings and for the reporting of parallel values in Asset Accounting.

Want to learn more about Asset Accounting with Universal Parallel Accounting? - For more information, see:

- Business function documentation for Universal Parallel Accounting at Universal Parallel Accounting. See the separate section on Asset Accounting.

- Scope information at 3191636 - Universal Parallel Accounting (SAP S/4HANA 2022): Scope Information - SAP ONE Support Laun.... The Asset Accounting section specifies which functions are included in the scope and which are not.

We also recommend the central blog post on Universal Parallel Accounting at Universal Parallel Accounting in SAP S/4HANA, which contains further links.

- SAP Managed Tags:

- SAP S/4HANA,

- SAP S/4HANA Finance,

- FIN (Finance),

- FIN Asset Accounting

Labels:

10 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

Related Content

- Account Balance Validation in SAP S/4HANA Cloud, Public Edition in Enterprise Resource Planning Blogs by SAP

- Portfolio Management – Enhanced Financial Planning integration in Enterprise Resource Planning Blogs by SAP

- Enterprise Portfolio and Project Management in SAP S/4HANA Cloud, Private Edition 2023 FPS1 in Enterprise Resource Planning Blogs by SAP

- Account modification/ General Modification in Enterprise Resource Planning Q&A

- Extending Bank Account Number Length for China in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 8 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |