- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- SAP S/4HANA Cloud, Private Edition, and SAP S/4HAN...

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Universal Parallel Accounting

Greenfield projects can now benefit from Universal Parallel Accounting. With Universal Parallel Accounting legal as well as management valuation ledgers and up to ten currencies are supported along end-to-end processes resolving many restrictions of the past, improving steering effectiveness and providing simplified configuration and processes for:

- Overhead Accounting

- Asset Accounting

- Inventory Accounting

- Production Accounting

- Event-based Revenue Recognition

In SAP S/4HANA 2022 Universal Parallel Accounting supports the following use cases:

- Parallel valuations – unconsolidated views: international companies need to follow parallel accounting standards for group and local GAAP (affecting inventory valuation, WIP, asset values etc.)

- Parallel valuation – group valuation with consolidated views: for steering purposes, customers require a group view where intercompany profits between trading partners are eliminated in real-time

- Alternative Fiscal Year – companies operating in certain countries require a Fiscal Year Variant for their local financial reporting that is deviating from their Fiscal Year Variant of their central reporting on group level

- Multicurrency capabilities – in internationally operating companies, financial and management reporting need to be available in several currencies such as functional currency, etc.

It will be the foundation for additional innovations in the future. For more information, please refer to the following blog series for Universal Parallel Accounting:

- Universal Parallel Accounting - sarah.roessler

- Overhead Accounting with Universal Parallel Accounting - janetdorothy.salmon

- Asset Accounting with Universal Parallel Accounting - hilgenberg

- Inventory Accounting and Universal Parallel Accounting - janetdorothy.salmon

- Event-Based Revenue Recognition for Universal Parallel Accounting - volkmar.zahn and Dr. Gerold Wellenhofer

- Universal Parallel Accounting in Production Accounting - shuge.guo

Financial Planning and Analysis

Overhead Cost Controlling

Allocation tags to improve searches for allocation cycles

With this app, you can create and assign allocation tags. Allocation tags are semantic tags you can assign to allocation cycles and segments that allow you to group and identify those cycles and segments. The tags can be used across allocation contexts and types, allowing you to track and label all elements of an allocation process.

- Planned and actual allocations for profit centers and cost centers based on the universal journal

- SAP Fiori apps to support the management and execution of allocation cycles

- Usability based on the SAP Fiori user experience

Figure 1: Manage Allocations Tags

Figure 1: Manage Allocations Tags

Benefit

- Improve user productivity during period-close activities

- Consistently handle planned and actual costs

- Improve transparency into the results of the allocation

Product Costing

With production order split (at actual costs) you can dispatch a partial quantity from a current production order into a new order, and distribute the corresponding costs to the new order at the same time. Sometimes, during the lifecycle of a production order, you can encounter some issues, such as: material shortage for some required components; capacity bottle necks; quality issues; changed schedules; and engineering changes. It may be necessary to finish a partial quantity of a production order as scheduled and to postpone execution for the remaining quantity. In such cases it is necessary to dispatch a partial quantity for the existing production order into a new order to organize its production separately. Therefore, product order split (as actual costs) is provided to meet this requirement.

Enhanced production order split functionality supporting cost moves. New production order split functionality that:

- Enables cost distribution for split orders between parent and child, in product cost controlling

- Assigns production actual costs, target costs, and variance values to the appropriate projects

Benefit

- Increases process flexibility to manage production order split scenarios in combination with project manufacturing management and optimization (PMMO) cost distribution to track actual cost in such scenarios

- Supports PMMO consumption and pegging by moving non-valuated project stock (project cost accounting method) components from the parent order to the child order

- Supports as built list (ABL) processes by moving valuated and non-valuated project stock components from parent order to child order

- Enables each order to contain its own share of actual components and costs

Accounting and Financial Close

Upload of general journal entries – Google Workspace integration

Leverage the Upload General Journal Entries app to:

- Download a template from SAP S/4HANA

- Enter your journal entries in Google Workspace

- Import the data to SAP S/4HANA

Figure 2: Google Workspace Integration - Upload JE from Google Workspace

Figure 2: Google Workspace Integration - Upload JE from Google Workspace

Benefit

- Enhances user satisfaction by extending the upload capabilities for the Upload General Journal Entries app

- Improves efficiency by offering all collaborative capabilities of Google Workspace and Google Sheets

Financial data consistency analyzer

- Framework to accommodate a data consistency check and correction activities in finance and controlling

- Implementation of the framework in general-ledger accounting

- Capture of critical master data changes

- Inconsistency check based on collected master data changes

- Complete system scan or reconciliation

- Correction of data inconsistencies wherever possible

- Classification of inconsistencies based on business impact

Benefit

- Reduce cost and effort for data consistency management through proactive measures

Organizational flexibility in financial accounting: profit center reorganization

Overview:

- Central app to define the reassignment of profit centers to master data and to manage all process steps

- Simulation of an organizational change

- Central processing of master data updates and transfer posting of account balances and related open payables and receivables to new profit centers

- Analytical app to evaluate the dependencies between objects and their reassignments to profit centers

- Analytical app to identify the effect of organizational changes on financial KPIs

- Scope of profit center reassignments:

- Material master data and related objects for processes including procure to stock, sell from stock, make to stock, make to order, and material inventory

- Open payables and receivables

- Cost center and internal orders

Figure 3: Organizational Change App for Profit Center Reorganization

Figure 3: Organizational Change App for Profit Center Reorganization

Benefit

- Reduced cost and complexity by supporting an organizations' ability to perform changes in a timely manner

- Easier reactions to changed internal and external situations and reflection of the changes in internal controlling structures and external reporting

Organizational flexibility in financial accounting for fixed assets

- Further scope to support the profit center reorganization for Fixed Assets

- The system considers the objects relationships to other objects that have imparted or inherited their profit center assignment, e.g.: fixed assets for which the profit center is assigned by means of a cost object or fixed assets for which profit center is directly assigned and the dependent business objects

- The technical steps will be managed by the solution to automatically reassign the entities for the defined and dependent master data/objects in above scope, and manage the transfer postings between the old and new entities with a defined effective date

- Asset balances in Asset Accounting and open payables/ receivables related to asset sale or purchase will both be covered by transfer postings

Benefit

- Ability to support profit center change for Asset Accounting with ensured consistency and accuracy in relevant business operational processes and in accounting balance

- Easier reactions to changed internal and external situations and reflect the changes in the profit and loss report and external reporting

Organizational flexibility in financial accounting for enterprise portfolio and project management (EPPM) projects

- Enable the capability of profit center changes for EPPM projects

- The technical steps will be managed by the solution to automatically reassign the entities for the defined and dependent objects in projects, and manage the transfer postings between the old and new entities with a defined effective date

- Analytical capabilities are provided to check the objects' dependencies and their profit reassignment status, and to analyze the organizational changes effect on the financial position

- The scope will cover the reassignment of profit centers of these objects: project definition, WBS elements, assigned sales orders, purchase orders and orders.

Benefit

- Ability to support profit center change for EPPM projects with ensured consistency and accuracy in business operational processes

- Easier reactions to changed internal and external situations and reflect the changes in internal controlling structure and external reporting

- Provides transparency to stakeholders involved in the reorganization

Revenue and Cost Accounting – Event Based Revenue Recognition

Event-based revenue recognition for bill-of-material scenarios and additional process support in sell-from-stock

- Use event-based revenue recognition sell-from-stock scenarios to post accrued revenues and costs for a sales order with ERLA (header level) and LUMF (item level) sales bill-of-materials (BOMs)

- Recognize revenue based on the transfer of control as part of advanced intercompany sales, advanced intercompany stock transfer and sell from stock with valuated stock in transit

- Support for additional revenue recognition methods and processes in sell-from-stock scenarios, such as:

- Recognize costs and revenue as occurred

- Recognize costs on revenue-based percentage-of-completion (PoC)

Benefit

- Support margin analysis and event-based revenue recognition in sell-from-stock scenarios

- Increase sales-force process flexibility by enabling BOM variants with event-based revenue recognition and margin analysis

Event-based revenue recognition for maintenance-centric services

- Enable the derivation of revenue recognition keys for maintenance service orders based on the billing relevance attribute in the order

- Recognize revenue from cost generated from time and expenses posted against the service confirmation of the plant maintenance order that is assigned to the maintenance service order

- Defer billed revenue from invoicing the maintenance service order and balance deferred and accrued revenue during period-end closing

- Recognize revenue ratably over time for service contracts based on the billing plan information

Benefit

- Automate revenue recognition for service management

Revenue and Cost Accounting – RAR

Advanced revenue spreading and contract combination capabilities in revenue accounting

- Determine early termination accounts

- Edit postponed revenue accounting items in optimized inbound processing

- Quick access to posting activities from the Manage Revenue Contracts app

- Reassign performance obligations to existing revenue contracts and to a new revenue contract during contract combination using the SAP Fiori app for contract combination

- Spread revenue manually in revenue accounting with the new SAP Fiori app for manual revenue spreading

- Suspend postings to continue to calculate recognized revenue in revenue accounting, but without posting to accounting

- Suspend postings after allocation conflict

- Detect suspended performance obligations in SAP Financial Compliance Management

- Use direct posting to the universal journal for acquisition cost performance obligations

- Enable power users to view revenue contract data

- Support the use of shortened fiscal years with revenue accounting

Benefit

- Support customers in meeting international accounting regulations

- Ease auditability and traceability between revenue recognition and the universal journal

- Improve decision-making through advanced revenue analytics based on the universal journal

Additional extensibility options for revenue accounting

- Add flexibility in the “Determine the Price Allocation” (FARR_BADI_PRICE_ALLOCATION) business add-in (BAdI) with additional attributes

- Use the “Invoice Correction Account Derivation” (FARR_BADI_INV_CORR_ACCT_DERIV) BAdI to change account assignments for invoice correction postings

- Use the “Change Account Assignment of Linked POB” (FARR_BADI_LINKED_POB_ACCT_ASGT) BAdI to change the account assignment for linked performance obligations

- Use the "Fulfillment Custom Checks" (FARR_BADI_FULFILLMT_CSTM_CHECK) BAdI to check fulfillments

- Use CDS views for better analysis of the standalone selling price

Benefit

- Support customers in meeting international accounting regulations

- Enhance extensibility options for revenue accounting

Entity Close

Advanced valuations in the general ledger

New Advanced Valuation solution as a unified valuation framework and integrative posting and consumption techniques to support the period-end closing valuation activities, for:

- Advanced Foreign Currency Valuation

- Discounting of long-term Assets and Liabilities

- Credit-Risk-Based Impairment

- Post B/S Reclassification

Figure 4: Advanced Valuation - BS Reclassification

Figure 4: Advanced Valuation - BS ReclassificationBenefit

- Valuation tool as a framework to handle all valuation processes

- Offers simplified and flexible configuration, e.g.: flexible grouping rules, flexibility to define valuation rules for type of valuations

- Posts value changes as delta to previous run – no reversal postings any more

- Supports out of the box parallel accounting and posting in functional versus company code currencies

- Establishes a link between valuation journal entry and original journal entry

- Valuation line type – better reporting capabilities by type of the valuation posting

- Valuation postings are stored only as line items of the universal journal entry, in table ACDOCA. No redundant storage

Automatic accruals based on in-approval service entry sheet (SES) information

The Service Entry Sheet Accruals application enables you to calculate and post accruals in General Ledger Accounting automatically. The relevant data is transferred from Service Purchasing and Recording of the Materials Management component to the Accrual Engine and automatically converted from purchase order items into accrual sub objects. On the basis of service entry sheets of which the amounts haven't been approved, the system calculates the amounts to be accrued for each account assignment of service entry sheets. In each period, you can start an accrual run, which posts all accruals for the service transactions.

New accruals management functionality in SAP S/4HANA, enabling you to:

- Provide automatic calculations, proposals on accrual amounts, and posting of the accruals when the services have been received from suppliers and the respective SESs have been posted in SAP S/4HANA Cloud, but have not yet been approved

- Calculate and post the accruals with finer granularity

- Provide flexible configuration options to choose which information from the relevant purchase order and SES are used in the calculation and posting of the respective accrual amounts

Figure 5: Service Entry Sheet Accruals

Figure 5: Service Entry Sheet Accruals

Benefit

- Shorten and optimize the financial closing process by automating the service procurement accruals processes

- Increase productivity due to automation

- Help ensure accuracy and compliance in the internal and external P&L report for period-end

Automatic reverse accrual on the first day of the next period

When you schedule an accrual posting job, you can choose whether to select the Reverse on First Day of Next Period check box. If selected, all the accrual postings that occur in the current period will be reversed on the first day of the next period. You don't need to wait until the end of the next period for the reversal.

- Enable the "Reverse on the first day of the next period" option when performing an accruals periodic posting run

Benefit

- Improve automation by generating accrual reverse documents according to a predefined dates option

- Help avoid duplicated cost booking by being able to reverse accrual on the first day in the next period

Accrual forecast report

- Generate accrual forecast reports with flow information of past periods for planned posting, actual posting, and future periods posting simulation

- Enable report data to display with flexible defined report selection (for example, cost center, accrual objects number, or account ID)

- Create one central report for the display of information for different accrual object types

Figure 6: Accruals Posting Simulation

Figure 6: Accruals Posting Simulation

Benefit

- Help business steering by providing forecast information

- Improve usability to save business users' effort on reporting work

Corporate Close

Ability to integrate planning data from SAP Analytics Cloud with group reporting consolidation

Enhance integration of group reporting with SAP Analytics Cloud, for planning consolidation scenarios:

- Write data back from SAP Analytics Cloud to SAP S/4HANA for group reporting by pushing data from SAP Analytics Cloud to SAP S/4HANA for group reporting

- Integrate with the status of the data collection task in the group reporting monitor

Figure 7: Target Data Selection for Retraction

Figure 7: Target Data Selection for Retraction

Benefit

Allow direct integration of data from SAP Analytics Cloud into SAP S/4HANA for Group Reporting removing the need to transfer the data first into Accounting (ACDOCP) and release to GR (ACDOCU). With this improve conveniences and efficiencies planning scenarios such as:

- Group-level planning with no integration in company-level planning

- Planning of consolidation units that are not represented in accounting and need to be consolidated

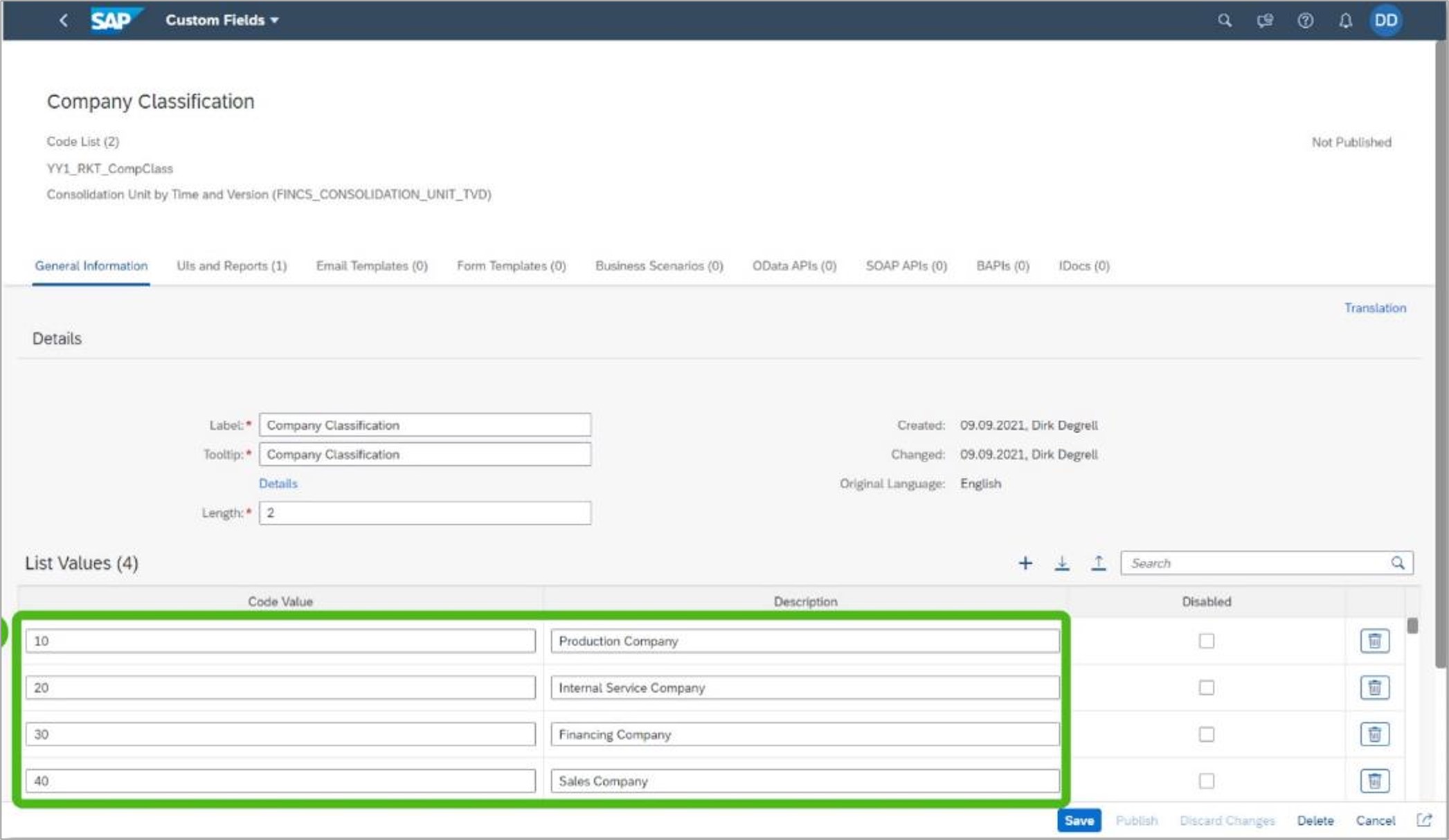

Extensibility of consolidation unit master-data attributes

You can create your own consolidation unit master data attributes. They can then be used in selections, totals validation rules, and analytics. Ability to extend consolidation unit master data with customer attributes for use in:

- Selection objects

- Analytics

Figure 8: Define Custom Field

Figure 8: Define Custom Field

Benefit

- Increase flexibility in analytics and processing configuration by leveraging customer field extensibility in SAP S/4HANA

CRUD APIs for group-reporting master data

Enable additional CreateReadUpdateDelete (CRUD) APIs for the master-data maintenance of additional fields in SAP S/4HANA for group reporting, such as:

- General ledger accounts, Segments,

- Profit centers, Cost centers

- Products, Product groups

- Customers, Customer groups

- Sales organizations, Distribution channels

- Divisions, Sales districts

- Plants, Functional areas

- Financial Transaction Type, Billing Document Type

Benefit

Allow direct integration of data from SAP Analytics Cloud into SAP S/4HANA for Group Reporting removing the need to transfer the data first into Accounting (ACDOCP) and release to GR (ACDOCU). With this improve conveniences and efficiencies planning scenarios such as:

- Group-level planning with no integration in company-level planning

- Planning of consolidation units that are not represented in accounting and need to be consolidated

Segment reporting through flexible derivation of the consolidation unit in group reporting preparation ledgers:

- Company as an editable attribute in consolidation unit master data

- Availability of the consolidation unit as a target field for substitutions in the business context "group reporting preparation ledger core fields"

- Default substitution in case of only one single consolidation unit referring to the company ID of the transactional data

- Possible realignment of incorrectly assigned consolidation units

Benefit

Enable the consolidation unit to be derived from the Company or other fields (such as segment or profit center) and for integrated accounting company codes covering the following scenarios:

- Management of the data collection process on the level of segments (represented by flexibly defined consolidation units using unchanged functionality of the data monitor)

- Ability to define consolidation groups for segments and assignment of corresponding slices of legal companies (represented by flexibly defined consolidation units) supporting level-30 postings on the segment level

Restatements and simulations - transparent changes on past closings

- Be able to adjust data of prior closed periods

- Process data from the original data version together with adjustments in a "restatement" characteristic and store the delta to the original base version to the "restatement" characteristic

Benefit

- Increased efficiency and improved quality of retrospective adjustments to closed financial statements

Migration support functions

Support for solution activation and go-live of SAP S/4HANA for Group Reporting (GR) with a focus on the transfer of data from SAP Financial Consolidation (FC) as "legacy" application.

- Export transactional data from SAP Financial Consolidation to Group Reporting Data Collection - Mapping

- Example mapping definition to transform transactional data of an FC starter kit to GR best practice content item 1SG

- Import transformed transactional data into GR

Benefit

- Increase efficiency in activating or setting up a GR system

- Improve efficiency in historical data transfer and parallel runs of legacy (FC) and new (GR) application

- Reduce risk and costs during system adoption

Reclassification – support additional and customer fields in configuration. Enhanced capabilities for reclassification rules:

- Read a percentage from a partner

- Break down the percentage selection by additional dimensions (such as product)

- Assign the retrieved percentages to the selected reported data of the trigger by partner and breakdown dimension value

- Multiply the selected value (from trigger) with the selected percentage by the assignment dimensions

- Change source and destination dimension values for additional and custom fields using developer extensibility

Benefit

- Increase efficiency, reduce manual work, and improve transparency and auditability of elimination of profit in inventory and other eliminations that require similar rule capabilities

Customer-coded posting logic and coded field validation and substitution rules. Allow customers to write their own program logic in the following areas:

- Customer code that writes journals in a custom task

- Assign document type to custom task

- Call write journal API from customer code in a custom task

- Call write journal API from an external customer application

- Customer coded functions in field substitution and validation

- Customer coded percentage selection in reclassification

Benefit

- Increase flexibility for customers by supporting app code extensibility:

- Custom task, generating transactional data

- Quality checks in field substitution and validation rules

- Reclassification percentage read

- Enable customers to develop their own applications for writing journals into group reporting (side-by-side extensibility)

Local currency change during balance carry-forward

- Support change of local currency of the consolidation unit during the fiscal-year change in balance carry-forward:

- Change the local currency key of the consolidation unit in the first period of the new year in the master data record

- Change of the behavior of auto-reversals in next year: reversals done by balance carry-forward

- Currency translation of old local currency to new local currency during the balance carry-forward including rounding

- Not part of the scope are enhancements to general ledger accounting.

Benefit

- Increase efficiency in handling companies that require a change of the local currency

Augmented posting rules to further automate consolidation of investments cases (at equity treatment). Enhanced reclassification rules for automating the consolidation of investments for companies accounted for "at equity":

- On posting level 30, read all data including data generated from a PCC task (preparation for consolidation group changes) by removing the reporting logic selection

- Option to read the percentage from the partner on posting level 30

Benefit

- Increase efficiency, reduce manual work, and enhance both transparency and auditability of consolidation of investments for companies accounted for "at equity"

Modification of cashflow (and other reporting rule-based) reports by posting to reporting items directly.

- Enabling users to use FS (financial statement) items of the type "reporting item" to write data using regular apps (for example, manual posting, flexible file import, or automatic tasks)

- Allowing users to use FS items of the type "reporting item" in reporting rules to assign to the reporting item dimension values

Benefit

- Increase efficiency in the correction of reporting rule-based reports

Central Finance

More flexible initial load process

Cross-company transactions can now be included in the Intermediate Initial Load (IDR) initial load, even if not all company codes are in the same initial load group. The data is split into separate transactions for each initial load group. This ensures the data is prepared for the IDR initial load and for the reset of the initial load.

Enable initial load using the intermediate data-retention (IDR) approach:

- Split cross company postings to enable the initial load for cross-company postings even when a company code is not part of the initial-load group

- Finalize postings in more than one period

- Switch back to standard replication (switch off recording for this approach)

- Start recording postings for this approach also if the central finance system is not set up (start recording in the source system)

- Stop recording and deletion after a successful go-live instance

Benefit

- Increase flexibility and reduce risks by allowing a phased go-live approach also for company codes with cross-company postings

- Improve coverage and granularity of historical data by starting the recording of postings earlier, even before the central finance system is set up

- Decrease costs by stopping and deleting a recording more easily

Consistency checks between source systems and central finance

You can now activate or deactivate the trading partner consistency check for individual company codes. With this check, you can receive notification in AIF when trading partner inconsistencies are detected during replication.

- Additional consistency checks between source systems and the central finance system for customizing settings and master data

- Ability to compare and check consistent trading partner assignments for business partners in the source systems and in the central finance system

- Ability to check for consistent "net vendor procedure" settings in the document types of the source systems and the central finance system

- Display of more details in consistency check messages, including the company code to which the message belongs

Figure 9: Example - A New G/L Account Created Source System Only

Figure 9: Example - A New G/L Account Created Source System Only

Benefit

- Prevent errors and reduce time spent on error resolution by finding inconsistent settings between source systems and the central finance system earlier

- Improve analysis of consistency check messages by getting more detailed information

More-efficient error resolution and robotic process automation in central finance

- Distribute error messages to different recipients

- Group error messages in error categories

- Upload assignments of error messages to error categories from a spreadsheet

- Use robotic process automation to automate tasks in central finance

Benefit

- Increase efficiency by distributing error messages to the right recipients

- Improve overview and classification of different types of errors

- Lower costs by automating tasks in central finance

Additional flexibility and scope for a centralized payment process in central finance

You can now activate Central Payment for a company code's intercompany AP/AR line items only. With this, only intercompany AP/AR open items with trading partner will be set as technically cleared in the source system once they're posted and can only be paid/cleared in the Central Finance system.

- Allow centralized payments for intercompany receivables and payables while receivables and payables to external customers and vendors can still be paid in the source systems

Figure 10: Example - CC CIRC: CPAY Active For Intercompany AP/AR with Tax Consistency Check

Benefit

- Increase flexibility in transitioning to centralized payments

- Reduce costs and improve efficiency by centralizing and streamlining payments of intercompany receivables and payables as a headquarters function

Central accruals management in central finance

With this enhancement, you can now automate the transfer of the purchase orders replicated by Accounting View of Logistics Information (AVL) to Accrual Engine in the Central Finance system. Additionally, AVL now enables you to replicate service purchase orders with service entry sheets from a source system to the Central Finance system.

Enhance the existing central accruals scenario in central finance:

- Support the online mode of central accruals management for replicated purchase orders

- Enable central accruals management also for purchase orders with service entry sheets

Benefit

- Reduce manual work for transferring replicated purchase orders to the accrual engine in a batch run by automatizing the process

- Stay up to date with purchase accrual objects, and get real-time insights into posting and calculation of purchase order accruals

- Enable central accruals management for purchase orders with service entry sheets

- Centralize and streamline accruals management for purchase orders

Integration of revenue accounting with central finance

Revenue Accounting and Reporting (RAR) now enables integration with Central Finance using the mapping mechanism. If you have heterogeneous systems, you can use the Central Finance Deployment approach.

- Use a mapping mechanism to integrate revenue accounting with central finance

Example:

Figure 11: Business Example

Benefit

- Support customers in meeting international accounting regulations

Finance Operations

Dispute and Collection Management

Manage assignment of open FI documents to Dispute Cases

New features enabling AR accountants and managers to do the following

- Create assignment proposals of open FI documents to existing dispute cases via a scheduled job

- Assign FI documents automatically to existing dispute cases if assignment proposals are unique

- Manually process assignment proposals via SAP Fiori app

Benefit

- Enable efficient processing of dispute cases

- High degree of automation

- Reduced operational costs for dispute resolution

- Improved working capital through improved number of days sales outstanding (DSO)

Application logs dispute and collections management

Enable new SAP Fiori apps for accounts receivable accountants to do the following:

- View application log details

- Filter logs by severity

- Search for message texts

- Display the message details

Benefit

- Monitor application logs more easily

- Provide timely detection of issues

Collections management e-mail correspondence.

Use this new app to send emails as part of the cash collection process in SAP Collections Management. To improve the communication with the customer, you have the option to include several types of attachments, for example, billing documents.

New SAP Fiori app enabling AR accountants to:

- Create e-mail correspondences from collection customer contacts

- Define e-mail body templates

- Add attachments to e-mails to be created

Figure 12: Send Individual Email Correspondence

Figure 12: Send Individual Email Correspondence

Benefit

- Enable efficient processing of customer receivables

- Enhance capabilities by adding another communication method

- Provide a user-friendly, Web-based user interface

Bank Statement Automation

More flexibility in Payment Advice Assignment and Life Cycle Management

The Payment Advice - Create API was enhanced by adding more options that can be used in the Lockbox scenario. In addition, it is now possible to maintain more than one deduction reason for an individual payment advice item.

- Periodic association job to search for matching open items and payment items:

- Assignment of open items and payment items to associated payment advice items

- Clearing of payment items and open items after assignment of all payment advice items

- Lifecycle management of payment advice:

- Original version of payment advice to stay untouched

- Each manual revision of the payment advice to be saved to a newer version

- Payment advice not to be deleted after clearing is done

- New feature in the reprocess bank statement and lockbox items to manually assign payment advice items to open items

Figure 13: New Lockbox Process

Benefit

- Automatic matching and clearing of invoice and payment items

- Lifecycle management of payment advisements

- Greater transparency and time savings in assigning open items to payment advice items

Credit Management

New apps for the credit controller to do the following:

- Define formulas for the automatic calculation of the internal credit score

- Define formulas for the automatic calculation of credit limits

- Trigger the simulation of the calculation for a single business partner

Figure 14: Credit Management Formula Editor

Figure 14: Credit Management Formula Editor

Benefit

- Higher degree of process automation when assessing the credit risk of customers.

- Credit controllers can do ad-hoc changes without requiring support from IT experts.

- The simulation mode helps you to understand the impact of any changes

New payment behavior key figures for credit accounts

- Develop a new report to calculate payment-behavior key figures based on current and historic posting data in accounts receivables accounting to include:

- Average days late

- Payment terms net days

- Perform calculation and update of key figures periodically on a monthly basis

- Determine the following for key figures:

- Transfer them to the credit management system

- Display them in the credit segment data of the credit account

- Build key figures in formulas using the SAP Fiori app "Manage Formulas in Credit Management"

Figure 15: Schedule Job to Update Payment Behavior Key Figures

Figure 15: Schedule Job to Update Payment Behavior Key Figures

Benefit

- Enhance insight into customer payment behavior for credit controllers

- Provide options for trend evaluations

- Expand options for taking payment history into account in formula-based determinations of:

- Internal score

- Credit limits

Accounts Payable

SAP Fiori app “Manage Payment Blocks” – improved searches, filtering, and management of supplier accounts to replace the transactional app of the same name:

- Search and filter supplier accounts and open invoices

- Display supplier accounts and open invoices and view their statuses

- Set and remove payment blocks

Benefit

- Handle key tasks with greater convenience

- Obtain support for more device types, such as smart phones

Billing and Revenue Innovation Management

Analyze the effectiveness of the automated clarification process provided by the standard

With the Analyze Incoming Payments app, you can monitor and analyze incoming payments to optimize clarification processes and team workload. You can use this app to regularly analyze how many payments have been clarified manually within a given period.

- Know what happened with payments

- Identify what helped during the payment-clarification process

- See how well machine learning supported the automatic process for matching incoming payments

Figure 16: Analyze Incoming Payments

Figure 16: Analyze Incoming Payments

Benefit

- Make better decisions with key details and feedback on the automatic matching of payments through machine learning

Automatic interest calculation for installment plans

When installment plan items are paid, the interest calculated from the original items of the installment plan has to be recalculated. You can manually recalculate interest for single installment plans by using the Maintain Installment Plan app.

- New mass run for recalculating and posting interest for installment plans through the new SAP Fiori app “Interest Run for Installment Plan”

Figure 17: Schedule Job to Calculate Interest for Installment Plans

Figure 17: Schedule Job to Calculate Interest for Installment Plans

Benefit

- Automatically calculate interest for installment plans, with no manual interaction necessary

Dispute management for objects in SAP Convergent Invoicing.

- Creation of an dispute case for an Convergent Invoicing invoice starting from the display of the invoice.

- Navigation to the dispute case of an individual invoice starting from the display of the invoice.

- Add invoice line items and billable items to an existing dispute case for an invoice.

Benefit

- Increase customer satisfaction by managing disputes of objects in SAP Convergent Invoicing

- Reduce DSO by managing customer-initiated disputes of objects in SAP Convergent Invoicing

Display of contract accounting subledger documents. New SAP Fiori app for displaying contract accounting subledger documents:

- Get an overview about the document with:

- Document header information

- Most important fields of open-item information

- Information for general-ledger items

- Navigate from the document to the most important document-related other information, such as:

- Clearing documents

- Reconciliation key

- General-ledger documents

Figure 18: With the Manage Documents app, you can manage Contract Accounting documents through a single point of access. From the list of selected documents, you get access to various apps and functions used for managing documents

Benefit

- Provide a new SAP Fiori user experience for contract accounting documents

- Show alerts for special characteristics of subledger documents in documents display, such as payment locks or dunning locks

Contract confirmation letter for new customers

- Automatically generate a contract-confirmation letter when a provider contract is created in contract accounting

Benefit

- Improve customer communication with:

- New correspondence type for the contract-confirmation letter

- Mass activity to schedule the printing of new correspondence

Support for bank account aliases as alternative for account representation and identification

Contract Accounting supports the use of bank account aliases as an alternative representation of bank accounts. The account alias is updated to payment documents, payment media files, and payment lists.

Use contract accounting to:

- Support bank account aliases as an alternative representation of bank accounts

- Update an account alias as to payment documents, payment media files, and payment lists

Benefit

- Decrease the number of bank accounts

- Reduce effort for management of bank accounts

Contract confirmation letter for new customers

If a provider contract was created successfully in the S/4HANA system, you can send a contract confirmation to the business partner

- Automatically generate a contract-confirmation letter when a provider contract is created in contract accounting

Benefit

Improve customer communication with:

- New correspondence type for the contract-confirmation letter

- Mass activity to schedule the printing of new correspondence

Tax reporting framework in contract accounting (deferred taxes REP06/07)

- Transfer of the tax rates recorded for the VAT return to the central data store for tax returns using the Transfer Tax Information for Tax Report app to:

- File a tax return at the time of clearing

- File a tax return on the due date (according to the minimum rule)

- App consideration of only the tax types that are subject to the minimum rule

Benefit

- Have the option to submit tax reports based on contract accounting subledger documents

Treasury Management

Advanced Payment Management

In-house banking for corporations

Centralize and streamline all payment transactions within a group or company using in-house banking for corporations, a complementary service related to SAP S/4HANA Cloud for advanced payment management that enables you to:

- Maintain internal bank accounts for your subsidiaries in different currencies

- Process intercompany payments, payments on behalf of other users, and central incoming payments, such as from external zero-balancing processes

- Report balances of payments to internal bank accounts

- Calculate interest on a regular basis

- Create bank statements, balances, and interest scale notifications for your subsidiaries

- Transfer all payments posted on the involved internal bank accounts to the financial accounting system of the internal bank owner

Figure 19: Maintain In-House Bank Account

Figure 19: Maintain In-House Bank Account

Benefit

- Streamline and centralize all payments within the group to achieve one view of the corporate group’s cash situation

- Make cashless settlement of open items in intercompany accounts payable and receivable

- Centrally monitor payments

- Centrally monitor the cash situation for internal bank accounts including consideration of internal limits

- Count on intuitive maintenance with the ability to create accounts en masse

- Access within-day bank statements

- Make general ledger transfers within a single day

- Leverage in-house banking that is fully embedded in the standard processes for payments and the electronic bank statements within financial accounting

Payments and Bank Communication

MDI service for bank directory

- Adopt the master data integration

(MDI) service for the bank directory to synchronize the bank master data across the landscape - Replicate the bank directory

- Replicate the key mapping service

Benefit

- Identify transactional data from different systems based on bank IDs

- Support a consistent bank directory model

Intelligent Real Estate

Contract and Lease Management

Updates for the contract management app: contract terms, customer-specific status, and error messages. Enable new usability and functional capabilities to simplify and enhance contract management processing, including:

- Comprehensive view of current contract term, possible renewal, notice options and upcoming reminders

- Customer-specific status handling

- Error-message handling

Figure 20: Manage Contract Terms

Benefit

- Provide these improvements to simplify contract management:

- Current contract term, renewal and notice options, and upcoming reminders

- Customer status updates

- Error messages

Integration with contract and lease management for advanced financial closing

Integrate important closing activities for SAP Contract and Lease Management with the automated closing task model of SAP S/4HANA Cloud for:

- Advanced financial closing

- Compliant lease valuation in accordance with IFRS16, ASC842, and other lease accounting standards

Benefit

Include the following activities in the global entity close game plan to help ensure high-quality, compliant lease valuation results in accordance with global lease accounting standards:

- Periodic contract

- Lease management

Lease Accounting

Updates of the app for valuation management

Enable new usability and functionality to simplify valuation management processing, including:

- Getting a comprehensive view about the current contract term and possible renewal and notice options

- Maintaining notes for valuation rules

- Displaying logs of changes done on valuation rules and their parameters

- Providing access to valuation process logs

Figure 21: Valuation Management

Figure 21: Valuation Management

Benefit

Provide additional improvements to simplify valuation management, including:

- Contract terms and renewal and notice options

- Valuation rule changes, parameters, and access to logs

Space Management

Updates of app for occupancy management processing

- Enable new usability and functionality to simplify occupancy management processing, including:

- Additional reporting capabilities

- Customer-specific status handling

Benefit

- Enhance occupancy and customer reporting in the SAP Intelligent Real Estate solution

If you want to learn more about the business value of the finance innovations as part of the SAP S/4HANA 2022 release, read this blog from michelhaesendonckx which includes several product update videos.

For more information on SAP S/4HANA Cloud, private edition, and SAP S/4HANA | 2022, check out the following links:

- SAP S/4HANA release info: com/s4hana

- SAP S/4HANA Community here

- SAP S/4HANA PSCC Digital Enablement Wheel here

- Inside SAP S/4HANA Podcast here

- Join the SAP S/4HANA Movement

- Best practices for SAP S/4HANA here

- Help Portal Product Page here

- Feature Scope Description here

- What’s New here

Follow us via @Sap and #S4HANA, or myself via @UlrichHauke and LinkedIn

- SAP Managed Tags:

- SAP S/4HANA Cloud for Finance,

- SAP S/4HANA,

- SAP S/4HANA Finance

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

- SAP S/4HANA Cloud Public Edition 2402.2: Final What's New & Product Assistance available in Enterprise Resource Planning Blogs by SAP

- SAP Preferred Success: A Day in a Life in Product Change Management with Change Records in Enterprise Resource Planning Blogs by SAP

- Data migration approach for Open PO and Contract in Public Cloud in Enterprise Resource Planning Q&A

- Manage Supply Shortage and Excess Supply with MRP Material Coverage Apps in Enterprise Resource Planning Blogs by SAP

- Quick Start guide for PLM system integration 3.0 Implementation/Installation in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 8 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |