- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by Members

- Predictive Accounting in Sales processes

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Predictive accounting enables us to look at and analyze data using a forecast of future results based on the most up-to-date data. It is used to create predictive journal entries based on the documents created for the following processes.

- Predictive accounting for Sales processes, using sales orders as source document.

The Predictive Journal Entry - Manage (Synchronous) web service is also available for using sales orders from an external system as source documents. - Predictive accounting for Travel and Expense Management, using travel requests as source document

Refer Note 2947863 for restrictions in Predictive accounting.

This blog post explains Predictive Accounting for Sales Processes to predict future revenue and cost based on the actual data.

Predictive Accounting in Sales Processes:

Predictive accounting predicts future revenue and cost on the sales processes in the universal journal when a sales order is created before any accounting documents posted from the subsequent processes.

Predictive journal entries are posted in an extension ledger which facilitates to see the possible impact on the margin of future good issues and billing.

Figure 1:Predictive Accounting in Sales Processes (Image Courtesy: SAP)

The configurations required for predictive accounting for sales processes is explained later in this blog post.

SAP has delivered multiple analytical apps for predictive accounting analysis. These Analytical apps are available to analyze and evaluate the presumed and actual margins resulting from incoming sales orders. It uses predictive postings from the journal entry database.

In this blog post, the following apps are used for explaining predictive accounting postings:

- Gross Margin - Presumed/Actual

- Incoming Sales Orders - Predictive Accounting

- Display Line-Item Margin Analysis

Predictive Accounting postings at the time of sales order creation.

Sales Order # 11 is taken for illustrating predictive accounting postings in the sales processes. Initially sales order is updated with 16k revenue and material cost is 10k. Predictive accounting postings are created after the sales order is saved without any errors. The posting is created only at the extension ledger ‘ZR’. No postings made in standard ledger.

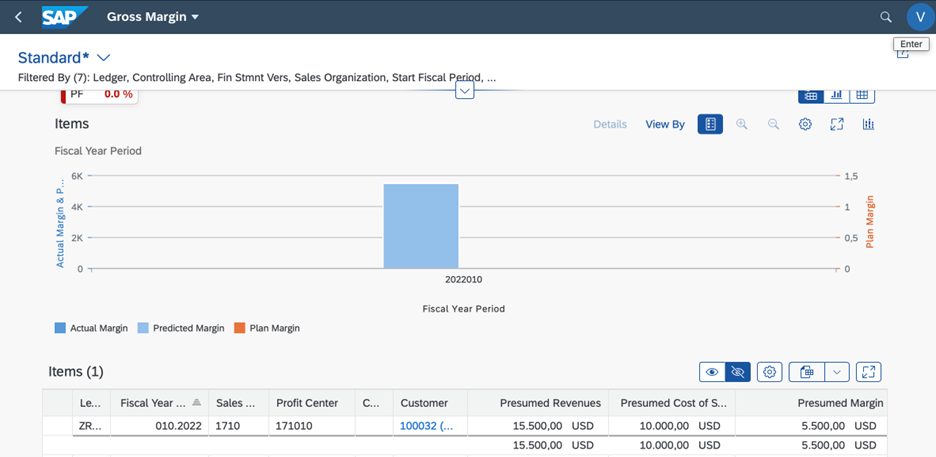

Figure 2:PA postings at the time of SO creation in the app Incoming Sales Orders - Predictive Accounting

Analytical App ‘Incoming Sales Orders - Predictive Accounting’ provides details at journal entries level and graphical representation.

Figure 3:PA postings at the time of SO creation in the app Gross Margin - Presumed/Actual

App ‘Gross Margin - Presumed/Actual’ provides summarized details of presumed revenue, presumed cost and presumed margin.

Predictive Accounting postings at the time of sales order changes.

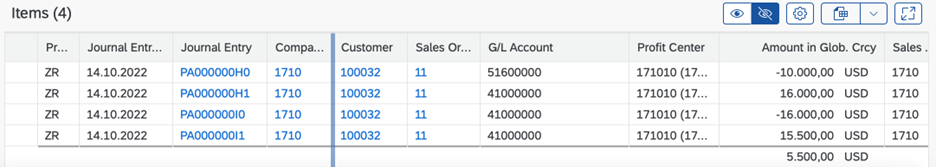

The pricing in sales order 11 is reduced to 15.5k and corresponding predictive accounting documents are created in the extension ledger.

Figure 4:App ‘Gross Margin - Presumed/Actual’ updated with SO price change

The revenue adjustment is updated in the App ‘Gross Margin - Presumed/Actual’.

Figure 5:Line item details for price change in SO

The line item details for predictive accounting journal entries after revenue adjustments.

Predictive Accounting postings at the time of goods issue.

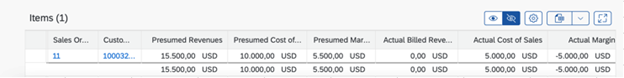

Partial goods are issued for Sales Order 11 & actual cost is posted in the standard ledger as well as in the predictive accounting – extension ledger.

Figure 6:Actual cost update in the app Gross Margin - Presumed/Actual

Predictive Accounting postings at the time of billing.

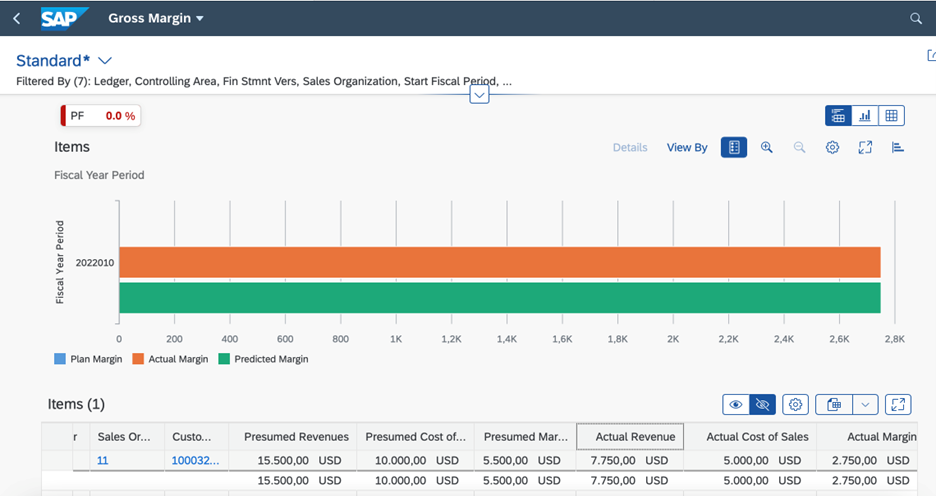

Partial billing is created for sales order 11 & actual revenue is posted in the standard ledger as well as in the predictive accounting – extension ledger.

Figure 7:App Gross Margin - Presumed/Actual - After partially billed

Actual Revenue, Actual Cost and margin are updated in the app ‘Gross Margin - Presumed/Actual’.

Figure 8:App Gross Margin - Presumed/Actual - After fully billed

Figure 9:Line item details in the Extension ledger

App ‘Display Line items – Margin Analysis’ for journal entries details in the extension ledger ZR for predictive accounting.

Setting Up Predictive Accounting in Sales Processes:

Standard configuration required for creating sales order, good issues, billing and posting to accounting to be set up before setting up the below customization required for Predictive accounting.

Create and Assign an Extension Ledger

Extension Ledger ZR is created to capture all predictive journal entries with underlying ledger as ‘0L’. The newly created extension ledger is assigned to the relevant company codes.

Figure 10:Extension Ledger configuration

Figure 11:Predictive Accounting configuration

The 3 key customization is required for predictive accounting:

- Activating Predictive accounting at controlling area level and selecting relevant processes. Also make sure that relevant company codes are assigned to the extension ledger mentioned in the previous step.

- Add extension ledger created for predictive accounting in the step ‘Check Prediction Ledger’

- Maintain Sales Document categories for Predictive accounting.

Conclusion:

This blog post provides predictive accounting in sales processes features with illustration. Please share your feedback in the comment section.

- SAP Managed Tags:

- SAP S/4HANA Finance,

- FIN Profitability Analysis

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

"mm02"

1 -

A_PurchaseOrderItem additional fields

1 -

ABAP

1 -

ABAP Extensibility

1 -

ACCOSTRATE

1 -

ACDOCP

1 -

Adding your country in SPRO - Project Administration

1 -

Advance Return Management

1 -

AI and RPA in SAP Upgrades

1 -

Approval Workflows

1 -

Ariba

1 -

ARM

1 -

ASN

1 -

Asset Management

1 -

Associations in CDS Views

1 -

auditlog

1 -

Authorization

1 -

Availability date

1 -

Azure Center for SAP Solutions

1 -

AzureSentinel

2 -

Bank

1 -

BAPI_SALESORDER_CREATEFROMDAT2

1 -

BRF+

1 -

BRFPLUS

1 -

Bundled Cloud Services

1 -

business participation

1 -

Business Processes

1 -

CAPM

1 -

Carbon

1 -

Cental Finance

1 -

CFIN

1 -

CFIN Document Splitting

1 -

Cloud ALM

1 -

Cloud Integration

1 -

condition contract management

1 -

Connection - The default connection string cannot be used.

1 -

Custom Table Creation

1 -

Customer Screen in Production Order

1 -

Customizing

1 -

Data Quality Management

1 -

Date required

1 -

Decisions

1 -

desafios4hana

1 -

Developing with SAP Integration Suite

1 -

Direct Outbound Delivery

1 -

DMOVE2S4

1 -

EAM

1 -

EDI

3 -

EDI 850

1 -

EDI 856

1 -

edocument

1 -

EHS Product Structure

1 -

Emergency Access Management

1 -

Energy

1 -

EPC

1 -

Financial Operations

1 -

Find

1 -

FINSSKF

1 -

Fiori

1 -

Flexible Workflow

1 -

Gas

1 -

Gen AI enabled SAP Upgrades

1 -

General

1 -

generate_xlsx_file

1 -

Getting Started

1 -

HomogeneousDMO

1 -

How to add new Fields in the Selection Screen Parameter in FBL1H Tcode

1 -

IDOC

2 -

Integration

1 -

Learning Content

2 -

Ledger Combinations in SAP

1 -

LogicApps

2 -

low touchproject

1 -

Maintenance

1 -

management

1 -

Material creation

1 -

Material Management

1 -

MD04

1 -

MD61

1 -

methodology

1 -

Microsoft

2 -

MicrosoftSentinel

2 -

Migration

1 -

mm purchasing

1 -

MRP

1 -

MS Teams

2 -

MT940

1 -

Newcomer

1 -

Notifications

1 -

Oil

1 -

open connectors

1 -

Order Change Log

1 -

ORDERS

2 -

OSS Note 390635

1 -

outbound delivery

1 -

outsourcing

1 -

PCE

1 -

Permit to Work

1 -

PIR Consumption Mode

1 -

PIR's

1 -

PIRs

1 -

PIRs Consumption

1 -

PIRs Reduction

1 -

Plan Independent Requirement

1 -

Premium Plus

1 -

pricing

1 -

Primavera P6

1 -

Process Excellence

1 -

Process Management

1 -

Process Order Change Log

1 -

Process purchase requisitions

1 -

Product Information

1 -

Production Order Change Log

1 -

purchase order

1 -

Purchase requisition

1 -

Purchasing Lead Time

1 -

Redwood for SAP Job execution Setup

1 -

RISE with SAP

1 -

RisewithSAP

1 -

Rizing

1 -

S4 Cost Center Planning

1 -

S4 HANA

1 -

S4HANA

3 -

S4HANACloud audit

1 -

Sales and Distribution

1 -

Sales Commission

1 -

sales order

1 -

SAP

2 -

SAP Best Practices

1 -

SAP Build

1 -

SAP Build apps

1 -

SAP Cloud ALM

1 -

SAP Data Quality Management

1 -

SAP Maintenance resource scheduling

2 -

SAP Note 390635

1 -

SAP S4HANA

2 -

SAP S4HANA Cloud private edition

1 -

SAP Upgrade Automation

1 -

SAP WCM

1 -

SAP Work Clearance Management

1 -

Schedule Agreement

1 -

SDM

1 -

security

2 -

Settlement Management

1 -

soar

2 -

Sourcing and Procurement

1 -

SSIS

1 -

SU01

1 -

SUM2.0SP17

1 -

SUMDMO

1 -

Teams

2 -

Time Management

1 -

User Administration

1 -

User Participation

1 -

Utilities

1 -

va01

1 -

vendor

1 -

vl01n

1 -

vl02n

1 -

WCM

1 -

X12 850

1 -

xlsx_file_abap

1 -

YTD|MTD|QTD in CDs views using Date Function

1

- « Previous

- Next »

- Speeding up your SAP HCM move to the cloud in 2024 - Part 2: Customer Evolution Kit for HCM in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Service in Enterprise Resource Planning Blogs by SAP

- Recap of SAP S/4HANA 2023 Highlights Webinar: Finance in Enterprise Resource Planning Blogs by SAP

- Preparing for Universal Parallel Accounting in Enterprise Resource Planning Blogs by SAP

- Working with SAFe Epics in the SAP Activate Discover phase in Enterprise Resource Planning Blogs by SAP

| User | Count |

|---|---|

| 3 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 2 | |

| 1 | |

| 1 |