- SAP Community

- Products and Technology

- Technology

- Technology Blogs by SAP

- Thailand e-Tax Invoice & e-Receipt

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Updated: June 2023

This blog explains about SAP Document and Reporting Compliance Solution for Thailand e-Tax Invoice & e-Receipt.

Source: https://etax.rd.go.th/etax_staticpage/app/index.html#/index/main#top

What is e-Tax Invoice & e-Receipt in Thailand

As a part of Thailand 4.0 and National e-Payment policies in order to transform Thailand into a “Digital Economy”, e-Tax Invoice & e-Receipt was introduced by Revenue Department (RD) in 2017. The e-Tax Invoice system intended to replace the paper-based tax invoices to help reduce cost of doing business and maintenance caused by paperwork for more business friendly. There are two types of e-Tax Invoice system i.e.

(1) e-Tax Invoice and e-Receipt

(2) e-Tax Invoice by email for small enterprises that revenue not higher than 30 Million Thai Baht.

Remark: This blog only focuses on (1) e-Tax Invoice and e-Receipt. For (2) e-Tax Invoice by email, please visit e-Tax Invoice by email website.

An e-Tax lnvoice is an invoice, credit note, or debit note provided in electronic format with a digital signature or time stamp under the e-Tax System by email. Similar to the e-Tax lnvoice, an e-Receipt is a receipt document provided according to the Thai Revenue Code in an electronic format.

e-Tax Invoice & e-Receipt is a Voluntary, Taxpayers opting to use the e-Tax Invoice & e-Receipt shall send invoices with a Digital Signature to the recipients. After distributing the invoice to the buyer, the supplier must report the invoice to the Revenue Department (Thailand’s Tax Authority) in an XML format (RSET.3-2560) by the 15th day of the following tax month.

Standards for electronic transactions provided by Electronic Transactions Development Agency (ETDA) that relevant to e-Tax Invoice & e-Receipt.

3-2560 (ขมธอ.3-2560) – Trade Services Message Standard

14-2560 (ขมธอ.14-2560) – Using XML Messages for Inter-Organizational Data Exchange

Digital Signature in the form of Electronic Certificate which must be kept in USB token or Hardware Security Module (HSM), can be obtained from Certification Authority (CA), CA must be trusted by Thailand National Root Certification Authority (Thailand NRCA) and Electronic Transaction Development Agency (ETDA) under Ministry of Digital and get standard certified “Trust Server Principles and Criteria Authority (Web Trust for Cas). Currently there are two providers:-

1. Thai Digital ID Co. Ltd.

2. Internet Thailand Co.,Ltd.

At FY2019, in order to promote e-Tax, Revenue Department issued tax benefit to allow the entrepreneurs to use double amount of expense on implementing e-Tax Invoice system to deduct Income tax of FY2019 and extended to FY2025.

More information, please visit e-Tax Invoice Website.

There are 3 parts to consider for implementing e-Tax Invoice & e-Receipt as follow:-

1. Generation of electronic documents (e-document) for Tax Invoice, Credit Note, Debit Note and Receipt

2. Get digital signature and embed digital signature into e-document.

3. Sending e-Tax Invoice & e-Receipt to Buyers and submission e-Tax Invoice & e-Receipt to Revenue Department (Thailand’s Tax Authority)

In order to provide end-to-end solution to customers, SAP developed an integration package (iFlow) which allows companies that using SAP to send electronic documents of Tax Invoice, Credit Note, Debit Note and Receipt, generated from SAP ECC or SAP S/4HANA to one of the listed service providers in Thailand’s Electronic Transactions Development Agency (ETDA) website. The Service provider shall apply the digital signature to the e-documents, convert to ebXML format and submit the e-Tax Invoice and e-Receipt to Revenue Department and return the status with signed e-documents to the companies. In general, the service provider fee consists of two parts i.e., set-up fee as fix cost based on the selected option and volume-based fee based on the number of transmitted documents.

Benefits of the integration to service providers

- Faster Adoption & Less investment than host-to-host option. No complex set up and directly involvement with Revenue Department.

- Save cost: Companies only purchase digital signature certificate, no HSM device required as the service provider will import to the certificate to their HSM and embed the digital signature to e-document.

- Better Control & No New Skill required: Monitor e-document transmission status from SAP ECC or SAP S/4HANA & Leverage standard integration from SAP (SAP support)

HOW IT WORKS

1) SAP Document and Reporting Compliance

SAP Document and Reporting Compliance solution is SAP’ strategic solution in addressing electronic document requirements all over the world. It supports more than twenty countries and various electronic document types. The solution enables you to create electronic documents, that is, to transform transactional data created in SAP ECC or SAP S/4HANA system into predefined exchange formats and transfer it electronically to external party systems such as to the Service Providers or Tax Authority of your country.

You can process and monitor electronic documents generated from transaction documents such as invoices and receipts by using either the eDocument cockpit or Manage Electronic Document app.

Support Solutions & Versions:

- SAP ECC 6 ehp 5 and above

- SAP S/4HANA 1510 and above

- SAP S/4HANA Cloud

SAP Notes for Thailand e-Tax Invoice & e-Receipt

| 2569090 | Installation Overview eDocument Thailand |

| 2497350 | eDocument Thailand: eInvoicing |

| 2617268 | eDocument Thailand: Process Class Implementation |

| 2525950 | eDocument Thailand: AIF ABAP Proxies |

| 2533501 | eDocument Thailand: AIF Mapping Classes |

| 2534358 | eDocument Thailand: Customization for Process Manager and eDocument Content |

| 2534367 | eDocument Thailand: Implementation of AIF Interface Connector |

| 2534471 | eDocument Thailand: AIF Customizing |

| 2547045 | eDcoument Thailand: Implementation of eDocument Inbound Message Handler |

| 2550658 | eDocument Thailand: Consulting Note for Implementation and Configuration |

| 2554420 | eDocument Thailand: SOA Service Configuration |

Additional Notes for special/exception processes:

3214864 – eDocument Thailand: Cancel Source Documents without Having to cancel eDocument First

3244533 – Document Compliance Thailand eInvoice: Enable Custom fields

3247960 - eDocument Thailand: Support for Deferred Tax Scenarios

2) Get Electronic Certificate for Digital Signature

The electronic certificate for digital signature is own by the Company. Company needs to purchase the electronic certificate from the Certificate Authority and provides it to Service Provider. Below are the steps to get electronic certificate from Thailand Digital ID (TDID), one of the Certificate Authority. This is intended to be an example or guideline only; it doesn’t mean that the Company must get the electronic certificate from TDID. And if TDID changes their procedures in the future, the steps may be different.

You can visit the e-Tax Invoice – Certification Authority page for contact information of Certification Authorities.

Go to TDID website https://www.thaidigitalid.com/ASCH/main_en

Fill in the necessary details to create application for requesting the certificate [Create Request]

- Create New User/Account with email, name, phone number

- Select request for electronic certificate, quantity, system = Revenue Department > Digital signature for e-tax invoice/ e-receipt

- Certificate type = Company/ Organization

- Year = 1 year (3000 THB), 2 years (5000 THB), note that the price was at the time when this blog created, subjected to change by the provider.

- Company Name | Company ID (13 digits) | Company Address

- Contact Person | Email | Mobile Phone for OTP

- Info for TDID to issue Tax Invoice (for Certificate cost)

Once enter all the above information, click [submit request], system will return request ID and click to download the request document.

In the request document, will have information of supporting documents and Bank accounts to transfer money.

- Transfer the payment, keep the transfer slip and send request document (downloaded), supporting documents and transfer slip to TDID email (ra@thaidigitalid.com)

- TDID shall send “Authentication code” to the email of contact person in the request

- Go to same website – Get a Certificate - enter request ID and authentication code - download the .CSR file - download certificate

- Go to same website – Activate Certificate - OTP will be sent to Mobile phone stated in request application.

- Service Provider to install TDID Key Suite to HSM

3) Transmit e-document to Service Provider

Leveraging SAP Integration Suite Platform, the integration package SAP Document and Reporting Compliance: Electronic Invoicing for Thailand is developed and made available in SAP API Business hub. Check the related SAP Notes:-

- 3213006 eDocument Thailand: Pre-requisite Note for SAP Note 3213009

- 3213009 eDocument Thailand: Submit Electronic Documents Using SAP Integration Suite or SAP Cloud Integration

The integration package is developed in collaboration agreement with one of the listed service providers. You can visit page: listed service providers to see the whole list of service providers and link to their websites.

If you would like to get connect to the service provider that SAP has worked together on this collaboration agreement, please leave your request and contact info in the comment.

The Service provider shall apply the digital signature to the e-documents, convert to ebXML format and submit the e-Tax Invoice and e-Receipt to Revenue Department and return the status with signed e-documents to Company.

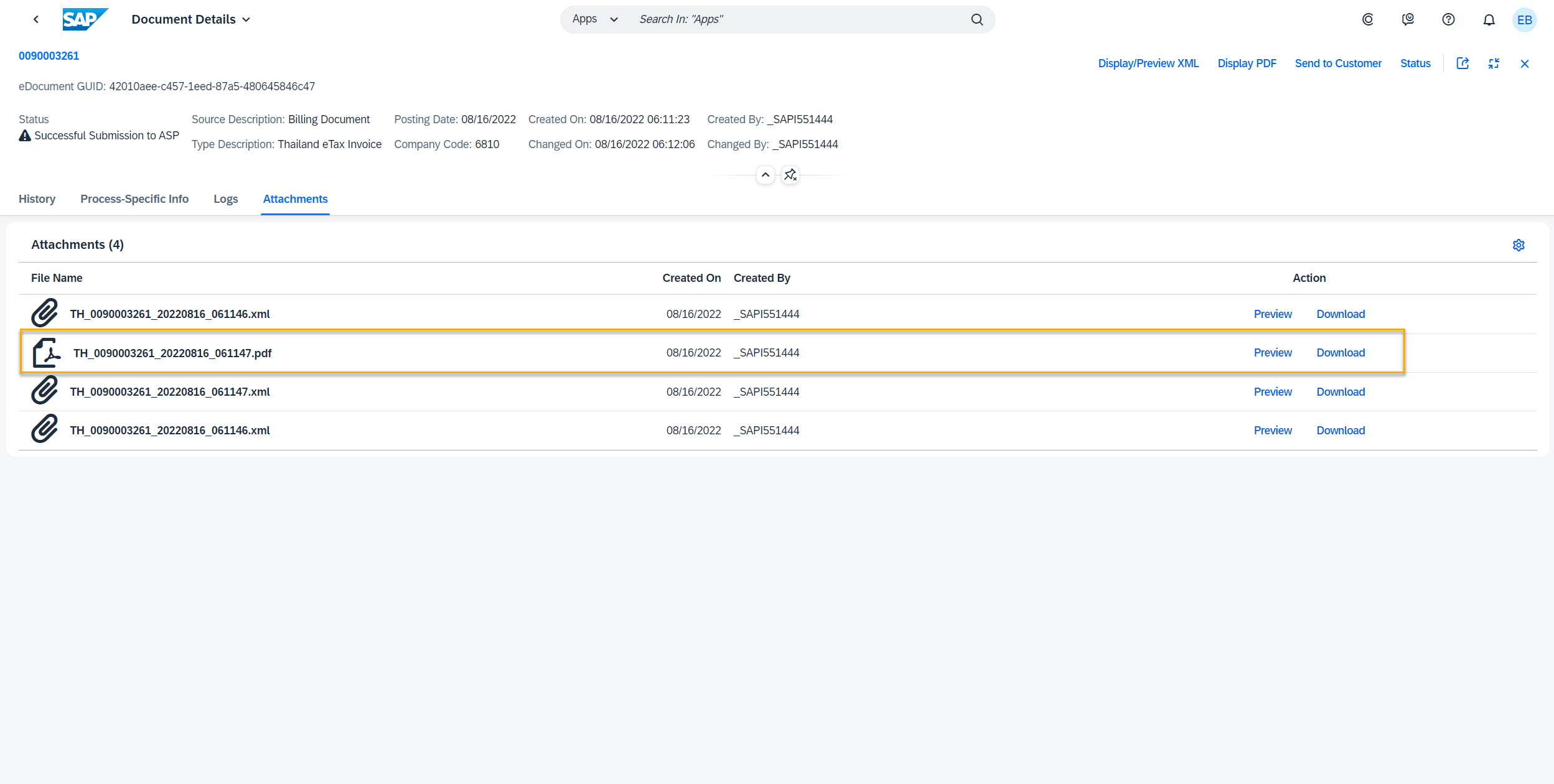

Signed PDF/XML from Service Provider can be found as Attachment of e-document in e-document cockpit or manage electronic document app. You can click [Preview] or [Download] the files.

To view digital signature in PDF file, open PDF file with Acrobat Reader and click [Signature] icon on the left.

*Important: Your service provider might renew their SSL certificate every year. If they do so, then you must deploy a new SSL certificate on your tenant every year.

Options of Sending e-Tax Invoice & e-Receipt to your Customers/ Buyers

- Service Provider can send signed PDF file via email to your customer's email

- After you receive signed PDF file from Service Provider, you send the signed PDF by your own channel e.g. email or other method, to your customers

- If your customer can accept e-document in XML format, you send signed XML by your own channel, to your customers

If you’d like to explore about SAP Document and Reporting Compliance solution, please refer to this page: Document and Reporting Compliance | SAP

-----------------------------------------------------------------------------------------------------------------------------------------

This blog is intended to provide SAP Customers and Partners about Thailand e-Tax Invoice and e-Receipt and how it works with SAP Document and Reporting Compliance solution.

Please share your feedback and thoughts in a comment. If you have questions about Thailand e-Tax Invoice and e-Receipt, you can post your question here.

- SAP Managed Tags:

- SAP ERP,

- SAP S/4HANA,

- SAP S/4HANA Finance,

- SAP S/4HANA Public Cloud,

- SAP Document and Reporting Compliance

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

-

ABAP CDS Views - CDC (Change Data Capture)

2 -

AI

1 -

Analyze Workload Data

1 -

BTP

1 -

Business and IT Integration

2 -

Business application stu

1 -

Business Technology Platform

1 -

Business Trends

1,658 -

Business Trends

91 -

CAP

1 -

cf

1 -

Cloud Foundry

1 -

Confluent

1 -

Customer COE Basics and Fundamentals

1 -

Customer COE Latest and Greatest

3 -

Customer Data Browser app

1 -

Data Analysis Tool

1 -

data migration

1 -

data transfer

1 -

Datasphere

2 -

Event Information

1,400 -

Event Information

66 -

Expert

1 -

Expert Insights

177 -

Expert Insights

297 -

General

1 -

Google cloud

1 -

Google Next'24

1 -

Kafka

1 -

Life at SAP

780 -

Life at SAP

13 -

Migrate your Data App

1 -

MTA

1 -

Network Performance Analysis

1 -

NodeJS

1 -

PDF

1 -

POC

1 -

Product Updates

4,577 -

Product Updates

343 -

Replication Flow

1 -

RisewithSAP

1 -

SAP BTP

1 -

SAP BTP Cloud Foundry

1 -

SAP Cloud ALM

1 -

SAP Cloud Application Programming Model

1 -

SAP Datasphere

2 -

SAP S4HANA Cloud

1 -

SAP S4HANA Migration Cockpit

1 -

Technology Updates

6,873 -

Technology Updates

420 -

Workload Fluctuations

1

- ASUG TECH CONNECT in New Orleans 2023 in Technology Blogs by Members

- Stronger than one – Hack2Build for United Vars to implement SAP S/4HANA Extensions leveraging AI in Technology Blogs by SAP

- SAP Intelligent RPA for Small and Midsize Enterprises in Technology Blogs by SAP

- SAP ByD - Enhancement PDISetLegalClassCode in Technology Q&A

| User | Count |

|---|---|

| 37 | |

| 25 | |

| 17 | |

| 13 | |

| 7 | |

| 7 | |

| 7 | |

| 6 | |

| 6 | |

| 6 |