- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- Governance, Risk, and Compliance (GRC) with SAP S/...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-03-2022

6:13 PM

Hello and welcome to the release highlights for Governance, Risk, and Compliance (GRC) with SAP S/4HANA Cloud 2208. This blog contains selected highlights from SAP Financial Compliance Management, SAP Privacy Governance, and last but not least from SAP Document Reporting Compliance, along with their business benefits and deep-dive system demos.

Watch my video to get a quick overview of our SAP S/4HANA Cloud 2208 highlights for Governance, Risk, and Compliance:

https://youtu.be/8CrREIyPmZw

This blog covers the following topics:

SAP Privacy Governance

SAP Financial Compliance Management

Global Tax

As you know, SAP Privacy Governance is a cloud GRC solution which is closely integrated with SAP S/4HANA Cloud via the scope item 'Privacy Risk Detection with SAP Privacy Governance (3KX)'. The general direction of the solution is moving towards a security framework. In this context, many changes have taken place in the last months as the risk management part has been completely redesigned. The result is that now we have a completely new risk service and a new risk response service. In addition, we have a new asset service with which you can build a repository of assets.

Back to Top

For risk management in SAP Privacy Governance, we previously had two services, the Manage Risk Service and the Assess Risk Service. These two services have been merged together into the new GRC Risk Service where you can both maintain and assess your risks. The new functionality can be used in privacy or IT security contexts and supports NIST-compatible risk management processes.

The service allows you to display an overview of all potential risks identified by your organization and create or edit risks for further analysis. In addition, you can assess risk types and their impact for your organization. Moreover, you can calculate the likelihood of risks along with the estimated potential cost.

Please note that what is currently available is the minimum viable scope which is planned to be extended over the course of the next quarters.

Fig. 1: With the new GRC Risk Service, compliance specialists can maintain and assess risks

Back to Top

The second part of the new risk management is Risk Response. Here, you can create and assign response measures to risks. These measures are actions which should be implemented in order to handle the respective risk in case it occurs. They should be designed in such a way that they reduce the probability of the risk or its impact.

After a risk has occurred, the impact is remediated by taking the defined measures and , if required, risk management can be adapted accordingly. In addition, you can define a response type, assign a purpose, a response owner, and a due date. Furthermore, you can document the completion contribution of the respective measures with regard to the occurred risk.

Fig. 2: With the new risk response functionality in SAP Privacy Governance, compliance specialists can create and assign response measures to risks

If you would like so see what this looks like in the system, please have a look at this demo recording:

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_oez8cxeo

Video 2: System demo illustrating the new GRC Risk Service with Risk Response

Please note that what is currently available is the minimum viable scope which is planned to be extended over the course of the next quarters.

Back to Top

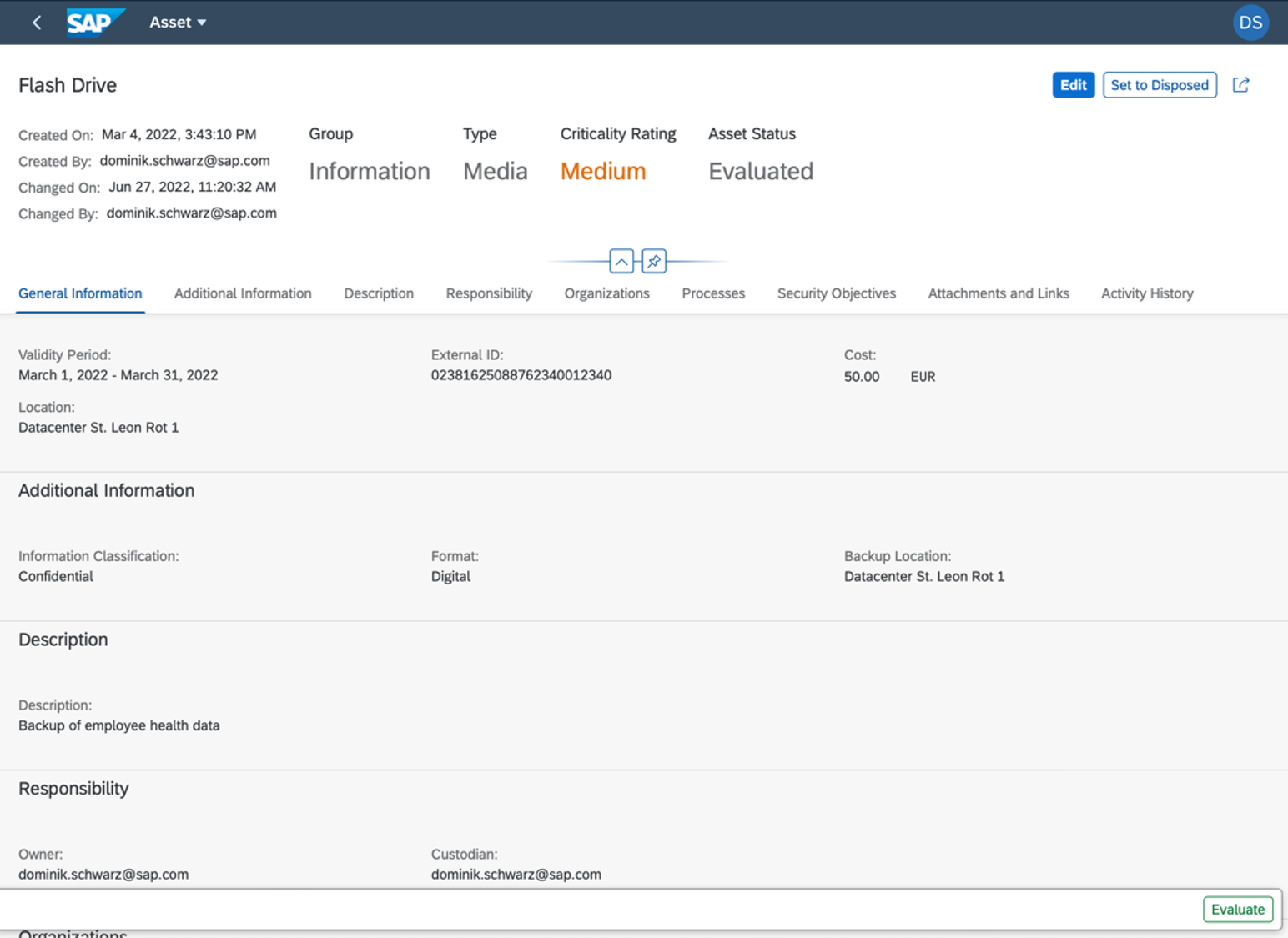

The GRC Asset Service is a brand-new service which allows you to maintain an inventory of your IT-related assets as part of your cybersecurity risk management. With this, you can create an inventory of assets by type and you can document the owner as well as the security objectives of an asset. The service provides predefined asset types that you can use out of the box. But of course, it is also possible to create custom asset types which you can tailor to your needs. Moreover, the service also allows you to assess the criticality of assets by running risk analyses with regard to threat and vulnerability analyses.

Fig. 3: With the new GRC Asset Service, compliance specialists can maintain an inventory of IT-related assets as part of a company's cybersecurity risk management

If you would like so see what the GRC Asset Service looks like in the system, please have a look at this demo recording:

Video 3: System demo illustrating the new GRC Asset Service

Please note that what is currently available is the minimum viable scope which is planned to be extended over the course of the next quarters.

Back to Top

As you know from previous sessions, SAP Financial Compliance Management is a controls solution in the cloud which is closely integrated with SAP S/4HANA Cloud. The corresponding scope item is 'Financial Operation Monitoring with SAP Financial Compliance' (3KY).

SAP Financial Compliance Management is a relatively new solution as it is available since Q1 2021 and it is steadily growing. In a nutshell, you could describe SAP Financial Compliance Management as a solution to detect and process so-called issues in your connected S/4HANA Cloud system. In order to detect these issues, you use automated and also manual controls which you execute via work package runs. For these controls, we provide a lot of business content, meaning predefined controls which you can use out of the box.

With the new release, compliance specialists now benefit from a workflow-driven process during the issue and remediation phase as we introduced the concept of tasks and task list templates. This means that the issues have now tasks assigned to them and these tasks are based on context-sensitive, predefined task list templates which can be tailored to the unique requirements of your organization. And - as you can imagine - this allows you to process your issues in a highly structured, consistent, and of course also efficient way.

Let‘s take an example to make this more concrete: One of the predefined controls in the business content that SAP Financial Compliance Management offers for SAP S/4HANA and S/4HANA Cloud, is a control to detect duplicate invoices. Now, let‘s imagine that we want to find all duplicate invoices in our SAP S/4HANA Cloud system within a certain time frame with certain search criteria. After executing the control by triggering a so-called a work package run, SAP Financial Compliance Management comes up with a list of issues which match our search criteria. In our example, this is a list of duplicate invoices.

Until this release, we now had a list of issues with which we could do some basic actions, like categorizing them by means of priorities and issue categories, assigning an owner and setting a conclusion, but the actual issue processing and the remediation part was not yet there. So, the end-to-end process, was not yet complete.

Now, with the 2208 release, we close the loop by introducing the concept of tasks and task list templates which allow you to use a workflow-based approach for the processing and the remediation of the issues. This means, you can configure so-called task list templates with tasks which can then be automatically assigned to the issues. So, if we stick with the example of the duplicate invoices, we could have an issue with an task list template that contains two tasks: one task might have the name ‚Visually compare the invoices‘ and another task could be 'Contact the supplier who sent invoice‘.

The beauty of this is that it allows the compliance specialists to use these tasks from the task list templates and trigger further actions like assigning colleagues who are supposed to perform the respective tasks and very importantly the compliance specialist can also monitor the progress of the respective tasks.

Fig. 4: As of the 2208 release, compliance specialists now benefit from tasks and task list templates for issues in SAP Financial Compliance Management

Let's take a closer look at the screenshot above:

As a prerequisite, in order for the task list template and the assigned tasks to appear here, this needs to be configured in the system. As the next step, compliance specialists can go ahead and assign the tasks to the respective colleagues which are automatically notified via the Inbox App. In addition, compliance specialists can monitor the progress of the processing of the tasks in here.

Back to Top

Also regarding business content for S/4HANA Cloud with SAP Financial Compliance Management, there is good news to spread, as we offer eight additional controls with the new release. This time, we are proud to announce that three of them are tax-related.

If would like to have a complete overview of which controls are currently available, you can have a look at the SAP Help Portal. There is a section on the available business content where everything is described in detail. The business content itself is delivered in the SAP Financial Compliance Management system. It is available in the form of draft objects for automated procedures and controls in the system which you can then adapt to your needs.

Fig. 5: One of the 8 new predefined controls for SAP S/4HANA Cloud in SAP Financial Compliance Management

Back to Top

Before we jump into the individual innovations, first of all, let's take a short look at transactional taxes in SAP S/4HANA from a holistic perspective, where we differentiate three different areas:

Fig. 6: Global Tax Management with SAP S/4HANA Cloud

For tax, we have several innovations with this release that I would like to draw your attention to: The first one is about tax controls, as we now offer tax-related controls with SAP Financial Compliance Management. And in addition, we have several innovations on the reporting side with SAP Document and Reporting Compliance: two regarding withholding tax and two regarding electronic document processing or e-invoicing to be more precise.

As you saw in the holistic view on transactional tax with SAP S/4HANA Cloud, one important part of it are the tax controls with SAP Financial Compliance Management. With these controls, you can improve the quality of your tax data by automatically identifying and correcting non-compliant data and addressing root causes. With the 2208 release, we deliver three tax-related controls.

Benefits

You can see the controls in the picture below along with a description, purpose, and the underlying business logic.

Fig. 5: As of the 2208 release, compliance specialists now benefit from tasks and task list templates for issues in SAP Financial Compliance Management

Back to Top

For the topic of withholding tax reporting, we have two innovations which are closely linked. The first one is enabling withholding tax adjustments at document level and the second one is about the automatic emailing of certificates. Both innovations are from SAP Document and Reporting Compliance. As you know, the solution it is offered with SAP S/4HANA Cloud and helps to fulfill legal mandates worldwide, that is electronic documents, real-time, as well as statutory reporting. The relevant scope item is 5XU.

Now, let's focus in more detail on the two innovations for withholding tax reporting.

The withholding tax adjustments innovation consists of two parts:

The field for the withholding tax reporting date is country agnostic. But the withholding reports need to be adapted to read the additional field. With the 2208 release, the following countries have been fully adapted accordingly: Japan, South Korea, Philippines, Singapore, Thailand, and Malaysia. The other countries will follow over the course of the next releases.

Back to Top

Now, let's come to the second innovation in the area of withholding tax and that is the automatic sending of withholding tax certificates via e-mail. This innovation also consists of several parts:

If you would like so see what the withholding tax adjustments and the e-mailing of withholding tax certificates look like in the system, please have a look at this demo recording:

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_ea0ykkiv

Video 4: System demo illustrating withholding tax adjustments and e-mailing of tax certificates with SAP Document and Reporting Compliance

Back to Top

Regarding electronic invoicing, there are two examples of innovations that I would like to mention: First of all, with the 2208 release, we introduce e-invoicing for Colombia for which a new country version is being delivered with 2208. Included in the scope are customer invoices, contingency documents and supplier invoices (acknowledgement and reception in future road map).

Contingency documents are used in cases where documents can't be sent to the tax authorities prior to sending billing documents to the customers (e.g. in case of system down times). In these cases, it is nevertheless possible to send billing documents to customers and after the fact, you can still declare them to the Colombian tax authority.

In addition, for Saudi Arabia the existing handling of e-invoices has now been enabled in the SAP Fiori app ‘Manage Electronic Documents’, with release 2202.2

Fig. 6: SAP Fiori Cockpit of SAP Document and Reporting Compliance - 'Manage Electronic Documents' app for Colombia

If you are wondering which other countries apart from Colombia and Saudi Arabia have been enabled so far for e-invoicing with the SAP Fiori app 'Manage Electronic Documents', these are: Italy, Saudi Arabia, Spain, Australia, Austria, Belgium, Denmark, France, Germany, Ireland, Luxembourg, Netherlands, New Zealand, Norway, Poland, Singapore, Sweden.

For more details on the functionality of the other countries, please check out the SAP Help Portal.

If you would like so see what the electronic invoicing for Colombia looks like in the 'Manage Electronic Documents' app, please have a look at this demo recording:

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_79baqoba

Video 4: System demo illustrating the electronic document processing with the 'Manage Electronic Documents' Fiori app in SAP Document and Reporting Compliance

Back to Top

Watch the Replays of Our SAP S/4HANA Cloud 2208 Early Release Series!

We’ve hosted a series of compelling live sessions from the heart of the SAP S/4HANA Engineering organization. Missed the live sessions? Watch our replays on demand!

Among the replays, you can find a replay, a presentation, and demos for Governance, Risk, and Compliance (GRC) as part of the SAP S/4HANA Cloud 2208 release as well as 20 other sessions on diverse topics like Manufacturing, Finance, Consumer Products, SAP User Experience, Developer Extensibility, Localization, and much more. For more information on the SAP S/4HANA Cloud Early Release Series and how to sign up for it, see this link.

For more information on SAP S/4HANA Cloud, check out the following links:

Follow us via @Sap and #S4HANA, or myself via LinkedIn or @DeissnerKatrin

Watch my video to get a quick overview of our SAP S/4HANA Cloud 2208 highlights for Governance, Risk, and Compliance:

https://youtu.be/8CrREIyPmZw

This blog covers the following topics:

SAP Privacy Governance

- Redesigned Risk Service and Risk Response

- System Demo of Risk Service and Risk Response

- GRC Asset Service

- System Demo of GRC Asset Service

SAP Financial Compliance Management

Global Tax

- Tax-Related Business Content for SAP S/4HANA Cloud with SAP Financial Compliance Management

- Withholding Tax Adjustments

- Automatic Sending of Withholding Tax Certificates Via E-Mail

- System Demo of Withholding Tax Adjustments and E-Mailing of Tax Certificates

- Electronic Invoicing for Colombia and Saudi Arabia

- System Demo E-Invoicing for Colombia

SAP Privacy Governance

As you know, SAP Privacy Governance is a cloud GRC solution which is closely integrated with SAP S/4HANA Cloud via the scope item 'Privacy Risk Detection with SAP Privacy Governance (3KX)'. The general direction of the solution is moving towards a security framework. In this context, many changes have taken place in the last months as the risk management part has been completely redesigned. The result is that now we have a completely new risk service and a new risk response service. In addition, we have a new asset service with which you can build a repository of assets.

More Information

- SAP Best Practice Explorer: Privacy Risk Detection with SAP Privacy Governance (3KX)

- SAP Help Portal: SAP Privacy Governance

Back to Top

Redesigned Risk Management and Risk Response

GRC Risk Service

For risk management in SAP Privacy Governance, we previously had two services, the Manage Risk Service and the Assess Risk Service. These two services have been merged together into the new GRC Risk Service where you can both maintain and assess your risks. The new functionality can be used in privacy or IT security contexts and supports NIST-compatible risk management processes.

The service allows you to display an overview of all potential risks identified by your organization and create or edit risks for further analysis. In addition, you can assess risk types and their impact for your organization. Moreover, you can calculate the likelihood of risks along with the estimated potential cost.

Please note that what is currently available is the minimum viable scope which is planned to be extended over the course of the next quarters.

Fig. 1: With the new GRC Risk Service, compliance specialists can maintain and assess risks

Back to Top

Risk Response

The second part of the new risk management is Risk Response. Here, you can create and assign response measures to risks. These measures are actions which should be implemented in order to handle the respective risk in case it occurs. They should be designed in such a way that they reduce the probability of the risk or its impact.

After a risk has occurred, the impact is remediated by taking the defined measures and , if required, risk management can be adapted accordingly. In addition, you can define a response type, assign a purpose, a response owner, and a due date. Furthermore, you can document the completion contribution of the respective measures with regard to the occurred risk.

Fig. 2: With the new risk response functionality in SAP Privacy Governance, compliance specialists can create and assign response measures to risks

System Demo of Risk Service and Risk Response

If you would like so see what this looks like in the system, please have a look at this demo recording:

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_oez8cxeo

Video 2: System demo illustrating the new GRC Risk Service with Risk Response

Please note that what is currently available is the minimum viable scope which is planned to be extended over the course of the next quarters.

Back to Top

GRC Asset Service

The GRC Asset Service is a brand-new service which allows you to maintain an inventory of your IT-related assets as part of your cybersecurity risk management. With this, you can create an inventory of assets by type and you can document the owner as well as the security objectives of an asset. The service provides predefined asset types that you can use out of the box. But of course, it is also possible to create custom asset types which you can tailor to your needs. Moreover, the service also allows you to assess the criticality of assets by running risk analyses with regard to threat and vulnerability analyses.

Fig. 3: With the new GRC Asset Service, compliance specialists can maintain an inventory of IT-related assets as part of a company's cybersecurity risk management

System Demo of GRC Asset Service

If you would like so see what the GRC Asset Service looks like in the system, please have a look at this demo recording:

Video 3: System demo illustrating the new GRC Asset Service

Please note that what is currently available is the minimum viable scope which is planned to be extended over the course of the next quarters.

Back to Top

SAP Financial Compliance Management

As you know from previous sessions, SAP Financial Compliance Management is a controls solution in the cloud which is closely integrated with SAP S/4HANA Cloud. The corresponding scope item is 'Financial Operation Monitoring with SAP Financial Compliance' (3KY).

SAP Financial Compliance Management is a relatively new solution as it is available since Q1 2021 and it is steadily growing. In a nutshell, you could describe SAP Financial Compliance Management as a solution to detect and process so-called issues in your connected S/4HANA Cloud system. In order to detect these issues, you use automated and also manual controls which you execute via work package runs. For these controls, we provide a lot of business content, meaning predefined controls which you can use out of the box.

More Information

- SAP Best Practice Explorer: Financial Operation Monitoring with SAP Financial Compliance (3KY)

- SAP Help Portal: SAP Financial Compliance Management

Tasks and Task List Templates

With the new release, compliance specialists now benefit from a workflow-driven process during the issue and remediation phase as we introduced the concept of tasks and task list templates. This means that the issues have now tasks assigned to them and these tasks are based on context-sensitive, predefined task list templates which can be tailored to the unique requirements of your organization. And - as you can imagine - this allows you to process your issues in a highly structured, consistent, and of course also efficient way.

Let‘s take an example to make this more concrete: One of the predefined controls in the business content that SAP Financial Compliance Management offers for SAP S/4HANA and S/4HANA Cloud, is a control to detect duplicate invoices. Now, let‘s imagine that we want to find all duplicate invoices in our SAP S/4HANA Cloud system within a certain time frame with certain search criteria. After executing the control by triggering a so-called a work package run, SAP Financial Compliance Management comes up with a list of issues which match our search criteria. In our example, this is a list of duplicate invoices.

Until this release, we now had a list of issues with which we could do some basic actions, like categorizing them by means of priorities and issue categories, assigning an owner and setting a conclusion, but the actual issue processing and the remediation part was not yet there. So, the end-to-end process, was not yet complete.

Now, with the 2208 release, we close the loop by introducing the concept of tasks and task list templates which allow you to use a workflow-based approach for the processing and the remediation of the issues. This means, you can configure so-called task list templates with tasks which can then be automatically assigned to the issues. So, if we stick with the example of the duplicate invoices, we could have an issue with an task list template that contains two tasks: one task might have the name ‚Visually compare the invoices‘ and another task could be 'Contact the supplier who sent invoice‘.

The beauty of this is that it allows the compliance specialists to use these tasks from the task list templates and trigger further actions like assigning colleagues who are supposed to perform the respective tasks and very importantly the compliance specialist can also monitor the progress of the respective tasks.

Fig. 4: As of the 2208 release, compliance specialists now benefit from tasks and task list templates for issues in SAP Financial Compliance Management

Let's take a closer look at the screenshot above:

- On the left, you the see the list of issues along with the risk level, status, and other information

- In the middle in the Investigation and Remediation area, you can see which task list templates are assigned to the issue along with the respective completion information.

- From the this information, the system has automatically assigned two tasks which you can see in the upper right section of the screen.

As a prerequisite, in order for the task list template and the assigned tasks to appear here, this needs to be configured in the system. As the next step, compliance specialists can go ahead and assign the tasks to the respective colleagues which are automatically notified via the Inbox App. In addition, compliance specialists can monitor the progress of the processing of the tasks in here.

More Information

- SAP Help Portal: SAP Financial Compliance Management

Back to Top

New Business Content for SAP S/4HANA Cloud

Also regarding business content for S/4HANA Cloud with SAP Financial Compliance Management, there is good news to spread, as we offer eight additional controls with the new release. This time, we are proud to announce that three of them are tax-related.

If would like to have a complete overview of which controls are currently available, you can have a look at the SAP Help Portal. There is a section on the available business content where everything is described in detail. The business content itself is delivered in the SAP Financial Compliance Management system. It is available in the form of draft objects for automated procedures and controls in the system which you can then adapt to your needs.

Fig. 5: One of the 8 new predefined controls for SAP S/4HANA Cloud in SAP Financial Compliance Management

More Information

Back to Top

Global Tax

Before we jump into the individual innovations, first of all, let's take a short look at transactional taxes in SAP S/4HANA from a holistic perspective, where we differentiate three different areas:

- tax determination within business transactions

- tax reporting via SAP Document and Reporting Compliance, both real-time and periodic

- tax controls via SAP Financial Compliance Management to improve data quality

Fig. 6: Global Tax Management with SAP S/4HANA Cloud

For tax, we have several innovations with this release that I would like to draw your attention to: The first one is about tax controls, as we now offer tax-related controls with SAP Financial Compliance Management. And in addition, we have several innovations on the reporting side with SAP Document and Reporting Compliance: two regarding withholding tax and two regarding electronic document processing or e-invoicing to be more precise.

Tax-Related Business Content for SAP S/4HANA Cloud with SAP Financial Compliance Management

As you saw in the holistic view on transactional tax with SAP S/4HANA Cloud, one important part of it are the tax controls with SAP Financial Compliance Management. With these controls, you can improve the quality of your tax data by automatically identifying and correcting non-compliant data and addressing root causes. With the 2208 release, we deliver three tax-related controls.

Benefits

- Automated tax controls framework for streamlined compliance

- Centralized checking rules applicable firmwide

- Controls applied to 100% of relevant transactions

- One central platform with full integration into processes

- Accelerated and streamlined remediation process to comply with digital mandates

- Continuous screening of erroneous tax postings

- Alert notification and orchestration via SAP workflow

- Audit-proof remediation

- Repository of issues to improve processes and minimiz non-compliance risk

- Expedite document corrections within current declaration period

- Full auditability

- Stronger controls that allow you to address issues at the source and improve the overall quality of tax data

You can see the controls in the picture below along with a description, purpose, and the underlying business logic.

Fig. 5: As of the 2208 release, compliance specialists now benefit from tasks and task list templates for issues in SAP Financial Compliance Management

Back to Top

Withholding Tax Adjustments

For the topic of withholding tax reporting, we have two innovations which are closely linked. The first one is enabling withholding tax adjustments at document level and the second one is about the automatic emailing of certificates. Both innovations are from SAP Document and Reporting Compliance. As you know, the solution it is offered with SAP S/4HANA Cloud and helps to fulfill legal mandates worldwide, that is electronic documents, real-time, as well as statutory reporting. The relevant scope item is 5XU.

Now, let's focus in more detail on the two innovations for withholding tax reporting.

The withholding tax adjustments innovation consists of two parts:

- The first part is a new field at document level to capture the withholding tax reporting date. So with this you can control when a document has to be reported, meaning it allows you to include or exclude a document from reporting. And you also have full traceability in the financial documents. So far we had the tax reporting date which is used for VAT. And now we introduce in addition the new field for the withholding reporting date which captures the same information for withholding purposes.

- The second part is the 'Manage Withholding Tax Items' app which allows you to manage tax items. That means you can include or exclude documents from reporting. For example, in case of documents which need to be corrected, you can exclude them in order to declare them in a following period.

Please Note

The field for the withholding tax reporting date is country agnostic. But the withholding reports need to be adapted to read the additional field. With the 2208 release, the following countries have been fully adapted accordingly: Japan, South Korea, Philippines, Singapore, Thailand, and Malaysia. The other countries will follow over the course of the next releases.

More Information

- Best Practice Explorer: Document and Reporting Compliance (5XU)

Back to Top

Automatic Sending of Withholding Tax Certificates Via E-Mail

Now, let's come to the second innovation in the area of withholding tax and that is the automatic sending of withholding tax certificates via e-mail. This innovation also consists of several parts:

- New address type in business partner master data. This means you can enter an e-mail address for withholding tax certificates which is different from the one for purchase orders, billing documents or any other correspondence that you sent to your business partners.

- It integrates with Output Management, the application that is used for business user correspondence e.g. for printing and e-mailing.

- We offer e-mail templates for it, just like you know it from purchase orders, billing etc.

System Demo of Withholding Tax Adjustments and E-Mailing of Tax Certificates

If you would like so see what the withholding tax adjustments and the e-mailing of withholding tax certificates look like in the system, please have a look at this demo recording:

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_ea0ykkiv

Video 4: System demo illustrating withholding tax adjustments and e-mailing of tax certificates with SAP Document and Reporting Compliance

Back to Top

Electronic Invoicing and/or Reporting for Chile, Colombia, Bulgaria, Qatar, and Saudi Arabia

Regarding electronic invoicing, there are two examples of innovations that I would like to mention: First of all, with the 2208 release, we introduce e-invoicing for Colombia for which a new country version is being delivered with 2208. Included in the scope are customer invoices, contingency documents and supplier invoices (acknowledgement and reception in future road map).

Contingency documents are used in cases where documents can't be sent to the tax authorities prior to sending billing documents to the customers (e.g. in case of system down times). In these cases, it is nevertheless possible to send billing documents to customers and after the fact, you can still declare them to the Colombian tax authority.

In addition, for Saudi Arabia the existing handling of e-invoices has now been enabled in the SAP Fiori app ‘Manage Electronic Documents’, with release 2202.2

Fig. 6: SAP Fiori Cockpit of SAP Document and Reporting Compliance - 'Manage Electronic Documents' app for Colombia

If you are wondering which other countries apart from Colombia and Saudi Arabia have been enabled so far for e-invoicing with the SAP Fiori app 'Manage Electronic Documents', these are: Italy, Saudi Arabia, Spain, Australia, Austria, Belgium, Denmark, France, Germany, Ireland, Luxembourg, Netherlands, New Zealand, Norway, Poland, Singapore, Sweden.

For more details on the functionality of the other countries, please check out the SAP Help Portal.

More Information

- SAP Help Portal: SAP Document and Reporting Compliance - Supported Compliance Tasks by Country/Region

System Demo E-Invoicing for Colombia

If you would like so see what the electronic invoicing for Colombia looks like in the 'Manage Electronic Documents' app, please have a look at this demo recording:

https://sapvideoa35699dc5.hana.ondemand.com/?entry_id=1_79baqoba

Video 4: System demo illustrating the electronic document processing with the 'Manage Electronic Documents' Fiori app in SAP Document and Reporting Compliance

Back to Top

Watch the Replays of Our SAP S/4HANA Cloud 2208 Early Release Series!

We’ve hosted a series of compelling live sessions from the heart of the SAP S/4HANA Engineering organization. Missed the live sessions? Watch our replays on demand!

Among the replays, you can find a replay, a presentation, and demos for Governance, Risk, and Compliance (GRC) as part of the SAP S/4HANA Cloud 2208 release as well as 20 other sessions on diverse topics like Manufacturing, Finance, Consumer Products, SAP User Experience, Developer Extensibility, Localization, and much more. For more information on the SAP S/4HANA Cloud Early Release Series and how to sign up for it, see this link.

For more information on SAP S/4HANA Cloud, check out the following links:

- GRC Collection Blog (roadmap, release highlights, microlearnings) here

- SAP S/4HANA Cloud release info: http://www.sap.com/s4-cloudrelease

- Latest SAP S/4HANA Cloud Release Blogs here and previous release highlights here

- Product videos on our SAP S/4HANA Cloud and SAP S/4HANA YouTube playlist

- SAP S/4HANA PSCC Digital Enablement Wheel here

- Early Release Webinar Series here

- Inside SAP S/4HANA Podcast here

- openSAP Microlearnings for SAP S/4HANA for Finance and GRC here

- Best practices for SAP S/4HANA Cloud here

- SAP S/4HANA Cloud Customer Community for Finance here

- Feature Scope Description here

- Help Portal Product Page here

- Implementation Portal here

Follow us via @Sap and #S4HANA, or myself via LinkedIn or @DeissnerKatrin

Labels:

2 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

21 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

152 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

208 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

88

Related Content

- Building Low Code Extensions with Key User Extensibility in SAP S/4HANA and SAP Build in Enterprise Resource Planning Blogs by SAP

- What You Need to Know: Security and Compliance when Moving to a Cloud ERP Solution in Enterprise Resource Planning Blogs by SAP

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

- SAP S/4HANA Cloud Extensions with SAP Build Best Practices: An Expert Roundtable in Enterprise Resource Planning Blogs by SAP

- Managing Security Roles across S/4HANA Public Cloud and SuccessFactors in Enterprise Resource Planning Q&A

Top kudoed authors

| User | Count |

|---|---|

| 8 | |

| 6 | |

| 5 | |

| 4 | |

| 4 | |

| 3 | |

| 3 | |

| 2 | |

| 2 | |

| 2 |