- SAP Community

- Products and Technology

- Enterprise Resource Planning

- ERP Blogs by SAP

- How to integrate SAP Analytics Cloud for planning ...

Enterprise Resource Planning Blogs by SAP

Get insights and updates about cloud ERP and RISE with SAP, SAP S/4HANA and SAP S/4HANA Cloud, and more enterprise management capabilities with SAP blog posts.

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Product and Topic Expert

Options

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

08-02-2022

1:21 PM

CUSTOMER

This guide applies to the following SAP S/4HANA Finance for Group Reporting release and above:

- Version 2208 (cloud)

- Version 2022 (on premise)

Author

SAP S/4 HANA and SAC Product Engineering

Revision history | ||

| Date | Description | |

| August 2022 | Initial | |

| Update | ||

Purpose:

This article is created to help customers and partners understand how to integrate SAP Analytics Cloud for planning with SAP S/4HANA Group Reporting. The scenarios and steps outlined in this article are meant as a guideline to ease deployment of the solutions by customers, which need to be adapted in real life for the specific corporate planning scenarios and requirements of each customer.

This article complements the previous blog issued in year 2020 on the same topic with updates on the new features using examples of financial statement planning.

Table of Contents

Planning scenarios, process flow, and technical components

1. Import S/4 HANA Group Reporting transaction data to SAP Analytics Cloud

1.1 Adapt import script

1.2 Data transformation during import to SAP Analytics Cloud

2. Perform corporate planning in SAP Analytics Cloud

2.1 Planning activities of corporate planning

2.2 Data harmonization – carryforward and opening balance

3. Export plan data from SAP Analytics Cloud to S/4 HANA Group Reporting

3.1 Separate export jobs for B/S and P&L

3.2 Transformation

3.3 Filtering

4. Run plan consolidation in S/4 HANA Group Reporting

5. Configuration in S/4 HANA Group Reporting for plan consolidation

5.1 Document types for data collection task

5.2 Plan category & consolidation cycle

5.3 Adjust additional configurations

Summary

More Information

Planning scenarios, process flow, and technical components

There are typical corporate planning scenarios performed in a business organization:

- You as a planner of a local entity want to use the entity close of your actual data for this year / month as a starting point for planning next year or the remaining months of the year.

- You as a planner of a local entity have already run planning for the local entities and you need to work with your corporate controller to consolidate the plan data and issue comparative consolidated financial statements for next year or the remaining months of the year.

- You as a corporate planner for your entire organization want to use the corporate close of your actual data for this year / month as a starting point to set the target for next year or the remaining months of the year.

- To continue with 3. above, you need to work with your corporate controller to consolidate the plan data and issue comparative consolidated financial statements for next year or the remaining months of the year.

If you are using S/4 HANA and SAP Analytics Cloud from SAP, the process diagram below breaks down the above scenarios and mirrors them with steps in the combined solution to facilitate your planning process. You might run part or all of these steps depending on the following:

- Your role in the organization

- Purpose of your planning

- Starting point of the planning

- Overall system architecture in your company

- Data models you use in both S/4 HANA and SAP Analytics Cloud

In this article we focus on scenarios 3. and 4. above, i.e. to plan on the actual close of the data from S/4 HANA Group Reporting and consolidate the plan data back in S/4 HANA Group Reporting.

Process diagram:

Steps in the process diagram:

For corporate planners:

(1) Import actual data from SAP S/4HANA Group Reporting into the corporate planning model in SAP Analytics Cloud and initialize plan data (SAP Analytics Cloud version = Actual).

(2) Perform corporate planning with planning features (spread, distribute, allocate...) for budget, forecast, rolling forecast, etc. Distribute it among entities when needed.

(3) Export corporate plan data to S/4 HANA Group Reporting for plan consolidation.

The rest of this article focuses on the above three steps.

For entity planners:

<1> Import actual data from S/4 HANA Accounting into the company planning model in SAP Analytics Cloud and initialize plan data (SAP Analytics Cloud version = Actual).

<2> Perform entity / local planning with planning features (spread, distribute, allocate…) for budget, forecast, rolling forecast, etc.

<3> Export entity plan data to S/4 HANA Accounting first.

<4> Release entity plan data to S/4 HANA Group Reporting for plan consolidation.

The second diagram below shows the key technical components needed to run the above processes based on S/4 HANA Group Reporting and SAP Analytics Cloud. We touch upon some of them in the sections that follow in this article.

1. Import S/4 HANA Group Reporting transaction data to SAP Analytics Cloud

You might know already that you can run a full-blown consolidated financial statement in SAP Analytics Cloud for data from SAP S/4HANA Group Reporting that apply features such as IC elimination during report run-time, consolidation in multiple Group currency, group dependent properties, and so on. These same CDS views plus the OData services on top were also delivered as Application Programming Interface (“API” in short) and packaged into an API service (APIs & Communication scenarios (SAP_COM_0370)) and work along with the import function in SAP Analytics Cloud to pull S/4 HANA Group Reporting data into SAP Analytics Cloud for planning purpose. Depending on the planning frequency you can schedule regular job runs in SAP Analytics Cloud to import data.

1.1 Adapt import script

When creating an import job in SAP Analytics Cloud based on the aforementioned import API for S/4 HANA Group Reporting, you can add or remove parameters in the script to fit it to your planning scenario.

For example, for a typical top-down planning process you want to start with the consolidated financial statement of the actual version. To do this you can simply specify a specific consolidation group and a specific consolidation version in the import script. It looks like this:

GROUP REPORTINGTransactionData(P_ConsolidationUnitHierId='$',P_ConsolidationPrftCtrHierId='$',P_ConsolidationSegmentHierId='$',P_KeyDate=datetime'2022-01-01T00:00:00')/Results?$select=FiscalYearPeriod,ConsolidationUnit,PartnerConsolidationUnit,FinancialStatementItem,ProfitCenter, PartnerProfitCenter,SubItem,SubItemCategory, AmountInLocalCurrency, AmountInGroup ReportingoupCurrency &$filter=ConsolidationVersion eq 'Y10' and PeriodMode eq 'PER' and ConsolidationGroup Reportingoup eq 'CG0' and FiscalYear eq '2022' and (FiscalPeriod ge '000' and FiscalPeriod le '012')

If you would rather plan on the unconsolidated data from S/4 HANA GROUP REPORTING for bottom-up planning, you can add filtering on posting levels and consolidation units so it looks like this:

GROUP REPORTINGTransactionData(P_ConsolidationUnitHierId='$',P_ConsolidationPrftCtrHierId='$',P_ConsolidationSegmentHierId='$',P_KeyDate=datetime'2022-01-01T00:00:00')/Results?$select=FiscalYearPeriod,ConsolidationUnit, PartnerConsolidationUnit, FinancialStatementItem,ProfitCenter,Partner ProfitCenter,SubItem,SubItemCategory,AmountInLocalCurrency,AmountInGroup ReportingoupCurrency&$filter=ConsolidationVersion eq 'Y10' and PeriodMode eq 'PER' and ConsolidationGroup Reportingoup eq 'CG0' and FiscalYear eq '2022' and (FiscalPeriod ge '000' and FiscalPeriod le '012') and ConsolidationUnit eq “1710” and (startswith(PostingLevel , '0') or startswith(PostingLevel , '1') or PostingLevel eq ''

1.2 Data transformation during import to SAP Analytics Cloud

In 2021 SAP delivered SAP Analytics Cloud content for planning on S/4 HANA Group Reporting. This content includes basic S/4 HANA Group Reporting dimensions, a model called “SAP_FI_IM_GroupFinance”, data actions, and planning stories. You can use this content as a reference for creating your own planning scenario. It is undergoing continuous enrichment taking into account product innovations in both S/4 HANA Group Reporting and SAP Analytics Cloud and also feedback from customers.

Given a few differences between S/4 HANA Group Reporting and the delivered SAP Analytics Cloud model, there are a few transformations needed in moving data between S/4 HANA Group Reporting and SAP Analytics Cloud when you use the import and export functions in SAP Analytics Cloud. Let’s look at the transformations needed based on the content model for the import first:

a) Posting period

In S/4 HANA we use posting period “000” to store the data (mainly for balance sheet accounts) being carried forwarded to the new year upon year end close. Since posting period “000” is not recognized in SAP Analytics Cloud, you need to replace it with period value “001” during import for all opening balances.

b) Transaction type, functional area, subitems, and subitem category

For simplicity the SAP Analytics Cloud model “SAP_FI_IM_GroupFinance” for S/4 HANA Group Reporting planning was delivered with basic dimensions that include transaction type, functional area, and a few dimensions based on S/4 HANA Group Reporting. It does not include subitem or subitem category which are solely used for consolidation purpose and not known for typical planners. And not all processes in S/4 HANA Group Reporting update transaction type or functional area while subitem is needed and updated each time you run transactions in S/4 HANA Group Reporting. To bridge the difference between the solutions, you can either add subitem and subitem category into your own SAP Analytics Cloud planning model for S/4 HANA Group Reporting. You can also create simple transformations during import to derive the correct values for transaction type and functional areas based on subitem and subitem category for planning purpose. It looks like this:

Transform transaction type for balance sheet FS items:

Transform functional area for income statement FS items:

Check out the following for details:

- Video - Import transaction from S/4 HANA for Group Reporting to SAP Analytics Cloud

- Importing S/4 HANA for Group Reporting to SAP Analytics Cloud - SAP Help Portal

2. Perform corporate planning in SAP Analytics Cloud

Once you have the S/4 HANA Group Reporting data loaded into a planning model in SAP Analytics Cloud, you can start your corporate planning activities in SAP Analytics Cloud.

2.1 Planning activities of corporate planning

SAP Analytics Cloud content model SAP_FI_IM_GroupFinance, related data actions and stories enable you to do the following typical planning activities. You can copy and adapt the content to cater for your own planning scenario.

a. Set corporate target based on consolidated data of the actual version.

b. Perform top-down as well as bottom-up planning for legal as well as management views. The content model is shipped with consolidation unit and consolidation profit center dimensions to denote these two views.

c. Simple allocation to spread corporate targets among individual consolidation units as well as consolidation profit centers along the hierarchy. See an example below:

d. Simple currency translation to convert corporate targets set in group currency to the local currency of the respective consolidation unit. Simple translation from local currency to group currency is also possible in the case of bottom-up planning.

e. Essential data administration tasks such as harmonizing actual data (see section 2.2 below), copying actual data to the plan version, calculating retained earnings and balancing books, and so on.

2.2 Data harmonization – carryforward and opening balance

In S/4 HANA Group Reporting you carry forward the balance sheet accounts typically once a year and store the opening balance in a dedicated subitem (subitem “900” is delivered in 1SG business content in S/4 HANA Group Reporting for this purpose) in the new year. In contrast monthly carryforward is used in SAP Analytics Cloud (transaction types “X00” and “X99” are used in the delivered SAP Analytics Cloud content to store the opening and ending balance each month). In view of the different way of handling balance carryforward, two conversion rules embedded in two data actions are used to harmonize both the incoming S/4 HANA Group Reporting data to SAP Analytics Cloud and outgoing data from SAP Analytics Cloud to S/4 HANA Group Reporting.

By running data action Prepare actuals (SAP_FI_GFP_IM_Group ReportingoupFinance_PrepareActuals) after you import the actual data from S/4 HANA Group Reporting to SAP Analytics Cloud, transaction type “900” of imported data is copied to “X00” so that the opening balance from S/4 HANA Group Reporting can be processed correctly throughout the planning process in SAP Analytics Cloud. And vice versa by the end of planning when you run another data action called Calculate balance sheet for closing (SAP_FI_GFP_IM_Group ReportingoupFinance_CalculateBSClosing), it then copies all plan data that is in “X00” to “900” before it’s ready for you to export it to S/4 HANA Group Reporting for plan consolidation.

Conversion rule to copy data from transaction type “900” to “X00”:

Conversion rule to copy data from transaction type “X00” to “900”:

Note that if you use different subitem / transaction type instead of “900” / “X00” for opening balances, you have to adapt the scripts in the corresponding data actions.

Check out the following for details:

- Video - How to perform corporate planning in SAP Analytics Cloud based on S/4 HANA for Group Reporti...

- SAP Analytics Cloud content for SAP S/4HANA Group Reporting

3. Export plan data from SAP Analytics Cloud to S/4 HANA Group Reporting

Once you set the corporate target in SAP Analytics Cloud, you can compare the target with the upcoming actual close coming from SAP S/4HANA Group Reporting for reporting purpose. If you perform a top-down planning or start with planning on entity (local) level in SAP Analytics Cloud and need to consolidate this plan data, you can also export the plan data back to S/4 HANA Group Reporting and consolidate in there, this is the so called “plan consolidation”. Either step (3) or <3> in the process flow in section 1 allows for exporting plan data back to S/4 HANA, depending on the dimensions you use for planning – if you plan on dimensions of S/4 HANA accounting such as company code, GL account, cost center, profit center, and so on, you export the plan data to the planning table in S/4 HANA accounting (step <3>) and then release it to S/4 HANA Group Reporting for consolidation; if you plan instead on dimensions of S/4 HANA Group Reporting such as consolidation unit, FS items, consolidation profit center, and so on, then you can export it directly to S/4 HANA Group Reporting, which is the focus of this section (step (3)) .

Note that both import into and export out of SAP Analytics Cloud are triggered at SAP Analytics Cloud side with job loads. While the import API was delivered prior to year 2022, SAP delivers the export API for S/4 HANA Group Reporting officially in year 2022 with S/4 HANA CE 2208 / OP 2022. The export API pushes SAP Analytics Cloud planning data to S/4 HANA Group Reporting based on the definition of the export job at SAP Analytics Cloud. Towards the end of the export job run, it triggers the data collection task in S/4 HANA Group Reporting to receive, check, and update the plan data for the corresponding plan version, fiscal year / period(s), FS items, subitems, consolidation units, consolidation profit centers, and so on. You can use the task log for data collection, display group journals, or reports to analyze load details in the same way as closing the actual version when you load reported financial data with a flat file, GRDC, or bulk import APIs.

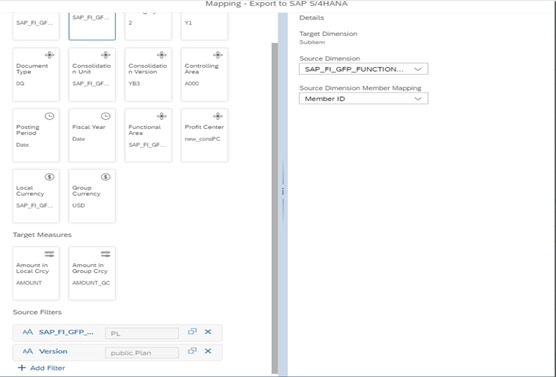

Differences between SAP Analytics Cloud and S/4 HANA data models and the ensuing transformation for import described in section 1 of this article apply also to the export process. See some transformations and filtering needed when defining the export job below.

3.1 Separate export jobs for B/S and P&L

Due to different ways of processing document types between SAP Analytics Cloud and SAP S/4HANA, if you need to export planning of the whole financial statement (i.e. for both balance sheet and income statement accounts) to SAP S/4HANA Group Reporting, create at least two export jobs and use different consolidation document types in each job, e.g. load balance sheet FS items in the 1st export job with document type “01” chosen in there and load income statement FS items in the 2nd export job with document type “02”. Once you define the export jobs you can repeat each job run to load B/S and P&L separately whenever you change the planning amount

3.2 Transformation

For the same explanation outlined in section 1.2 of this article, define a simple transformation in the export job so that it copies the value of transaction type to the subitem of each balance sheet FS item.

And in the same way map subitem to the functional area for subitem category “2” in the export job for P&L FS items.

3.3 Filtering

Different ways of handling carryforward and opening balance (see section 2.2 of this article) between SAP Analytics Cloud and S/4 HANA Group Reporting also requires you to filter the export job by the correct transaction types. This is especially relevant when you export balance sheet FS items to S/4 HANA Group Reporting.

Select transaction type “900” and “C99” (a hierarchy node that includes all changing amount of a period) when filtering transaction type:

Sample filtering of balance sheet load to S/4 HANA Group Reporting:

- Filter on plan version and balance sheet FS items:

- Filter on transaction types “X00” and “C99”

Sample filtering of P&L load to S/4 HANA Group Reporting:

Check out the following for details:

- Feature deck for S/4 HANA for Group Reporting CE 2208

- Exporting Group Reporting Financial Plan Data to S/4HANA SAP Help Portal

- Video - Export plan data from SAP Analytics Cloud to S/4 HANA for Group Reporting

4. Run plan consolidation in S/4 HANA Group Reporting

Once you get plan data in the plan version in S/4 HANA Group Reporting, you can run through related tasks in the monitors in the same way that you close the actual version. After that you can use various reporting tools in S/4 HANA, SAP Analytics Cloud, or any other reporting tools available to you for comparative analysis between actual and plan. We do not detail these processes in this article. Check SAP S/4HANA Group Reporting Help Portal for details.

5. Configuration in S/4 HANA Group Reporting for plan consolidation

Plan consolidation in S/4 HANA Group Reporting follows similar configuration steps needed for closing the actual data. There are a few additional steps to watch out for:

5.1 Document types for data collection task

You need to flag document types with “external reported financial data” to make these document types available on the list of export mapping screen in SAP Analytics Cloud and recognizable by the API to push plan data to S/4 HANA Group Reporting.

5.2 Plan category & consolidation cycle

If you need to run monitor tasks including data collection for multiple periods for the plan version in one go, you need to do the following:

a. Flag the version used for plan consolidation as an S/4 integrated version and assign a plan category. Doing this allows you to use this version to retrieve plan data from SAP S/4HANA plan table as well as from SAP Analytics Cloud, plus other external data sources. It is also a prerequisite to run multi-period plan consolidation for all data sources.

b. Assign the above consolidation plan version to a consolidation cycle:

5.3 Adjust additional configurations

The versioning concept in S/4 HANA Group Reporting allows you to reuse similar configurations across different versions and adapt them easily in the target version. See the following example for plan consolidation version YB3 which uses configurations from other versions for different consolidation processes:

Check details in S/4 HANA Group Reporting on-line documentation.

Summary

With S/4 HANA CE 2208 / OP 2022 we close the last mile of integrating plan data for financial consolidation. You can now perform entity planning as well as corporate planning using S/4 HANA and SAP Analytics Cloud based on built-in integration on planning functions and analytics reporting. We look forward to hearing your feedback through the post of this blog.

More information

Documentation

- SAP S/4HANA for Group Reporting Data Collection

- SAP S/4 HANA for Group Reporting - reporting logic

- Importing S/4 HANA for Group Reporting to SAP Analytics Cloud - SAP Help Portal

- Exporting Group Reporting Financial Plan Data to S/4HANA SAP Help Portal

- SAP Analytics Cloud content for SAP S/4HANA Group Reporting

- API for S/4 HANA for Group Reporting

Product release slide deck

Tutorial videos

- Video - Import transaction from S/4 HANA for Group Reporting to SAP Analytics Cloud

- Video - How to perform corporate planning in SAP Analytics Cloud based on S/4 HANA for Group Reporti...

- Video - Export plan data from SAP Analytics Cloud to S/4 HANA for Group Reporting

Labels:

27 Comments

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

Labels in this area

-

Artificial Intelligence (AI)

1 -

Business Trends

363 -

Business Trends

22 -

Customer COE Basics and Fundamentals

1 -

Digital Transformation with Cloud ERP (DT)

1 -

Event Information

461 -

Event Information

24 -

Expert Insights

114 -

Expert Insights

156 -

General

1 -

Governance and Organization

1 -

Introduction

1 -

Life at SAP

415 -

Life at SAP

2 -

Product Updates

4,685 -

Product Updates

217 -

Roadmap and Strategy

1 -

Technology Updates

1,502 -

Technology Updates

89

Related Content

- The Role of SAP Business AI in the Chemical Industry. Overview in Enterprise Resource Planning Blogs by SAP

- Futuristic Aerospace or Defense BTP Data Mesh Layer using Collibra, Next Labs ABAC/DAM, IAG and GRC in Enterprise Resource Planning Blogs by Members

- SAP Document and Reporting Compliance Brazil: Dashboard do Usage Analytics in Enterprise Resource Planning Blogs by SAP

- Demystifying Transformers and Embeddings: Some GenAI Concepts in Enterprise Resource Planning Blogs by SAP

- S4 HANA Cost Center Activity Rate Calculation Hybrid Approach in Enterprise Resource Planning Blogs by Members

Top kudoed authors

| User | Count |

|---|---|

| 12 | |

| 11 | |

| 8 | |

| 7 | |

| 6 | |

| 6 | |

| 4 | |

| 4 | |

| 4 | |

| 3 |